Dubai Land Department (DLD) launched the pilot phase of the Real Estate Tokenisation Project to enable fractional property ownership via blockchain-based digital tokens. This initiative enhances liquidity, accessibility, and transparency in real estate investments. Expected to reach a Dh60 billion market by 2033, it aims to attract global investors.

Read the full article on Khaleej Times

The UAE's real estate sector is set for strong growth in 2025, driven by limited supply, infrastructure expansion, and alternative assets. The UAE led 2024 construction project awards ($40.6B) and saw record residential sales. Office, retail, and hospitality markets remain robust, while data centers and logistics sectors continue to expand.

Read the full article on Middle East Economy

Dubai’s real estate sector is transforming through AI, blockchain, IoT, and smart city innovations. Developers like Emaar, Damac, and Nakheel integrate smart home automation, biometric security, sustainable designs, and 5G connectivity. Future trends include AI-driven urban planning, digital twins, and robotic construction, positioning Dubai as a global leader in smart real estate.

Read the full article on Analytics Insights

Abu Dhabi has tightened real estate laws, penalizing developers for unlicensed projects and property neglect. New transparency measures include the DARI platform and a rental index. Fines for violations range from Dh5,000 to Dh1 million. Similar crackdowns in Dubai and other emirates aim to regulate property ads, transactions, and overcrowding.

Read the full article on Khaleej Times

Just Real Estate (JRE) and Al Jazeera Finance “Tamweel” have partnered to offer Sharia-compliant real estate financing in Qatar. The agreement provides flexible options for all nationalities, with up to 15-year tenors and a three-month grace period, enhancing property ownership accessibility and supporting Qatar’s real estate market growth.

Read the full article on Zawya

The UAE is advancing as a global leader in sustainable real estate, ranking fifth for LEED-certified projects in 2024. With strong government policies and rising green finance, developers are adopting energy-efficient designs. New LEED v5 standards and private sector involvement are key to achieving Net Zero and long-term sustainability goals.

