Dubai’s rental market is undergoing a subtle but important recalibration. Once considered a transient city where renting was the default choice, 2025 is telling a more nuanced story. Tenants are thinking long-term, with aspirations for ownership, as market forces shape a different future for residents.

Read the full article on Arabian Business

Wasl Group is launching South Garden Buildings D & E at Wasl Gate, reserving many units for first-time buyers under Dubai’s FTHB program with early access and incentives. The Metro-linked project offers studios to 3BR homes, following a 48-hour sellout of phase one.

Read the full article on Government of Dubai Media Office

Ras Al Khaimah’s property market is booming under Sheikh Saud’s strategy: 2024 transactions AED15.08bn (+118%), up nearly 25,000% in seven years. Drivers include population growth, infrastructure, tourism and marquee projects like Wynn Al Marjan. 14,148 homes planned (2026–29), prices seen reaching AED4,000 psf by 2027 and AED4,500 by 2030.

Read the full article on Economy Middle East

AMIS Development accelerates Dubai luxury expansion, acquiring prime land in Meydan and Dubai Islands. Its $116m Woodland Residences sold out in a week; Woodland Terraces and Crest complete in 2027. A Dh5bn investment MoU with First APAC Fund fuels growth, led by Neeraj Mishra.

Read the full article on Gulf News

Nakheel has awarded a contract worth AED2.6bn ($708m) to Fibrex Contracting for the construction of the Bay Villas project at Dubai Islands.

Read the full article on Arabian Business

Danube’s Rizwan Sajan says Golden Visa holders, especially healthcare professionals, are fueling Dubai’s property demand. Dubai issued 158,000 Golden Visas in 2023. He forecasts 15–20% annual price gains over 4–5 years in central areas, citing soaring land values and construction costs, barring geopolitical shocks.

Read the full article on Khaleej Times

Betterhomes says Dubai is shifting from stopover to permanent wealth hub: 10,000 new millionaires in 2025; 81,200 resident millionaires (UAE 130,500). HNWIs spend AED11.4m; ultra-prime sales surge, villas/townhouses hit AED147.2b YTD (+41%). Tax-free stability, DIFC services and branded ecosystems drive permanence; tight supply sustains pricing power.

Read the full article on Trade Arabia

Dubai villas are scarce (7% of listings) and surging: prices +29% YoY; Jumeirah Islands +41%, Palm +40%. Values are 66% above 2014 and 175% above post-pandemic. Prime villas average Dh25m; entry areas Dh1.2–2.5m. Growth may moderate; prices could rise another 10% by end-2025.

Read the full article on Khaleej Times

Proptech is making UAE property buying remote-friendly: immersive 3D/VR tours from major developers, real-time valuations (YallaValue, DLD Smart Evaluation, Property Finder), instant mortgage matching via Holo, and blockchain-enabled contracts on Dubai REST. Fractional, tokenized ownership is rising—all from a phone, without multiple viewings.

Read the full article on What’s On

Dubai South is thriving but missing basics: no nearby ATMs and buses only every 90 minutes. Residents seek ATMs at key hubs, better public transport, improved lighting, indoor sports, pigeon control, and direct road links, especially a flyover to Expo Road, to make the community fully connected.

Read the full article on Gulf News

Over half of UK millionaires would consider leaving if a wealth tax is introduced, with the UAE a top-five choice. Tax-free status, the Golden Visa, and high-yield Dubai property drive appeal; 82% would pursue residency-by-investment and 60% expect a better life abroad.

Read the full article on Khaleej Times

Van Oord won the land-reclamation contract for Naïa Island Dubai, a Shamal Holding project off Jumeirah: 13 hectares, six kilometres of beaches. Works include 28m m³ of sand, 4.3m tonnes of rock and marine infrastructure. Completion targeted H1 2027, emphasizing environmental preservation and coastal protection.

Read the full article on Port News

Dubai Real Estate Transactions as Reported on the 19th of August 2025

On 19-Aug-2025, Dubai recorded AED 2,075.7m in transactions. Off-plan contributed AED 1,113.5m (53.6%), while Ready accounted for AED 962.2m (46.4%)—a balanced day with a slight off-plan lead.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,054.4 | 350.0 |

Villas | 46.6 | 119.2 |

Hotel Apt. & Rooms | 5.5 | 12.3 |

Commercial | 7.0 | 480.7 |

Total | 1,113.5 | 962.2 |

Off-Plan Market Performance

Flats: AED 1,054.4m (94.7% of off-plan)

Villas: AED 46.6m (4.2%)

Hotel Apt. & Rooms: AED 5.5m (0.5%)

Commercial: AED 7.0m (0.6%)

Off-plan activity was overwhelmingly apartment-led, with villas and other segments marginal.

