Dubai’s real estate market continues to attract global investors, with Indian, British, and Italian buyers leading in 2025. Egyptian investment surged 150%, driven by currency hedging, high rental yields, and residency incentives. Dubai’s tax advantages and lifestyle appeal reinforce its status as a top global property investment hub.

Read the full article on Khaleej Times

The Real Estate Report is a reader-supported publication. To receive new posts and support my work, consider becoming a paid subscriber.

Dubai’s real estate market remains strong in 2025, driven by limited supply, infrastructure growth, and demand for off-plan properties. Sales hit Dh367 billion in 2024, with off-plan making up 60.7%. Rental growth slowed, while capital values rose. The UAE leads GCC real estate growth, supported by construction and non-oil GDP expansion.

Read the full article on MSN

Dubai real estate investors are turning to affordable luxury as high rental yields and price increases sustain demand.

Read the full article on Arabian Business

Riyadh added 327,000 sqm of office space in 2024—10x more than Dubai—but still faces a prime office shortage. Rents rose 11%-20%, with vacancy rates under 1.4%. Office supply will grow 889,000 sqm in 2025, driven by business expansion and Saudi Arabia’s 5% non-oil GDP growth.

Read the full article on Arabian Gulf Business Insights

Eywa, a luxury wellness-focused residential project by R.Evolution, launches in Dubai’s Business Bay, set for completion in Q2 2026. Inspired by Vastu Shastra, it features LEED Platinum sustainability, wellness-centric design, a Crystal Pyramid, and advanced air/water filtration. Offering 50 exclusive residences, it blends luxury, sustainability, and holistic living.

Read the full article on Zawya

Subscribed

While international expansion in underway – Azizi remains confident about both the local and global property markets, citing that Dubai’s ability to attract high-net-worth individuals (HNWIs) will continue to fuel demand.

Read the full article on Arabian Business

Dubai’s real estate market is shifting in favor of buyers as prices decline amid growing supply. Developers offer discounts and joint ventures to conserve cash, while off-plan prices revert closer to ready home values. With supply exceeding demand, buyers negotiate better deals, signaling a market correction after years of price surges.

Read the full article on Gulf News

Ras Al Khaimah’s real estate market is set for strong growth, driven by high demand, limited supply, and the Wynn Resort’s completion in 2025. Off-plan prices rose 15-20% in 2024, with waterfront properties seeing rapid sellouts. With RAKEZ expansion and population growth, demand will likely continue outpacing supply.

Read the full article on Zawya

The MEA real estate market is set for strong growth in 2025, driven by economic expansion, urbanization, and digital transformation. Prime office supply remains tight, while alternative assets like data centers are attracting investment. AI is expected to automate 70% of CRE activities by 2030, with sustainability and ESG initiatives gaining prominence.

Read the full article on Khaleej Times

Dubai’s hospitality sector is booming, with 11,300 new hotel rooms expected by 2027. Luxury hotels dominate, driven by rising tourism, which saw 17.15 million visitors in 2023. Occupancy hit 78% in 2024, boosting RevPAR by 1.3%. Dubai remains a global tourism hub, with sustained high-end hospitality growth.

