ValuStrat says Dubai real estate enters 2026 with strong fundamentals but a “normalisation” phase. Residential growth may slow to ~10% (villas +17.7% vs apartments +7.4%), rents flatten, and completions may lag. Offices stay strong (~15% value/rent growth), hospitality expands, industrial remains tight, while retail faces e-commerce pressure.

Read the full article on Khaleej Times

Sobha Realty says 2025 property sales hit AED 30bn ($8.17bn), up 30% year-on-year, driven by new masterplan launches and international expansion. UAQ was a major contributor, generating AED 8bn from Downtown UAQ and Sobha Siniya Island. The developer launched four new masterplans and expanded into the US and Australia.

Read the full article on Zawya

The Dubai residential property market is expected to shift into a more normalised phase in 2026, with price growth moderating sharply from recent highs, while the office sector is forecast to remain a standout performer, according to the latest outlook from ValuStrat.

Read the full article on Arabian Business

Samana Developers says 2025 was its best year, with AED 7.1bn gross sales (up from AED 5.4bn), ranking 5th among Dubai off-plan developers. It launched 16 projects and vertically integrated via in-house design (YORK Engineering) and construction (Italtech). It also introduced “Flexible Homes” and expanded smart, resort-style, high-yield offerings.

Read the full article on Biz Today

Dubai South is emerging as a major growth corridor, boosted by Al Maktoum International Airport and the Metro Blue Line expansion. In 2025 it ranked 5th by sales volume with 10,025 deals worth Dh25.3bn, offering ~8% rental yields and ~19% capital appreciation (DXB Interact). Amirah Developments launched Crown Palace, a G+6+R low-rise with 104 units, due Q1 2028.

Read the full article on Zawya

Saudi Arabia real estate prices declined in the final quarter of 2025, weighed down by a broad-based slowdown in the residential sector, according to the latest official data released by the General Authority for Statistics (GASTAT).

Read the full article on Arabian Business

ACRES 2026 opened at Expo Centre Sharjah (21–24 Jan) as its largest edition, with 120+ exhibitors and 200+ projects across residential, commercial, industrial and investment land. Organisers expect major deals, aided by reduced registration fees. Officials highlighted rising transactions (Dh1.4bn in 2024 to Dh4.3bn in 2025).

Read the full article on Gulf Today

Object 1 has closed a major land investment in Abu Dhabi, acquiring four waterfront plots on Al Reem Island as the developer accelerates its expansion into the capital and deepens its focus on long-term residential communities.

Read the full article on Arabian Business

ELEVATE sold a 10,000 sq ft “Sky Mansion” at Mondrian Al Marjan Island Beach Residences for AED 38m (US$10.35m), a Ras Al Khaimah record, boosted by demand near the planned US$5.1bn Wynn Resort. Phase 2 EOIs are open; prices start at AED 2.7m (1–3BR), AED 8.8m (Sky), AED 9.4m (Front Row).

Read the full article on Zawya

The emergence of Ras Al Khaimah as a global ultra-luxury residential destination has been reinforced by two landmark sky-residence sales worth a combined AED168m ($45.75m), setting new benchmarks for the Northern Emirates’ high-end property market.

Read the full article on Arabian Business

Sanzen Real Estate Development says Phase One of Sukoon in Al Tay, Sharjah sold out: 240 villas, with the overall project value estimated at AED 2.36bn. Sukoon will total 859 villas plus a retail mall and mosque, positioned near the Sharjah–Dubai border. The developer also opened an on-site sales centre to support upcoming phases.

Read the full article on Zawya

Emirates Airline has signed an agreement with Dubai Investments Park to acquire land for a new purpose-built Cabin Crew Village, marking a multi-billion-dirham investment in residential infrastructure for its workforce.

