Emaar will launch “Dubai Mansions,” an ultra-luxury, private enclave beside Dubai Hills Estate with 10k–20k sq ft homes for UHNW buyers. Promising “quiet luxury,” bespoke design, and seclusion with access to golf, healthcare, schools, and Dubai Hills Mall, it aims to elevate Dubai’s elite address market.

Read the full article on Zawya

Dubai unveiled plans to cut education and housing costs and boost livability, aligned with Sheikh Mohammed’s vision. KHDA proposes non-profit schools; DLD targets more mid-market housing; Municipality invests in infrastructure and rural services; Dubai Health expands specialist care and efficiency, advancing Dubai Plan 2033.

Read the full article on Gulf Today

Green, wellness-focused Dubai communities are outperforming: up to 40% higher demand, prices, and yields. H1-2025 villa values +31.6%, apartments +23.6%; transactions surged. Developers launching nature-led masterplans. CBRE shows ~14% annual price growth; rentals and short-term demand up ~30%, with 5–6% yields.

Read the full article on Khaleej Times

Azizi says Rêve in MBR City is 56% complete: structure 94%, blockwork 74%, plastering 66%, tiling 30%, HVAC 48%, MEP 42%, façade 18%. With 3,900 workers, it anchors Riviera’s 75-building, 16,000-home community featuring a 2.7km swimmable lagoon and resort-style amenities.

Read the full article on Zawya

UAE real estate stays a 2025 growth engine: off-plan leads; Dubai Q2 sales AED153.7bn (+44.5% YoY), Abu Dhabi prices +12.1%. Rentals stable, leases up. ~32,400 units under construction; office supply rising. Market projected ~$694bn in 2025, $759bn by 2029; diversification and pro-investment policies sustain demand.

Read the full article on Economy Middle East

Devmark and Manodev Unveil Arka Enclave on Dubai Islands, Marking Atmosphere Living’s Debut in Dubai

Devmark, Manodev and Atmosphere Living launch Arka Enclave, a wellness-led ultra-luxury waterfront community on Dubai Islands. One- to three-bed homes and penthouses with resort amenities (pools, spa, Technogym, clubhouse) and concierge services. Designed by Znera Space/Arkiplan. Completion Dec 2027; bookings open, with prime city connectivity.

Read the full article on Hospitalitynet

Dubai’s big developers are going global to reduce reliance on Dubai’s cycle. Emaar, buoyed by H1-2025 Dh46bn sales and backlog, is eyeing acquisitions in the US, India, China and Europe. DAMAC plans $20bn US data centres plus luxury projects. Sobha expands in UAE and US, targeting $1bn first-year sales.

Read the full article on Gulf News

Dubai forum outlined executing Sheikh Mohammed’s vision: human-centered urban services, world-class education (E33), transparent real estate, and integrated academic healthcare toward Dubai Plan 2033. Chaired by Abdulla Al Basti, with senior officials, it gathered 1,000 leaders to advance D33 agendas and cement Dubai as a global benchmark.

Read the full article on Gulf News

UAE President Sheikh Mohamed bin Zayed Al Nahyan attended the announcement of agreements to develop 13 new residential communities across Abu Dhabi, with projects valued at AED106bn ($28.8bn).

Read the full article on Arabian Business

Abu Dhabi real estate hit Dhs54bn in H1 2025 (+42% YoY); residential Dhs25bn (+38%), a record. Demand (+6%) outpaced supply (+2.6%); inventory ~400k. Q2 prices: apartments +14%, villas/townhouses +11%. Future supply +4.6% by 2028 (45k–55k units). Cash sales 81%; rents rising.

Read the full article on Gulf Business

Gemini Property Developers will launch a 26-storey, 455-unit residential tower in Business Bay with 10 retail units, Burj/Canal views, and resort-style amenities (infinity pool, gyms, wellness/yoga, parks, kids areas, rooftop BBQ, concierge, prayer rooms). Follows award-winning 2017 project, Gemini Splendor.

Read the full article on Gulf News

RAK Properties launched Mirasol Phase II at Mina, Raha Island: 280 waterfront units across low-rise buildings/duplexes. Studios from 389 sq ft (from AED 861,000) to 3-bed penthouses. Amenities: oasis pool, kids’ splash, cinema, yoga/gym. Near Four Seasons/Nikki Beach. Strong local and international demand expected.

