Earn Your Certificate in Private Equity on Your Schedule

The Wharton Online + Wall Street Prep Private Equity Certificate Program delivers the practical skills and industry insight to help you stand out, whether you’re breaking into PE or advancing within your firm.

Learn from Wharton faculty and industry leaders from Carlyle, Blackstone, Thoma Bravo, and more

Study on your schedule with a flexible online format

Join a lifelong network with in-person events and 5,000+ graduates

Earn a certificate from a top business school

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

GFS Developments launched Coventry Residence in Dubai Industrial City, 163 units (studios/1BR) from AED 450,080, completing Q3 2027. Amenity-rich and well-connected, it targets affordable buyers and investors with a flexible plan, 5% booking, 15% month one, 1% monthly over 60 months, 20% on completion (3-year post-handover).

Read the full article on Biz Today

Dubai Investments plans an IPO of up to 25% of Dubai Investments Park (valued up to $2.5B), potentially in Q1 2025. DIP spans 2,300 ha with 160k residents and 5,000 tenants. The deal underscores UAE IPO momentum, tests property-sector demand, and could fund expansion or debt reduction.

Read the full article on Modern Diplomacy

MBRAH at Dubai South logged 9,753 business-aviation movements in H1 2025, up 15% year-on-year, reinforcing Al Maktoum International’s role as a regional business-jet hub. Leadership says growth aligns with Dubai’s HNWI/investor strategy, supported by MBRAH’s free-zone infrastructure for private jets, MRO, and training.

Read the full article on Gulf News

Dubai’s Land Department, with DFF and VARA, launched a pilot to tokenize real estate, enabling regulated fractional ownership and liquidity. Echoing Lithuania’s InRento and Japan’s MUFG efforts, with NFTMAY aiding adoption, it signals tokenized property’s shift from experiment to mainstream, compliance-driven investing.

Read the full article on MSN

Dubai Land Department won “Inspirational Brand” at the Asia-Pacific Property Awards 2025, recognizing its AI-driven digital services. In H1 2025, DLD logged 1.3m procedures and 125k transactions worth AED 431bn, with 59k new investors and 118k investments (AED 326bn), advancing D33 and Real Estate Strategy 2033.

Read the full article on Zawya

Dubai sold 26,103 studio units worth Dh20.1bn in Jan–Aug 2025; 76.3% were off-plan. Residential studios totaled Dh18.7bn, hotel-style Dh1.3bn. Downtown Dubai led by value (Dh3.6bn), JVC by deal count. Demand driven by investors, practical housing needs, and short-term rental appeal.

Read the full article on Gulf News

Proptech Holo launched the UAE’s biggest property promo, a Dhs500,000 prize toward a second home (or a JVT studio). Buyers using Holo’s mortgage or concierge services earn entries; both services give three. The DET-supervised draw rides Dubai’s record H1 2025 property market.

Read the full article on Gulf Business

Amirah Developments’ Bonds Avenue Residences on Dubai Islands offers waterfront homes with a 60/40 plan, 20% booking, 40% during construction, 40% on Q1 2027 completion. Competitive prices (Dh1.63m–9.95m) and strong sales tap Dubai’s investor influx and record transactions, targeting diverse buyers seeking flexible, premium yet affordable living.

Read the full article on Zawya

ATARA Development has signed an agreement with Marriott International to launch The Residences at the Sheraton Al Marjan Island Resort, marking the first Sheraton-branded residences in the GCC.

Read the full article on Arabian Business

Ras Al Khaimah’s newest real estate project is being touted by a major developer as a chance to fetch prices double those in Dubai. At the unveiling of master developer Marjan’s plans for RAK Central, BNW Developers suggested property prices could reach those of London.

