| Check out our new website |

|

|

AboutTheUAE is your definitive guide to Dubai—discover top schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more.

|

Expats in Dubai increasingly fall prey to rental scams on social media and listing sites, losing booking fees and deposits to fake agents. Fraudsters exploit high demand for affordable housing with bogus listings, bait-and-switch tactics, and overcrowded flats. Authorities urge using RERA-certified agents and official platforms.

Read the full article on Khaleej Times

Investors in 2025 should target emerging UAE hotspots such as, Naseem Villas (Sharjah +243%), Remah (Al Ain +242%), Zone 12 (MBZ City +238%), Meydan Avenue (Dubai +204%), and Palm Jebel Ali (Dubai +203%), for superior ROI, driven by affordability, infrastructure upgrades, and renewed luxury interest.

Read the full article on Gulf News

Dubai’s DFM index hit a 17-year peak above 5,400 points in early 2025, fueled by strong dividends, IPOs, Real Estate, and global inflows. While some sectors look overvalued, broadening diversity, from AI and fintech to real estate, and ongoing reforms point to selective investment opportunities ahead.

Read the full article on TradingView

Dubai Municipality launches $177m Ras Al Khor Wildlife Sanctuary development to boost eco-tourism.

Read the full article on Arabian Business

| Check out our new website |

|

|

AboutTheUAE is your definitive guide to Dubai—discover top schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more.

|

Affordable UAE real estate under Dh1 million is available in Ajman Corniche, Sharjah Industrial Area 17, Dubai South, Fujairah’s Dibba/Creative City, and Umm Al Quwain, with units from Dh230k–700k offering strong rental yields and future upside.

Read the full article on Gulf News

Dubai South Properties has launched Hayat, a master-planned 10 million sq ft Golf District community near Al Maktoum International Airport, featuring 2,500 townhouses, villas, apartments, and hotel apartments (1–5 bedrooms). Completion of phase one is expected Q2 2028. Amenities include parks, trails, pools, a retail boulevard, and a five-year payment plan.

Read the full article on Economy Middle East

Dubai’s premium real estate investors are focused on privacy, design, and long-term value, with rising demand for adaptable layouts and lifestyle-driven amenities.

Read the full article on Arabian Business

Bloom Holding’s 2025 UAE Property Market Report finds nationwide price surges, Abu Dhabi up 202% and Dubai 124% in 2024, with emerging hotspots in Sharjah, Ras Al Khaimah, and Umm Al Quwain. Luxury listings are booming beyond capitals, while off-plan and rental markets stay highly sought after.

Read the full article on Gulf News

Dubai maintains 140 branded real estate projects scheduled for completion by 2031, the report said.

Read the full article on Arabian Business

Dubai apartment prices soared 122% over five years, rents by 50%, topping global city gains, yet remain relatively affordable (10th mortgage-to-income). Reforms like golden visas and co-habitation easing spurred growth, but looming oversupply and regional geopolitical risks threaten a moderate correction.

Read the full article on Bloomberg

Emaar Properties jumped to 4th globally with a 58% brand-value increase to $4 billion. ROSHN debuted at #24 ($1.1 billion), JLL rose to #20 ($1.3 billion), and CBRE topped the commercial ranking ($3.2 billion). Chinese brands still lead, led by Vanke at $7.4 billion.

Read the full article on Economy Middle East

MERED’s H1 2025 survey of ICONIC Residences buyers reveals 65% prioritize privacy, 60% design quality, and 55% connectivity. One- and two-bedroom units dominate—45% for self-use, 30% investment, 25% hybrid. Amenities like terraces and wellness features drive decisions, with architecture (40%) and ROI (30%) leading purchase motives.

Read the full article on Zawya

Dubai’s real estate has moved from speculative flips to lifestyle-focused second homes, driven by golden visas, tax perks, and residency reforms. Families, retirees, and digital nomads now favor gated communities and urban centers for long-term living, drawn by world-class infrastructure, liveability, and flexible visa options.

