Outsmart college costs

Ready for next semester? June is a key time to assess how you’ll cover college costs. And considering federal aid often isn’t enough, you might have to consider private student loans.

You’re just in time, though—most schools recommend applying about two months before tuition is due. By now, colleges start sending final cost-of-attendance letters, revealing how much you’ll need to bridge the gap.

Understanding your options now can help ensure you’re prepared and avoid last-minute stress. View Money’s best student loans list to find lenders with low rates and easy online application.

Emirates Properties Group has launched the AED350 million Azha Millennium Residences in Dubai’s JVT—a 30-storey, 196-unit Millennium Hotels & Resorts branded development with studios to two-bedrooms, retail spaces, and lavish amenities. Completion is set for Q4 2027, with a flexible payment plan.

Read the full article on Zawya

Nisus Finance’s Dubai arm invested Dh183 million in two properties and is evaluating Dh669 million more, boosting AUM 55% to Rs 15.72 billion. FY25 profit rose 35.5% on 65% revenue growth. NiFCO is raising global capital to deploy US$468 million in UAE real estate.

Read the full article on Khaleej Times

Fund managers like JPMorgan are increasing exposure to emerging markets amid global volatility and easing US tariffs, with Uzbekistan’s debt favored for stability and high yields. Other opportunities include India, Brazil, China and the “Global South,” buoyed by strong demographics and diversification away from US assets.

Read the full article on Invezz

GFS Developments marked the June 18 groundbreaking of Coventry Gardens in Dubai Land Residence Complex with Bollywood star Chitrangda Singh. Located 15 minutes from Downtown Dubai, the project offers studios to two-bedroom apartments from AED 450K, private parking, Dh 25K bookings, and a 3-year post-handover payment plan.

Read the full article on Khaleej Times

| Check out our new website |

|

|

AboutTheUAE is your definitive guide to Dubai—discover top schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more.

|

Devmark has launched Résidences Du Port, Autograph Collection Residences in Dubai Marina: 74 boutique Marriott-branded Riviera-inspired waterfront homes in the redeveloped Nuran Hotel & Apartments, offering world-class hospitality, refined interiors, and curated amenities, marking Marriott’s Autograph Collection debut in Dubai.

Read the full article on Zawya

Bayut’s AI-powered TruEstimate has generated over 300,000 valuation reports in under a year, underscoring Dubai’s shift to data-driven real estate. With the new PropTech Hub and tools like Bayut GPT, market transparency and informed decision-making are rapidly becoming the industry standard.

Read the full article on Gulf News

In Q1 2025, Dubai recorded 42,000+ transactions worth Dhs114 billion (up 23% YoY); residential prices rose 5–6% and villas 8%. Whitewill highlights six hotspots: Dubai Creek Harbour, Al Marjan Island, Business Bay, Yas Island, Dubai South, and JVC—offering yields of 6–9% and strong growth prospects.

Read the full article on Gulf Business

Peak Summit unveiled Solena at The Orchard Place in JVC—phase three adds 400+ European-inspired studios to penthouses with private pools, landscaped terraces, and luxury finishes. With an AED 300 million GDV, amenities include an infinity pool, gym, playground, padel court; completion by July 2028 and prices from AED 720 000.

Read the full article on Zawya

Beeah Group is launching a Dh5 billion Sharjah development featuring 1,500 villas, townhouses, shops, offices and sports facilities to meet 30% y-o-y sales growth. Financed via equity and off-plan sales, homes will use recycled materials, net-zero-ready infrastructure, and competitive pricing for Gulf and South Asian buyers.

Read the full article on Financial Post

Dubai’s appeal to millionaires reaches beyond tax considerations to include factors such as the weather, lifestyle, and business opportunities in emerging markets.

Read the full article on Arabian Business

Dubai Real Estate Transactions as Reported on the 19th of June 2025

On 19 June 2025, Dubai’s total real estate transaction value reached AED 2.149 billion. Off-plan properties accounted for AED 1.291 billion (60.1 % of the total), while ready assets contributed AED 857.3 million (39.9 %).

