|

Arthouse Hills Arjan launches in Dubai, expanding the global Arthouse brand with a design-led, wellness-rich residential tower.

Read the full article on Arabian Business

Object 1 is expanding in Dubai Land Residence Complex with its VERDAN1A green, wellness-focused project, leveraging strong yields, upcoming Blue Line metro connectivity, and Dubai’s record real estate market to attract long-term investors and residents seeking sustainable, well-connected community living across the UAE.

Read the full article on Zawya

HRE Development has launched Sakura Gardens, a low-rise, nature-centric residential community in Dubailand’s Falcon City of Wonders, offering studios to townhomes, resort-style wellness and lifestyle amenities, and a car-free central park, targeting families and investors with higher yields, long-term growth and calm, greenery-rich living.

Read the full article on Economy Middle East

Green Horizon and Refine have launched Meriden Beach Residences, a 63-unit boutique low-rise on Dubai Islands – Island A, offering design-led, European-inspired beachfront apartments with resort-style amenities, smart-home features, and a 35/65 payment plan, starting from AED 1.8 million, completing Q1 2028.

Read the full article on Zawya

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

Dubai is emerging as a global launchpad for startups, with Supy, Huspy and Stake leveraging its time zone, infrastructure and regulation to expand across MENA, Europe, Australia, Saudi Arabia and the US, while emphasizing disciplined growth, regulatory alignment and long-term investor trust.

Read the full article on Forbes

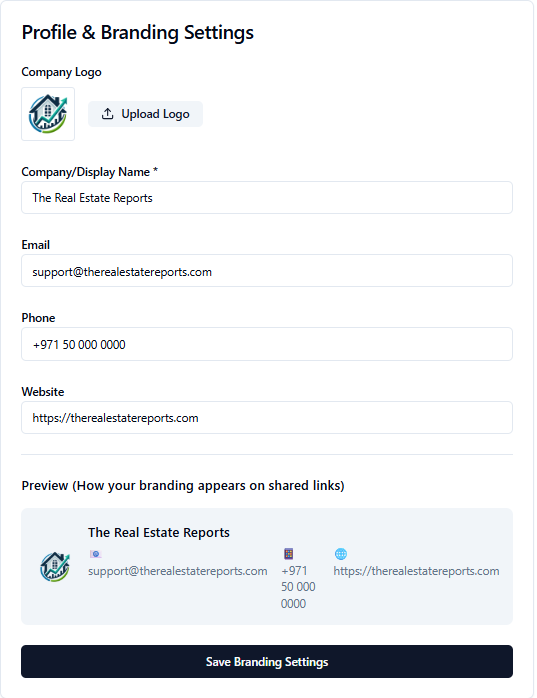

Former Emaar executive Bhaskara Santosh has launched Arthouse Hills Arjan, a 330-unit “five-star living at affordable prices” project in Arjan, featuring hotel-style amenities. Positioned near E311 and Al Maktoum Airport, it targets Dubai’s growing middle class amid a southwest shift in the city’s centre, though analysts warn the boom may peak by 2026.

Read the full article on Finews

OMNIYAT’s Marasi Bay is emerging as Dubai’s most prestigious ultra-luxury waterfront district, anchored by The Lana, VELA, ENARA and new VELA Viento residences, combining superyacht marina, hotel, retail and green spaces, record ROI per sqft, and landmark architecture with extensive sky-level wellness and leisure amenities.

Read the full article on Construction Business News

Used by Execs at Google and OpenAI

Join 400,000+ professionals who rely on The AI Report to work smarter with AI.

Delivered daily, it breaks down tools, prompts, and real use cases—so you can implement AI without wasting time.

If they’re reading it, why aren’t you?

Dubai has launched the 22 million sq ft Dubai Auto Market, developed by DP World, to become the world’s largest automotive hub with 1,500 showrooms, workshops, logistics and event facilities, handling 800,000 vehicles a year and boosting trade, re-exports and D33 economic growth goals.

Read the full article on Trade Arabia

Imtiaz Developments’ Symphony Tower, a 42-storey Zaha Hadid Architects design in Dubai’s new Horizon district near Ras Al Khor, features an exoskeleton inspired by Emirati embroidery that shades outdoor living spaces, integrates photovoltaics, and uses recycled steel, low-carbon concrete and water-saving systems to reduce environmental impact.

Read the full article on Zawya

The UAE’s wellness economy has reached $40.8 billion, the fastest-growing in MENA and a leader in wellness real estate, beauty and spas. Backed by wellbeing strategies, AI-driven healthcare and wellness tourism, it is positioning itself as a global, sustainability-focused wellness destination.

Read the full report on Global Wellness Institute

All the news that matters to your career & life

Hyper-relevant news. Bite-sized stories. Written with personality. And games that’ll keep you coming back.

Morning Brew is the go-to newsletter for anyone who wants to stay on top of the world’s most pressing stories — in a quick, witty, and actually enjoyable way. If it impacts your career or life, you can bet it’s covered in the Brew — with a few puns sprinkled in to keep things interesting.

Join over 4 million people who read Morning Brew every day, and start your mornings with the news that matters most — minus the boring stuff.

Saudi Arabia’s Real Estate Registry has launched a national blockchain infrastructure for property tokenization, enabling digital ownership, fractional investment, and an open-API marketplace. Aligned with Vision 2030 and global standards, it links real estate with capital markets to attract FDI, boost proptech innovation, and modernize the property ecosystem.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 20th of November 2025

On 20 November 2025, the total transacted value in Dubai real estate reached AED 1,841,880,243. Off-plan led the market with AED 1,166,277,421 (63.3%), while Ready properties accounted for AED 675,602,822 (36.7%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 919.7 | 478.9 |

Villas | 189.9 | 132.6 |

Hotel Apts & Rooms | 2.2 | 20.0 |

Commercial | 54.4 | 44.2 |

Total | 1,166.3 | 675.6 |

Off-Plan Market Performance

Total Value: AED 1,166,277,421 (63.3% of daily total)

Flats: AED 919,680,063 (78.9% of off-plan)

Villas: AED 189,922,875 (16.3% of off-plan)

Hotel Apts & Rooms: AED 2,230,650 (0.2% of off-plan)

Commercial: AED 54,443,834 (4.7% of off-plan)

Off-plan flats once again did the heavy lifting, signaling sustained demand from buyers looking to lock in future supply at today’s prices, while off-plan villas and commercial assets provided smaller but meaningful support to overall volumes.

Ready Market Performance

Total Value: AED 675,602,822 (36.7% of daily total)

Flats: AED 478,855,417 (70.9% of Ready)

Villas: AED 132,560,184 (19.6% of Ready)

Hotel Apts & Rooms: AED 20,026,973 (3.0% of Ready)

Commercial: AED 44,160,248 (6.5% of Ready)

The Ready segment continues to cater to end-users and yield-focused investors who prioritise immediate occupancy and cash flow, with villas and commercial assets adding depth to the day’s activity.

On The Micro Level

Market Insights & Outlook

Today’s figures reinforce a familiar pattern in Dubai’s current cycle: off-plan remains the primary engine of value, driven largely by flats, while Ready stock provides a solid secondary pillar for those seeking immediate use or rental income. The strong skew toward off-plan suggests continued confidence in future supply, ongoing developer launch momentum, and a market that is still very much in expansion mode rather than consolidation.

Data Source: Dubai Land Department