Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Indian residents shouldn’t use international credit cards to book Dubai property. Such capital transactions must go via RBI’s LRS, bank transfer through an authorised dealer with Form A2, PAN and 20% TCS. Card payments risk FEMA violations, investigations, and extra costs; LRS ensures clean, repatriable ownership.

Read the full article on Gulf News

Branded residences grew 160% in a decade, with Dubai leading globally, 61 completed, 100 underway, and 140+ due by 2031, as the world nears 1,400 by 2030 (MENA 25%). Pro-business policies and rising HNWIs fuel demand; branded homes command 40% premiums, sell faster, and retain value better.

Read the full article on Economy Middle East

ASICO was appointed property management partner for National Bonds Corporation, overseeing part of its Bur Dubai commercial and residential portfolio. The deal, signed by Ahmed Al Suwaidi and Mohammed Qasim Al Ali, tasks ASICO with operations, maintenance, and long-term asset care to uphold tenant experience and brand standards.

Read the full article on Zawya

Dubai real estate hit AED 431bn with 125k+ deals (+25% value). Whitewill spotlights five freehold plays: Jumeirah Residences Emirates Towers (2030), PASSO Palm West Crescent (2029), Emaar’s Selvara (2029), Omniyat’s Lumena offices (2029), and Vida’s Baystar (2029), offering 6–9% yields.

Read the full article on MENA FN

The Dubai real estate sector recorded AED19bn ($5.2bn) of transactions last week, according to data from the Land Department.

Read the full article on Arabian Business

Used by Execs at Google and OpenAI

Join 400,000+ professionals who rely on The AI Report to work smarter with AI.

Delivered daily, it breaks down tools, prompts, and real use cases—so you can implement AI without wasting time.

If they’re reading it, why aren’t you?

Azizi Developments launched Azizi Wares in Downtown Jebel Ali, freehold studios to 3BRs plus retail, next to JAFZA. Amenities include pools, separate gyms, cinema, kids areas, clubhouse and 24/7 security. With Metro/SZR access and proximity to major hubs and Fortune 500 firms, it targets investors and end-users seeking connected living.

Read the full article on Zawya

Awqaf Dubai completed four real-estate endowments worth AED 23m+ in H1 2025, supporting mosques, general charity, underprivileged families (via Dubai Charity), and a first endowment for government employees. A new portfolio of malls, residential and mixed-use projects is planned to grow sustainable, community-focused returns aligned with Dubai’s vision.

Read the full article on Government of Dubai Media Office

A Dubai real estate court ordered the judicial auction of a 2,402-sqm plot valued at AED 16.8m to end a seven-sibling inheritance dispute. Bidding is limited to co-owners, with proceeds split by shares, after partition was deemed impossible under municipal rules and prior procedural attempts failed.

Read the full article on Gulf News

BEYOND Developments launched the “Forest District by the Sea” in Dubai Maritime City and Talea, a 354-unit is thefirst tower. The nature-first plan adds 65,000 sqm of parks (55,000 sqm native woodland), 75% canopy, shaded trails and wellness amenities, creating a cooler microclimate and supporting the Dubai 2040 Master Plan.

Read the full article on Economy Middle East

Object 1 closed H1 2025 with a 4.5m sq ft pipeline across 16 projects, 1,433+ units sold, and DLD-tracked sales up 188% (value) and 157% (volume) YoY. It’s expanding to Abu Dhabi and pushing sustainability-led launches (JVC/JVT, Evergr1n House), aligned with the UAE Green Agenda 2030.

Read the full article on Zawya

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

UAE mortgage fintech Holo raised $22m Series A led by Impact46 with Mubadala and others. Profitable in the UAE, Holo will expand in Saudi, enhance products and teams, and digitize home financing. Backers cite strong GCC real-estate growth and demand for seamless, tech-driven ownership.

Read the full article on Gulf Business

Al Huzaifa, a UAE luxury furniture brand, launched Al Huzaifa Properties to develop premium lifestyle communities, starting with a debut project on Al Marjan Island, Ras Al Khaimah. Led by CEO Saif Nensey, it will deliver fully furnished, design-driven residences for end-users and investors.

