UAE real estate stays a 2025 growth engine: off-plan dominates; Dubai Q2 sales AED153.7bn (+44.5% YoY), Abu Dhabi prices +12.1%. Leases, transactions, and office supply up. Market seen at US$693.5bn (2025), US$759bn (2029); services US$18.5bn- US$24.8bn (2030). RAK fastest growth.

Read the full article on Zawya

RAK residential values rose 13.8% YoY (VPI 117.2) in H1-2025: villas +15%, apartments +13.2%. Off-plan dominated 85% of sales (3,000 units, AED6bn; avg AED2m), while volumes fell. Rents surged, especially apartments. Luxury/branded projects and a 19,300-unit pipeline to 2030, plus Wynn resort, underline strong, investment-driven growth.

Read the full article on Economy Middle East

Read the full article on Arabian Business

Serenia District unveils its final two 46th-floor penthouses at West Residence: 6,000 sq ft each with 180° city views, private lift-to-door access, four parking bays, and 40+ resort amenities. Refined interiors include gym, study, walk-ins, spa baths. Priced from AED 29m.

Read the full article on Zawya

UBS’s 2025 Bubble Index flags sharp risk rises in Dubai (now 5th from 14th) and Madrid (10th from 16th). Dubai prices are 50% above five years ago amid 15% population growth and tight supply. Globally, Miami tops risk; Tokyo/Zurich high; LA/Geneva/Amsterdam elevated; Hong Kong least affordable.

Read the full article on Khaleej Times

Egypt’s Aspect Development expands to UAE and Greece while consolidating in Egypt. Launching Winds Abu Dhabi (Sept 2025) with Aldar, two towers, 104 units. Five Greek coastal projects (Golden Visa). New Cairo flagship, 12 acres. Target sales: $33m UAE, $59m Greece, $312m Egypt. Showcasing at Cityscape Egypt 24–27 Sep 2025.

Read the full article on Zawya

Dubai’s four-year rally is set to rebalance as 150k–250k new homes (2025–27) outpace demand. Moody’s/Fitch see orderly cooling, potential price falls up to ~15%. Luxury likely resilient; mid-market pressured. Slower rent growth, higher rates, de-risked developers/banks, and stronger safeguards cut systemic risk; buyers/tenants gain leverage.

Read the full article on Khaleej Times

Abu Dhabi H1-2025 real estate hit AED54bn (+42%). Residential AED25bn (+38%), with 81% cash. Master-planned projects drove ~50% of sales; Al Hudayriat led (AED2.4bn). Prices rose: apartments +14% YoY, villas +11%; rentals AED8.2bn (+6%), apartment rents +21% in two years. Demand outpaced 400k-unit supply.

Read the full article on Economy Middle East

Indian HNIs are ramping $10m+ Dubai home purchases, drawn by no income/capital gains tax, proximity, and rising values. They were the #3 luxury buyers; 2024 saw 435 sales, on par with NYC/London. Limited supply pushed prices ~50% in five years. Preferences: back kitchens, large halls, vastu; 5–6 bedrooms.

Read the full article on Financial Express

Dubai mortgages surged in Q2-2025 to Dh42.2bn (23% of Dh184bn, +48.3% YoY). Brokerages now drive a major share, with banks building dedicated teams. But uneven standards spur calls for licensing akin to RERA. Proper regulation could sustain growth and broaden trusted homeownership.