Read the full article on Zawya

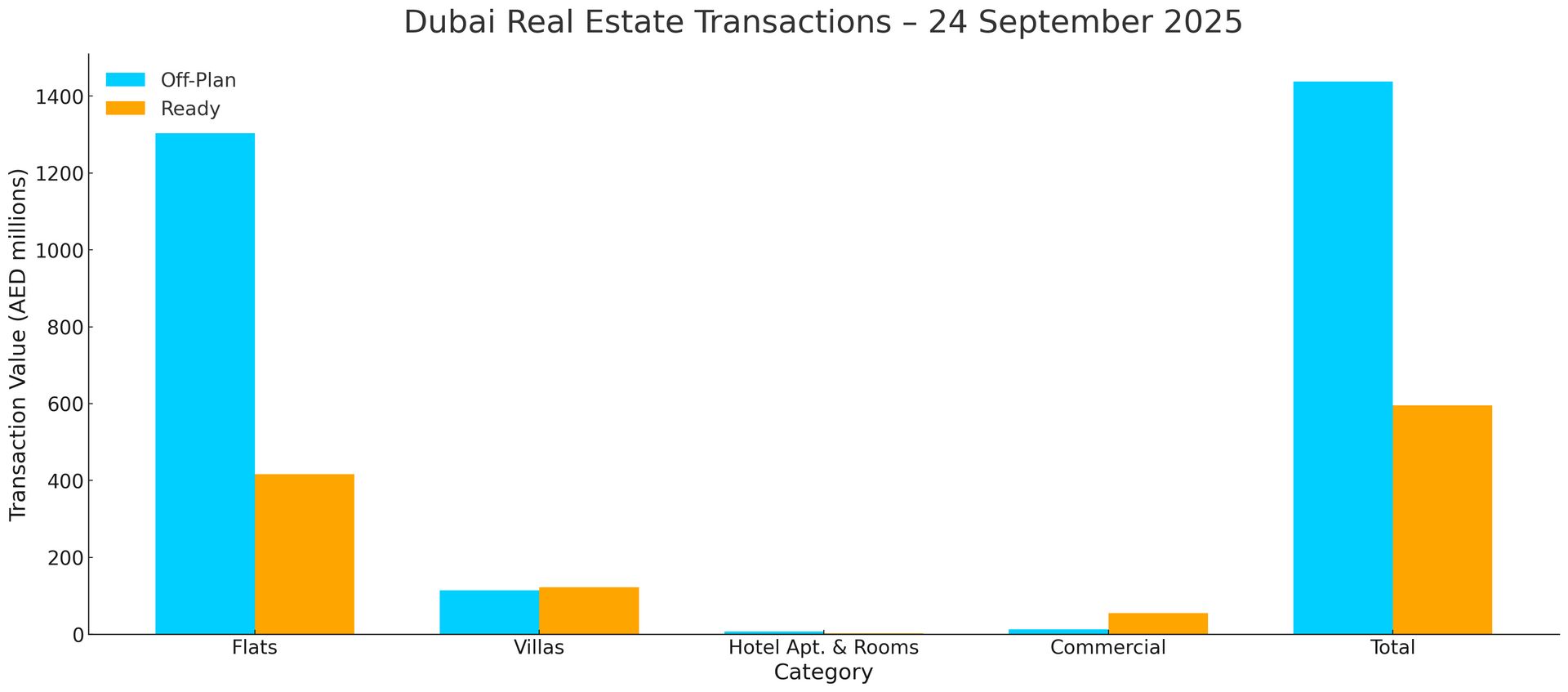

Dubai Real Estate Transactions as Reported on the 24th of September 2025

On the 24-Sep-2025, the total transacted value reached AED 2,033,393,321. Off-plan dominated with AED 1,437,933,293 (70.7%), while Ready accounted for AED 595,460,028 (29.3%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,303.9 | 416.3 |

Villas | 114.5 | 121.9 |

Hotel Apt. & Rooms | 6.7 | 2.6 |

Commercial | 12.8 | 54.7 |

Total | 1,437.9 | 595.5 |

Off-Plan Market Performance

Total Value: AED 1,437,933,293

Flats: AED 1,303.9 (90.7%)

Villas: AED 114.5 (8.0%)

Hotel Apts & Rooms: AED 6.7 (0.5%)

Commercial: AED 12.8 (0.9%)

Off-plan trading was overwhelmingly led by Flats, with Villas a distant second; hospitality and commercial were minimal.

Ready Market Performance

Total Value: AED 595,460,028

Flats: AED 416.3 (69.9%)

Villas: AED 121.9 (20.5%)

Hotel Apts & Rooms: AED 2.6 (0.4%)

Commercial: AED 54.7 (9.2%)

Ready activity was broad-based but still Flat-heavy, with Villas contributing a meaningful fifth of segment value.

On The Micro Level

Market Insights & Outlook

A classic “risk-on” split: Off-plan at ~71% signals strong forward demand, while Ready’s ~29% shows selective end-user and investor appetite. Flats remain the liquidity engine across both segments; sustained depth in Villas suggests continued upgrade and lifestyle-driven demand.

Data Source: Dubai Land Department