Dubai’s Real Estate Court cancelled a Dhs1.2m unit sale after the buyer paid about Dhs600k then defaulted on remaining installments. The unit’s registration was revoked and returned to the seller. The buyer must pay Dhs150k compensation plus 5% interest after the judgment is final, plus fees.

Read the full article on Gulf Today

It ranked first among Dubai’s private developers, boosted by $3bn sales in just five hours of its most recent launch – DAMAC Islands 2.

Read the full article on Arabian Business

ZāZEN Properties will launch a low-density Dubai South project (48 homes in a G+4 building) with Vida Bricks as exclusive sales partner. Aimed at end users, it offers 1–3 bedroom and study layouts plus rooftop wellness amenities. Construction starts Q2 2026, completion due November 2027.

Read the full article on MENA FN

Seven in ten UAE residents plan to buy property within the next six months, underscoring sustained buyer confidence heading into 2026, according to the Property Finder Market Pulse.

Read the full article on Arabian Business

Sharjah’s real estate market hit a record Dh65.6bn in 2025 (+64.3% vs 2024), with 132,659 total transactions (+26.3%). Outright sales rose to 33,580 (+38.4%). Mortgages reached Dh15.5bn across 6,300 deals (+45.1%). Investors from 129 nationalities participated; foreign-traded properties jumped to 60,322. New development projects rose to 38, aided by digital services.

Read the full article on Gulf News

Dubai logged a record 648 project launches in 2025, one every 13.5 hours, by 258 developers (+40% YoY), adding ~167,000 units worth Dh463bn. Apartments were 88.8% of supply, while villas/townhouses drove more value. Activity centered in JVC, Business Bay, Dubai South; prime waterfront areas captured higher pricing.

Read the full article on Khaleej Times

Digital Twin 2.0 is a “living” digital asset, not just a 3D model, combining BIM geometry, engineering/operational data, IoT/BMS feeds, real-time analytics and dashboards. In Dubai, it’s positioned as a financial tool to cut OPEX, boost transparency, enable predictive maintenance, extend asset life, and raise capitalization. The main hurdle is integrating siloed systems, typically via specialist engineering integrators.

Read the full article on MSN

Al Marwan Developments’ District 11 aims to elevate Sharjah’s commercial real estate with an integrated, “future-ready” business ecosystem. The 3.5m sq ft project spans 11 buildings with premium offices, a 368-key international hotel, and 3,000+ parking spaces, strategically located on E311. Positioned as the UAE’s first AI-designed business complex, it targets smarter operations, energy efficiency, and improved user experience.

Read the full article on Zawya

Dubai developers reported strong 2025 sales: Damac led private developers with a record Dh36bn (including Dh11bn sold in 5 hours for Damac Islands 2) and 50,000 units delivered. Samana posted Dh7.1bn. Market-wide, 2025 saw Dh917bn transactions and 648 new project launches (~167k units, Dh463bn).

Read the full article on Khaleej Times

Betterhomes’ FY2025 report says Dubai hit a record 203,000 residential transactions worth AED547bn, with Q4 at AED141bn. Liquidity is strongest in studios to 2-bed homes (77% of deals), mostly AED500k–3m. Off-plan and resale were balanced (AED286bn vs AED262bn). Prices rose 12% to AED1,673/sq ft, while mortgages financed 52% of purchases. Focus is shifting to yield and location selectivity amid rising 2026 supply.

Read the full article on Construction Week Online

Ohana Development has begun delivering Ohana by the Sea, an AED700m luxury villa community in Al Jurf on the Abu Dhabi–Dubai coast. The project includes 75 fully customised 4–7 bedroom beachfront villas and is on track for completion in Q1 2026. Abu Dhabi Real Estate Centre officials visited to review progress.

Read the full article on Zawya

The Abu Dhabi residential property market is poised for a strong year, with total off-plan sales expected to reach over AED120 billion ($32.7 billion) in 2026, as buyer confidence returns and off-plan demand accelerates, supported by a robust pipeline.

Read the full article on Arabian Business

Sharjah’s Ruler, HH Sheikh Dr. Sultan Al Qasimi, announced a new community in Jabal Al Ashkel (near Khorfakkan) with hundreds of homes and amenities, with land allocated and roads to be paved toward Al Rafisah. He also confirmed work started on Al Dahiyat, and highlighted 270 homes underway in Al Harray (including 120 in Al Mudeife) plus similar projects in Kalba.

Read the full article on Zawya

Meraki Developers launched Nirvana Residence 1, a 22-storey tower in Me’aisem, Dubai Production City, with 392 units (studios to 1–3 bedrooms). It emphasizes wellbeing and community through integrated amenities and “Nirvana Groves” green wellness zones. The project offers strong road connectivity while maintaining a tranquil setting.

