What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Warning of hidden risks like unrealistically low prices, service charges, and unproven developers. Fitch predicts a moderate market correction with up to 15% price falls in late 2025; experts highlight yield-driven investments and rigorous due diligence.

Read the full article on The National

Meraas, part of Dubai Holding Real Estate, has awarded Naresco a AED 450 million contract for Central Park Plaza at City Walk. Slated for Q3 2027 delivery, the development comprises two towers (23 and 20 floors) with 212 apartments, embodying premium urban living focused on community and well-being.

Read the full article on Dubai Eye

Dubai’s luxury real estate market exploded: Dh10m+ transactions rose from 469 in 2020 to 4,670 in 2024, with 1,300 sales in Q1 2025 (31% YoY). Off-plan deals now make up 69%. Villas account for 70%, apartments fetch Dh5,400/sqft. Branded residences and new masterplans fuel an 8–10% price rise.

Read the full article on Khaleej Times

Infracorp launched California Residences in Wadi Al Safa, Dubai: a BD 61.8 M, 370-unit development (one- to three-bedroom apartments, villas, townhouses). Sales began June 11, 2025. Amenities include gym, pools, and landscaped gardens. Completion is set for Q2 2028, offering sustainable, family-focused living near Global Village and IMG Worlds.

Read the full article on Zawya

Dubai’s DLD now issues blockchain-based property tokens through its REES pilot, creating enforceable ownership certificates. Regulated by DLD, VARA, RERA, and SCA, tokenised real estate uses smart contracts for transparency. Investors gain freehold rights in SPVs, but must use licensed platforms and ensure tokens link to actual DLD-registered titles.

Read the full article on Gulf News

Ellington Properties has joined Dubai’s second tokenized property initiative, tokenizing a Kensington Waters unit in MBR City. Offering fractional shares from AED 2,000 with blockchain-backed certification, this move broadens access to design-led real estate and underscores Dubai’s push toward a digital economy.

Read the full article on MENA FN

Despite record Dh528 billion transactions (+17%), Dubai’s 12,000+ brokers face fierce competition, stricter RERA regulations, and savvy, data-driven clients. Agents must leverage real-time market insights, niche specialisation, multilingual support, and digital tools to navigate volatility and stay ahead.

Read the full article on Gulf News

Gulf waterfront real estate is shifting from isolated, prestige-driven icons (like Palm Jumeirah) to integrated, livable districts. Developers now favor mid-rise, mixed-use schemes with strong connectivity, public spaces, and ecological buffers. Examples include Dubai Maritime City’s low-density projects (e.g. The Mural Beyond), Lusail’s community-focused marina, and Saudi Arabia’s eco-oriented waterfront plans.

Read the full article on MENA FN

Despite well-capitalized developers, investors need cash and cash flow to capitalize on dips amid speculative launches, oversupply, and inflated rent-yield claims. Real estate success relies on supply-pipeline analysis, patience, and liquidity, not clichés like “buy the dip.”

