| Check out our new website |

|

|

AboutTheUAE is your definitive guide to Dubai—discover top schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more.

|

Dubizzle Group has recruited over 80 data scientists and engineers to expand its Business Intelligence and data science operations, the company announced today.

Read the full article on Arabian Business

Skyloov’s Q2 data (44 M searches, 540 M views) shows renters prioritise affordable, convenient communities (e.g. International City, Deira), while buyers target emerging, infrastructure-led areas for long-term gains, highlighting diverging market needs.

Read the full article on Gulf News

Qatar’s Q1 2025 real estate market stayed stable: residential sales rose 13.2% QoQ (avg QAR 2.7 M) with steady rents; mortgage transactions up 37% YoY. Office rents softened (Grade A QAR 116/m²) amid 60 000 m² new supply. Retail GLA hit 2.5 M m² with mall rents at QAR 182.5/m².

Read the full article on Consultancy-me

Migration fuels the UAE’s economic and real estate boom: expatriates (88% of residents) drive GDP growth, consumer spending, and workforce expansion. Skilled and high-net-worth migrants underpin infrastructure projects and luxury property demand. Golden visas and tax incentives attract investors, while policy reforms aim for integration and sustainable development.

Read the full article on Economy Middle East

Dubai’s real estate saw four years of growth through 2024. Savills reports prime sales (AED 10 M+) surged tenfold to 4,670 in 2024, with Q1 2025 up 31%. Off-plan deals made 69% of high-end transactions, led by villas (70%). Prime segment set for 8–10% growth in 2025.

Read the full article on Consulancy-me

Samana Developers sold out its AED 400 million Samana Hills South project (510 units) in just 90 minutes. Located in Dubai South near Al Maktoum Airport, studios to two-bedrooms from AED 570 K feature 30+ resort-style amenities, flexible payments and strong ROI potential. The developer’s AED 17 B portfolio underpins its market leadership.

Read the full article on MENA FN

Betterhomes projects Dubai could attract 7,100 millionaires in 2025 (USD 7.1 B), driven by geopolitical and tax uncertainties. Demand for luxury, off-plan apartments is rising as investors seek stable, tax-efficient, lifestyle-focused property, solidifying Dubai’s role as a global residential investment benchmark.

Read the full article on Street Insider

Dubai has become a leading blockchain hub through progressive regulation (VARA, free zones), strong ecosystem support (Dubai Blockchain Centre, incubators), and real-world adoption in digital payments, DeFi, and smart contracts. Key use cases include UAE Pass digital ID, real estate tokenisation, and DeSci, bolstered by India–Dubai collaboration.

Read the full article on MSN

Lumena, OMNIYAT’s 48-storey commercial tower at Business Bay/Downtown Dubai, blends sculptural design with wellness-focused workspaces, full-height windows, biophilic floors, suspended Sky Pool and Sky Theatre, while targeting LEED, WELL, WiredScore and SmartScore certifications to redefine future-ready office environments.

Read the full article on Esquire Middle East

ANAX Developments partners with Lagardère to launch ELLE Residences Dubai Islands, designed by The One Atelier and ARQUINAUT, featuring beachfront luxury branded homes with curated interiors, wellness and dining spaces. Global marketing by PIXL, with sales timelines and unit details to be announced soon.

Read the full article on Verge

APEX 2025, backed by Dubai Land Department, will bring 100+ UAE and global developers to Miami (Sept 15–17), connecting 3,000+ buyers and investors with the US’s US$110.8 trillion real estate market amid a US$1.4 trillion UAE investment drive.

