Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

Dubai’s mid-market communities like JVC and Al Furjan are seeing surging demand, with rising prices, strong rental yields, and growing appeal among young professionals and investors, as residential sales hit record highs. JVC remains a top performer, while Al Furjan posts the highest growth in Property Finder searches.

Read the full article on The National

Peninsula spans 3.3 million sq. ft. of waterfront real estate, combining residential, commercial, business and lifestyle amenities in a waterfront destination.

Read the full article on Arabian Business

AHS Properties has unveiled Casa AHS, a $750 million waterfront development on the Dubai Water Canal, comprising 32 ultra-luxury Sky Villas, Mansions, and Palaces. Each offers private elevators, infinity-edge pools, double-height ceilings, and bespoke five-star amenities, all designed by architect Shaun Killa with interiors by HBA Residential.

Read the full article on Zawya

Saudi, Indian, British, and East Asian HNWIs dominate Dubai luxury real estate, with 71% of global ultra-wealthy preferring it. In 2024, Saudis, Indians, and Brits comprised over half of Knight Frank’s Dubai sales. Dubai led the $10 million+ home market, recording 435 sales in 2024 and 111 in Q1 2025.

Read the full article on Gulf News

Whitewill’s Q1 2025 Dubai real estate report records over 42,000 transactions worth AED 114.1 billion: 25,000 off-plan deals (AED 53.9 billion) and 17,500 secondary sales (AED 60.2 billion). Apartments in JVC and Business Bay, plus villas/townhouses in The Valley and Villanova, led robust mid- and luxury-market demand.

Read the full article on Zawya

DAMAC Properties’ Aykon City Tower C on Sheikh Zayed Road redefines Dubai living with iconic architecture, waterfront vistas, luxury residences boasting private elevators, infinity pools, and five-star amenities, plus flexible rent-and-buy options.

Read the full article on Business Matters

Knight Frank’s 2025 report shows global HNWIs budget $32 million on average for Dubai homes, with 54% of ultra-wealthy willing to spend over $80 million. Genuine end-users make up 55% of buyers, 83% plan to purchase land to build, and 71% name Dubai their preferred emirate, injecting $10.3 billion.

Read the full article on Khaleej Times

Object 1 has unveiled ESSENL1FE, a wellness-focused residential community in JVT featuring resort-style pools, a Sky Deck, extensive fitness and leisure amenities, and smart-home technology. Slated for Q4 2027 delivery, it responds to a 62% surge in local transactions and rising demand for high-end, experience-driven living.

Read the full article on Zawya

Dubai Investments’ Q1 profit before tax rose 52% to Dh185 million, driven by its Dh15.7 billion real estate portfolio. After a record Dh1.2 billion real estate profit in 2024, the group advances major projects - from Dubai Investments Park to Danah Bay - and expands its Al Mal REIT holdings.

Read the full article on Gulf News

Dubai will protect the rights of financial whistleblowers as it enhances audit rules.

Read the full article on Arabian Business

Imkan has partnered with Saal.ai to embed AI and big-data technologies across its development process, driving design optimization, operational efficiency, automated compliance, and hyper-personalized customer engagement to create sustainable, IoT-enabled, future-ready communities in line with the UAE’s technological and sustainability goals.

Read the full article on Zawya

VOXA will include studios, one- and two-bedroom apartments, penthouses, office spaces, and ground-floor retail units.

Read the full article on Arabian Business

DAMAC Properties unveiled the Middle East’s first experiential e-commerce real estate website, featuring interactive 3D tours, live inventory updates and instant reservations. Integrated with metaverse capabilities, multilingual targeting, end-to-end CRM support, the platform offers personalized agent links with lead tracking, EOI submission, invoicing and near-real-time unit availability.

Read the full article on Zawya

Abu Dhabi’s Lunate and NYSE-listed Brookfield Asset Management have formed a $1 billion joint venture to develop build-to-sell and opportunistic residential projects across the Middle East. Lunate will provide cornerstone capital and regional expertise—building on its ICD Brookfield Place stake—to capitalize on booming UAE, Saudi, and wider GCC property markets.

