Top investors are buying this “unlisted” stock

When the team that co-founded Zillow and grew it into a $16B real estate leader starts a new company, investors notice. That’s why top firms like SoftBank invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties – revamping a $1.3T market.

By handing keys to 2,000+ happy homeowners, Pacaso has already made $110m+ in gross profits.

Now, after 41% gross profit growth last year, they recently reserved the Nasdaq ticker PCSO. But the real opportunity is now, at the unlisted stage.

Until May 29, you can join Pacaso as an investor for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Dubai’s VARA updated its May 19 VASP rulebook, giving market participants until June 19 to comply. The new rules formalize tokenization of real-world assets as ARVA tokens, authorize their issuance and secondary trading, and require issuers to hold a Category 1 license, publish a white paper, maintain AED 1.5 million capital, undergo audits and adhere to ongoing supervision.

Read the full article on PANews

Major masterplan developments such as Sobha Siniya Island and Downtown UAQ, Sobha Realty have become the primary investment catalysts in Umm Al Quwain.

Read the full article on Arabian Business

UAE real estate is attracting over $100 billion in international capital, driven by strong regulations and digital innovation—tokenization, virtual assets, crowdfunding, and PropTech. Affordable housing demand, REITs, and co-living trends fuel high yields. The $680 billion market ($207 billion annual sales) is unlocking $14 billion in legacy assets.

Read the full article on Gulf Business

Smarter Investing Starts with Smarter News

The Daily Upside helps 1M+ investors cut through the noise with expert insights. Get clear, concise, actually useful financial news. Smarter investing starts in your inbox—subscribe free.

Dubai’s waterfront scene welcomes LuzOra, DIA Properties’ debut project launching May 27, 2025 at Mandarin Oriental Jumeira. Featuring elegant coastal design, a 60/40 payment plan, Q2 2027 handover, and master-planned community amenities, LuzOra offers prime living and investment, plus exclusive event previews and giveaways.

Read the full article on Gulf Buzz

TownX acquired a 400,000 sq ft plot in Arjan for AED 110 million to build a residential community with homes, landscaped gardens and amenities. With a AED 4 billion portfolio, it’s delivered 967+ units (1.04 million sq ft) and is now constructing 2,125 apartments, including 11 Hills Park and Luma Park Views.

Read the full article on Zawya

Riyadh now ranks alongside Dubai, London, New York, and Hong Kong in the global prime office markets rankings.

Read the full article on Arabian Business

The acquisition is effective immediately. Ben Corrigan will continue to lead the Middle East operations and will join the tp bennett Board.

Read the full article on Construction News Online

Oman plans 62,800 homes and 5,800 hotel rooms by 2030, adding 5,500 units in 2025 as its population nears 7.7 million by 2040. Integrated Tourism Complexes offer freehold ownership, 5–8% yields, and affordable pricing. A 340,000-unit shortfall underscores strong long-term investment potential.

Read the full article on Gulf News

MAG Group Holding has signed a land acquisition agreement with Al Zorah Development Company for a mixed-use waterfront project in Ajman’s Al Zorah Marina 1. The 261,180 sq ft plot will feature residential units, branded serviced residences, offices, retail outlets and a hotel, totaling about 2 million sq ft of built-up area.

Read the full article on Zawya

Omniyat’s Enara in Marasi Bay is nearly sold out, offering 34 ultra-luxury, Grade A office floors with private lift access. Designed for sustainability and wellness (Platinum WELL, LEED, WiredScore, SmartScore), it blends smart tech, high-end amenities, and waterfront views to address Dubai’s premium office space shortage.

Read the full article on The National

Dubai’s ValuStrat Price Index hit 214.1 in April, with villas up 63% above 2014 highs and apartments nearing pre-pandemic peaks. Off-plan sales jumped 61.5% annually and ready transactions 49.6%. New entrant Elton launched Védaire Residences, while prime transactions and top locations set fresh records.

Read the full article on MENA FN

Dubai’s branded residence transactions rose 50% in Q1 2025, with 13,000 units sold in 2024 and 140 projects underway. New launches include DoubleTree by Hilton in Jumeirah Garden City (AED 500 M), Clédor’s Arthouse Residences on Al Marjan Island (AED 400 M), and Biltmore Sufouh penthouses.

Read the full article on Khaleej Times

Tasmeer Indigo President Khyzer Altaf highlighted luxury yet accessible Shariah-compliant JVC developments, emphasizing flexible payment plans, sustainability, smart technology, and design-led, community-focused projects. He stressed balancing investor and end-user needs, integrating art and culture, and previewed Tasmeer Indigo’s upcoming initiatives, underscoring Dubai’s evolving, innovation-driven real estate market.

