Former Zillow exec targets $1.3T market

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind.

That’s why investors are so excited about Pacaso.

Created by a former Zillow exec, Pacaso brings co-ownership to a $1.3 trillion real estate market. And by handing keys to 2,000+ happy homeowners, they’ve made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO.

No wonder the same VCs behind Uber, Venmo, and eBay also invested in Pacaso. And for just $2.90/share, you can join them as an early-stage Pacaso investor today.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Nakheel awarded a Dh2.6bn contract to Fibrex to build Bay Villas on Dubai Islands: 636 luxury homes (townhouses, semi-detached, garden, waterfront, beachfront) with beach club, parks, and pools. Heritage-inspired design. Part of the Dubai 2040 plan across five islands with extensive waterfront and amenities.

Read the full article on Khaleej Times

Dubai provided Dh1.725bn in housing support to 3,027 citizens in H1 2025 via the Mohammed bin Rashid Housing Establishment: 1,390 schemes (Dh1.184bn), 935 grants (Dh540.3m) and 695 land grants. The initiative aligns with the Dubai 2040 plan, Social Agenda 33 and Real Estate Strategy 2033.

Read the full article on The National

Dubai’s commercial market surged: Q1 2025 sales +23%, volumes +83%, office sales +68%, prime rents up to +24%. Mid-2025 sales hit AED 13.1bn (+41% YoY). Investors find 6–8% yields, 60–70% LTV financing, transparent RERA rules, and value via WALE (Weighted Average Lease Expiry), tenant quality, cost control, and planned exits.

Read the full article on Fintechzoom

The Dubai real estate sector recorded AED16.29bn ($4.4bn) of transactions last week, according to data from the Land Department.

Read the full article Arabian Business

Dubai housing hit record Q2 2025: 50k transactions (+21% YoY), 80% apartments; off-plan 70%. Zone 6 led (53%). 20k units launched (+66%). Prime deals >Dh10m doubled (2,500), villas 76%. Villas +4% values; apartments steady. Policy boosts and millionaire inflows support strong H2 supply and demand.

Read the full article on Khaleej Times

Chestertons highlights six emerging Dubai communities (JVC, DAMAC Islands, Downtown, Dubai Marina, Meydan City, and Dubai South) with rising transactions. Suburban master-planned areas offer strong yields (~6–7%+, e.g., JVC 7.39%, DAMAC Islands 7.38%). Growth is driven by infrastructure upgrades, buyer-friendly initiatives, and D33, with Abu Dhabi also gaining attention.

Read the full article on Construction Business News

The success of an off-plan project now relies on its ability to deliver quality, functionality, and community-centred living.

Read the full article on Construction Week Online

GCC real estate stayed strong in H1 2025. Kuwait saw broad price and sales growth; Saudi prices +4.3% and sales +37% despite fiscal pressures; the UAE, led by Dubai, posted record transactions and 7.6% yields. Lower rates, diversification and investment support continued H2 momentum.

Read the full article on Economy Middle East

Apartment sales on Bluewaters Island averaged AED 3.8 million ($1.03 million) in August, the highest across Dubai communities, while villa transactions in Arabian Ranches continued to anchor suburban demand, according to Property Finder’s latest community insights.

Read the full article on Arabian Business

Dubai’s office market surged: H1 sales AED5.4bn (+84% YoY) on 1,900 deals (+22%). Demand from prime office/logistics and international entrants. New supply: 34k sqm H1, 110k by end-2025, 340k in 2026, lifting GLA (Gross Leasable Area) to 9.78m sqm. Developers emphasize sustainable, flexible, amenity-rich workplaces.

Read the full article on MENA FN

Park Properties enters the UAE market, expanding across prime waterfront and urban locations. It’s launching Park Beach Residence 1 & 2 and becomes exclusive sales partner for GJ Properties’ Ajman Creek Towers marketed as the UAE’s most affordable waterfront, with a 1% monthly post-handover plan and rich amenities.

