Rising rents in Dubai are pushing tenants to seek affordable suburban areas like Lehbab, Al Aweer, and Al Marmoom, where rents range from Dh23,000 to Dh73,000. While new affordable housing projects are expected, demand still outpaces supply, making these areas increasingly popular despite longer commutes and fewer amenities.

Read the full article on Khaleej Times

How much should Dubai property buyers save before purchasing a $1 million home, beyond the down payment?

Read the full article on Arabian Business

Dubai’s property market is booming in early 2025, driven by population growth and high demand, especially for luxury villas. Major developments, strong investor interest, and rising off-plan sales reflect a supply-demand imbalance. Abu Dhabi is also seeing similar momentum, with sharp rises in rents, prices, and returns.

Read the full article on Property Investor Today

A UAE real estate developer is wooing wealthy investors with wellbeing-friendly amenities at a Ras Al Khaimah property project.

Read the full article on Arabian Business

Abu Dhabi has begun handing over 306 five-bedroom villas in Al Ain’s Al Saad project to Emirati beneficiaries. The AED993.7 million development includes homes, parks, mosques, commercial complexes, and a community centre, spanning 1.23 million square metres.

Read the full article on Zawya

Due to the UAE dirham's peg to the U.S. dollar, Fed rate cuts impact UAE borrowing costs. A recent 25 bps cut had minimal effect on UAE mortgage rates. Experts say only substantial reductions would significantly lower borrowing costs and boost real estate demand.

Read the full article on MENA FN

Arabian Hills Real Estate has surpassed 50% completion of roads and infrastructure in Zone 2 of its Al Faqa-based master development in Al Ain. Covering 2.5 million sqm with 748 residential plots, the project includes roads, utilities, and community facilities, aiming to offer modern, sustainable living.

Read the full article on Zawya

The Luxe Developers' new project, La Mazzoni, in Ras Al Khaimah is seeing strong interest due to rising global demand for wellness-focused living. Featuring biophilic design, wellness amenities, co-working spaces, and family-friendly features, the luxury development aligns with a growing trend toward health, sustainability, and lifestyle-integrated real estate.