Read the full article on The National

Dubai Real Estate Transactions as Reported on the 20th of May 2025

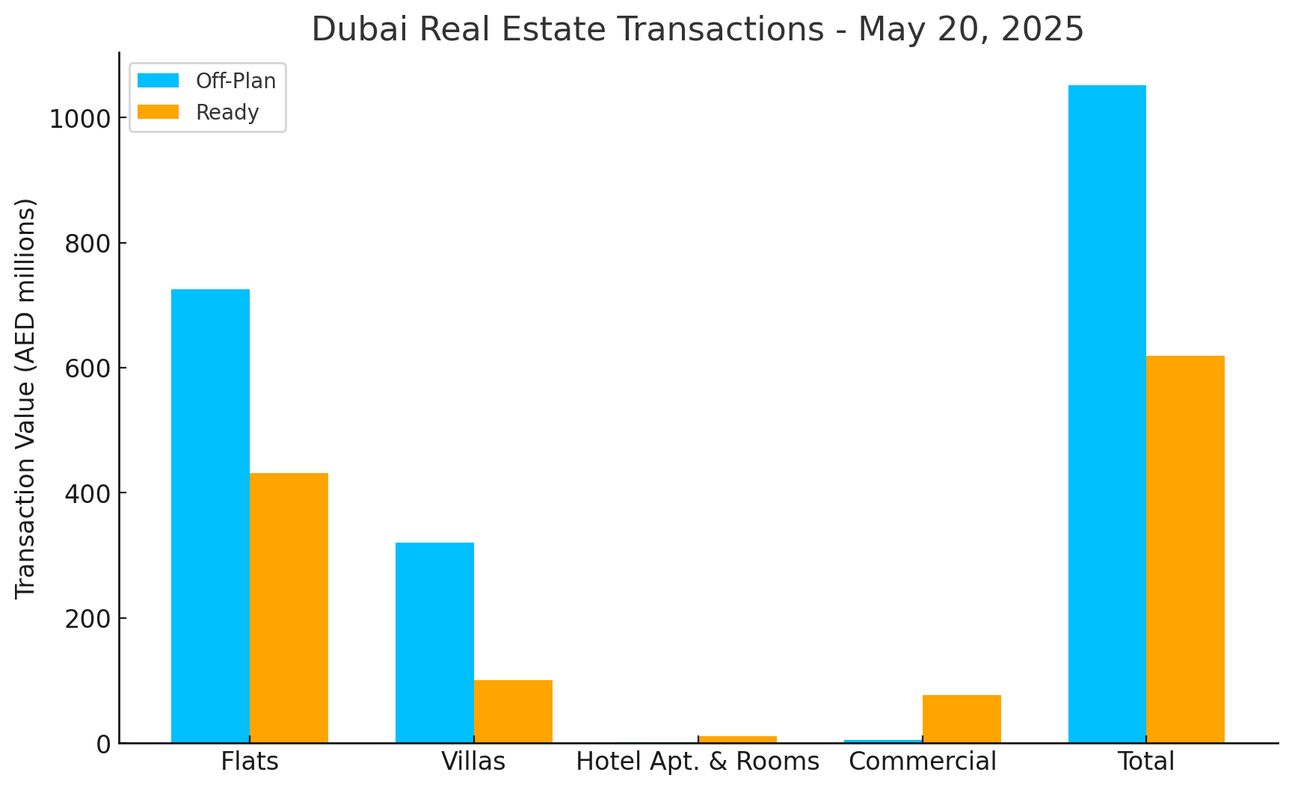

On 20 May 2025, Dubai recorded AED 1.67 billion in total residential transactions, with off-plan deals accounting for AED 1.05 billion (62.9%) and ready properties contributing AED 619 million (37.1%).

