Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

Experts say don’t rely on new-supply forecasts for Dubai price corrections. Strong demand, rents, migration, and macro strength matter. Track seven signals: bid weakness, days-on-market, sales volumes, inventory/absorption, yield compression, rent-price divergence, and mortgage costs/liquidity to spot shifts early.

Read the full article on Khaleej Times

Knight Frank: UAE construction is booming, forecast ~4% annual growth to 2029. Construction is 62% of pipeline (mixed-use 42%, residential 28%, data centres 9%, hospitality 4%). Dubai’s diversified economy leads with major projects and a 15km Metro Blue Line; population to 5.8m by 2040; office demand outpacing 8.2m sq ft.

Read the full article on Global Construction Review

RBI’s liberalised ODI/OPI rules are spurring Indian outbound capital, potentially $20B yearly, with the UAE a prime destination. UAE real estate shows scale, a $100B funding gap, tokenisation momentum, and rising UHNI inflows. Expect faster REIT growth and professional capital; Nisus targets $1B across affordable projects.

Read the full article on Gulf News

SOL Properties unveils $600m SOL LUXE, a 62-floor freehold tower on Sheikh Zayed Road with luxury homes and Grade A offices.

Read the full article on Arabian Business

Over the past two decades the property giant has been both catalyst and enabler of Dubai’s spectacular rise as the Gulf’s pre-eminent financial, leisure, retail, logistics and tourism hub.

Read the full article on Arabian Gulf Business Insight

Azizi Developments unveiled Azizi Lina in Downtown Jebel Ali beside JAFZA and a Metro station—studios to three-bed apartments with pools, separate gyms, cinema, lounges, play areas, retail and 24/7 security. Direct SZR connectivity, minutes from key hubs and Fortune 500 employers. Sales gallery: Conrad Hotel, 13th floor.

Read the full article on Zawya

Dubai Investment Real Estate's Danah Bay Wins“Best Mixed-Use Development” At Arabian Property Awards

Dubai Investment Real Estate’s Danah Bay (Al Marjan Island) won “Best Mixed-Use Development” at the 2025–2026 Arabian Property Awards. The waterfront project includes 189 villas, apartment towers, a 300-key hotel, private beaches, and amenities—praised for design, sustainability, and community impact supporting RAK’s tourism and investment appeal.

Read the full article on MENA FN

Qatar Q2 2025 real estate: residential values +2% YoY (villas +2.4% QoQ); sales volumes +30.9% QoQ, +62.6% YoY, median QAR2.8m; rents ~-1%. Office rents fell with new supply; hospitality 71% occupancy. Warehouses +2.9%. GDP +3.7%, inflation 0.2%. H1: residential transactions +114% to QAR9.23b; leases +26%.

Read the full article on Economy Middle East

Amaal opened an experience centre for the world’s first MANSORY Residences near Ras Al Khor. The Dh1.8bn Meydan Horizon tower (48 floors) completes Q4 2028. Centre showcases scale model, mock-up, VR, and MANSORY cars for HNWIs, reflecting Dubai’s booming branded-residence demand and ultra-luxury amenities.

Read the full article on Khaleej Times

Gulf fintechs are competing to be among the first to offer tokenised and fractional ownership products in Saudi Arabia, an industry that according to various estimates could be worth up to $30 trillion in the coming decade.

Read the full article on Arabian Gulf Business Insight

Magus Real Estate launched an invitation-only Exclusive Luxury Portfolio of ultra-prime, off-market villas, penthouses, and branded residences in Dubai’s top districts. Aimed at UHNW investors, the firm stresses confidentiality, bespoke advisory, and long-term value, positioning itself as a trusted partner amid strong global demand for Dubai property.

Read the full article on Khaleej Times

Fakhruddin Properties says lasting value comes from prime locations, quality, sustainability, and active management, not hype. It embeds net-zero design from the outset, adopts PropTech only with real benefits, uses IoT to optimize operations, and via Treppan Living expands a wellness-centric luxury model to the UK/Africa, prioritizing community impact.

Read the full article on Fast Company

Dubai rents aren’t rising everywhere. Oversupply, especially new one-bed towers, has softened rents in Downtown, JVC, Sports City and Silicon Oasis (avg one-bed: Dhs135k, 78k, 60–65k, 65k). Drops are likelier on new leases than renewals as recent handovers boost vacancy and tenant choice.

Read the full article on Time Out Dubai

Rupee weakness and higher inflation have eroded Indians’ and Pakistanis’ ability to buy UAE property: India ranks 18th and Pakistan 22nd in Stamn’s Foreign Buyer Power Index. British, American and Kuwaiti buyers lead as stronger GBP/EUR boost power. Despite FX headwinds, Indian HNWIs and UAE expats remain active.

Read the full article on Khaleej Times

Lotus Living opened a Dubai office and broke ground on its first UAE project in Dubai South after delivering 1,000+ London homes. Land acquired from ASICO. The residential scheme promises modern design, quality finishes, and amenities, reinforcing Dubai South’s growth as a key hub.

