|

The Fed’s latest 25 bps rate cut, mirrored by the UAE Central Bank, lowers borrowing costs, improving mortgage affordability and likely boosting UAE real estate demand. Potential manufacturing inflows driven by US tariff wars and continued population and investment growth further support the UAE’s ongoing property market rally.

Read the full article on MENA FN

Property Finder has become the first platform to reach 100% compliance with Dubai Land Department rules, verifying every listing via Trakheesi permits, QR codes and AI checks. This partnership with DLD and RERA boosts transparency, cuts fake listings, and strengthens trust in Dubai’s real estate market.

Read the full article on Zawya

Dubai Land Department’s new Digital Sale Procedure on the Dubai Now app lets UAE-resident cash buyers and sellers complete ready-property transfers fully online, using UAE Pass and a DLD escrow IBAN. It removes manager’s cheques, trustee visits, and manual approvals, with title deeds issued instantly once funds clear.

Read the full article on Allsop & Allsop

Kleindienst Group’s voco Dubai Nice – The Heart of Europe on The World Islands has received its Building Completion Certificate, clearing it to open on 1 December 2025. The Riviera-inspired hotel is a key milestone toward the project’s 20-hotel, 5,000-key tourism and investment vision.

Read the full article on Trade Arabia

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

ARY Group and Maher Al Zarooni Group have formed ARY & MAZ Developments, a AED 2.5bn JV to deliver high-rise and villa projects across Dubai’s key growth areas, including Barari Palace. Leveraging both families’ track records, the venture targets quality, sustainable, smart developments amid Dubai’s expanding real estate market.

Read the full article on Zawya

Dubai is preparing for 2026 air taxi services by integrating vertiports into new residential and commercial projects, with the first DXB vertiport 60% complete. Successful test flights, plans for four initial vertiports, and close work with developers aim to make air mobility safe, quiet, walkable, and eventually affordable.

Read the full article on Khaleej Times

Emirati developer Mohamed Alabbar has bought the 12th-century Castello di Antognolla in Umbria for about $55m and plans to invest up to $200m total to create a Six Senses luxury resort with hotel, golf, villas and wellness for affluent global guests.

Read the full article on Zawya

Grovy Developers has launched RIVO by Grovy, a design-led mid-market residence in Dubai Land Residence Complex, already 50% booked and due for Q4 2027 handover. The 133-unit project offers larger-than-average, highly amenitised studios to 4BR apartments targeting end-users and families.

Read the full article on Construction Business News

All the stories worth knowing—all in one place.

Business. Tech. Finance. Culture. If it’s worth knowing, it’s in the Brew.

Morning Brew’s free daily newsletter keeps 4+ million readers in the loop with stories that are smart, quick, and actually fun to read. You’ll learn something new every morning — and maybe even flex your brain with one of our crosswords or quizzes while you’re at it.

Get the news that makes you think, laugh, and maybe even brag about how informed you are.

PRYPCO Blocks has signed an MoU with myAlfred (InsuranceMarket.ae’s rewards platform) to offer subscribers up to AED 350 off their first AED 2,000+ fractional property investment, aiming to democratise real estate access and help users grow wealth through small-ticket, diversified ownership.

Read the full article on Zawya

Qatar’s residential market saw Q3 2025 sales volume jump 57% and value 43% year-on-year, led by Doha and strong growth in Al Rayyan and Al Daayen. Demand is supported by incentives, expanding freehold/residency rules, and booming lifestyle retail, especially luxury-led destinations like Place Vendôme and Msheireb.

Read the full article on Economy Middle East

Homebuyers in Saudi Arabia and the UAE are willing to pay an average 7 per cent premium for homes with sustainable features, while properties lacking them face a 4 per cent discount, according to a new survey by PwC Middle East.

Read the full article on Arabian Business

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Bayut has launched Bayut Studios, a 3D visualisation service for brokers, developers and investors to create renders, animations, virtual tours and floor plans for off-plan properties. Integrated with Bayut and Dubizzle, it aims to boost marketing, lead generation and buyer decision-making.