Ready Market Performance

Commercial: AED 480.7m (50.0% of ready)

Flats: AED 350.0m (36.4%)

Villas: AED 119.2m (12.4%)

Hotel Apt. & Rooms: AED 12.3m (1.3%)

Ready market was dominated by commercial deals (~50%), with solid support from apartments.

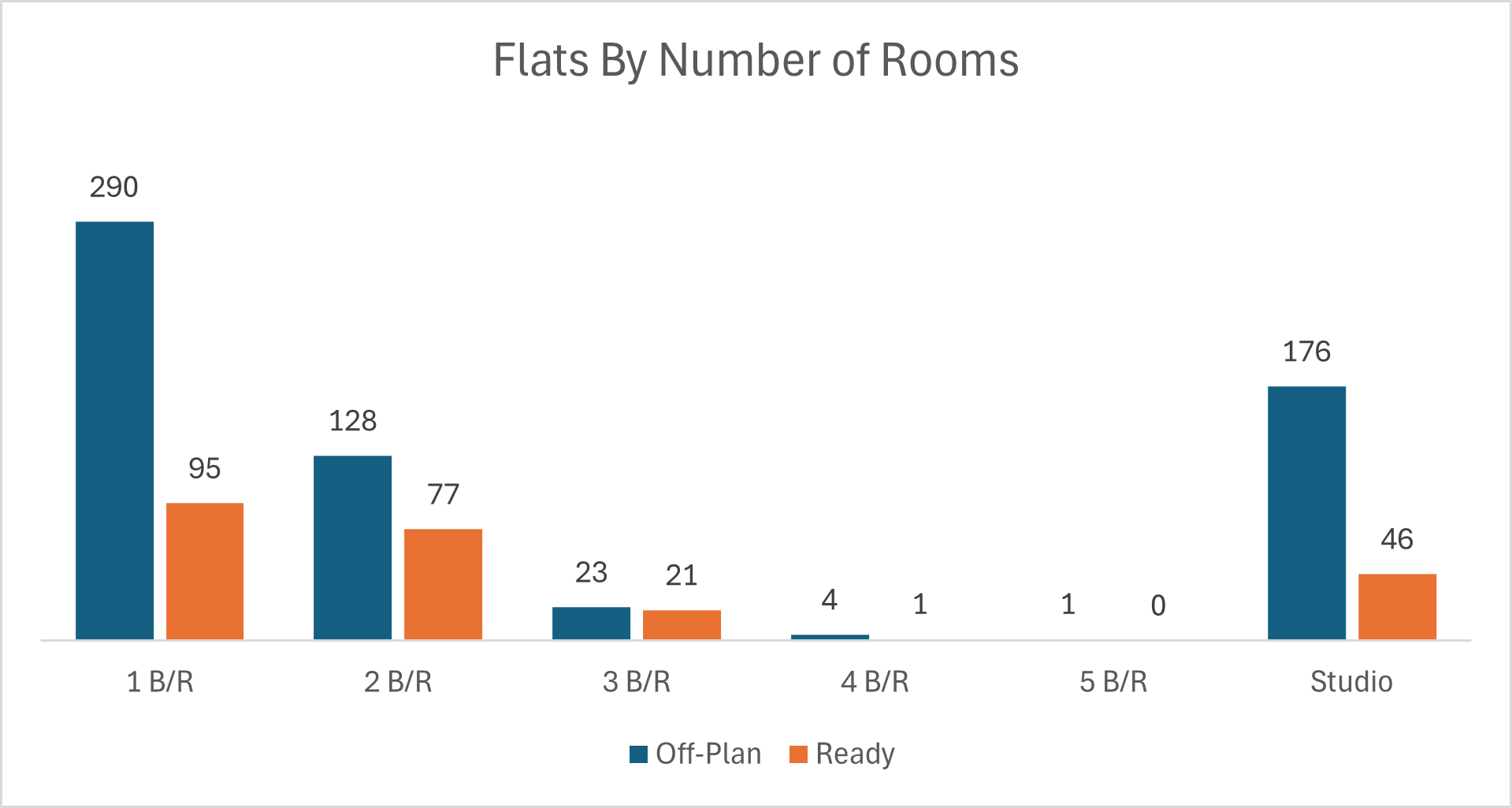

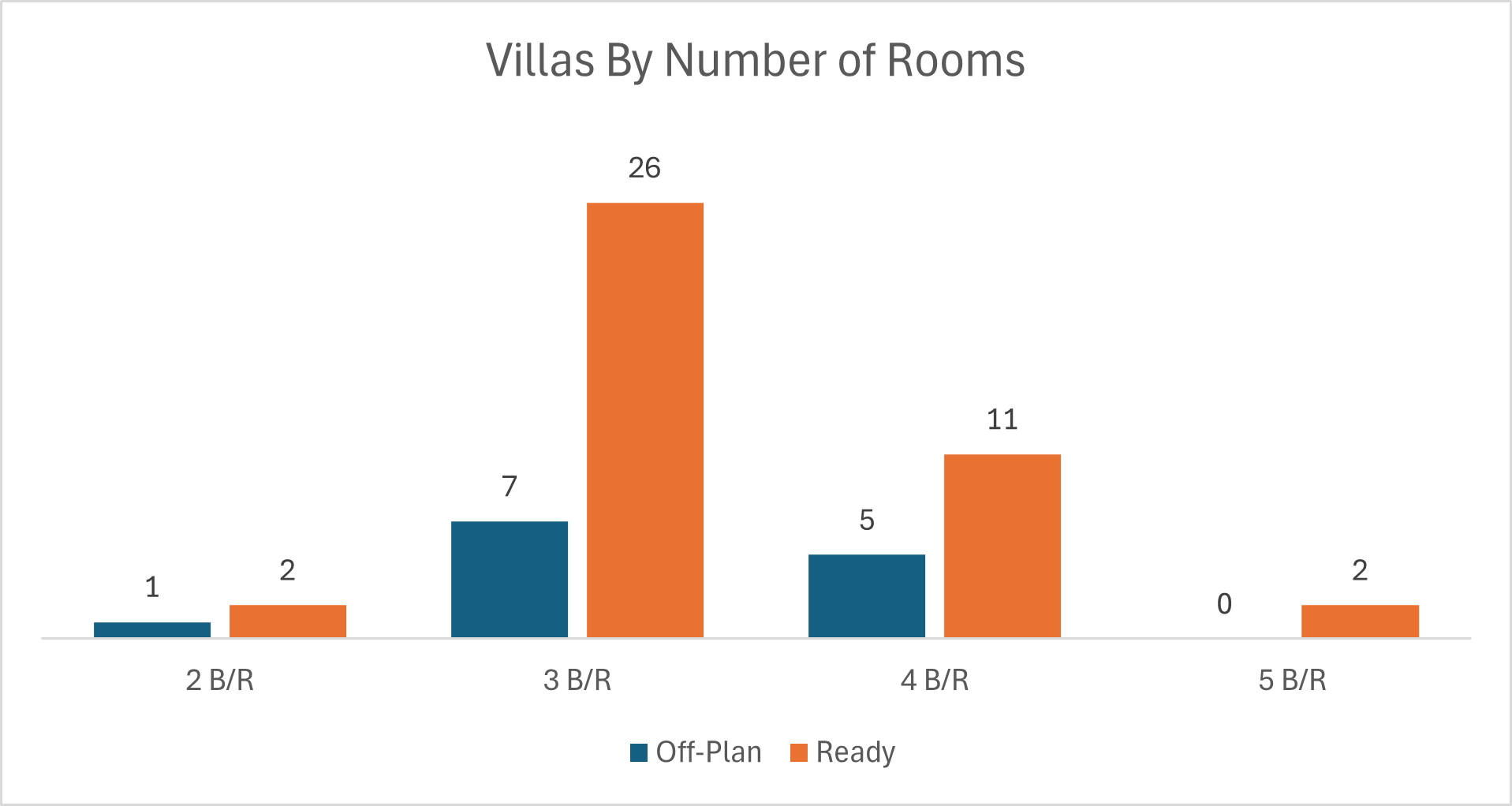

On The Micro Level

Market Insights & Outlook

The day’s split shows end-user apartment demand in off-plan alongside institutional/occupier strength in ready commercial. It’s worth mentioning that most of the commercial deal value came from the mortgage of City Walk

Villa flows were modest across both segments, keeping momentum centered on apartments and commercial stock.

If this mix persists, expect pipeline absorption in mid-market apartments and pricing resilience in income-producing commercial assets.

Data Source: Dubai Land Department