Read the full article on ME Construction News

UAE rental rules tightened. Dubai’s 2025 Smart Rental Index uses live Ejari to set renewal brackets; 90-day change and 12-month eviction notices remain, co-occupants must be registered. Abu Dhabi reinstates 5% cap; Sharjah freezes rent hikes for three years. RERA oversight and Tayseer ease service-charge collections.

Read the full article on Economy Middle East

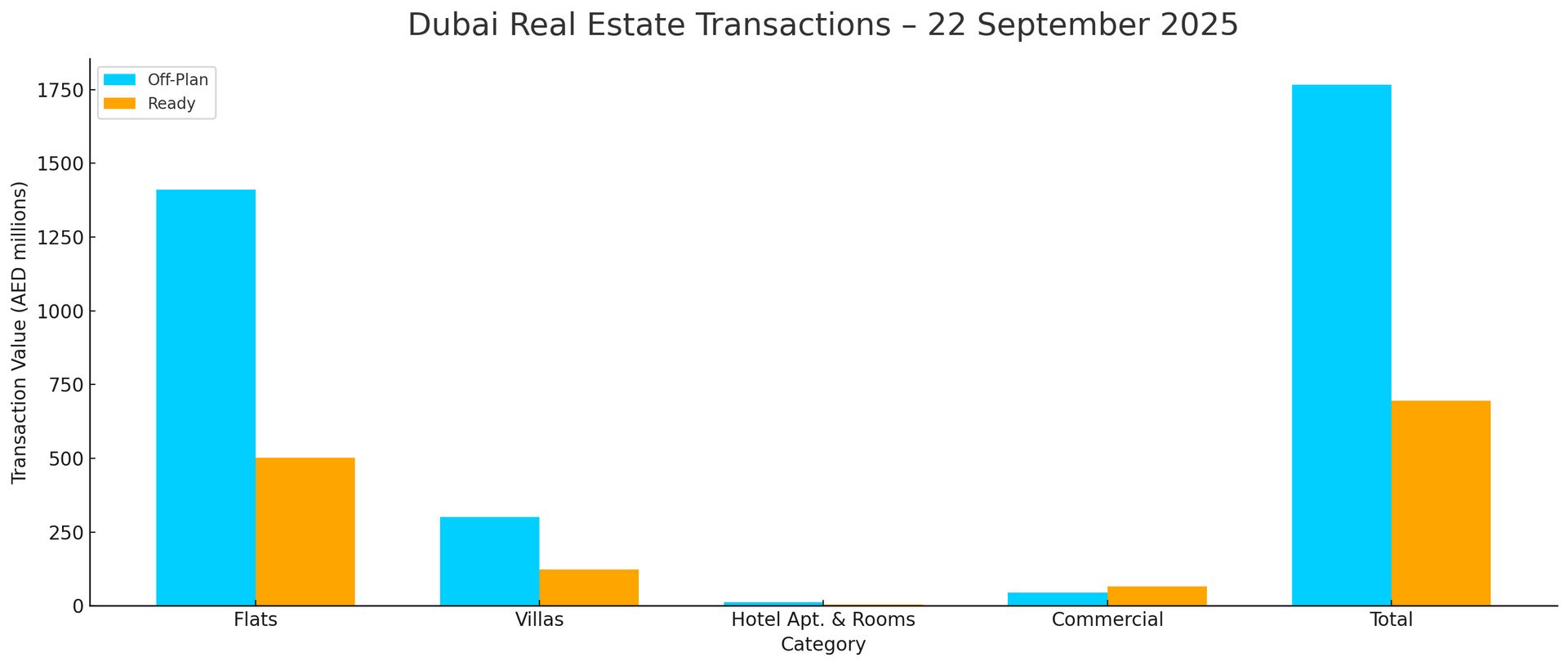

Dubai Real Estate Transactions as Reported on the 22nd of September 2025

On the 22-Sep-2025, the total transacted value reached AED 2,462,503,633. Off-plan dominated with AED 1,767,256,793 (71.8%), while Ready accounted for AED 695,246,840 (28.2%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,410.1 | 502.6 |

Villas | 300.8 | 122.0 |

Hotel Apts & Rooms | 11.7 | 4.6 |

Commercial | 44.8 | 66.1 |

Total | 1,767.3 | 695.2 |

Off-Plan Market Performance

Total Value: AED 1,767,256,793

Flats: AED 1,410,071,814 (79.8%)

Villas: AED 300,752,775 (17.0%)

Hotel Apts & Rooms: AED 11,650,209 (0.7%)

Commercial: AED 44,781,995 (2.5%)

Off-plan activity was led decisively by flats, with villas a meaningful secondary driver.

Ready Market Performance

Total Value: AED 695,246,840

Flats: AED 502,577,904 (72.3%)

Villas: AED 121,974,385 (17.5%)

Hotel Apts & Rooms: AED 4,640,000 (0.7%)

Commercial: AED 66,054,551 (9.5%)

Ready transactions were concentrated in flats, while villas and commercial provided a notable share of value.

On The Micro Level

Market Insights & Outlook

A strong off-plan skew continues to set the tone, with flats anchoring both segments. The healthy commercial share in the ready market hints at occupier confidence. If mortgage costs and absorption remain stable, momentum should persist, though watch inventory build-up and days-on-market for early inflection signals.

Data Source: Dubai Land Department