Sticking with the same home insurance could cost you

Home insurance costs are rising fast, up nearly 40% nationwide in just the past few years. With premiums changing constantly, sticking with the same provider could mean overpaying by hundreds of dollars. Shopping around and comparing multiple insurers can help lock in better rates without losing the protection your home needs. Check out Money’s home insurance tool to shop around and see if you can save.

Dubai’s Property Finder secured $250m debt from Ares to fuel growth, AI products, marketing, and partnerships. It reports 40%+ revenue CAGR since 2020; UAE revenue rose $30m (2021) to $117m (2024) and $73m in H1 2025, with EBITDA margin >60%. Follows Sept 2025 $525m Permira/Blackstone minority stake.

Read the full article on Entrepreneur

Dubai’s property market is maturing, demanding data-driven, tech-enabled, ESG-literate brokers. Intuition alone no longer works: clients expect transparency, analytics, seamless digital service, and actionable insight. Agents must use real-time tools, robust CRMs, and translate data into strategy, or risk being outcompeted.

Read the full article on MSN

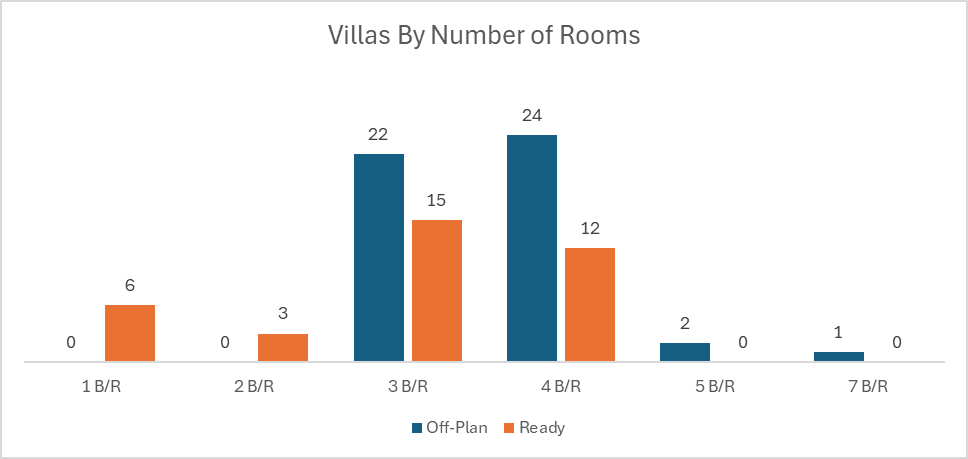

Betterhomes Q3 2025 report, 55,280 deals worth Dh139.7bn (+18% YoY). Market recalibrates toward apartments: off-plan apt sales +35% QoQ; villas -22% YoY. Leasing +92% YoY; avg rent Dh196k. Investors 63%; values -6% QoQ, volumes +11%. Avg PSF Dh1,664; 28.5k units delivered; pipeline 250k to 2027.

Read the full article on Khaleej Times

Dubai has unveiled a major hotel investor incentive programme offering 100 per cent refunds on key municipal and tourism fees for two years after opening.

Read the full article on Arabian Business

US rentals face rising mortgage/insurance costs, flat rents, and thin net yields (~2.1–4.8%), squeezing profits. Dubai looks stronger: higher gross yields (5–10%+), no income/capital-gains tax, robust demand, and clear regulation, though location choices, broker incentives, and lofty promised returns pose risks.

Read the full article on Forbes

Global Partners is betting on Dubai’s transformation into a globally recognised investment hub, as the firm’s second real estate fund nears its $350m close.

Read the full article on Citywire

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

REEF Luxury Developments broke ground on REEF 999 in Al Furjan: a AED300m, 142-unit project (1–3BRs and Sky Villas) featuring patented outdoor-cooled Sunken Balconies, Winter Gardens, and 60,000 sq ft of amenities. Completion Q2 2027; prime connectivity to Marina, Expo City, and Al Maktoum Airport.