Read the full article on Khaleej Times

Photo by M. Omar

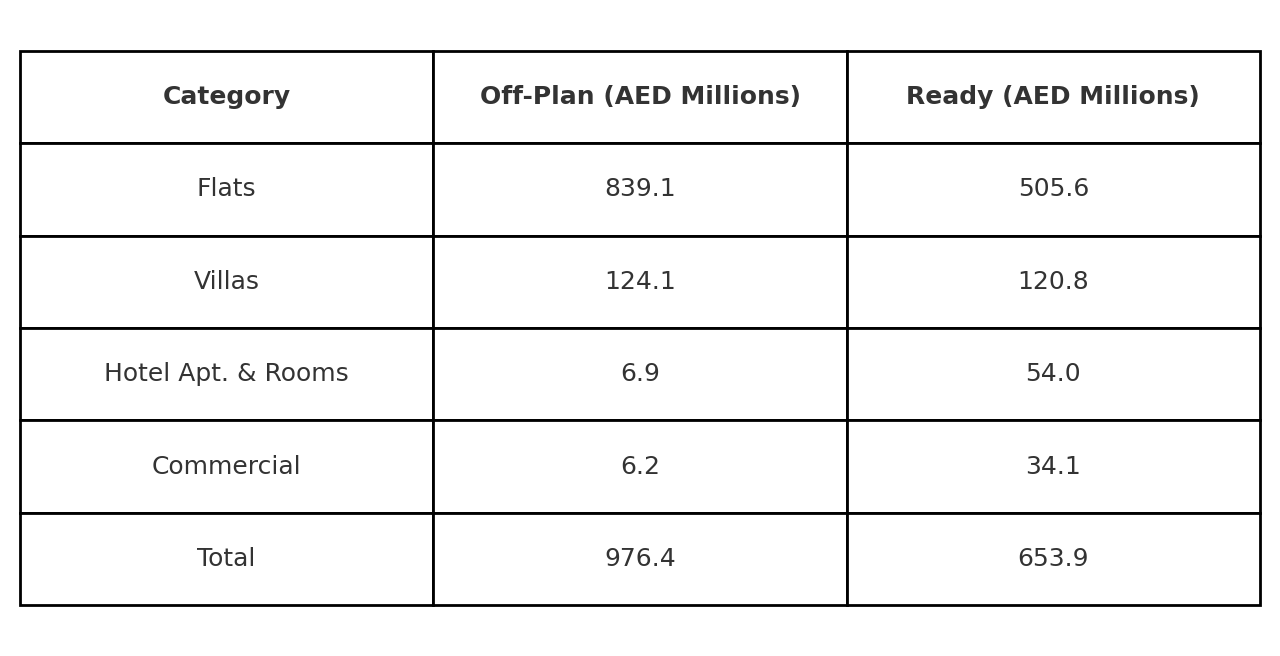

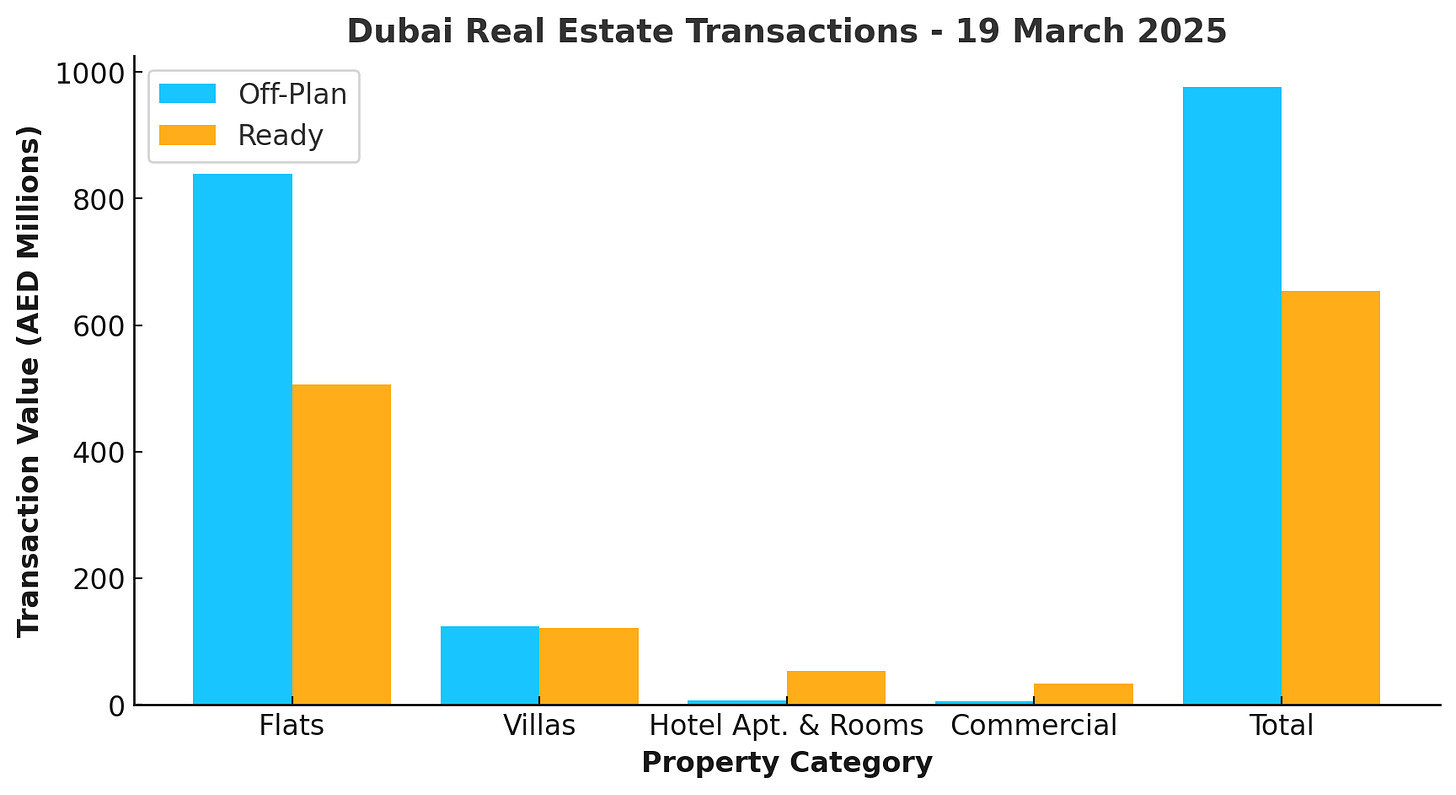

Dubai Real Estate Transactions as Reported on the 19th of March 2025

On March 19, 2025, Dubai’s real estate market recorded a total transaction value of AED1.63 billion, showcasing sustained investor confidence in both off-plan and ready properties. The breakdown of transactions indicates a stronger performance in the off-plan sector, accounting for a larger share of the total market activity.

Off-Plan vs. Ready Property Transactions

The off-plan segment dominated the market, contributing 59.9% of the total transactions, amounting to AED976.37 million. Meanwhile, the ready properties segment accounted for 40.1%, totaling AED653.92 million.

Off-Plan Total: AED976,370,349 (59.9% of total transactions)

Ready Total: AED653,923,509 (40.1% of total transactions)

This trend underscores the ongoing investor interest in off-plan properties, likely driven by flexible payment plans, competitive pricing, and promising future returns.

Breakdown by Property Type

Off-Plan Transactions (Total: AED976.37 million)

Flats: AED839.08 million (86.0% of off-plan transactions)

Villas: AED124.13 million (12.7% of off-plan transactions)

Hotel Apartments & Rooms: AED6.95 million (0.7% of off-plan transactions)

Commercial: AED6.21 million (0.6% of off-plan transactions)

Key Insight: Flats continued to be the dominant off-plan asset, accounting for a substantial 86.0% of the segment. The strong preference for off-plan flats suggests demand from both investors and end-users looking for attractive pre-construction pricing and flexible payment options.

Ready Transactions (Total: AED653.92 million)

Flats: AED505.60 million (77.4% of ready transactions)

Villas: AED120.82 million (18.5% of ready transactions)