Read the full article on Arabian Gulf Business Insight

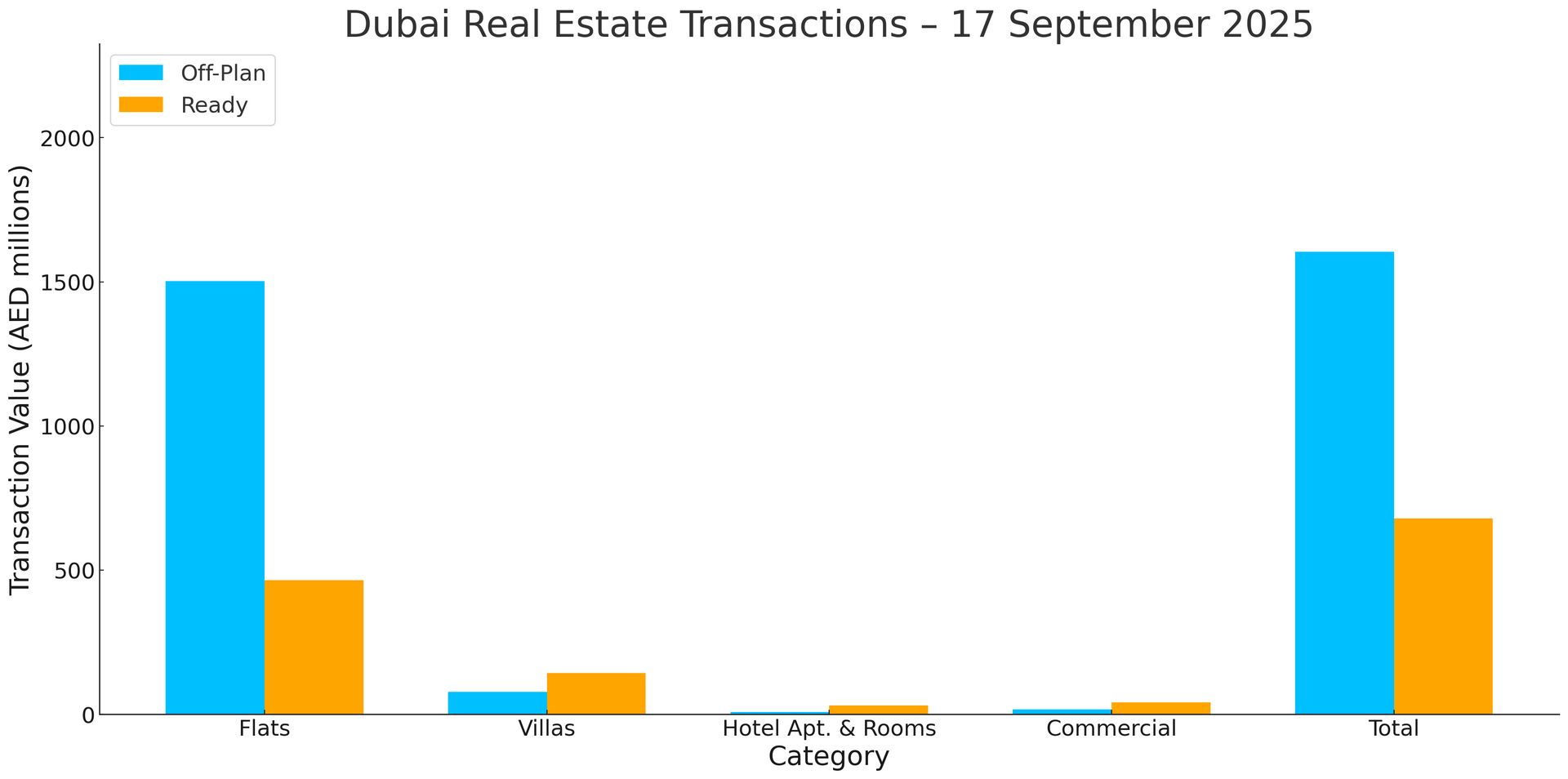

Dubai Real Estate Transactions as Reported on the 17th of September 2025

On the 17th of September 2025, the total transacted value reached AED 2,282,757,284. Off-plan dominated with AED 1,603,816,997 (70.3%), while Ready accounted for AED 678,940,286 (29.7%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,501.7 | 465.4 |

Villas | 77.8 | 142.8 |

Hotel Apts & Rooms | 7.6 | 29.9 |

Commercial | 16.6 | 40.8 |

Total | 1,603.8 | 678.9 |

Off-Plan Market Performance

Total Value: AED 1,603,816,997

Flats: AED 1,501,699,602 (93.6%)

Villas: AED 77,838,653 (4.9%)

Hotel Apts & Rooms: AED 7,641,594 (0.5%)

Commercial: AED 16,637,148 (1.0%)

Off-plan activity was overwhelmingly flats-led, with villas a distant second; hospitality and commercial were marginal.

Ready Market Performance

Total Value: AED 678,940,286

Flats: AED 465,399,064 (68.5%)

Villas: AED 142,791,710 (21.0%)

Hotel Apts & Rooms: AED 29,925,009 (4.4%)

Commercial: AED 40,824,503 (6.0%)

Ready transactions were anchored by flats, with villas providing a substantial secondary share.

On The Micro Level

Market Insights & Outlook

A strong flats skew on both off-plan and ready sides signals persistent end-user and investor demand for compact inventory. Villas remain supportive but secondary. If this mix holds, expect continued momentum in mid-ticket launches and stable absorption in established ready communities.

Data Source: Dubai Land Department