Read the full article on Zawya

IMF outlook report. Abu Dhabi ~6% and Dubai 3.4% growth in 2025; UAE 4.8% in 2025, ~5% in 2026, leading the GCC. Growth is service-led (tourism, finance, real estate) and aided by eased OPEC+ cuts. Region to grow 3.5% in 2025. Inflation ~1.6%; risks balanced by strong reserves and reforms.

Read the full article on Economy Middle East

Sobha Realty has launched Sobha AquaCrest, the second residential cluster within its landmark Downtown UAQ masterplan, a $20bn (AED73.4bn) coastal destination that is transforming the urban and architectural landscape of Umm Al Quwain.

Read the full article on Arabian Business

Ras Al Khaimah’s market is accelerating, with residential stock set to double by 2030. Waterfront launches at AED2k–3k psf, off-plan prices +10–15% YoY, transactions +30% in 2024 (+850% since 2017). Q1-2025: 1,300 off-plan deals (AED2.4bn). Yields 5–8%, rents rising, and marquee projects (Wynn 2027, Four Seasons, Hard Rock).

Read the full article on Khaleej Times

Alef Group launched Phase 2 of its AED2.5bn Olfah development in New Sharjah, a forest-designed, walkable community. The phase adds 1–3BR apartments (expanded 3BR supply), 75% with park/pool views, extensive greenery and amenities. Centrally located near University City, Zahia City Centre, and Sharjah International Airport.

Read the full article on Zawya

Qatar had hoped its $220 billion Fifa World Cup in 2022 would be the advertisement it needed to draw foreigners to stay and live in the country. Instead the property market is flat, government data reveals.

Read the full article on Arabian Gulf Business Insight

Palma Development says Serenia Living on Palm Jumeirah is ~94% complete and on track for year-end delivery. The AED3bn ultra-premium project offers 226 residences (incl. penthouses and a Sky Mansion) with major works done; final snagging underway. Amenities include a vast pool, gym, kids’ areas, beach access, and a padel court.

Read the full article on Zawya

MERED is partnering with Pritzker-winning Herzog & de Meuron to design Riviera Residences on Al Reem Island: 400+ apartments and 12 villas with pearl-inspired façades, lush landscaping, and rich amenities (pools, wellness, padel, promenade). Launching November 2025 amid strong demand; Al Reem off-plan prices rose 38% YoY in Q2 2025.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 21th of October 2025

On the 21-Oct-2025, the total transacted value reached AED 2,159,393,370. Off-plan dominated with AED 1,381,366,052 (64.0%), while Ready accounted for AED 778,027,319 (36.0%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,123.9 | 568.2 |

Villas | 194.6 | 100.3 |

Hotel Apt. & Rooms | 4.0 | 28.8 |

Commercial | 58.8 | 80.7 |

Total | 1,381.4 | 778.0 |

Off-Plan Market Performance

Total Value: AED 1,381,366,052

Flats: AED 1,123,850,596 (81.4%)

Villas: AED 194,627,029 (14.1%)

Hotel Apts & Rooms: AED 4,045,200 (0.3%)

Commercial: AED 58,843,226 (4.3%)

Off-plan activity was led overwhelmingly by apartments, with villas a distant second and limited hotel/Commercial turnover.

Ready Market Performance

Total Value: AED 778,027,319

Flats: AED 568,224,490 (73.0%)

Villas: AED 100,304,354 (12.9%)

Hotel Apts & Rooms: AED 28,787,647 (3.7%)

Commercial: AED 80,710,827 (10.4%)

Ready transactions were flat-heavy, with notable Commercial deals outpacing hotel units.

On The Micro Level

Market Insights & Outlook

Apartments continue to anchor daily liquidity across both segments, reinforcing a mid-market, end-user/investor mix. Commercial’s share within Ready hints at steady business demand. If this pattern persists, expect sustained pricing resilience in apartment-led submarkets, with villas remaining selectively active.

Data Source: Dubai Land Department