Estate Protocol says tokenizing even 10% of the $70T U.S. real estate market could create a $7T liquid, tradable asset class. It has tokenized 31 properties ($12M+). Using an SPV structure, it targets both crypto and traditional investors as tokenization spreads, with Dubai among few title-friendly jurisdictions.

Read the full article on The Street

Dubai’s 2026 property boom shows rare dual momentum: seller interest surged (Google searches for “real estate agency” +115% Jul 2025–Jan 2026) while buyer interest stayed strong (“buy property” +16%). With prices up 40% since 2020 and 2025 sales topping Dh520bn, analysts see a maturing, balanced market despite rising supply.

Read the full article on Khaleej Times

Al Ghurair Collection appointed BSBG as lead consultant/structural engineer and Turner & Townsend as project manager for Wedyan, a 46-storey, 149-home super-prime waterfront tower on Dubai Canal designed by Kengo Kuma (his first UAE residence). The project is moving from design development into technical delivery.

Read the full article on Zawya

Aldar launches The Wilds Residences in Dubai, adding 740 apartments to its nature-led masterplanned community.

Read the full article on Construction Week Online

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

Alpen Capital forecasts 390,000 new UAE homes by 2030, lifting stock to 1.51m, with Dubai apartment-heavy mixed-use and Abu Dhabi premium villas/waterfronts. GCC supply may rise from 6.26m (2025) to 7.28m (2030), led by Saudi and UAE. Delays likely. Market shifting to quality, phased, demand-led projects.

Read the full article on Khaleej Times

Zoya Developments launched Miorah, a premium 60-unit fully furnished apartment project in Dubai South, handing over Q2 2027. It offers studios from AED 640k and two-beds from AED 1.1m with flexible payment plans. Amenities focus on wellness; features include solar power, EV charging, and concierge/security as Zoya accelerates new launches.

Read the full article on Zawya

Century Tower (210 units, Business Bay) handed over two months early, highlighting why delivery speed matters as Dubai construction costs rise. fäm Properties urges developers to start building immediately, lock contractors/materials, and model inflation. Materials are ~60% of baseline costs; off-plan sales still dominate.

Read the full article on MENA FN

Dubai Real Estate Transactions as Reported on the 18th of February 2026

On the 18-Feb-2026, the total transacted value reached AED 2.52 billion. Off-plan dominated with AED 1.75 billion (69.7%), while Ready accounted for AED 0.76 billion (30.3%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,416.2 | 492.3 |

Villas | 157.2 | 163.7 |

Hotel Apt. & Rooms | 13.8 | 25.6 |

Commercial | 167.4 | 81.4 |

Total | 1,754.6 | 763.0 |

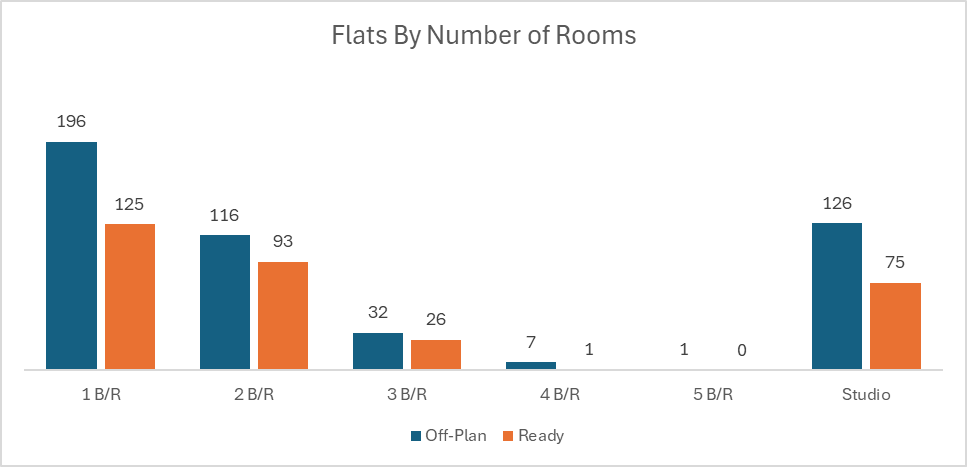

Off-Plan Market Performance

Total Value: AED 1,754.6m

Flats: AED 1,416.2m (80.7%)

Villas: AED 157.2m (9.0%)

Hotel Apt. & Rooms: AED 13.8m (0.8%)

Commercial: AED 167.4m (9.5%)

Off-plan activity was overwhelmingly apartment-led, with flats contributing over four-fifths of off-plan value.

Ready Market Performance

Total Value: AED 763.0m

Flats: AED 492.3m (64.5%)

Villas: AED 163.7m (21.5%)

Hotel Apt. & Rooms: AED 25.6m (3.4%)

Commercial: AED 81.4m (10.7%)

Ready transactions were more balanced, with villas taking a meaningful share and commercial providing solid depth.

On The Micro Level

Market Insights & Outlook

The day’s turnover stayed firmly off-plan-driven, reflecting continued demand for new-build apartment supply, while the ready market showed healthier diversification, particularly in villas, suggesting sustained end-user and investor appetite across segments.

Data Source: Dubai Land Department