Read the full article on Gulf News

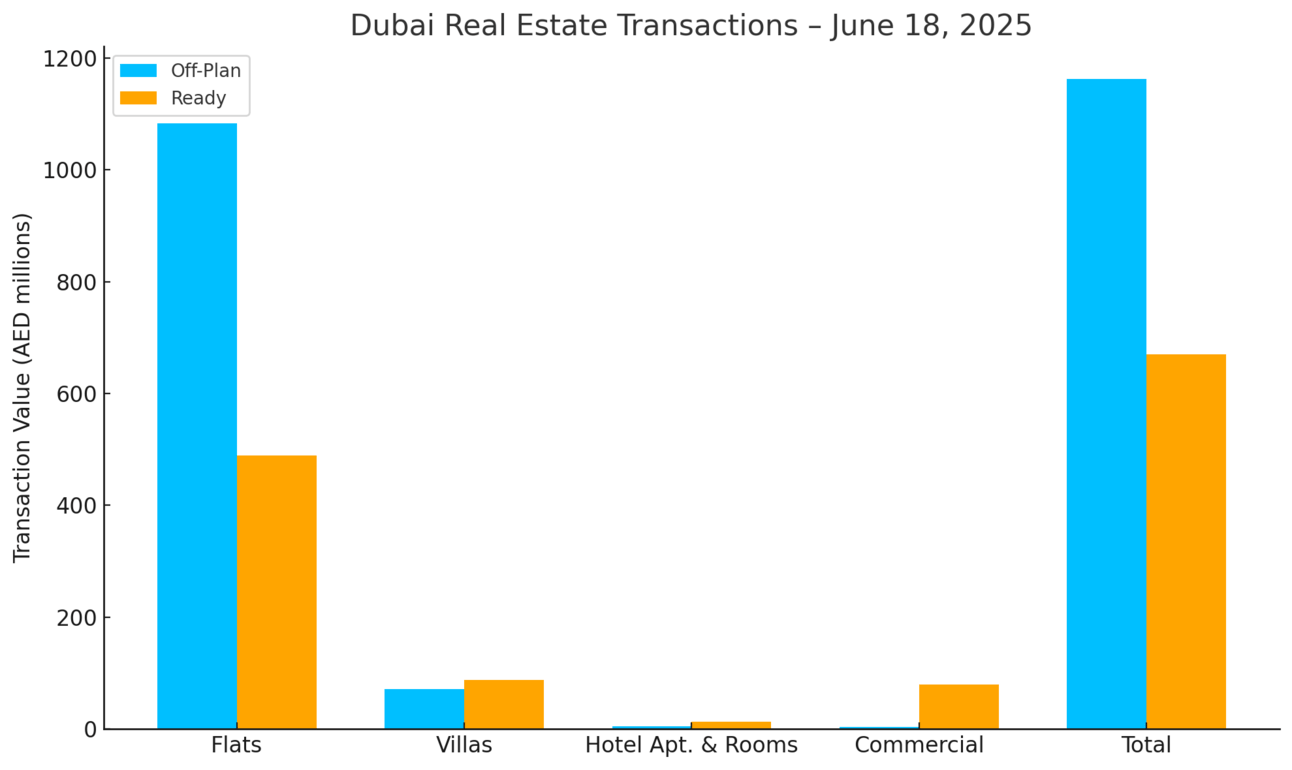

Dubai Real Estate Transactions as Reported on the 18th of June 2025

On 18 June 2025, Dubai’s total real estate transaction value reached AED 1.832 billion. Off-plan sales accounted for AED 1.163 billion (63.5%), while ready properties contributed AED 669.5 million (36.5%).

Category | Off-Plan (AED million) | Ready (AED million) |

|---|---|---|

Flats | 1,082.5 | 488.6 |

Villas | 71.7 | 87.6 |

Hotel Apt. & Rooms | 4.5 | 13.6 |

Commercial | 4.1 | 79.7 |

Total | 1,162.8 | 669.5 |

Off-Plan Market Performance

Total Off-Plan: AED 1.163 billion (63.5% of total)

Flats: AED 1.082 billion (93.1% of off-plan)

Villas: AED 71.7 million (6.2%)

Hotel Apartments & Rooms: AED 4.5 million (0.4%)

Commercial: AED 4.1 million (0.4%)

The market on the 18th of June was almost entirely focused on flats, villas made a modest appearance, while hotel rooms & apartment and commercial saw minimal activity.

Ready Market Performance

Total Ready: AED 669.5 million (36.5% of total)

Flats: AED 488.6 million (73.0% of ready)

Villas: AED 87.6 million (13.1%)

Hotel Apartments & Rooms: AED 13.6 million (2.0%)

Commercial: AED 79.7 million (11.9%)

The ready-market mix similarly favors flats, with villas and commercial transactions showing healthy participation, and hotel apartment sales remain modest.

On The Micro Level

Market Insights

Investor appetite remains firmly behind off-plan flats, which dominate nearly two-thirds of activity. The ready segment shows solid flat demand alongside a notable villa share, reflecting both end-user and investor interest. Low commercial and hotel-apartment volumes suggest cautious diversification. Looking ahead, delivery timelines, pricing transparency and service-charge clarity will be key to absorbing new supply and sustaining market momentum.

Data Source: Dubai Land Department