Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Dubai developers are shifting from “price per sq ft” to “wellness per sq ft.” Post-pandemic demand fuels scientifically designed homes with air/water quality tech, biophilic design, sleep-friendly lighting, and private spas. Wellness is now a core value driver and ROI pitch, not a mere amenity.

Read the full article on Khaleej Times

Sharjah economy grew 8.4% in 2024, triple global average, driven by real estate and transport, according to Sheikh Fahim bin Sultan Al Qasimi.

Read the full article on Arabian Business

Emaar launched Dubai Mansions, a Dh100bn ultra-luxury project in Emaar Hills, adding 40,000 mansions (10k–20k sq ft). Targeting UHNW demand, it anchors Dubai’s booming prime market, top-three globally, with villas dominating Dh10m+ deals. Savills sees another 4–5.9% price rise; Emaar’s H1 profit rose 34%.

Read the full article on The National

Property Finder has announced an investment in Stake, reinforcing its commitment to supporting the growth of innovative technology companies that are reshaping the region’s real estate sector.

Read the full article on Arabian Business

DAMAC International entered Iraq with phase one of DAMAC Hills Baghdad, three clusters (Misk, Fayrouz, Lamar) in a 6.2m-sqm master community near Baghdad Airport. The project offers 4–5BR luxury villas and full amenities, aligning with national investment goals and DAMAC’s Middle East expansion strategy.

Read the full article on Economy Middle East

Ras Al Khaimah is positioning itself to attract multinational firms seeking expansion space amid a shortage of Grade A offices across the UAE and Saudi Arabia, Marjan’s Group Chief Strategy and Business Development Officer Tariq Bsharat told Arabian Business.

Read the full article on Arabian Business

Soaring land demand, scarce plots, and investor-friendly reforms spur joint ventures between landowners and developers. Golden Visas attract capital, especially from India, China, and Russia. Waterfront projects command premiums and strong ROI. Collaboration-led, JV-driven development is set to define the next decade.

Read the full article on Gulf News

Nakheel unveiled 11 architect-designed waterfront villa styles at Palm Jebel Ali across The Beach (5–6BR, 7,500–8,500 sq ft) and The Coral (6–7BR, 11,500–12,500 sq ft) collections, all with beachfront access. The plan also includes a 9,000 sqm retail centre and a 1,000-capacity SOM-designed mosque.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 23rd of October 2025

On 23-Oct-2025, the total transacted value reached AED 1,664,660,181. Near 50/50 split in transactions value today. Off-plan contributed AED 839,257,461 (50.4%), while Ready accounted for AED 825,402,721 (49.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 773.7 | 541.7 |

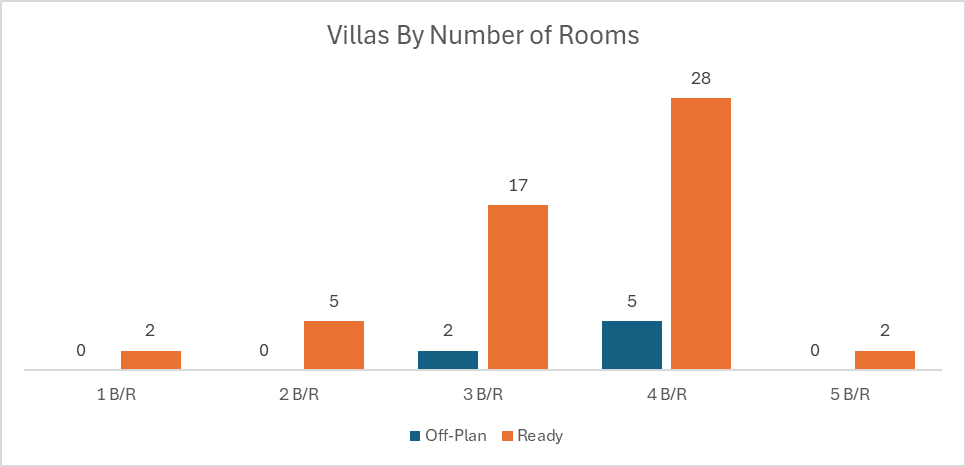

Villas | 32.5 | 168.2 |

Hotel Apt. & Rooms | 1.1 | 11.0 |

Commercial | 31.9 | 104.5 |

Total | 839.3 | 825.4 |

Off-Plan Market Performance

Total Value: AED 839,257,461

Flats: AED 773,728,043 (92.2%)

Villas: AED 32,542,277 (3.9%)

Hotel Apts & Rooms: AED 1,051,650 (0.1%)

Commercial: AED 31,935,490 (3.8%)

Off-plan activity was overwhelmingly driven by flats, with minor contributions from villas and commercial segments.

Ready Market Performance

Total Value: AED 825,402,721

Flats: AED 541,679,254 (65.6%)

Villas: AED 168,179,896 (20.4%)

Hotel Apts & Rooms: AED 11,007,074 (1.3%)

Commercial: AED 104,536,496 (12.7%)

Ready transactions were led by flats, with notable villa and commercial volumes.

On The Micro Level

Market Insights & Outlook

A balanced split between off-plan and ready indicates steady end-user and investor demand. Flats remain the core liquidity engine across both segments, while resilient villa and commercial trades suggest confidence ahead of year-end.

Data Source: Dubai Land Department