Read the full article on Khaleej Times

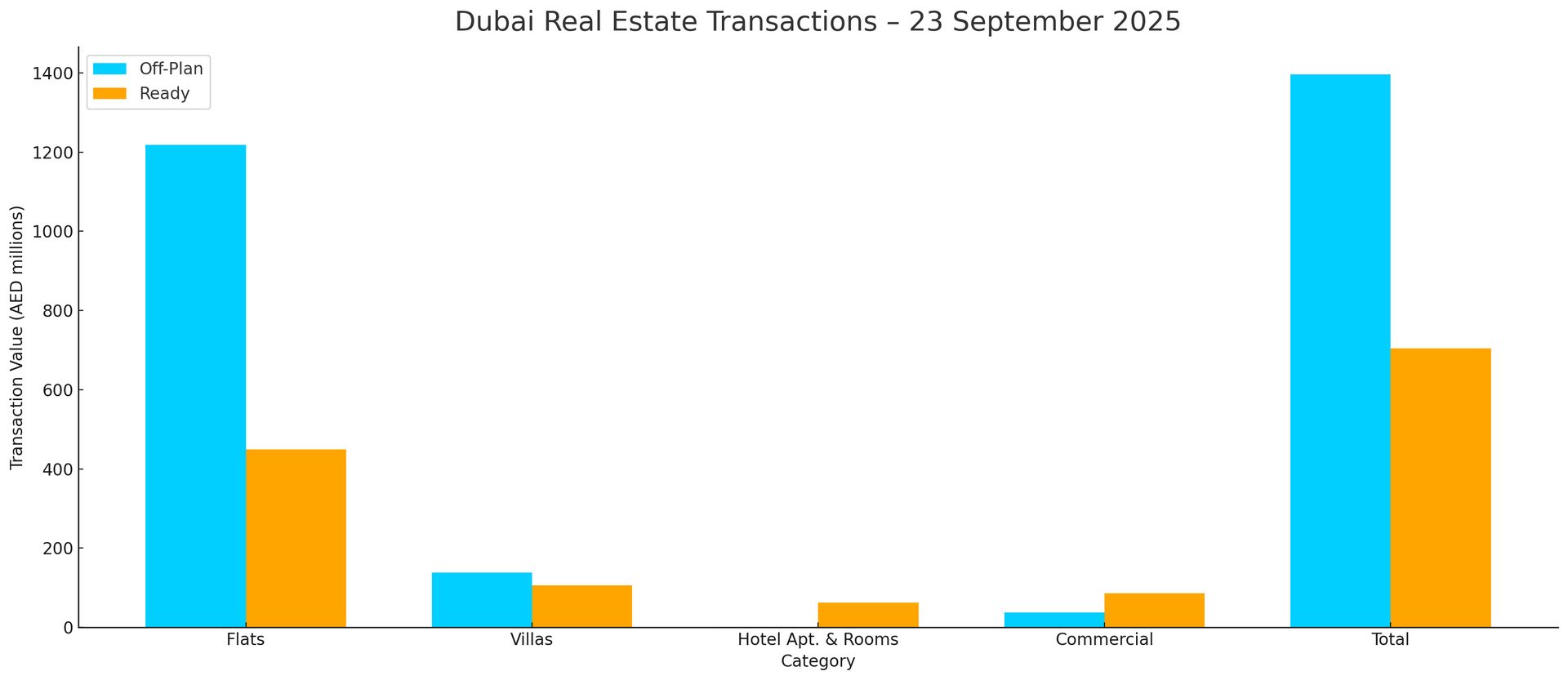

Dubai Real Estate Transactions as Reported on the 23rd of September 2025

On 23-Sep-2025, the total transacted value reached AED 2,099,859,143. Off-plan dominated with AED 1,395,563,797 (66.5%), while Ready accounted for AED 704,295,345 (33.5%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,218.1 | 449.2 |

Villas | 138.5 | 106.4 |

Hotel Apts & Rooms | 1.7 | 62.0 |

Commercial | 37.2 | 86.6 |

Total | 1,395.6 | 704.3 |

Off-Plan Market Performance

Total Value: AED 1,395,563,797

Flats: AED 1,218.1 (87.3%)

Villas: AED 138.5 (9.9%)

Hotel Apts & Rooms: AED 1.7 (0.1%)

Commercial: AED 37.2 (2.7%)

Off-plan activity was overwhelmingly flat-led, with villas a distant second and minimal hospitality/commercial contribution.

Ready Market Performance

Total Value: AED 704,295,345

Flats: AED 449.2 (63.8%)

Villas: AED 106.4 (15.1%)

Hotel Apts & Rooms: AED 62.0 (8.8%)

Commercial: AED 86.6 (12.3%)

Ready trade was flats-heavy, with balanced support from commercial and villas; hospitality showed a notable share.

On The Micro Level

Market Insights & Outlook

A two-thirds off-plan skew underscores sustained launch momentum and buyer appetite for pipeline product. Ready activity remains resilient in apartments, with healthy depth in commercial and hospitality. If this mix persists, expect pricing firmness in prime off-plan flats and selective strength in ready apartments.

Data Source: Dubai Land Department