Former PepsiCo Exec Invented A Plastic That Dissolves in Water

If anyone knows a thing about plastic’s impact on the planet, it’s Manuel Rendon. The former PepsiCo executive and environmental engineer is using his 20 years of expertise to solve one of the world’s biggest problems with Timeplast.

Up to 450 million metric tons of plastic are wasted each year. Microplastics seep into our bodies, and mountains of bottles pile up in the ocean. But Timeplast has patented a water-soluble, time-programmable plastic that vanishes without harming the environment.

Major players are already partnering with Timeplast for its patented technology—their sales grew 6,000% in the first month.

You have just a few days left to invest as Timeplast scales in its $1.3T plastic market, from packaging to 3D printing. Become a Timeplast shareholder by midnight, 7/31.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

Property developer Arada has awarded the main construction contract for the Armani Beach Residences at Palm Jumeirah to China Tiesju Civil Engineering, a subsidiary of China Railway Group Ltd (CREC).

Read the full article on Arabian Business

Three reports out this week point to a maturing residential and commercial property market in Dubai, marked by slower price growth but increased resilience.

Read the full article on Arabian Gulf Business Insight

Dubai property prices surged 14% in Q2 2025 due to strong demand, millionaire migration, and economic reforms. Off-plan sales rose sharply, driving a 23% increase in overall transactions to AED 270 billion. Luxury areas and government incentives boosted home ownership and investment interest.

Read the full article on Zawya

Regular inspections carried out by Dubai Municipality have reduced the opportunities for illegal subletting.

Read the full article on Arabian Business

Dubai set a record with 51,000 home sales in Q2 2025, driven by end-user demand and luxury off-plan projects. Total H1 sales hit AED 268 billion, up 41% year-on-year. Off-plan sales made up 70%. Prices rose 3.4%, with resale activity down, signaling a maturing, end-user-led market.

Read the full article on Gulf News

Mina Al Hamriya port in Dubai is undergoing a major expansion to boost capacity, support food security, and enhance regional trade. The redevelopment will nearly double storage space, accommodate larger vessels, and strengthen its role in perishables handling, with vessel traffic up 11% year-on-year.

Read the full article on Construction Week Online

Property Finder’s new PF Market Pulse survey shows strong homebuying intent in the UAE, with 72% in May and 69% in June planning to buy within six months. However, expectations of price drops rose to 44% in June, suggesting a shift toward a more mature, price-sensitive market outlook.

Read the full article on Economy Middle East

TownX has launched Ashley Hills, a AED 662 million residential project in Arjan, Dubai, featuring 616 modern units. Targeting families and investors, it offers flexible payment plans and strong connectivity. The project reflects TownX’s continued expansion and commitment to quality, sustainable communities in emerging Dubai neighborhoods.

Read the full article on Trade Arabia

London Gate and OCTA Properties have launched three new residential projects, including a Franck Muller-branded waterfront development in Dubai Maritime City. The other projects are in Dubai South and JVC. This marks their second collaboration, expanding their shared vision for luxury, design-led living across key Dubai locations.

Read the full article on Zawya

|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Much like New York in the 1930s or Dubai in the 1990s, Riyadh is experiencing a period of rapid, visionary growth that is reshaping its urban fabric and global standing.

Read the full article on Arabian Business

Dubai’s real estate sector is shifting toward wellness-focused, green, and walkable communities in response to rising obesity and extreme heat. Developments like Ghaf Woods, Athlon, and The Wilds prioritize active, nature-based living. Government projects like THE LOOP support this vision, aiming for 80% bike/walk commutes by 2040.

Read the full article on CBRE

BurJuman Mall launched B Hive in early 2025—a co-working and chill zone for professionals and young adults. Attracting 6,000 monthly visitors, it offers free workspaces, a play area, and Bo’s Coffee. The space reflects the mall’s shift toward lifestyle-driven, inclusive, and experience-led environments.

Read the full article on Zawya

Penthouses make up just 0.8% of Dubai’s property listings, highlighting their rarity and prestige. Demand is rising amid global interest, but supply remains limited due to design constraints and owners holding long-term. Seen as trophy assets, penthouses offer exclusivity, luxury amenities, and fast appreciation in value.