Read the full article on Middle East Construction News

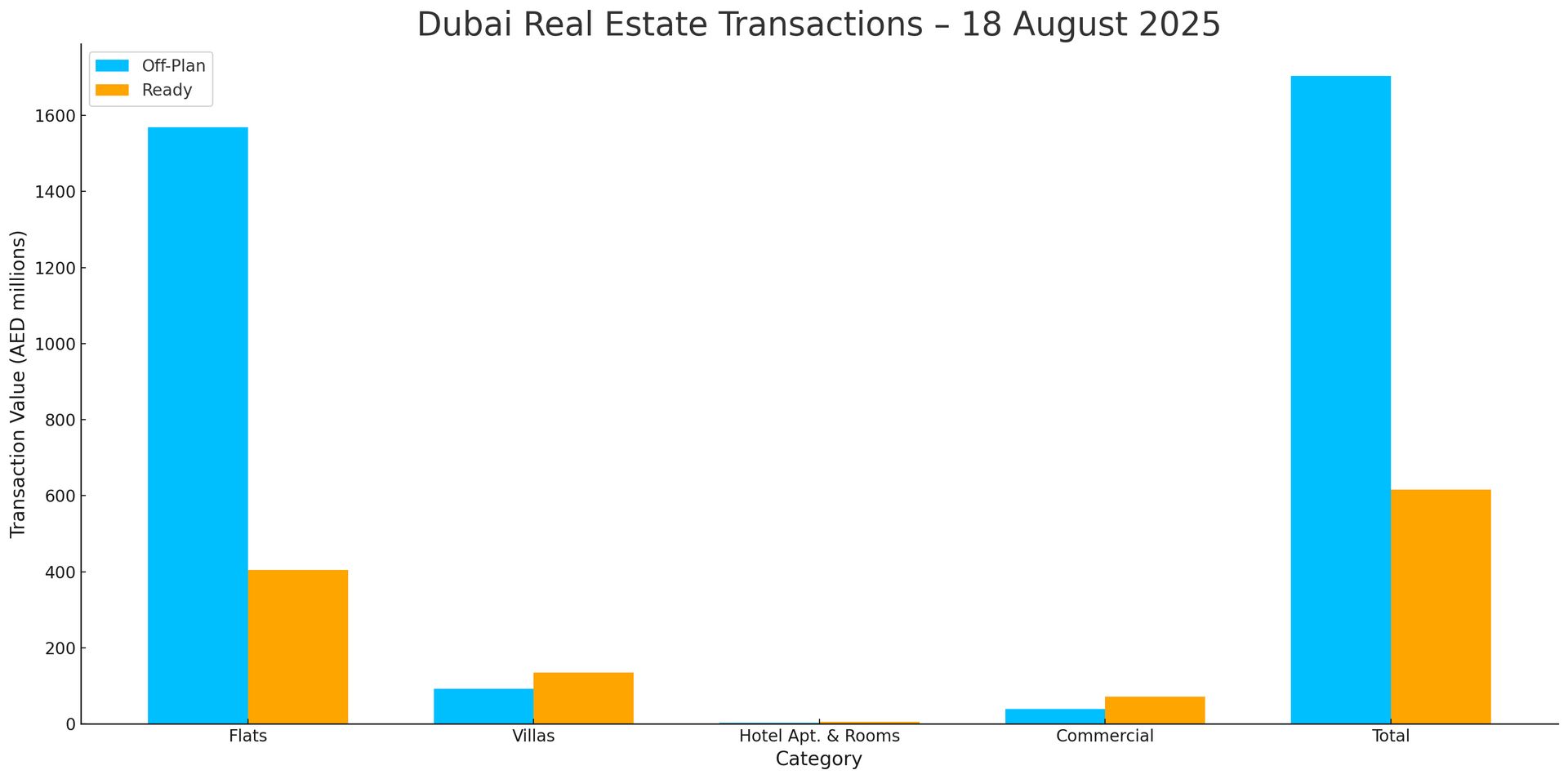

Dubai Real Estate Transactions as Reported on the 18th of August 2025

On 18-Aug-2025, Dubai’s property market recorded AED 2,319.6m in transactions. Off-plan contributed AED 1,703.5m (73.4%), while ready added AED 616.1m (26.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,568.8 | 404.2 |

Villas | 91.9 | 135.7 |

Hotel Apt. & Rooms | 3.4 | 5.0 |

Commercial | 39.5 | 71.2 |

Total | 1,703.5 | 616.1 |

Off-Plan Market Performance

Flats: AED 1,568.8m (92.1% of off-plan)

Villas: AED 91.9m (5.4%)

Hotel Apts & Rooms: AED 3.4m (0.2%)

Commercial: AED 39.5m (2.3%)

Off-plan activity was overwhelmingly apartment-led, indicating strong demand for new residential supply.

Ready Market Performance

Flats: AED 404.2m (65.6% of ready)

Villas: AED 135.7m (22.0%)

Hotel Apts & Rooms: AED 5.0m (0.8%)

Commercial: AED 71.2m (11.6%)

Ready transactions were dominated by apartments, with a healthy villa share and a notable commercial slice.