Read the full article on Khaleej Times

Dubai Real Estate Transactions as Reported on the 26th of June 2025

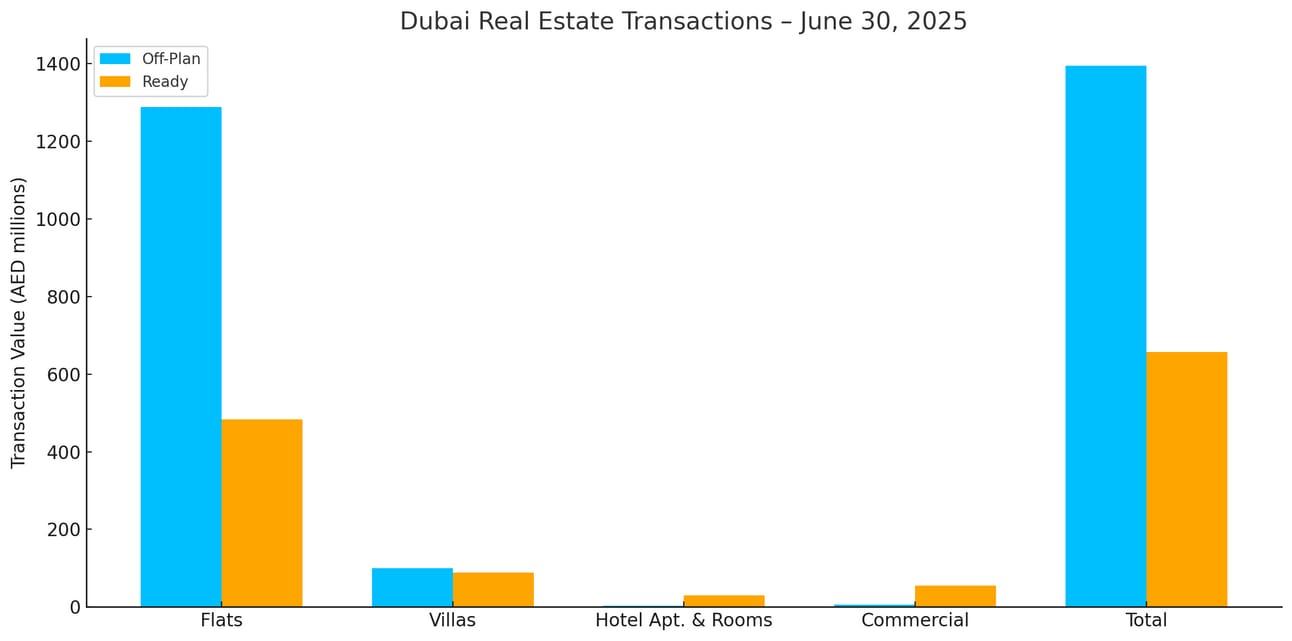

On 30 June 2025, Dubai’s total real estate transaction value reached AED 2.052 billion. Off-plan properties accounted for 68.0 % (AED 1.395 billion), while ready assets contributed 32.0 % (AED 656.6 million) of the total volume.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,287.5 | 483.2 |