Read the full article on Travel and Tour World

Photo by Walid Ahmad

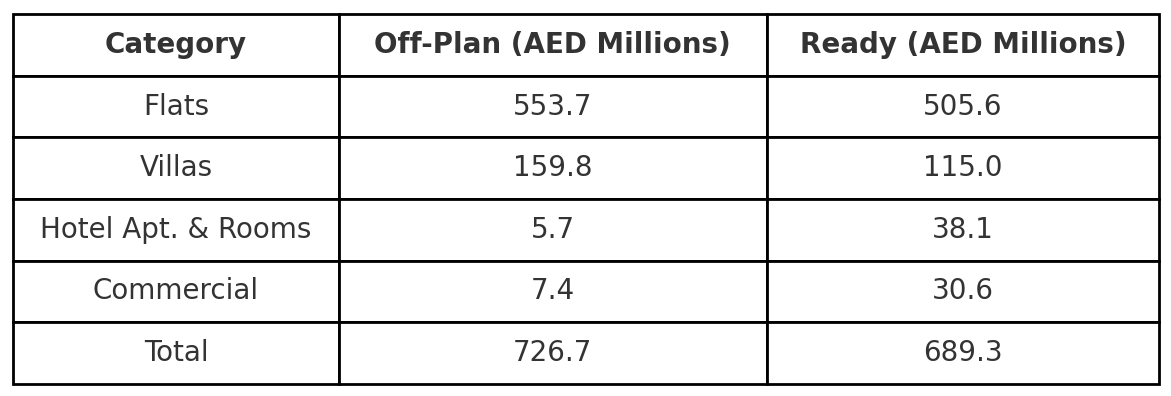

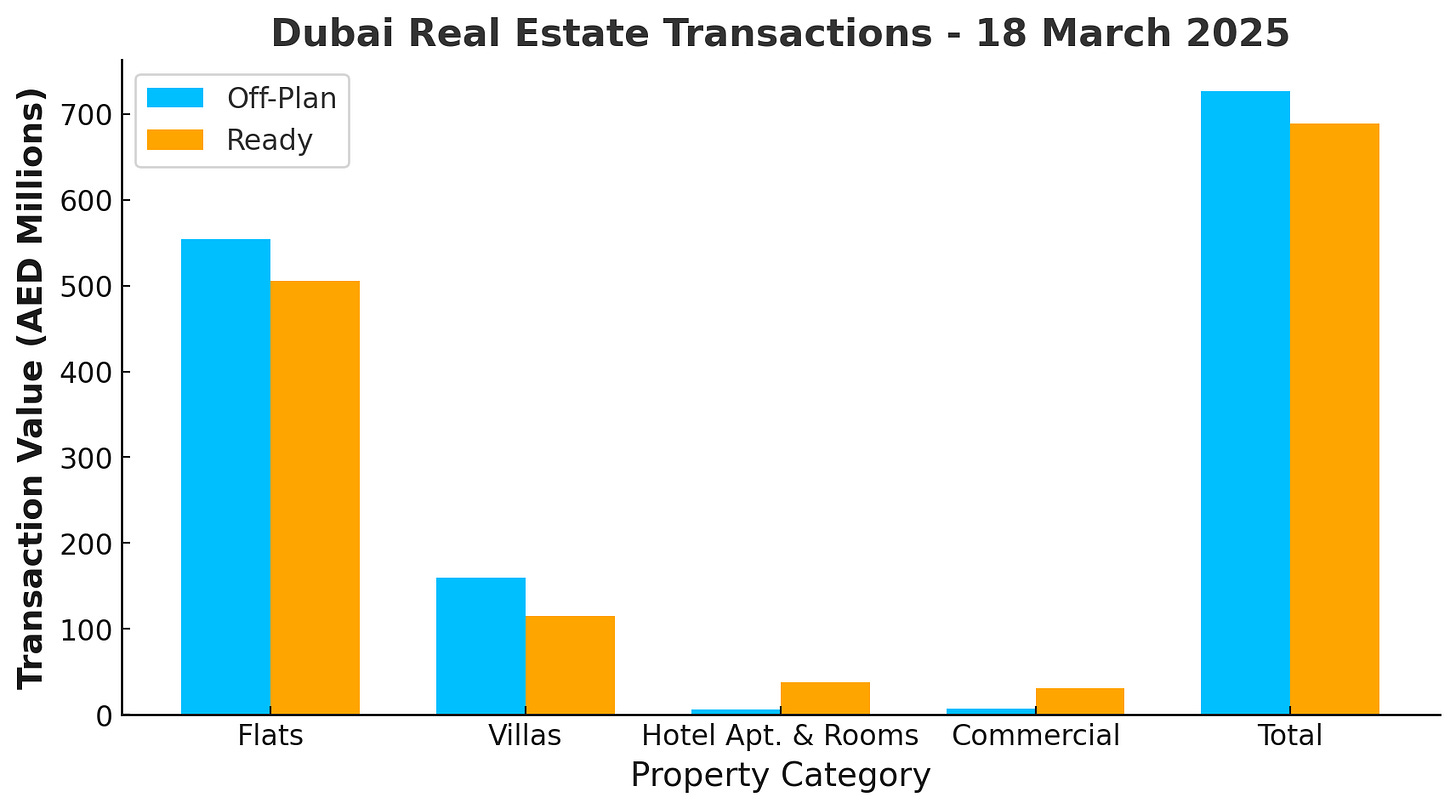

Dubai Real Estate Transactions as Reported on the 18th of March 2025

Dubai’s real estate market recorded a total transaction volume of AED1.42 billion on March 18, 2025, reflecting continued momentum in both off-plan and ready property segments. The market remains strong, with demand evenly distributed between these two categories.

Segment Contributions

Off-plan properties accounted for 51.3% of the total transaction value, amounting to AED726.67 million.

Ready properties contributed 48.7%, with a total of AED689.28 million.

This balanced distribution highlights sustained interest in both new developments and completed properties, catering to a diverse range of investors and end-users.

Off-Plan Transactions Breakdown

The off-plan market remains a dominant force, constituting a slightly higher share of total sales compared to ready properties. Within this segment:

Flats led transactions, contributing 76.2% of the off-plan total (AED553.74 million).

Villas followed with a 22.0% share (AED159.78 million).

Commercial properties and hotel apartments & rooms accounted for a minor 1.8% of off-plan sales, with AED7.40 million and AED5.75 million, respectively.

These figures indicate that investors and buyers continue to prioritize residential off-plan developments, with a strong preference for apartments over villas and commercial assets.

Ready Transactions Breakdown

Ready properties also saw substantial demand, particularly in the residential sector. The key contributions were:

Flats accounted for 73.4% of the ready property segment, totaling AED505.60 million.

Villas represented 16.7% with transactions worth AED115.04 million.

Hotel apartments & rooms recorded AED38.07 million, contributing 5.5% to the ready property market.

Commercial properties made up 4.4%, with a total transaction value of AED30.58 million.

The strong performance of ready flats suggests that end-users and investors alike are targeting completed residential units, while villa sales continue to hold steady.

Market Insights

Balanced Demand: The near-equal split between off-plan (51.3%) and ready (48.7%) transactions underscores a diversified market where both long-term investors and immediate buyers find value.

Flats Dominate: Across both off-plan and ready categories, apartments remain the most sought-after asset type, comprising 76.2% of off-plan and 73.4% of ready sales.

Continued Investor Confidence: The steady volume of commercial and hospitality transactions suggests sustained investor interest in Dubai’s real estate market.

Conclusion

Dubai’s property market continues to demonstrate resilience and growth, with strong transactions across both off-plan and ready segments. The data reflects investor confidence, end-user demand, and a maturing real estate landscape, positioning the city as a top global real estate destination.

Data Source: Dubai Land Department