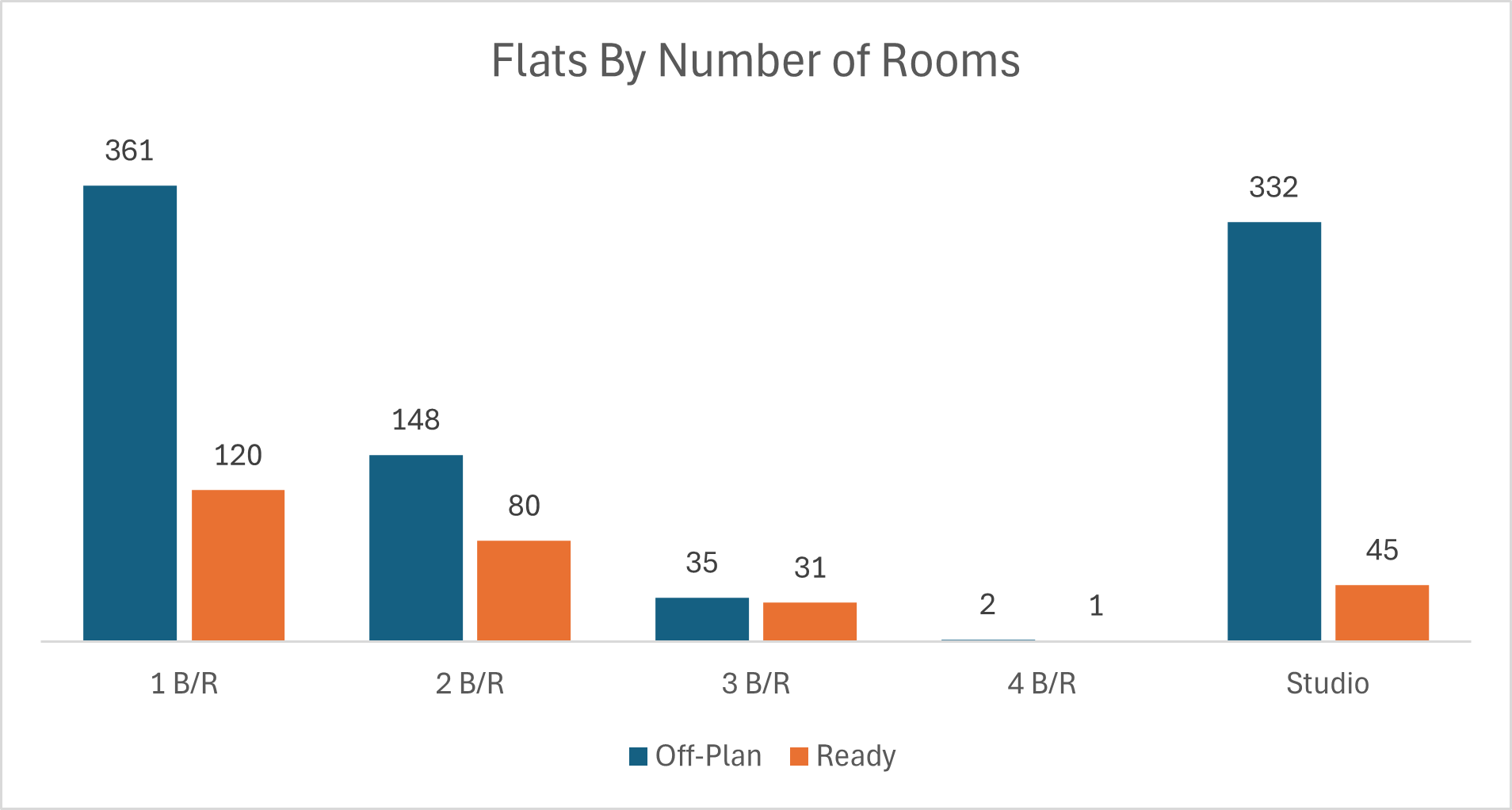

On The Micro Level

Market Insights & Outlook

Off-plan remains the engine of daily turnover, led by apartment launches and buyer appetite for payment plans.

Ready demand is broad-based, with villas supporting higher-ticket deals and steady interest in income-producing commercial assets.

Overall mix suggests sustained momentum, anchored by end-user demand for apartments and investor confidence in new projects.

Data Source: Dubai Land Department