Read the full article on AIM Group

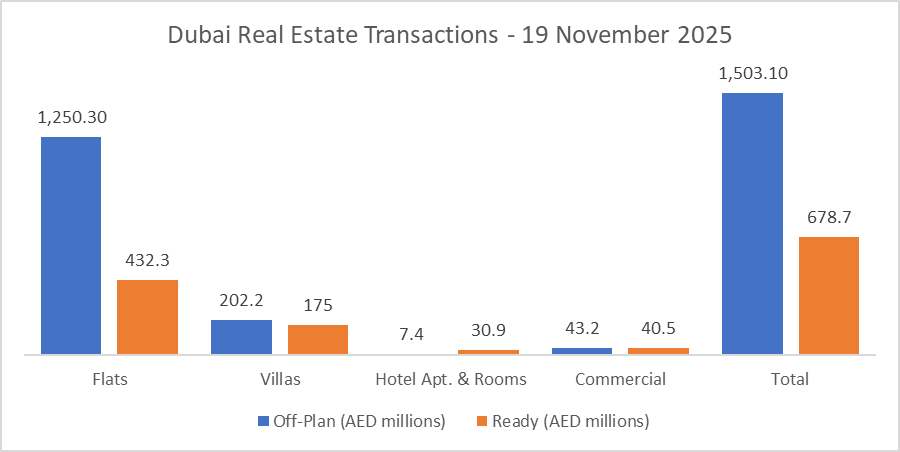

Dubai Real Estate Transactions as Reported on the 19th of November 2025

On 19-Nov-2025, the total transacted value reached AED 2,181,823,971. Off-plan dominated with AED 1,503,117,100 (68.9%), while Ready accounted for AED 678,706,872 (31.1%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,250.3 | 432.3 |

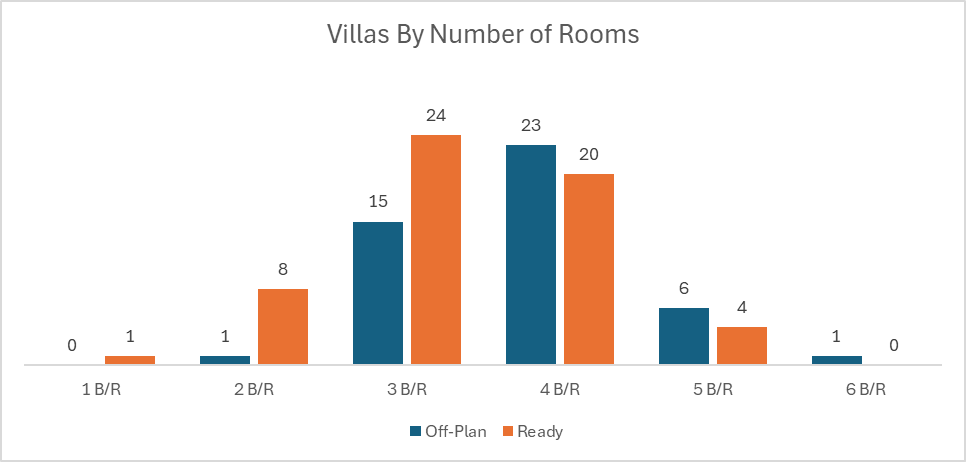

Villas | 202.2 | 175.0 |

Hotel Apt. & Rooms | 7.4 | 30.9 |

Commercial | 43.2 | 40.5 |

Total | 1,503.1 | 678.7 |

Off-Plan Market Performance

Total Value: AED 1,503,117,100

Flats: AED 1,250,313,789 (83.2%)

Villas: AED 202,184,380 (13.5%)

Hotel Apts & Rooms: AED 7,369,650 (0.5%)

Commercial: AED 43,249,280 (2.9%)

Off-plan activity was heavily concentrated in flats, which accounted for more than four-fifths of all off-plan value, with villas adding a meaningful but secondary layer of demand and commercial/ hospitality remaining niche.

Ready Market Performance

Total Value: AED 678,706,872

Flats: AED 432,287,983 (63.7%)

Villas: AED 174,992,313 (25.8%)

Hotel Apts & Rooms: AED 30,916,325 (4.6%)

Commercial: AED 40,510,250 (6.0%)

In the ready segment, flats also led but with a more balanced mix, as villas contributed over a quarter of value, indicating healthy end-user and upgrader activity alongside investor-driven apartment trades.

On The Micro Level

Market Insights & Outlook

The day’s transactions reaffirm Dubai’s off-plan-led cycle, with nearly 70% of value coming from projects under development, yet the sizeable ready share shows that immediate-occupancy and income-generating assets remain in strong demand. Flats dominate both segments, reflecting investor preference for liquid, easily rentable stock, while the solid villa contribution underscores ongoing appetite for larger family homes and lifestyle-led communities. If this balance holds, the market is likely to see continued depth across both off-plan launches and established neighbourhoods, rather than a one-dimensional rally.

Data Source: Dubai Land Department