Asset Type | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,136.3 | 618.5 |

Villas | 134.9 | 170.1 |

Hotel Apt. & Rooms | 4.8 | 41.6 |

Commercial | 15.3 | 27.1 |

Total | 1,291.2 | 857.3 |

Off-Plan Market Performance

Total Off-Plan: AED 1.291 billion (60.1% of total)

Flats: AED 1.136 billion (88.0 % of off-plan)

Villas: AED 134.9 million (10.4 %)

Commercial: AED 15.3 million (1.2 %)

Hotel Apartments & Rooms: AED 4.8 million (0.4 %)

The off-plan market on the 19th of June was dominated by flats, villas made a decent double-digit appearance, while hotel rooms & apartment and commercials stayed marginal.

Ready Market Performance

Total Ready: AED 857.3 million (39.9% of total)

Flats: AED 618.5 million (72.1 % of ready)

Villas: AED 170.1 million (19.8 %)

Hotel Apartments & Rooms: AED 41.6 million (4.9 %)

Commercial: AED 27.1 million (3.2 %)

The ready properties market was focused on residential properties with flats taking the lion share or the day.

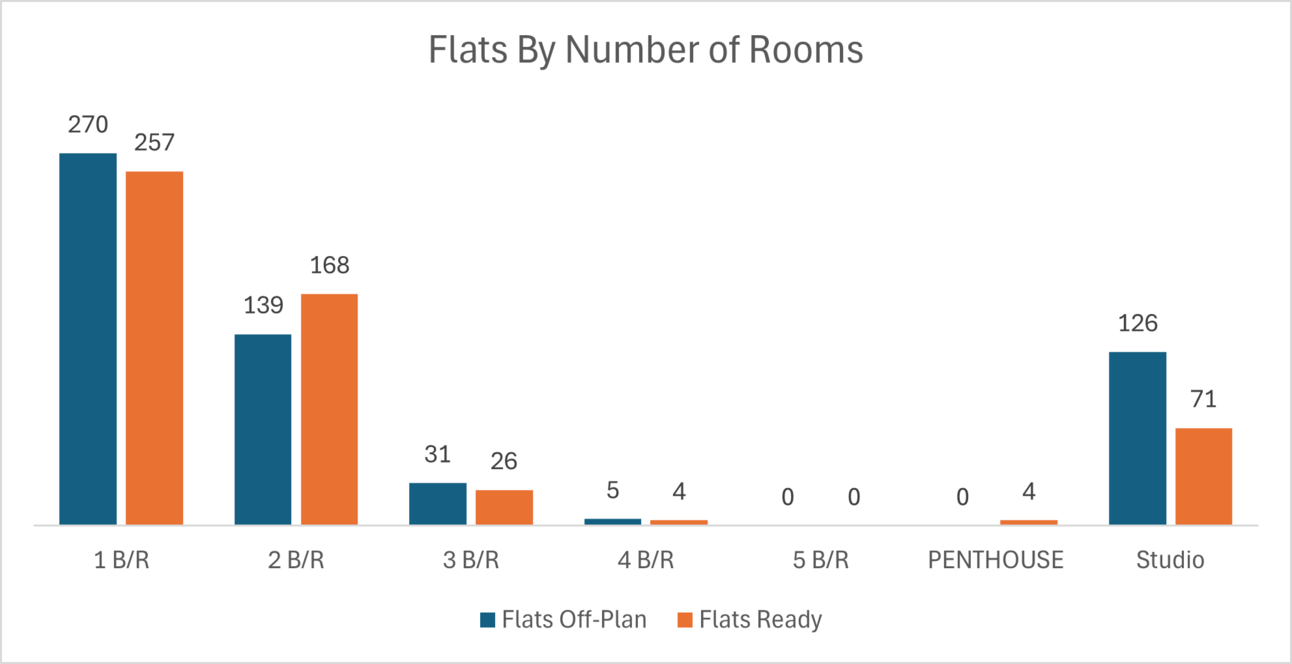

On The Micro Level

Market Insights

The 60:40 split in favor of off-plan underscores sustained investor appetite for new-launch flats. Villas and commercial play a smaller role in this segment, while ready-stock activity, led by flats and villas, continues to attract end-users seeking immediate occupancy. Hospitality volumes remain niche. Developers will likely lean further into flat-focused off-plan offerings, supported by competitive pricing and flexible payment plans, even as the healthy ready market provides steady yield opportunities.

Data Source: Dubai Land Department