|

Dubai’s property market hit record H1 2025 sales and strong 7–9% rental yields, led by affordable communities and foreign investors, while Abu Dhabi rebounded. A 240,000-unit pipeline should shift the seller’s market toward buyers from 2026, favouring well-located, sub-AED 1,500/sq ft assets.

Read the full article on Elite Agent

Dubai’s property market remains resilient, with off-plan sales up 20% and resales 10% amid tightening supply as land prices surge 200–300%, favouring big developers; JVC may see corrections, Jebel Ali and Abu Dhabi offer upside, and Dubai stays the prime long-term hub.

Read the full article on Khaleej Times

Property Finder is partnering with Keyper to let UAE tenants pay rent monthly via its app, replacing large upfront cheques. The integrated system, launching in H1 2026, aims to ease financial strain, speed up rentals, and give landlords more reliable digital payments.

Read the full article on Gulf News

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

The JLL Real Estate Knowledge Hub’s unique approach involves a strategic partnership with a number of institutions to deliver an exceptional practical learning experience to the Real Estate Executives in Saudi.

Read the full article on Construction Week Online

Dubai real estate company Pantheon Development has officially broken ground on VOXA, an AED800 million (US$217.8 million) mixed-use development in Jumeirah Village Triangle (JVT).

Read the full article on Arabian Business

Samana Developers has launched a zero-down, interest-free payment plan: buyers secure units with no initial deposit and pay 2% monthly for 50 months. The scheme lowers entry barriers, aligns with Dubai’s first-time buyer programme, and targets younger, value-seeking investors in resort-style projects.

Read the full article on Biz Today

Savills values global real estate at $393.3 trillion, with housing the dominant asset. Dubai mirrors this shift: 2025 residential sales have surpassed AED 540 billion and already beaten 2024’s record, cementing the city as a highly liquid, transparent, tax-efficient haven for global investors.

Read the full article on Khaleej Times

Consider this our entire pitch:

Morning Brew isn’t your typical business newsletter — mostly because we actually want you to enjoy reading it.

Each morning, we break down the biggest stories in business, tech, and finance with wit, clarity, and just enough personality to make you forget you’re reading the news. Plus, our crosswords and quizzes are a dangerously fun bonus — a little brain boost to go with your morning coffee.

Join over 4 million readers who think staying informed doesn’t have to feel like work.

AIR (AI Realtor), a Dubai-founded proptech company, has launched what it describes as the world’s first fully AI-native real estate brokerage platform, marking a major step toward the UAE’s ambition to become a global leader in artificial intelligence.

Read the full article on Arabian Business

SOL Properties aims to shape Dubai’s skyline with sustainable, community-focused, tech-enabled developments. Backed by in-house construction, it delivers high-end, smart, wellness-centric projects like Fairmont Residences Solara Tower, SOL LUXE and SOL Levante, while betting on digital twins, branded residences and a strong internal culture to drive long-term value.

Read the full article on Gulf News

DMDC, the award-winning construction and design company, will deliver Dubai’s first renovate-to-resell model after entering into a partnership with Residual.ae.

Read the full article on Arabian Business

The Middle East has become a leading hub for luxury and wealth, with Dubai and Saudi Arabia attracting global investors through tax efficiency, mega-projects and lifestyle ecosystems. Booming luxury real estate and collectible markets position the region as a long-term engine of global wealth creation.

Read the full article on Gulf News

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

UAE real estate ends 2025 strongly, with Dubai’s sales, rentals and villas showing sustained, end-user driven growth. Developers respond with incentive-led events, new ready stock like Leaf Tower in Abu Dhabi, and branded overseas projects such as Panorama by ELIE SAAB in Baku.

Read the full article on Khaleej Times

Aldar has launched Yas Riva Residences on Yas Island’s canal, a resort-style waterfront community centered around “The Pavilion” social hub. The project blends wellness, family life and recreation with waterside spas, pools, sports facilities, boating, shaded gardens and canal-side cafés, offering an active yet relaxed lifestyle.

