Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Dubai’s Q3 2025 set records. 59,228 sales worth AED 170.7bn (+17% volume, +20% value). Jan–Sep: 158,200 deals, AED 498.8bn. Apartments dominated; off-plan formed 73% of volume, 66% of value. September stayed strong. Growth aided by visas, foreign ownership, streamlined registration, and infrastructure.

Read the full article on Reuters

UAE real estate surged in Q3 2025. Dubai logged Dh138bn across 55,280 deals (70% off-plan); villa prices rose in 31/34 communities, Jumeirah Islands +22%. Average prices +12.4%, rents +8.7%. New launches advance (Takmeel, London Gate). RAK accelerates—transactions +118% in 2024, off-plan 85%, Wynn-driven growth.

Read the full article on Khaleej Times

Azizi Developments launched Azizi Leily in Al Jaddaf, premium freehold studios to 2BRs and penthouses with Creek/skyline views. Amenities include gym, pools, sauna/steam, kids’ areas, cinema, rooftop garden, hall, and accessibility. Prime connectivity to Creek Metro, DXB, Wafi, DWTC, Al Khail/SZR.

Read the full article on Construction Week Online

ADGM’s Registration Authority expanded digital real-estate “smart services” to boost transparency and efficiency. New tools include off-plan termination, reservation agreement registration, SMART valuations, and improved leasing/broker permitting. A unified escrow account is coming. The upgrade follows Al Reem Island’s 2024 transition to ADGM jurisdiction.

Read the full article on Gulf News

Home insurance costs continue to climb, with premiums rising over 9% this year and more than 60% in the past five years. However, coverage hasn’t kept pace, leaving many homeowners paying significantly more for less protection. With affordability becoming a growing concern, it’s more important than ever to compare options—check out Money’s handy home insurance tool to find the best fit for you.

Ellington Properties awarded an AED1 billion contract to China Railway 18th Bureau for Mercer House in Uptown Dubai, two towers (34 & 41 floors) with studios to 4-bed penthouses. Includes Uptown Plaza retail and amenities like an urban beach club, wellness zones, sports hall, advancing DMCC’s integrated community vision.

Read the full article on Zawya

Dubai real estate is structurally booming. 94,700 H1 2025 investors (+26%), H1 transactions Dhs262.1bn (+36%). Prices +20%, rents +19%. Off-plan >70% of sales, driven by visas and end-users. Trends: suburban shift, wellness/sustainability amenities, mixed-use, proptech. Top buyers: India, UK, Russia, China; Saudi fastest-growing.

Read the full article on Gulf Business

The Dubai real estate sector recorded AED14.64bn ($4bn) of transactions last week, according to data from the Land Department.

Read the full article on Arabian Business

Dubai Land Department (DLD) concluded its participation at GITEX Global 2025, reaffirming its position as a leading government entity in smart real estate transformation and strengthening Dubai’s standing among the world’s most digitally advanced cities.

Read the full article on Arabian Business

Dubai’s MBRHE is advancing four projects—Wadi Al Amardi (432, Q1 2026), Al Awir (398, Q1 2026), Hatta (213, Q4 2026), and Al Yalayis 5 (706, Q4 2028)—totaling 1,749 homes (AED3.3bn). They’re part of a wider 3,004-home, AED5.4bn program to boost Emirati housing stability.

Read the full article on Economy Middle East

TownX finished Luma Park Views (JVC) nine months early and will hand over 600 one- to three-bed apartments. Amenities include two sky pools, Technogym gyms, a 32,000-sq-ft garden, smart-home systems, Siemens appliances, EV charging, and advanced security. TownX has delivered 967 units, with 1,774 in development.

Read the full article on ME Construction News

Gulf real estate is surging, Dubai prices up, Riyadh offices tight, Doha building rapidly, raising bubble concerns. Global firms (Starwood, Brookfield) are opening locally and investing in-region to align with Gulf expectations, secure sovereign/family-office capital, and gain influence; marquee projects signal commitment beyond returns.