Sub-Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 725.1 | 432.0 |

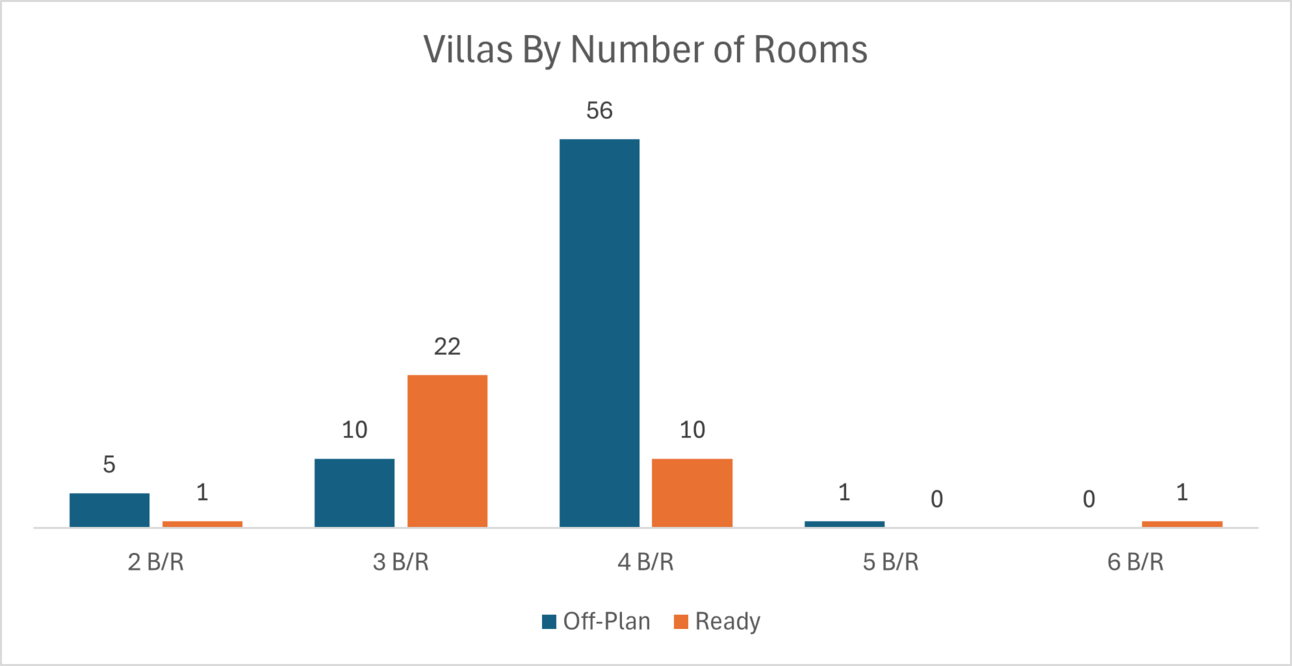

Villas | 320.1 | 100.6 |

Hotel Apartments & Rooms | 1.0 | 10.6 |

Commercial | 5.1 | 76.3 |

Segment Total | 1,051.2 | 619.5 |

Off-Plan Market Performance

The off-plan segment accounted for AED 1.05 billion, reaffirming investor confidence in pre-construction opportunities across Dubai. The detailed contribution of each sub-category is as follows:

Sub-Category | Transaction Value (AED) | % of Off-Plan Total |

|---|---|---|

Flats | 725,057,293 | 68.9% |

Villas | 320,126,743 | 30.5% |

Hotel Apartments & Rooms | 965,000 | 0.1% |

Commercial | 5,100,791 | 0.5% |

Off-plan flats dominated, reflecting strong pre-launch interest in apartment living. Villas also attracted significant commitments, while hotel apartments and commercial investments remained negligible.

Ready Market Performance

The ready property market recorded a total of AED 619 million, maintaining healthy momentum across multiple asset classes. Here's the sub-category breakdown:

Sub-Category | Transaction Value (AED) | % of Ready Total |

|---|---|---|

Flats | 432,037,156 | 69.7% |

Villas | 100,579,359 | 16.2% |

Hotel Apartments & Rooms | 10,567,528 | 1.7% |

Commercial | 76,284,164 | 12.3% |

Ready flats again led, underscoring sustained demand for turnkey apartments. Villas held a smaller share post-handover, and commercial sales showed modest activity compared with residential assets.

On The Micro Level

Market Insights & Outlook

The twin dominance of flats—nearly 70% in both off-plan and ready segments—signals ongoing investor and end-user appetite for high-liquidity, yield-friendly units. Villas remain attractive during construction but taper in the secondary market, suggesting buyers’ patience for off-plan incentives. Minimal hotel-apartment transactions imply a current focus on pure residential formats, while commercial volumes stay marginal at this micro-level. Going forward, robust pre-sales of apartments should sustain momentum, and the healthy absorption of ready stock points to balanced growth across Dubai’s residential ecosystem.

Data Source: Dubai Land Department