Earn Free Gifts 🎁

Share with your customers and colleagues and get access to our premium content.

3 Referrals will get you 1 month free premium subscription

5 Referrals will get you 3 month free premium subscription

{{rp_personalized_text}}

His Highness Sheikh Hamdan launched the Dubai PropTech Hub aligned with Dubai Economic Agenda D33 and the Real Estate Sector Strategy 2033, to accelerate digital transformation in real estate, aiming to grow the market to AED 4.5 billion in five years, secure AED 1 billion in investments by 2030, and support 200 companies.

Read the full article on Economy Middle East

Dubai property values surged 70% over four years, drawing Wall Street and Asian investors: Brookfield eyes a Dubai Hills residential project, while Temasek explores commercial and luxury assets. Growth stems from diversification, infrastructure expansion, regulatory incentives, and Expo 2020 legacy, though analysts warn of affordability and market-cooling risks.

Read the full article on MSN

Dubai Holding’s DHAM REIT increased its Dubai Residential REIT IPO to 1.95 billion units (15% float) from 1.625 billion (12.5%) due to strong demand. At AED 1.07 - 1.10/unit, it will raise ~AED 2.09 - 2.15 billion, valuing the REIT at AED 13.9 - 14.3 billion, with a DFM listing expected around May 28.

Read the full article on Zawya

Digital twin technology - dynamic 3D replicas updated in real time - has revolutionized DAMAC Properties’ sales, boosting transactions from $24 million to $400 million, while the global market is set to climb from $24.5 billion in 2025 to $259 billion by 2032. By optimizing design, sustainability, staging, and virtual tours, it’s reshaping real estate sales.

Read the full article on Economy Middle East

Wealthy individuals now weigh quality-of-life alongside financial incentives when relocating, making Dubai and Abu Dhabi the top HNWI destinations, according to Savills. Tax-free status, luxury amenities, golden visas, and a 6.8% prime property price rise with 47% more transactions in 2024 fuel this influx.

Read the full article on Consultancy ME

NABNI Developments opened sales for the 146-unit Waldorf Astoria Residences Dubai Business Bay, a 65-storey ultra-luxury tower by Carlos Ott with HBA interiors, launching in May 2025. Featuring Signature, Sky, and four-floor Sky Palace collections, premium amenities, immersive 1,000 m² sales centre, construction starts June 2025.

Read the full article on Gulf Business

Elton Real Estate Development has unveiled Védaire Residences, its first boutique residential project on Meydan Avenue: 43 apartments and three showrooms with skyline and racecourse views. Construction starts Q3 2025, handover in Q3 2027, with prices from AED 1.35 million and a rich amenity offering.

Read the full article on Zawya

The ongoing drive for economic diversification, the surge in digital adoption and e-commerce, and the rising flexible job market are triggering demand for different types of commercial real estate

Read the full article on Arabian Business

UAE real estate is poised for 2.45% annual growth in affordable luxury (2025–29), 5–8% in Dubai’s premium segment, and an 18% surge in vacation rentals. Smart-home, sustainability, hybrid developments, and novel financing schemes are luring North American and European investors despite digital and supply challenges.

Read the full article on PropertyWire

RTA to build new bridge in Nad Al Sheba to cut Dubai journey times for thousands of motorists a day.

Read the full article on Arabian Business

Despite rising rents and abundant new supply, nearly 90% of Dubai tenants renew leases—driven by high moving costs and landlords’ leverage. The digital Rental Index has curbed aggressive hikes and boosted tenant awareness, but hasn’t yet triggered a broader market correction.

Read the full article on Gulf News

Shamal launches a 42-unit second tower, Le Noir, at Baccarat Hotels & Residences Downtown Dubai—complementing Le Rouge. Developed with H&H, designed by Studio Libeskind with 1508 London interiors and operated by Starwood, it offers luxury amenities and exclusive privileges, opening to residents in 2026.

Read the full article on Zawya

Parkin now offers subscription parking across all its zones - including Silicon Oasis, Dubai Hills, Wasl, and roadside/plot areas - with plans from AED 300/month up to 12 months. Subscriptions remove time limits, fines, and per-use payments.