Watch the podcast on Gulf News

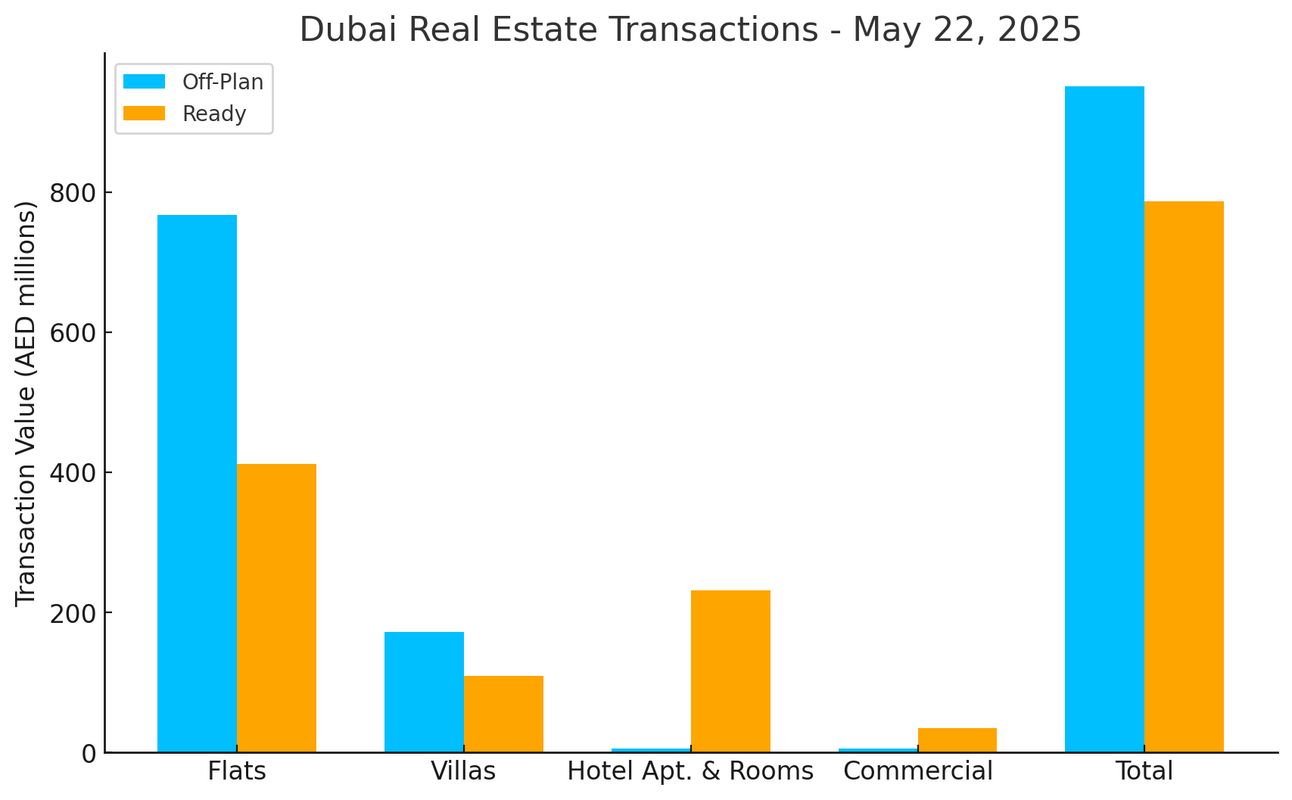

Dubai Real Estate Transactions as Reported on the 22nd of May 2025

On 22 May 2025, Dubai’s total real estate transactions reached AED 1,737.96 million, with off-plan properties accounting for 54.7% (AED 950.92 million) and ready properties 45.3% (AED 787.04 million) of the market.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 767.4 | 411.7 |

Villas | 171.9 | 109.0 |

Hotel Apartments & Rooms | 5.9 | 231.0 |

Commercial | 5.7 | 35.3 |

Total | 950.9 | 787.0 |

Off-Plan Market Performance

Off-plan activity totalled AED 950.92 million (54.7% of overall transactions).

Flats: AED 767.38 million (80.7% of off-plan)

Villas: AED 171.91 million (18.1%)

Hotel Apartments & Rooms: AED 5.90 million (0.6%)

Commercial: AED 5.74 million (0.6%)

Flats dominated the off-plan segment, reflecting strong investor appetite for high-density residential developments. Villas and commercial units played smaller but meaningful roles.

Sub-Category | Value (AED millions) | % of Off-Plan Total |

|---|---|---|

Flats | 767.4 | 80.7% |

Villas | 171.9 | 18.1% |

Hotel Apartments & Rooms | 5.9 | 0.6% |

Commercial | 5.7 | 0.6% |

Ready Market Performance

Ready properties amounted to AED 787.04 million (45.3% of overall transactions).

Flats: AED 411.74 million (52.3% of ready)

Villas: AED 108.97 million (13.8%)

Hotel Apartments & Rooms: AED 231.04 million (29.4%)

Commercial: AED 35.29 million (4.5%)

The ready market continues to be led by flats, underscoring solid end-user demand. Hotel Apartments & Rooms showed up with a strong performance, accounting for 29.4% of secondary-market turnover.

Sub-Category | Value (AED millions) | % of Ready Total |

|---|---|---|

Flats | 411.7 | 52.3% |

Villas | 109.0 | 13.8% |

Hotel Apartments & Rooms | 231.0 | 29.4% |

Commercial | 35.3 | 4.5% |

On The Micro Level

Market Insights & Outlook

The market’s off-plan majority, driven overwhelmingly by flats, underscores strong speculative demand ahead of handover. In the ready segment, hotel apartments’ substantial 29.4% share, AED 204 million, comes from THE 8 at Palm Jumeirah. Villas occupy a niche role in both markets. Moving forward, developers may focus on off-plan flats to capitalize on pre-completion interest, while expanding ready hospitality stock to meet yield-seeking investor demand.

Data Source: Dubai Land Department