Read the full article on Arabian Business

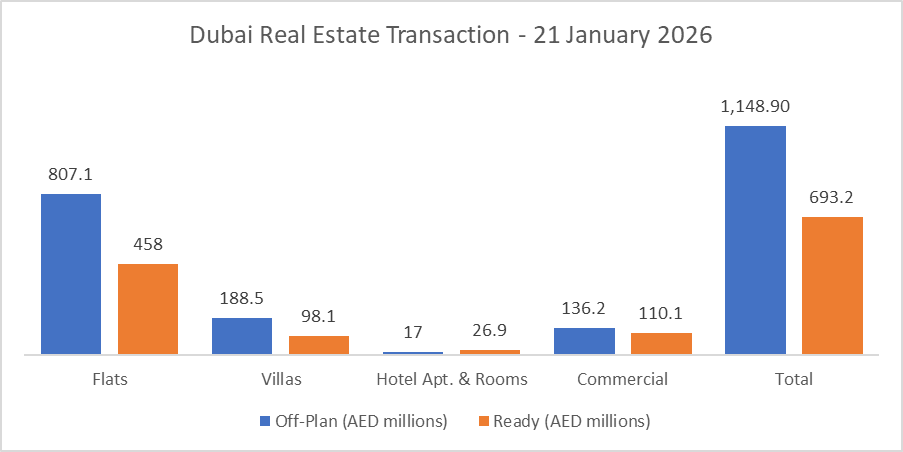

Dubai Real Estate Transactions as Reported on the 21st of January 2026

On the 21-Jan-2026, the total transacted value reached AED 1.84 billion. Off-plan dominated with AED 1.15 billion (62.4%), while Ready accounted for AED 0.69 billion (37.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 807.1 | 458.0 |

Villas | 188.5 | 98.1 |

Hotel Apt. & Rooms | 17.0 | 26.9 |

Commercial | 136.2 | 110.1 |

Total | 1,148.9 | 693.2 |

Off-Plan Market Performance

Total Value: AED 1.15 billion

Flats: AED 807.1m (70.2%)

Villas: AED 188.5m (16.4%)

Hotel Apts & Rooms: AED 17.0m (1.5%)

Commercial: AED 136.2m (11.9%)

Off-plan strength was clearly apartment-led, with flats contributing over two-thirds of off-plan value.

Ready Market Performance

Total Value: AED 0.69 billion

Flats: AED 458.0m (66.1%)

Villas: AED 98.1m (14.2%)

Hotel Apts & Rooms: AED 26.9m (3.9%)

Commercial: AED 110.1m (15.9%)

Ready activity was also driven by flats, while commercial formed a meaningful secondary pillar.

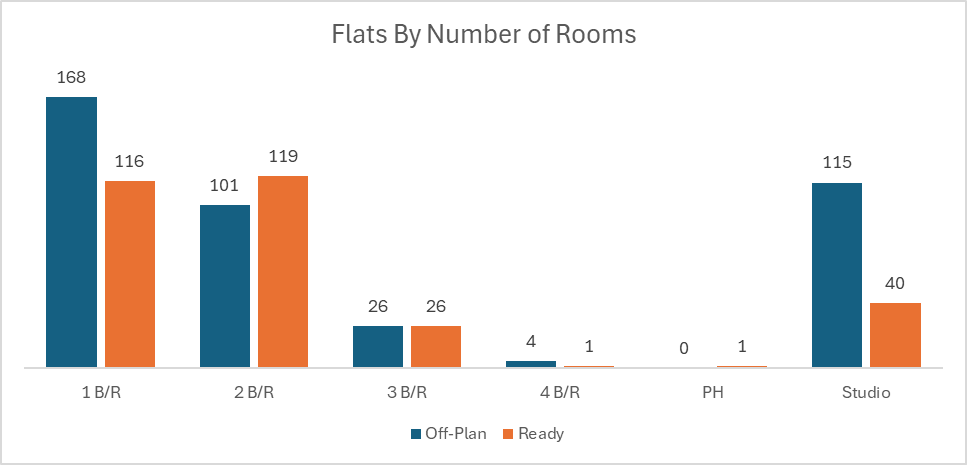

On The Micro Level

Market Insights & Outlook

The day’s market leaned decisively off-plan, reflecting continued preference for pipeline inventory, especially flats, while Ready maintained solid depth across flats and commercial. With both segments led by apartments, today’s flow suggests broad-based end-user and investor demand remains concentrated in liquid, high-turnover product, while villas stayed supportive rather than dominant.

Data Source: Dubai Land Department