Hotel Apartments & Rooms: AED54.00 million (8.3% of ready transactions)

Commercial: AED34.08 million (5.2% of ready transactions)

Key Insight: Flats also dominated the ready property segment, making up 77.4% of the category’s total transactions. Villas followed at 18.5%, indicating steady demand for standalone homes, likely fueled by long-term investors and end-users seeking immediate occupancy.

Market Implications

Continued Confidence in Off-Plan Market: The higher share of off-plan transactions highlights strong investor sentiment and a preference for new developments that offer modern designs and long-term value.

Flats Lead Across Both Segments: The consistent dominance of flats in both off-plan (86.0%) and ready (77.4%) segments suggests that apartment living remains the top choice for buyers, whether for investment or residence.

Villas Maintain Steady Demand: Villas contributed 12.7% of off-plan transactions and 18.5% of ready transactions, reinforcing the appeal of larger homes, particularly in premium and suburban locations.

Sustained Interest in Hotel Apartments: With AED54.0 million in ready sales, the hospitality-focused real estate segment continues to attract investors looking for short-term rental yields and tourism-driven revenue.

Conclusion

Dubai’s real estate market continues to exhibit strong investment activity, particularly in the off-plan sector, which remains the preferred choice for buyers seeking capital appreciation and flexible purchase terms. The ready property market also retains a solid foothold, particularly among end-users and investors seeking immediate possession. With steady growth and increasing interest across diverse property types, Dubai’s real estate sector is well-positioned for continued expansion throughout 2025.

Data Source: Dubai Land Department