|

JLL says Dubai’s land market has transformed, with land transaction values up 404% since 2019, driven by population growth, major infrastructure spending, and pro-investor regulations. Freehold zones, mixed-use projects, and hubs like Business Bay and Dubai Islands lead gains in prices, volumes, and investor demand.

Read the full article on Khaleej Times

Dubai’s luxury real estate is increasingly popular with Egyptian high-net-worth investors, attracted by tax-free returns, currency stability, strong governance, and high rental yields. They favour prime areas like Palm Jumeirah, Emirates Hills, and Dubai Hills, supported by clear freehold laws, escrow protections, mortgages, and flexible developer payment plans.

Read the full article on Egyptian Streets

Binghatti Developments unveiled AED 1.25bn Binghatti Vintage in Majan at a Mumbai gala, alongside new Dubai projects Binghatti Sky Terraces in Motor City and Binghatti Pinnacle in Al Jaddaf. Targeting Indian investors, the three towers add thousands of units, amenities and Burj Khalifa-view homes to Dubai’s pipeline.

Read the full article on Economy Middle East

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

Stage Properties will host The Grand Property Show 2025 at Fairmont The Palm on 22–23 November, bringing 25+ UAE developers together with event-only prices, payment plans, off-plan launches, ready properties, holiday-home investment advice, on-site financing support, and free registration for local and international buyers.

Read the full article on Zawya

Dubai property developer Meraas has launched The Edit at d3, a new residential project located in the heart of Dubai Design District (d3).

Read the full article on Arabian Business

Abu Dhabi’s Q3 2025 residential market hit a 12-month high with 6,500+ deals, 77% off-plan and prices up 16% year-on-year. Strong demand, limited ready supply, major new launches, and rising prime/branded projects are deepening its appeal to high-net-worth buyers and families, supporting further growth into 2026.

Read the full article on Economy Middle East

Centurion Properties and Mouawad are launching Dubai’s first Mouawad-branded residences in Meydan Horizon, a 19-storey luxury tower with a grand lobby, premium amenities, and jewellery-inspired interiors, aiming to set a new benchmark for high-end, design-led living in the city.

Read the full article on Zawya

Consider this our entire pitch:

Morning Brew isn’t your typical business newsletter — mostly because we actually want you to enjoy reading it.

Each morning, we break down the biggest stories in business, tech, and finance with wit, clarity, and just enough personality to make you forget you’re reading the news. Plus, our crosswords and quizzes are a dangerously fun bonus — a little brain boost to go with your morning coffee.

Join over 4 million readers who think staying informed doesn’t have to feel like work.

Fakhruddin Properties has launched Treppan Serenique Residences on Dubai Islands, a Treppan Living–branded dual-tower wellness community with 164 apartments, 50+ amenities (including biohacking lab and rooftop infinity pool), advanced air and water systems, AI-driven energy savings, extensive recycling, and rewards that incentivise sustainable, health-focused living.

Read the full article on Trade Arabia

BEYOND Developments has launched 31 Above, its first commercial tower and Dubai Maritime City’s first office high-rise, offering skyline and sea views, Art Deco–inspired architecture, and wellness-focused workspaces. Due in Q1 2029, it targets regional HQs, creative firms and entrepreneurs in a highly connected location.

Read the full article on Economy Middle East

Sharafi Development has launched Marea Residences on Dubai Islands, a G+2+12 luxury waterfront project with 1–2 bed units and penthouses, resort-style amenities, and sea views. Priced from Dh2.6m with a 40/30/30 plan, it’s exclusively marketed by Metropolitan Premium Properties with post-handover management and maintenance perks.

Read the full article on Gulf News

Dubai’s premium office demand is surging as OMNIYAT launches Lumena Alta, a 73-storey, AED 5bn ultra-luxury commercial tower in Business Bay. Completing in 2030, it will feature Grade A offices, a five-star hotel with a record-height infinity pool, metro connectivity, and sustainability certifications.

Read the full article on Economy Middle East

Sharjah-based Arada has acquired a 47-acre waterfront mixed-use development site located in London’s Royal Docks, in what the master developer’s group CEO has described as the largest property transaction in the UK capital for at least five years.