Read the full article on MEP Middle East

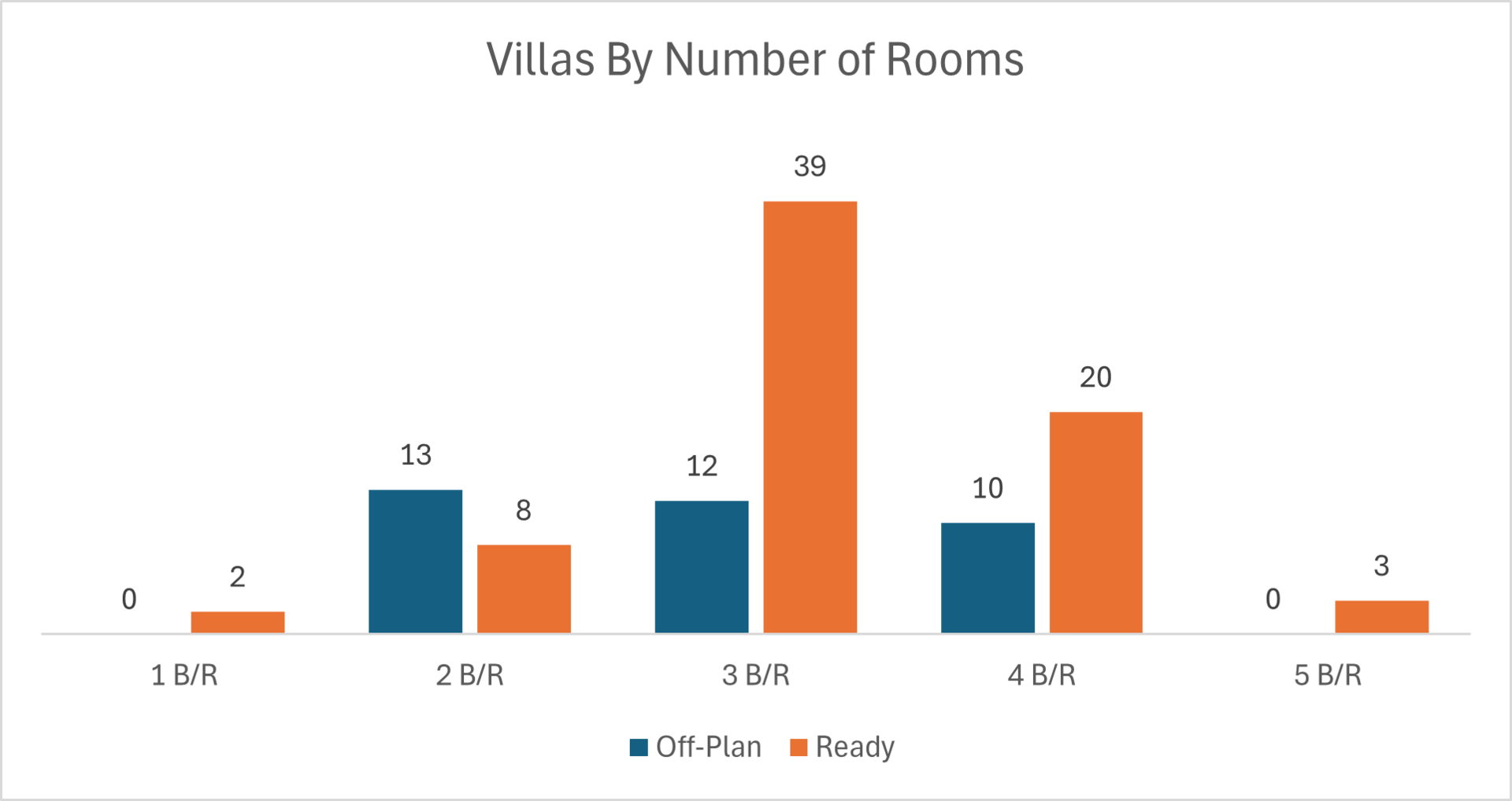

Abu Dhabi H1 2025: ready villa/townhouse sales +72% (700 units), highest since 2021. Overall sales value down 33% to AED 8.9bn on 3,300 deals (-37%) amid fewer launches. Prices: apartments +14%, villas +11; rents +14%. Pipeline: 10,400 units due H2 2025.

Read the full article on Zawya

Abu Dhabi H1 2025 shifted to ready homes: villa/townhouse sales +72% YoY (2,300 of 3,300 deals), average ticket AED 2.5m. Off-plan -70% YoY; total sales AED 8.9bn (-33%). Prices and rents rising (VPI +8.1% YoY). Tight supply supports secondary-market momentum into H2.