Read the full article on MENA FN

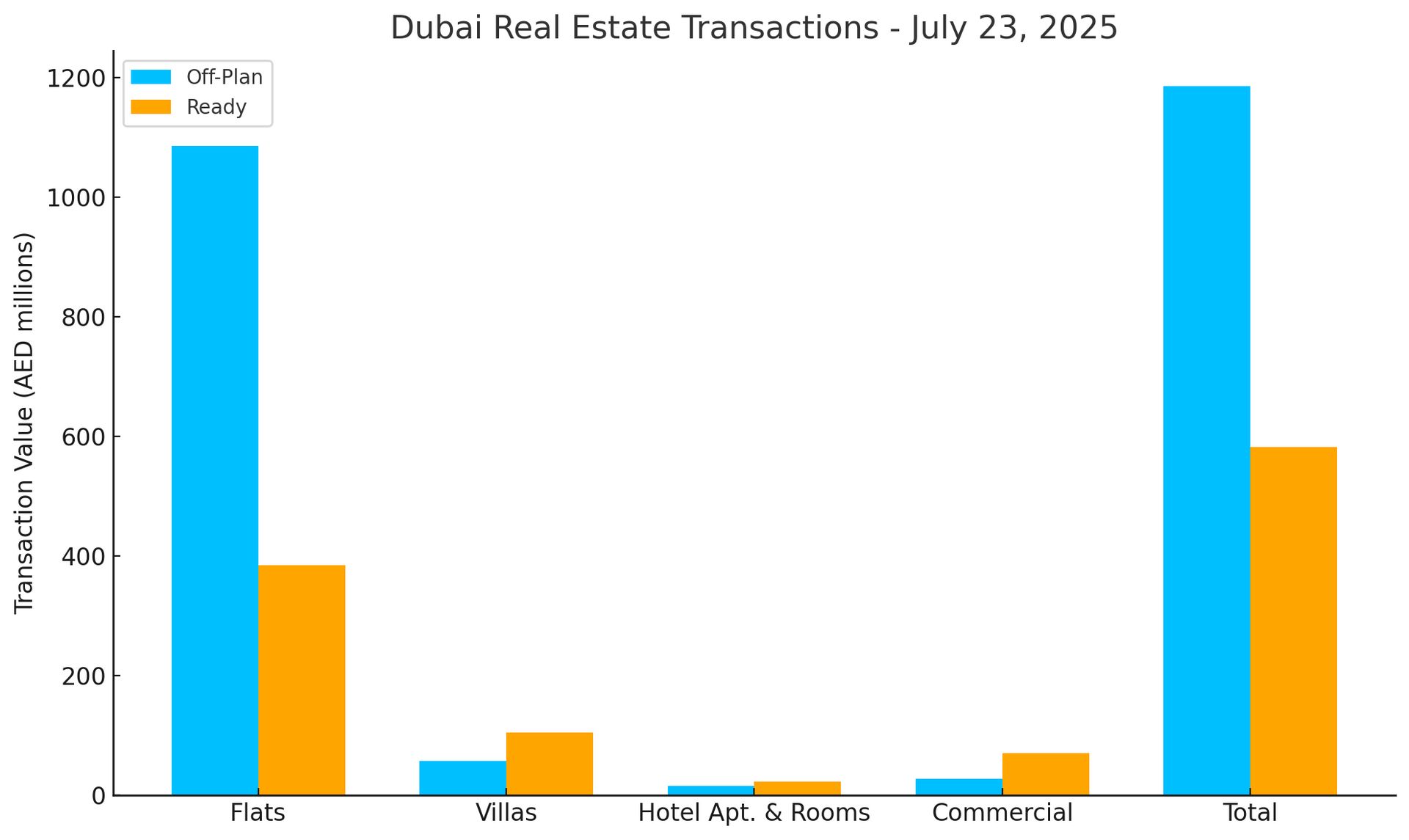

Dubai Real Estate Transactions as Reported on the 23rd of July 2025

On 23 July 2025, Dubai recorded AED 1.77 billion in real estate transactions, reflecting strong continued interest in both off-plan and ready property segments. Off-plan properties dominated with a 67.1% share of the total market (AED 1.19 billion), while ready properties contributed 32.9% (AED 582.76 million), underscoring sustained investor confidence in under-construction projects.

Category | Off‑Plan (AED million) | Ready (AED million) |

|---|---|---|

Flats | 1,086.2 | 384.7 |

Villas | 57.8 | 104.8 |

Hotel Apt. & Rooms | 15.3 | 23.2 |

Commercial | 27.5 | 70.1 |

Total | 1,186.8 | 582.8 |

Off-Plan Market Performance

Total Value: AED 1,186.76 million

Share of Total Transactions: 67.1%

Subcategory | Value (AED) | % of Off-Plan |

|---|---|---|

Flats | 1,086.20M | 91.5% |

Villas | 57.83M | 4.9% |

Hotel Apt. & Rooms | 15.27M | 1.3% |

Commercial | 27.46M | 2.3% |

Off-plan flats led the segment, accounting for over 91% of off-plan transactions. Limited activity was seen in hotel apartments and commercial units.

Ready Market Performance

Total Value: AED 582.76 million

Share of Total Transactions: 32.9%

Subcategory | Value (AED) | % of Ready |

|---|---|---|

Flats | 384.68M | 66.0% |

Villas | 104.76M | 18.0% |

Hotel Apt. & Rooms | 23.23M | 4.0% |

Commercial | 70.08M | 12.0% |

The ready segment was dominated by flat sales (66%), followed by villas and commercial properties, indicating balanced demand for both end-user homes and income-generating assets.

On The Micro Level

Market Insights

Investor sentiment remains firmly tilted toward off-plan opportunities, particularly in the apartment segment, due to competitive payment plans and anticipated capital appreciation. The ready market shows stable activity, supported by end-user demand for immediate occupancy. The continued dominance of apartments in both segments reflects strong urban living preferences. Looking ahead, a healthy mix of speculative and end-user interest is expected to drive consistent transaction volumes.

Data Source: Dubai Land Department