Villas | 99.3 | 88.8 |

Hotel Apartments & Rooms | 2.8 | 29.6 |

Commercial | 5.5 | 55.0 |

Total | 1,395.2 | 656.6 |

Off-Plan Market Performance

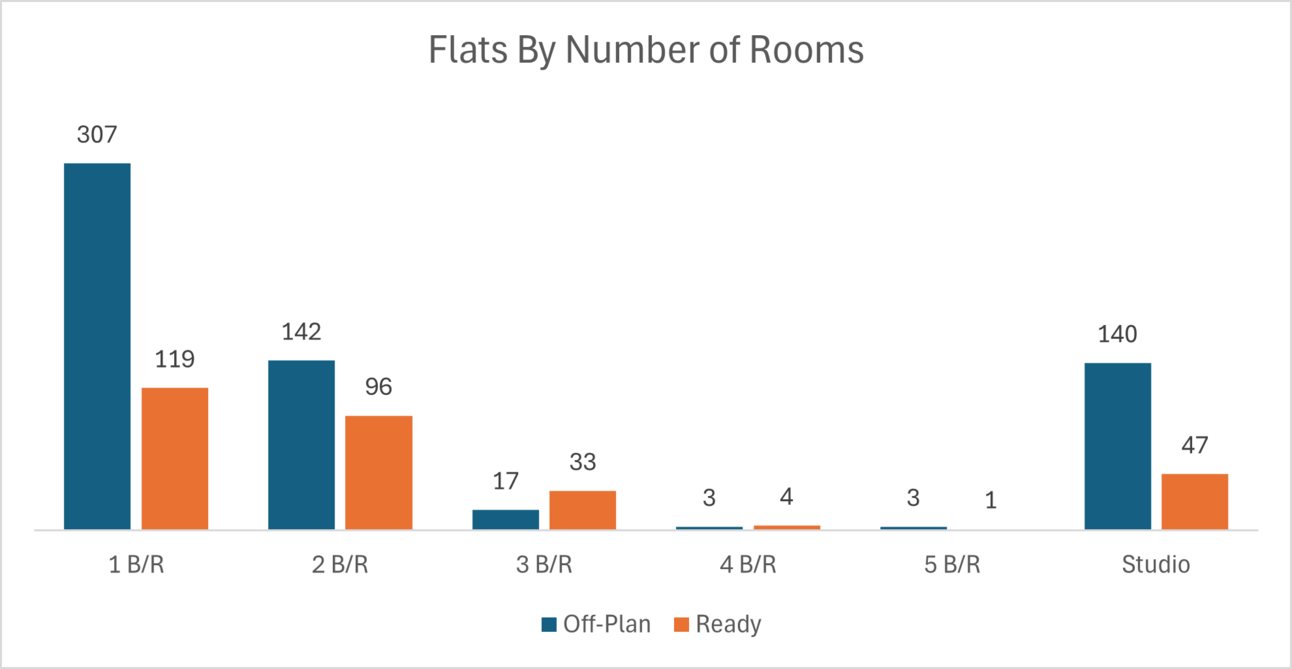

Off-plan sales totaled AED 1.395 billion, led overwhelmingly by flats:

Flats: AED 1.288 billion (92.3 % of off-plan)

Villas: AED 99.3 million (7.1 %)

Hotel Apartments & Rooms: AED 2.8 million (0.2 %)

Commercial: AED 5.5 million (0.4 %)

The dominance of flats underscores sustained investor appetite for smaller, early-stage units, while villas and commercial segments remain niche.

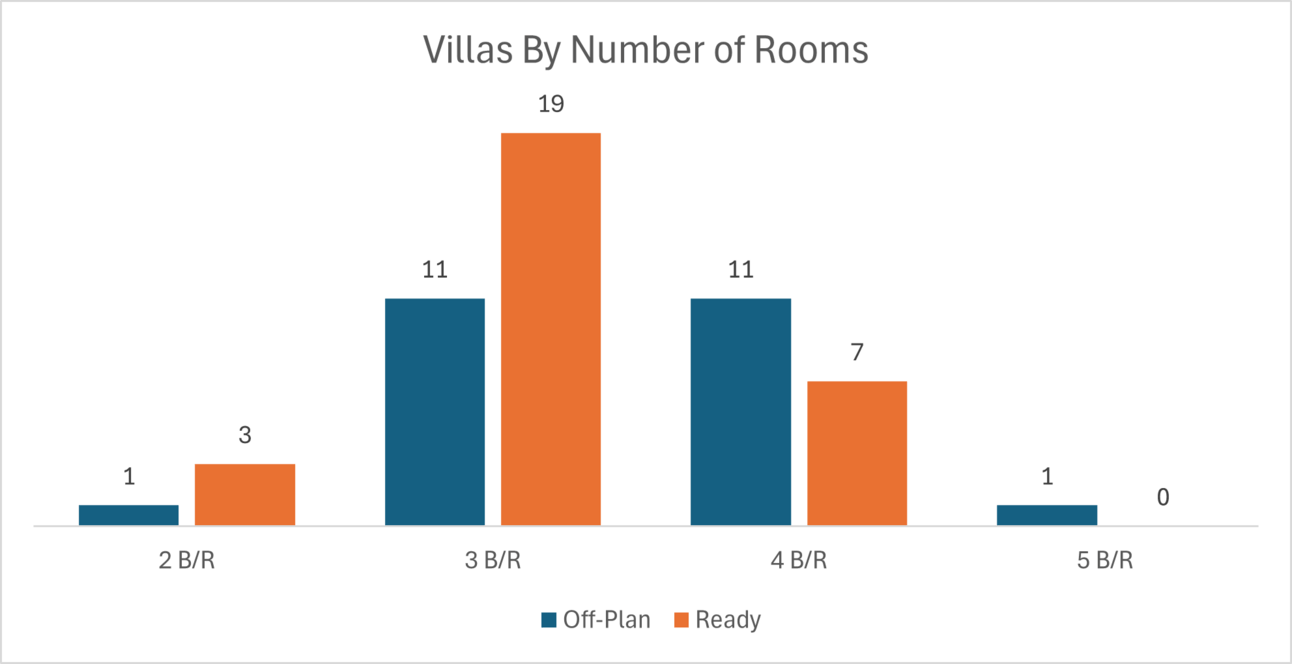

Ready Market Performance

Ready transactions reached AED 656.6 million, with a more balanced mix:

Flats: AED 483.2 million (73.6 % of ready)

Villas: AED 88.8 million (13.5 %)

Hotel Apartments & Rooms: AED 29.6 million (4.5 %)

Commercial: AED 55.0 million (8.4 %)

Although flats lead, the ready market shows notable diversification, particularly in the villa sector.

On The Micro Level

Market Insights

The strong skew toward off-plan volumes indicates that investor-driven demand remains robust, especially for flats offering high leverage and capital appreciation. Meanwhile, the ready segment’s diversification, especially in villas and commercial assets, reflects growing end-user and occupier activity.

Data Source: Dubai Land Department