Read the full article on MENA FN

Dubai Real Estate Transactions as Reported on the 25th of August 2025

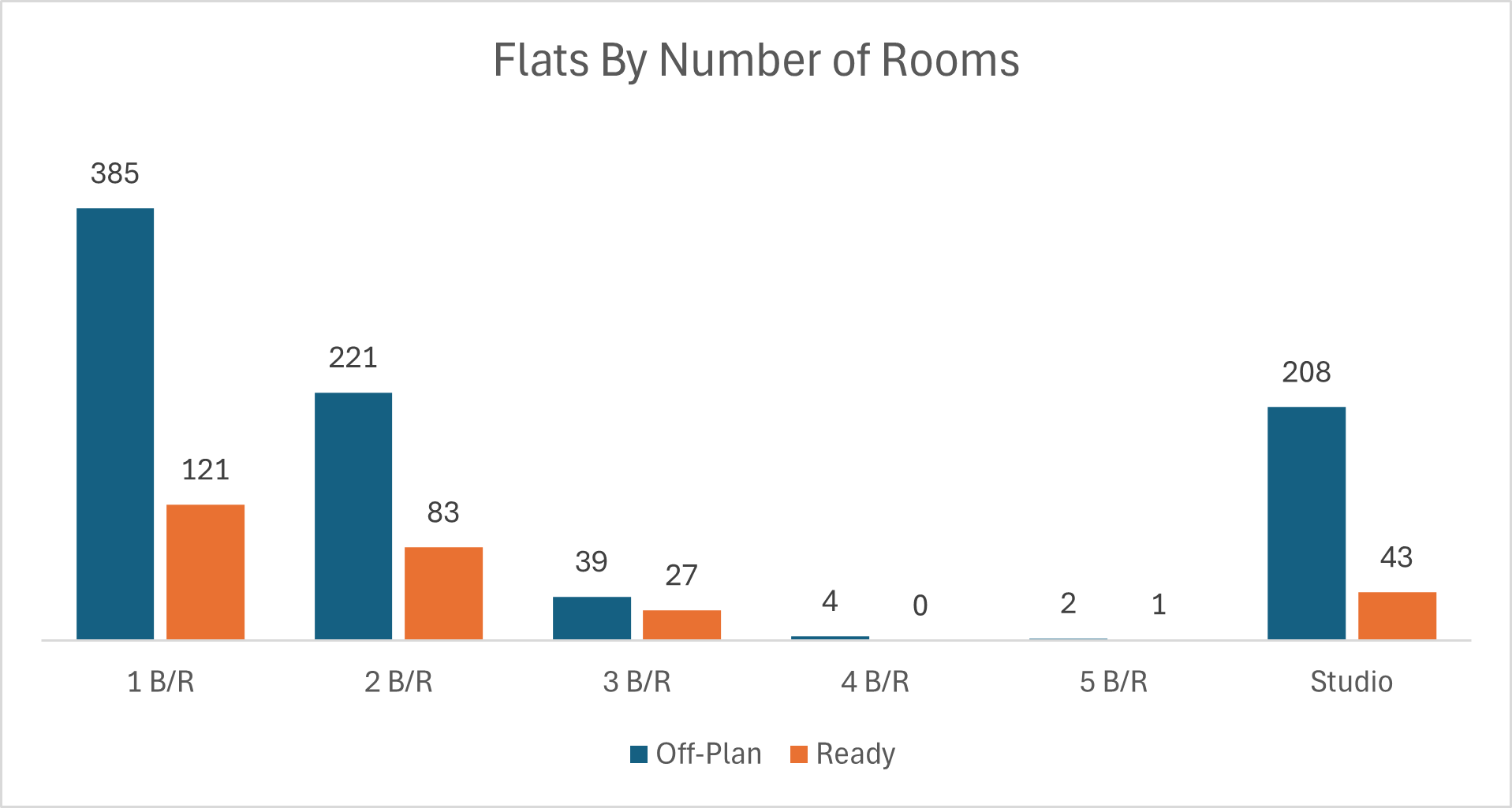

Dubai recorded AED 2.813bn in real estate transactions. Off-plan accounted for AED 2.085bn (74.1%), while ready totaled AED 0.728bn (25.9%), underscoring a day dominated by new project sales.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,943.6 | 427.3 |

Villas | 89.4 | 211.2 |

Hotel Apt. & Rooms | 16.8 | 15.1 |

Commercial | 34.9 | 74.7 |

Total | 2,084.7 | 728.4 |

Off-Plan Market Performance

Total: AED 2.085bn

Flats: AED 1.944bn (93.2% of off-plan)

Villas: AED 0.089bn (4.3%)

Hotel Apt. & Rooms: AED 0.017bn (0.8%)

Commercial: AED 0.035bn (1.7%)

Off-plan activity was overwhelmingly led by flats, with minimal contribution from villas and commercial segments.

Ready Market Performance

Total: AED 0.728bn

Flats: AED 0.427bn (58.7% of ready)

Villas: AED 0.211bn (29.0%)

Hotel Apt. & Rooms: AED 0.015bn (2.1%)

Commercial: AED 0.075bn (10.3%)

Ready sales were flat-led, with villas contributing nearly a third; commercial provided a meaningful secondary share.

On The Micro Level

Market Insights & Outlook

The three-quarters off-plan share highlights strong buyer appetite for pipeline inventory, particularly apartments.

Ready villas’ solid share signals steady end-user demand for family housing.

With commercial slices small on both sides, the day’s flows were residential-centric, consistent with recent momentum in apartment-led trading.

Data Source: Dubai Land Department