Read the full article on Zawya

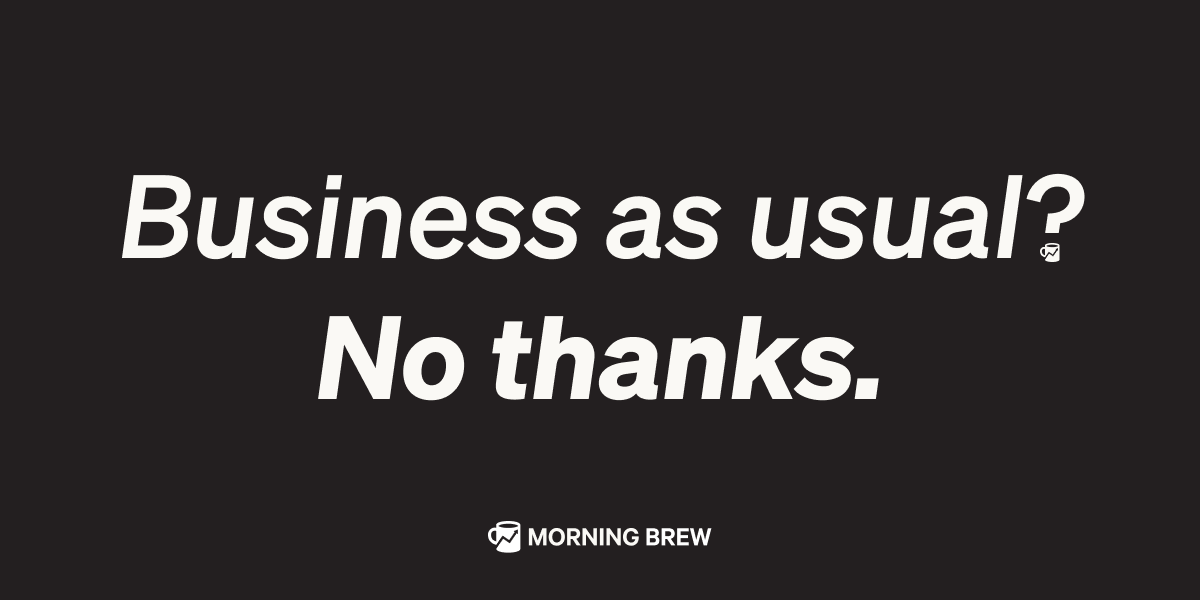

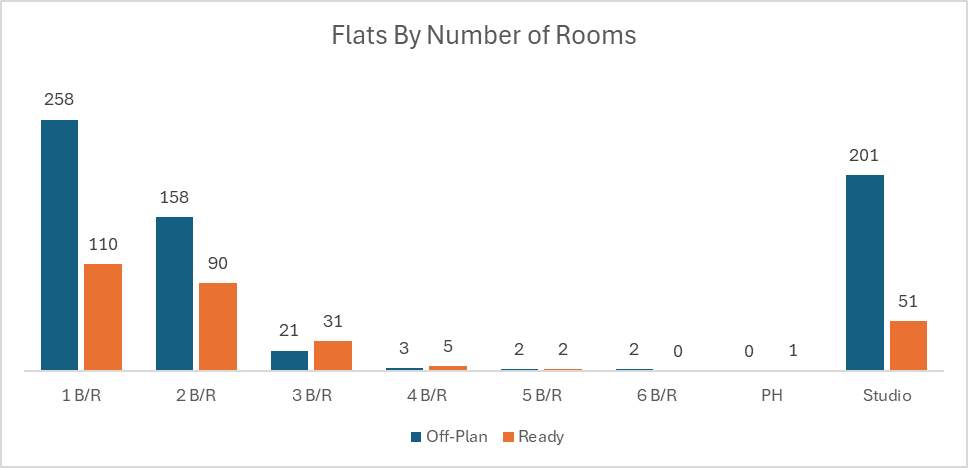

Dubai Real Estate Transactions as Reported on the 18th of November 2025

On 18 November 2025, the total transacted value reached AED 2,482,512,794. Off-plan dominated with AED 1,696,842,999 (68.4%), while Ready accounted for AED 785,669,795 (31.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,479.0 | 518.7 |

Villas | 183.3 | 137.7 |

Hotel Apts & Rooms | 5.1 | 34.6 |

Commercial | 29.3 | 94.6 |

Total | 1,696.8 | 785.7 |

Off-Plan Market Performance

Total Value: AED 1,696,842,999

Flats: AED 1,479,001,285 (87.2% of off-plan)

Villas: AED 183,349,082 (10.8% of off-plan)

Hotel Apts & Rooms: AED 5,147,889 (0.3% of off-plan)

Commercial: AED 29,344,743 (1.7% of off-plan)

Off-plan activity was heavily concentrated in apartments, with flats contributing nearly nine out of every ten dirhams spent, while villas provided meaningful depth and commercial assets remained a small but complementary niche.

Ready Market Performance

Total Value: AED 785,669,795

Flats: AED 518,723,342 (66.0% of ready)

Villas: AED 137,739,568 (17.5% of ready)

Hotel Apts & Rooms: AED 34,581,644 (4.4% of ready)

Commercial: AED 94,625,241 (12.0% of ready)

Within the ready segment, flats also led activity with two-thirds of value, supported by solid villa demand and a notable 12% share from ready commercial properties, underscoring continued appetite for income-generating stock.

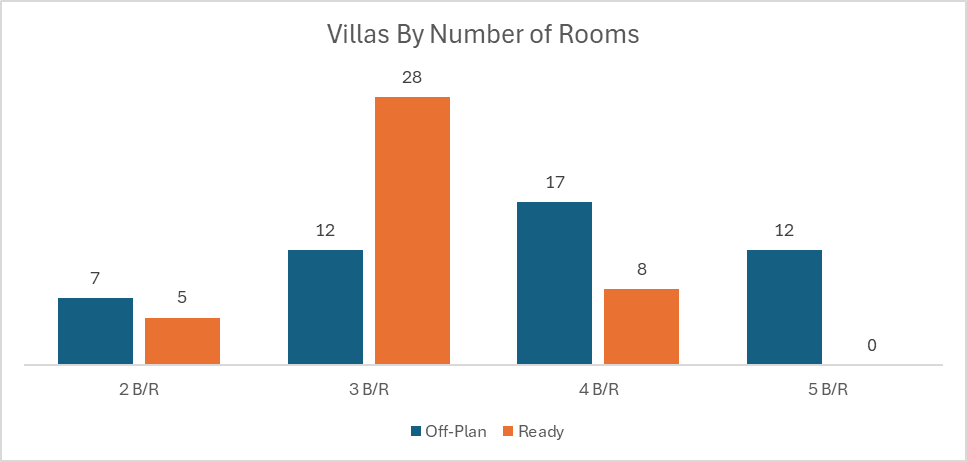

On The Micro Level

Market Insights & Outlook

The day’s figures reaffirm Dubai’s off-plan leadership, with roughly two-thirds of all value flowing into projects still under development, led overwhelmingly by apartments. Ready assets, however, continue to provide a substantial one-third of liquidity, especially in mid- to upper-tier flats and select commercial properties. This balance between new launches and completed stock points to a market where both investors and end-users are actively repositioning, locking in future supply while still competing for quality, income-ready homes today.

Data Source: Dubai Land Department