Read the full article on Gulf News

The Bugatti Residences in Business Bay—a Bugatti-Binghatti collaboration—comprises two 52-storey towers with 182 branded units, private car elevators, fitness, spa, pool, valet, and concierge services. Neymar Jr. bought a $54.5 M Sky Mansion. Completion is slated for end-2025.

Read the full article on Supercar Blondie

Dubai Real Estate Transactions as Reported on the 19th of May 2025

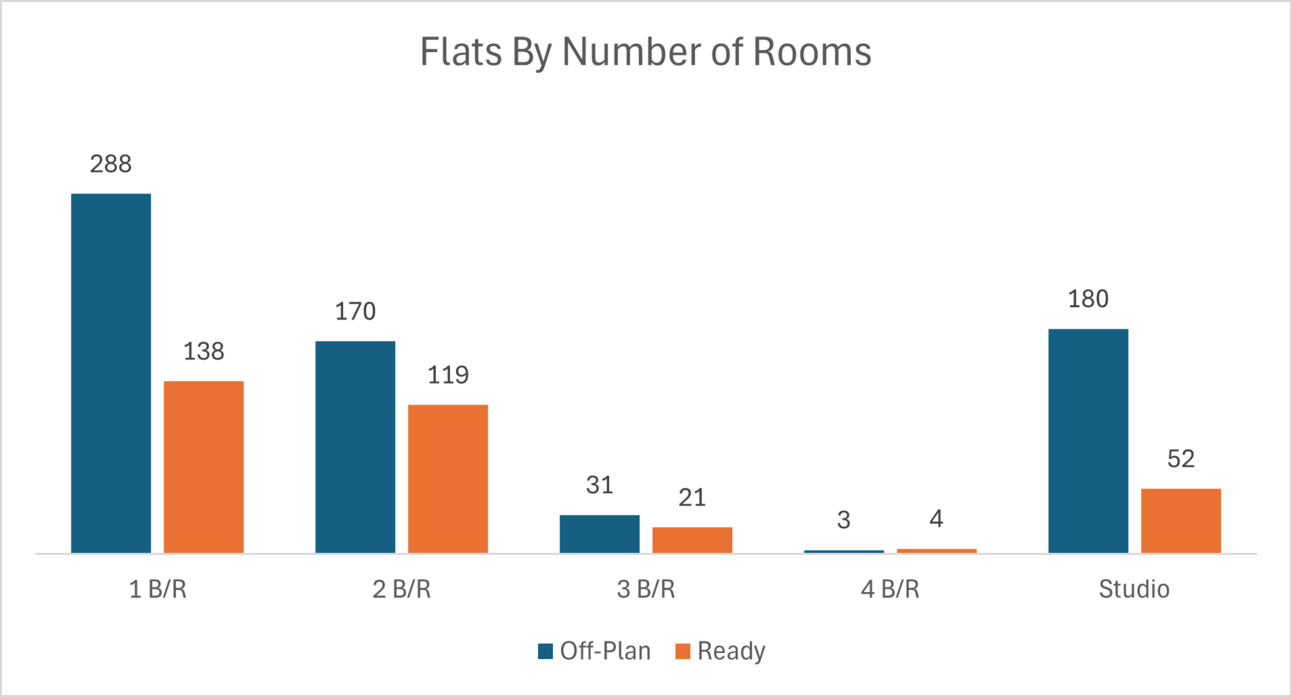

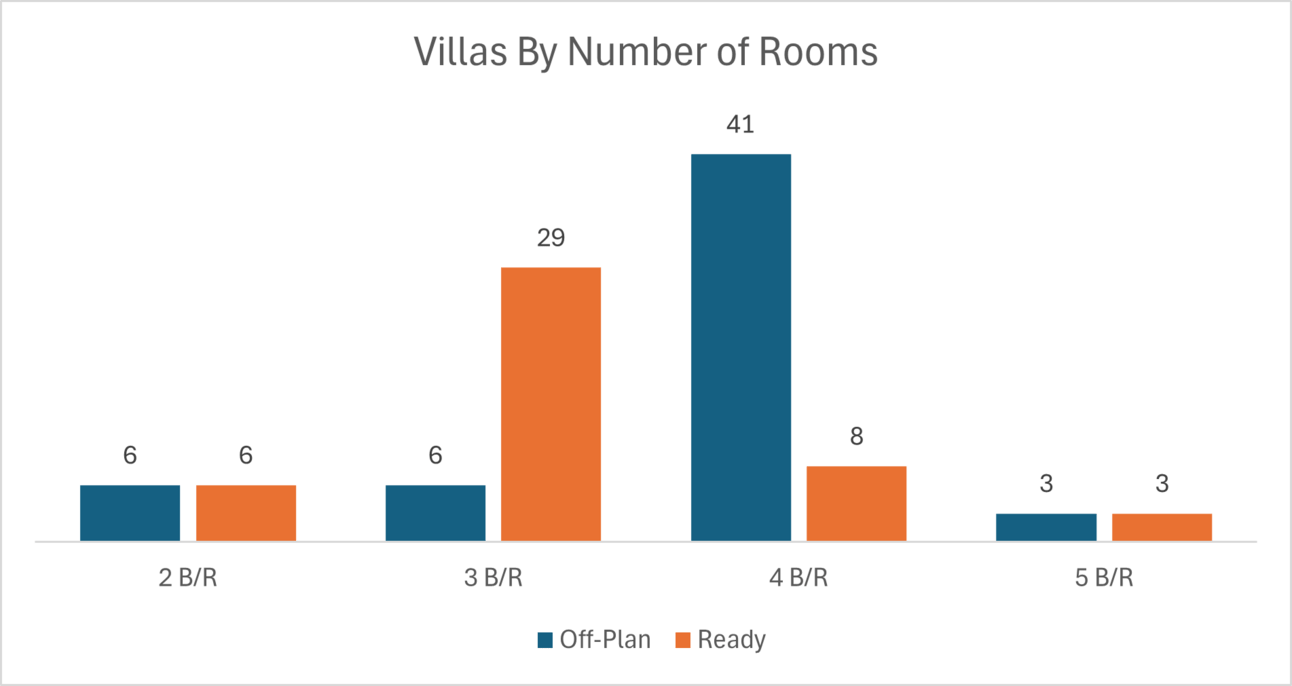

On 19 May 2025, Dubai recorded a total of AED 2.27 billion in real estate transactions. The market remains firmly driven by the off-plan segment, which contributed 64.4% of the total, while ready property transactions made up the remaining 35.6%.

Sub-Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,188.7 | 572.8 |

Villas | 257.2 | 129.3 |

Hotel Apartments & Rooms | 10.0 | 18.9 |

Commercial | 2.1 | 86.3 |

Total | 1,457.9 | 807.3 |

Off-Plan Market Performance

The off-plan segment accounted for AED 1.46 billion, reaffirming investor confidence in pre-construction opportunities across Dubai. The detailed contribution of each sub-category is as follows:

Sub-Category | Transaction Value (AED) | % of Off-Plan Total |

|---|---|---|

Flats | 1,188,659,680 | 81.5% |

Villas | 257,167,192 | 17.6% |

Hotel Apartments & Rooms | 9,968,973 | 0.7% |

Commercial | 2,119,887 | 0.1% |

Key Insight:

Off-plan flats dominated the segment, contributing over 81.5%, reflecting strong demand for new-build apartments. Villas also remained a substantial contributor, while commercial and hotel units saw minimal activity.

Ready Market Performance

The ready property market recorded a total of AED 807.3 million, maintaining healthy momentum across multiple asset classes. Here's the sub-category breakdown:

Sub-Category | Transaction Value (AED) | % of Ready Total |

|---|---|---|

Flats | 572,798,159 | 70.9% |

Villas | 129,268,762 | 16.0% |

Hotel Apartments & Rooms | 18,919,688 | 2.3% |

Commercial | 86,326,644 | 10.7% |

Key Insight:

Flats again led the activity, representing nearly 71% of the ready market, followed by villas. Notably, commercial transactions captured a larger share than in the off-plan market, indicating growing interest in income-generating assets.

On The Micro Level

Market Insights & Outlook

The off-plan market continues to outperform, driven by investor interest in upcoming communities and attractive developer payment plans.

Ready properties still hold strong appeal for end-users, especially in the flats and villa segments.

The comparatively low hotel and commercial activity suggests a residential-led cycle, although the commercial segment in the ready market shows good traction.

Data Source: Dubai Land Department