Read the full article on Arabian Business

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Phase One of Khalid Bin Sultan City in Sharjah saw exceptional sales, with one residential node sold out at launch. The Zaha Hadid–masterplanned, net-zero-ready community taps surging demand for sustainable, design-led living, reinforcing Sharjah’s booming real estate market and appetite for climate-smart, wellness-focused neighbourhoods.

Read the full article on Construction Week Online

CDS Developments, with 25+ years of global experience, is entering Dubai to build boutique residential and mixed-use communities. Prioritising quality over scale, it promises European precision, human-centred design, and long-term value, aiming to “build fewer, but better” homes that foster trust and peace of mind.

Read the full article on Zawya

Dubai now offers two distinct property paths: the First-Time Home Buyer Programme, which lowers upfront costs and fees for genuine resident-owners, and the Dh2m Golden Visa route, which demands higher capital but grants 10-year residency, family sponsorship, and long-term investment upside.

Read the full article on Gulf News

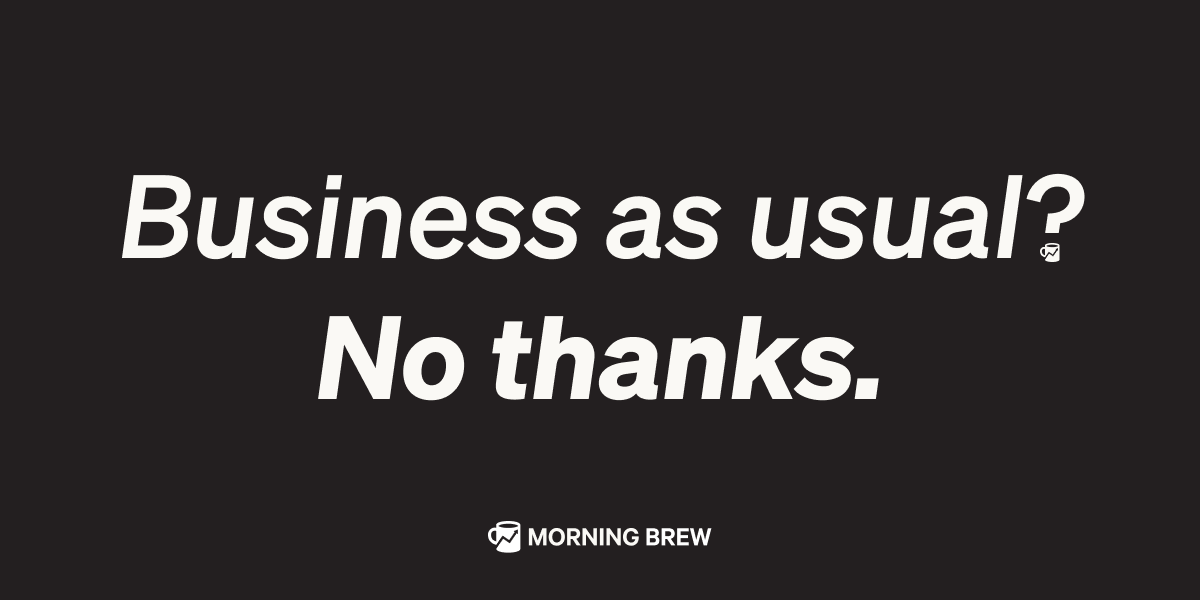

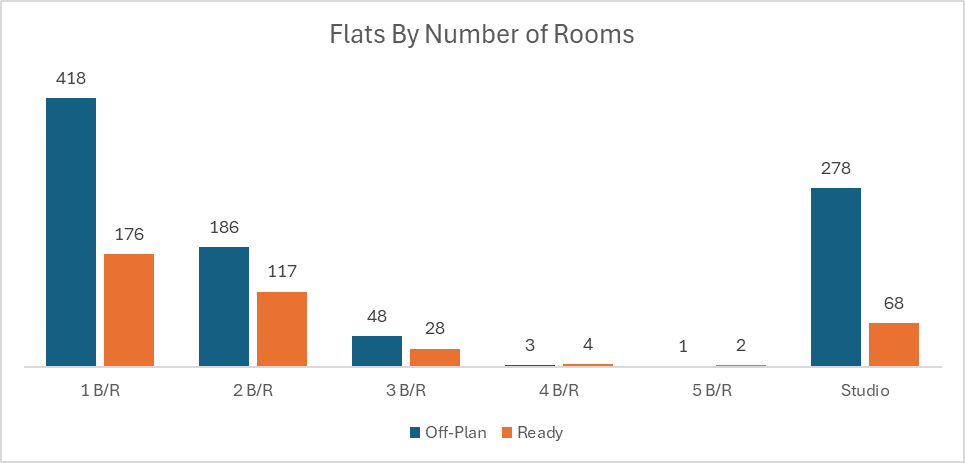

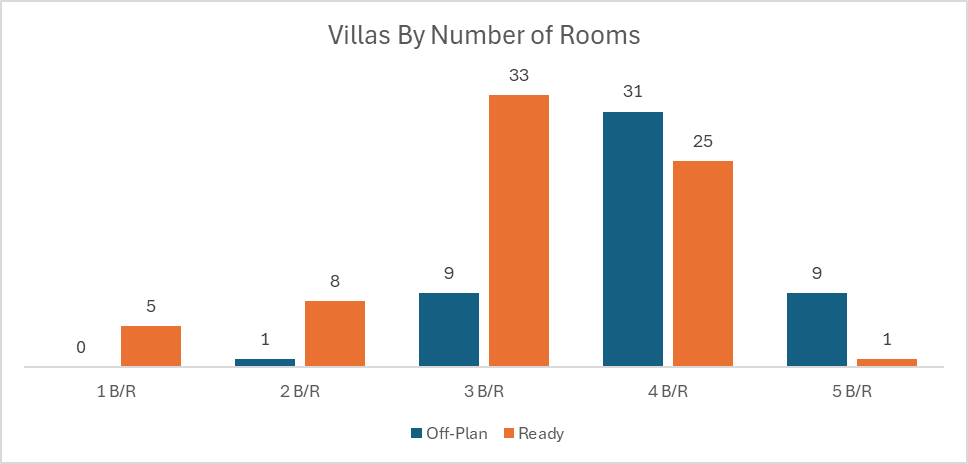

Dubai Real Estate Transactions as Reported on the 17th of November 2025

On the 17 November 2025, the total transacted value reached AED 3,124,422,267. Off-plan dominated with AED 2,168,172,634 (69.4%), while Ready accounted for AED 956,249,633 (30.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,717.4 | 655.1 |