Read the full article on Zawya

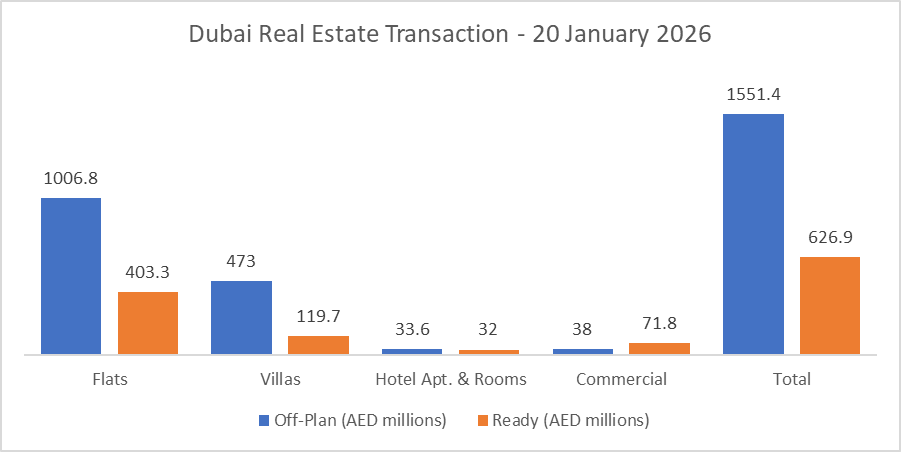

Dubai Real Estate Transactions as Reported on the 20th of January 2026

On the 20-Jan-2026, the total transacted value reached AED 2.18 billion. Off-plan dominated with AED 1.55 billion (71.2%), while Ready accounted for AED 626.9 million (28.8%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1006.8 | 403.3 |

Villas | 473.0 | 119.7 |

Hotel Apt. & Rooms | 33.6 | 32.0 |

Commercial | 38.0 | 71.8 |

Total | 1551.4 | 626.9 |

Off-Plan Market Performance

Total Value: AED 1.55 billion

Flats: AED 1.01 billion (64.9%)

Villas: AED 473.0 million (30.5%)

Hotel Apt. & Rooms: AED 33.6 million (2.2%)

Commercial: AED 38.0 million (2.4%)

Off-plan activity was decisively led by apartments, with villas providing a strong secondary pillar and minimal contribution from hotel and commercial deals.

Ready Market Performance

Total Value: AED 626.9 million

Flats: AED 403.3 million (64.3%)

Villas: AED 119.7 million (19.1%)

Hotel Apt. & Rooms: AED 32.0 million (5.1%)

Commercial: AED 71.8 million (11.5%)

Ready transactions were also apartment-led, but commercial had a noticeably larger footprint than in off-plan, supporting a more diversified mix.

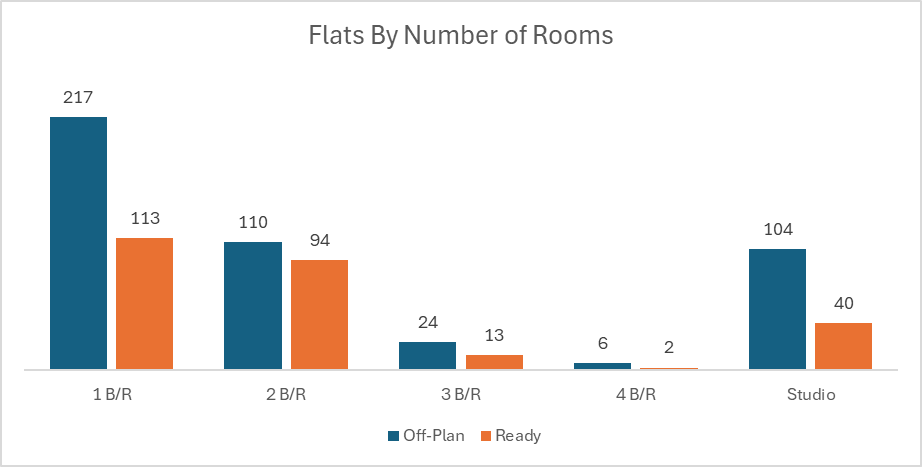

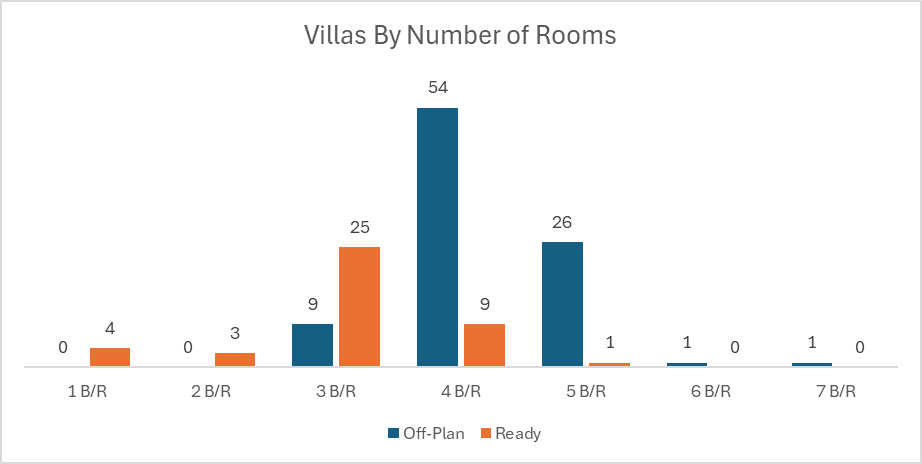

On The Micro Level

Market Insights & Outlook

The day’s market leaned strongly toward off-plan (over 70% of value), suggesting developers and buyers continue to favor new supply for larger-ticket deployment, especially in the apartment segment. Meanwhile, the ready market’s higher commercial share hints at selective end-user/occupier and investor activity targeting immediately usable assets, adding balance to an otherwise residential-driven day.

Data Source: Dubai Land Department