Read the full article on MENA FN

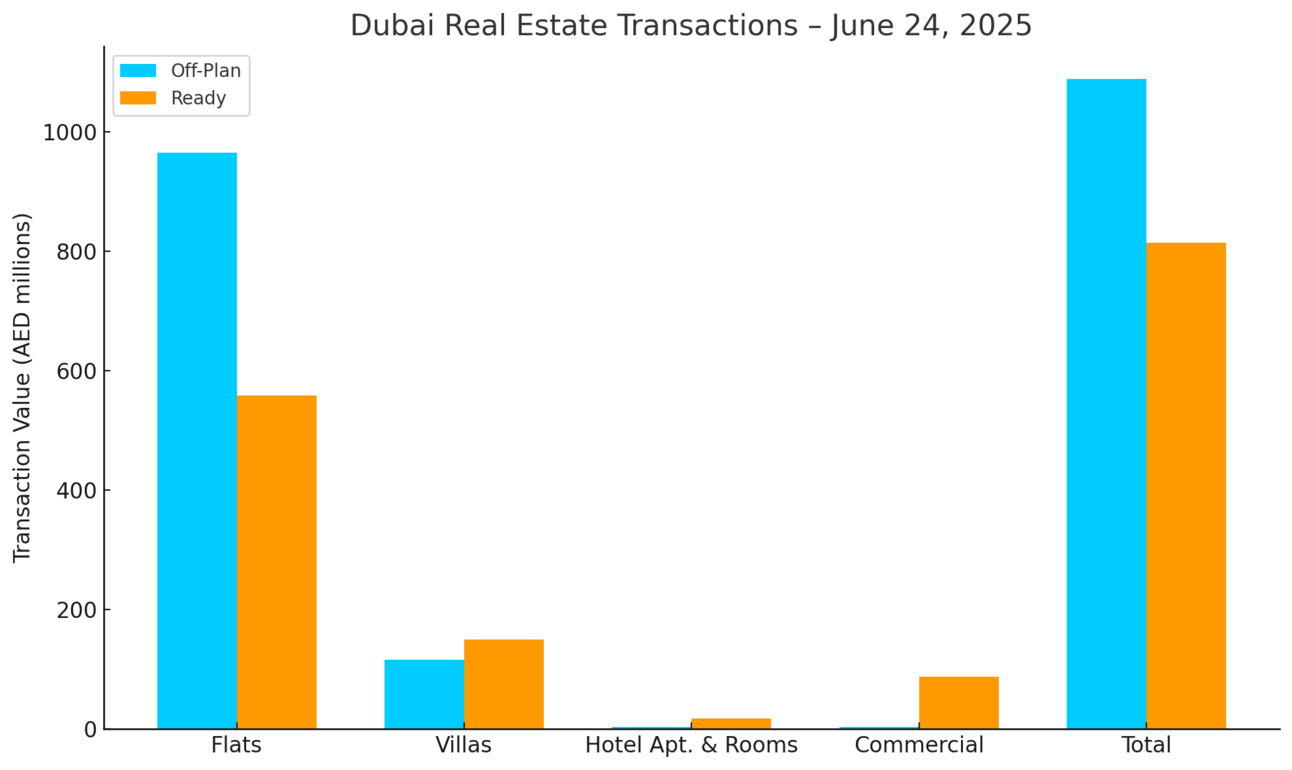

Dubai Real Estate Transactions as Reported on the 24th of June 2025

On 24 June 2025, Dubai’s total real estate transaction value reached AED 1.903 billion. Off-plan properties accounted for 57.2 % (AED 1.089 billion), while ready assets made up 42.8 % (AED 814 million) of the total volume.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 965.5 | 558.3 |

Villas | 116.6 | 149.9 |

Hotel Apt. & Rooms | 3.7 | 18.3 |

Commercial | 3.6 | 87.6 |

Total | 1089.4 | 814.0 |

Off-Plan Market Performance

Off-plan sales dominated with AED 1.089 billion in value, driven overwhelmingly by flats:

Flats: AED 965.5 million (88.6 % of off-plan)

Villas: AED 116.6 million (10.7 %)

Hotel Apartments & Rooms: AED 3.7 million (0.3 %)

Commercial: AED 3.6 million (0.3 %)

The concentration in flats highlights strong investor confidence in early-stage, smaller unit offerings. This could also be the result of higher speculation activity.

Ready Market Performance

Ready transactions totaled AED 814 million, with a more diversified mix:

Flats: AED 558.3 million (68.6 % of ready)

Villas: AED 149.9 million (18.4 %)

Hotel Apartments & Rooms: AED 18.3 million (2.2 %)

Commercial: AED 87.6 million (10.8 %)

While flats lead, the notable share for villas and commercial units points to healthy end-user and rental demand.

On The Micro Level

Market Insights

Off-plan’s majority share, centred on flats, reflects robust pre-completion appetite and flexible payment plans. The ready market’s higher villa and commercial contributions suggest strong immediate possession demand, both for owner-occupiers and landlords.

Data Source: Dubai Land Department