UAE branded real estate investments surge as Dubai, Abu Dhabi and Ras Al Khaimah drive luxury growth

The UAE is consolidating its position as a global hub for luxury living, with branded residences emerging as one of the country’s fastest-growing real estate segments.

Read the full article on Arabian Business

Bader Saeed Hareb says his leadership is collaborative and governance-led, prioritizing planning, accountability, and disciplined execution. At Global Partners, he aims to deliver quality, community-driven developments with institutional standards, not growth for its own sake, while focusing on long-term value, integrity, innovation, and mentoring future leaders.

Read the full article on Entrepreneur

Brazilian football star Vinícius Júnior bought a luxury penthouse from Tiger Properties in Business Bay’s Tiger Sky Tower. The home offers 360-degree skyline views, direct Burj Khalifa views, floor-to-ceiling windows, and premium finishes, highlighting Dubai’s growing appeal to global celebrities and elite athletes.

Read the full article on Gulf News

Juwai IQI CEO Kashif Ansari says Dubai’s residential market should hit new highs in 2026, driven by real economic growth, not speculation. With GDP projected to rise from ~Dhs565bn in 2025 to ~Dhs590–600bn in 2026, expanding finance and Dubai’s growing AI hub (jobs and investment) are expected to sustain housing demand.

Read the full article on Gulf Today

British buyers in Dubai often make mistakes by assuming the UAE market works like the UK: shorter mortgage tenures, high upfront transaction fees, and freehold limits require recalibration. It is important to do your diligence on freehold zones/off-plan risks, budgeting for all fees, and following a clear DLD process before committing quickly to a location.

Read the full article on Gulf News

Pure Bliss Development (Lals Group) topped out Bliss Tower in Dubai Land Residence Complex, completing its main structure. Inspired by Japanese minimalism, units start at AED1.1m with a 20:80 plan. Built with GRID, over 90% of homes are sold, and construction reached topping out within 14 months.

Read the full article on Trade Arabia

UAE prime offices and retail surged in 2025 as demand outpaced supply in Dubai and Abu Dhabi. Prime retail rents rose 13.5% in Dubai and 3.4% in Abu Dhabi; office rents jumped sharply, with CBD occupancy above 90%. JLL warns prime/Grade A growth may be nearing its peak as affordability tightens.

Read the full article on Khaleej Times

Sharjah is emerging as a UAE testbed for “next-generation” communities where lifestyle, sustainability, and long-term value are expected together. Projects like Sharjah Sustainable City and Ajwan Khorfakkan show demand shifting toward low-emission, wellness-led living, backed by government standards and rising international investment.

Read the full article on Khaleej Times

Azizi Developments has started handing over Beach Oasis I in Dubai Studio City, a two-building community with 762 apartments and amenities like a beach-style pool, gyms, gardens, play areas, and retail. Beach Oasis II is under construction with 683 units and is nearly 20% complete.

Read the full article on Zawya

UAE hospitality investors are shifting to a real-estate view of hotels, favouring boutique, design-led properties for stronger guest loyalty, direct bookings, and asset flexibility. With RevPAR/ADR up and supply growth moderating, focus is moving from new builds to acquisitions, conversions, and repositioning, using design and operational discipline to drive long-term value.

Read the full article on Khaleej Times

UAE property investors should prioritise fundamentals: strong locations, sensible density, and real end-user demand. He highlights tighter scrutiny on governance and developer credibility, resilient supply-chain planning amid tariffs, and rising HNW expectations. With diversification accelerating, growth will be driven by quality, disciplined delivery, and coherent community planning, not volume.

Read the full article on Khaleej Times

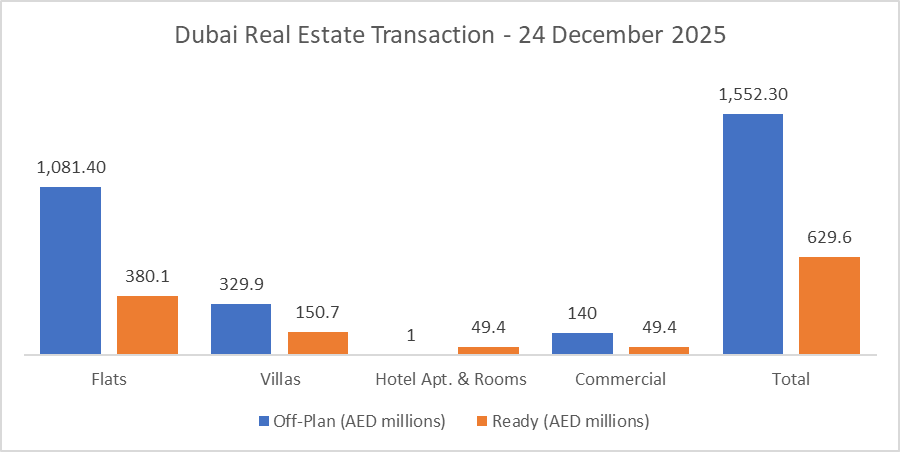

Dubai Real Estate Transactions as Reported on the 24th of December 2025

On the 24-Dec-2025, the total transacted value reached AED 2,181,858,624. Off-plan dominated with AED 1,552,308,285 (71.1%), while Ready accounted for AED 629,550,339 (28.9%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,081.4 | 380.1 |

Villas | 329.9 | 150.7 |

Hotel Apt. & Rooms | 1.0 | 49.4 |

Commercial | 140.0 | 49.4 |

Total | 1,552.3 | 629.6 |

Off-Plan Market Performance

Total Value: AED 1,552,308,285

Flats: AED 1,081,384,176 (69.7%)

Villas: AED 329,890,027 (21.3%)

Hotel Apts & Rooms: AED 1,017,338 (0.1%)

Commercial: AED 140,016,744 (9.0%)

Off-plan activity was overwhelmingly apartment-led, with flats contributing roughly seven-tenths of off-plan value.

Ready Market Performance

Total Value: AED 629,550,339

Flats: AED 380,080,734 (60.4%)

Villas: AED 150,653,762 (23.9%)

Hotel Apts & Rooms: AED 49,418,187 (7.8%)

Commercial: AED 49,397,656 (7.8%)

The ready segment was also flat-heavy, while villas provided a solid secondary base and hotel/commercial split the remainder almost evenly.

On The Micro Level

Market Insights & Outlook

Overall turnover stayed firmly off-plan driven, reflecting continued appetite for new inventory and structured payment plans. Meanwhile, the ready market showed a balanced mix beyond flats, suggesting end-users and investors are still selectively deploying capital into completed units, especially where immediate use or rental income is a priority.

Data Source: Dubai Land Department