Read the full article on Propmodo

Empire Developments’ portfolio tops Dh2bn. It’s delivered four projects, with three more due by 2026–27 (~1,500 units). Positioned as “affordable luxury,” it pioneered 1% then 0.5% monthly payment plans to convert renters to owners. New launches: 604-unit Empire Lakeviews (Liwan) and 325-unit Empire Estates (2026).

Read the full article on Zawya

Saion Properties launches Reposé Residence in Al Furjan, five minutes from Dubai Marina, targeting “affordable luxury.” Q1 2027 completion; registrations open. Highlights: high ceilings, smart homes, German/Italian finishes, yoga/pool/zen garden. Prices: 1BR Dh1.26m, 2BR Dh2.09m, 3BR Dh2.75m. Approvals/escrow in place; construction underway; Furjan yields ~7% net.

Read the full article on Gulf News

Dubai Real Estate Transactions as Reported on the 16th of October 2025

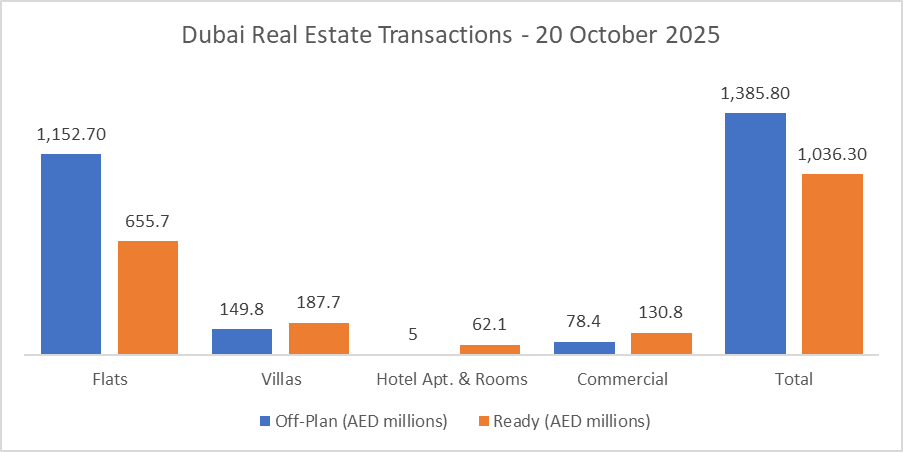

On 20-Oct-2025, the total transacted value reached AED 2.422 billion. Off-plan dominated with AED 1.386 billion (57.2%), while Ready accounted for AED 1.036 billion (42.8%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,152.7 | 655.7 |

Villas | 149.8 | 187.7 |

Hotel Apt. & Rooms | 5.0 | 62.1 |

Commercial | 78.4 | 130.8 |

Total | 1,385.8 | 1,036.3 |

Off-Plan Market Performance

Total Value: AED 1.386 billion

Flats: AED 1,152.7 m (83.2%)

Villas: AED 149.8 m (10.8%)

Hotel Apts & Rooms: AED 5.0 m (0.4%)

Commercial: AED 78.4 m (5.7%)

Off-plan activity was heavily flat-led, with villas a clear second; commercial and hospitality were marginal.

Ready Market Performance

Total Value: AED 1.036 billion

Flats: AED 655.7 m (63.3%)

Villas: AED 187.7 m (18.1%)

Hotel Apts & Rooms: AED 62.1 m (6.0%)

Commercial: AED 130.8 m (12.6%)

Ready transactions were broad-based, but flats remained the anchor; commercial showed a notable double-digit share.

On The Micro Level

Market Insights & Outlook

Momentum remains firm with a balanced split between off-plan leadership and resilient ready demand. Flat segments are doing the heavy lifting; watch for sustained commercial participation on the ready side and villa depth in off-plan to gauge breadth of demand.

Data Source: Dubai Land Department