Read the full article on MENA FN

Photo by Subbu Rayan

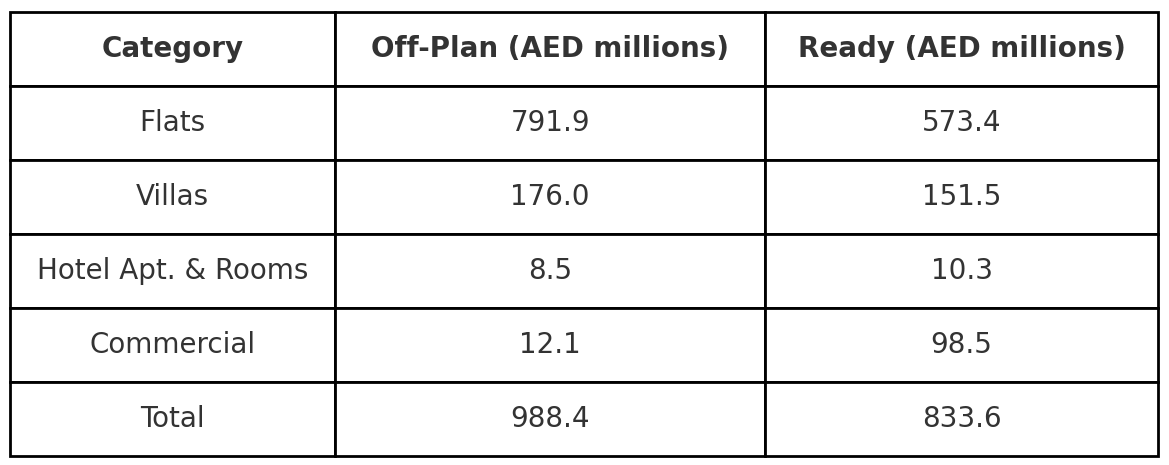

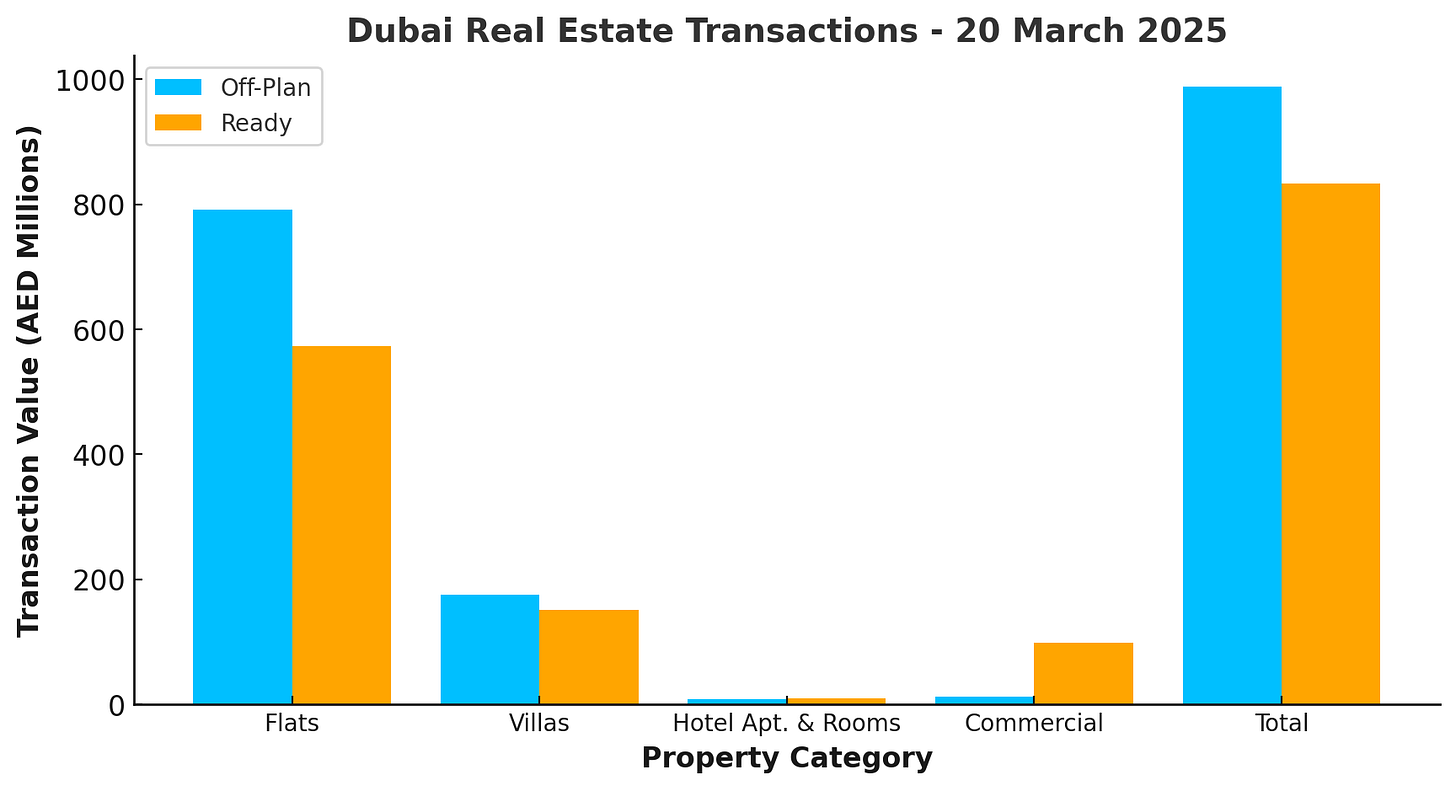

Dubai Real Estate Transactions as Reported on the 20th of March 2025

Dubai's real estate market continued its strong performance on 20 March 2025, with total transactions reaching AED 1.82 billion. The market activity was driven by both off-plan and ready properties, showcasing investor confidence in Dubai’s real estate sector.

Off-plan properties accounted for 54.3% (AED 988.4 million) of the total transactions, while ready properties contributed 45.7% (AED 833.6 million). The high off-plan activity suggests sustained demand for new developments, supported by Dubai’s robust economic growth and infrastructure expansion.

Off-Plan Transactions – AED 988.4 Million (54.3% of Total)

The off-plan sector saw strong activity, reflecting continued investor interest in upcoming developments. The breakdown within the off-plan category is as follows:

Flats: AED 791.9 million (80.1% of off-plan transactions)

Villas: AED 176.0 million (17.8%)

Hotel Apartments & Rooms: AED 8.5 million (0.9%)

Commercial: AED 12.1 million (1.2%)

The dominance of flats in the off-plan market highlights the growing demand for apartment living in key investment zones, fueled by attractive payment plans and future appreciation potential.

Ready Transactions – AED 833.6 Million (45.7% of Total)

The ready property segment also remained strong, with significant demand across various asset classes. The category distribution is:

Flats: AED 573.4 million (68.8% of ready transactions)

Villas: AED 151.5 million (18.2%)

Hotel Apartments & Rooms: AED 10.3 million (1.2%)

Commercial: AED 98.5 million (11.8%)

Flats once again led the ready property transactions, accounting for nearly 69% of this segment, reinforcing Dubai’s appeal to end-users and investors looking for immediate occupancy or rental income.

Key Takeaways

Off-Plan Dominance: Off-plan transactions outpaced ready sales, making up 54.3% of total deals, a sign of confidence in Dubai’s long-term real estate prospects.

Flats Drive the Market: Across both segments, flats accounted for nearly 75% of total transactions, reflecting their continued appeal among investors and residents.

Strong Commercial Presence in Ready Market: Commercial transactions made up 11.8% of the ready market, indicating stable demand for business spaces.

Villas Maintain Steady Growth: Villas contributed 17.8% in off-plan sales and 18.2% in ready sales, suggesting consistent interest in larger living spaces.

Dubai’s real estate market remains dynamic, with both off-plan and ready properties attracting significant investment. The data suggests a well-balanced demand between future developments and ready properties, reinforcing Dubai’s position as a global real estate hub.

Data Source: Dubai Land Department