Villas | 297.6 | 196.3 |

Hotel Apts & Rooms | 8.4 | 44.7 |

Commercial | 144.8 | 59.4 |

Total | 2,168.2 | 956.2 |

Off-Plan Market Performance

Total Value: AED 2,168,172,634

Flats: AED 1,717,357,011 (79.2% of off-plan)

Villas: AED 297,616,032 (13.7% of off-plan)

Hotel Apts & Rooms: AED 8,419,820 (0.4% of off-plan)

Commercial: AED 144,779,771 (6.7% of off-plan)

Off-plan activity was led decisively by flats, which captured nearly four-fifths of the segment, while villas added meaningful depth and commercial projects attracted selective investment capital.

Ready Market Performance

Total Value: AED 956,249,633

Flats: AED 655,115,087 (68.5% of ready)

Villas: AED 196,302,943 (20.5% of ready)

Hotel Apts & Rooms: AED 44,687,509 (4.7% of ready)

Commercial: AED 59,372,832 (6.2% of ready)

In the ready market, apartments remained the cornerstone of daily activity, complemented by a solid share of villa transactions and a steady flow into hospitality and commercial assets.

On The Micro Level

Market Insights & Outlook

The 17 November performance reinforces a familiar pattern: developers and investors are driving volume through off-plan apartment launches, while end-users and yield-focused buyers continue to absorb completed flats and villas. This dual engine, future supply via off-plan and immediate usability via ready stock, supports both liquidity and price resilience as Dubai moves through the final weeks of 2025.

Data Source: Dubai Land Department