Mashriq Elite Developments began construction of Floarea Breeze in Dubai Islands, a waterfront project with 48 luxury apartments and 4 townhouses (from Dh1.799m), due Q3 2027. The firm cites strong Dubai Islands demand (Dh6.1bn H1 2025 sales) and highlights premium finishes, connectivity, and a 1,200+ unit pipeline.

Read the full article on Gulf News

ALA Developments, founded in January 2025 in Dubai, is entering the luxury property market with a design-first pipeline worth about Dh1 billion, launching from 2026. Its first project, Creek Views at Jaddaf Waterfront, targets handover in Q4 2026, emphasizing privacy, architectural quality, and long-term value.

Read the full article on Khaleej Times

Exclusive Links closed one of Dubai’s priciest residential rentals of 2025: an AED 4.25m/year lease for a fully furnished 18,749-sq-ft mansion in Dubai Hills Estate. Listed immediately, it drew enquiries within two hours and secured a VIP Asian tenant in a week, underscoring strong HNW demand for ultra-luxury leasing and relocation-driven buying interest.

Read the full article on Business Insider

NBCC (India) Ltd made its first real estate investment outside India, buying a Dh15m Dubai Mainland plot (14,776.8 sq ft) via its wholly owned NBCC Overseas Real Estate LLC to build a mixed-use project. The move reflects Indian developers’ growing UAE push, driven by clear regulations, faster approvals, and global buyer demand.

Read the full article on Gulf News

Meraki Developers’ The Haven in Dubailand’s Majan is a community-focused residential enclave built with an in-house development model, enabling faster delivery and strong quality control. Handed over on time, it offers family amenities, co-working and wellness spaces, sustainability features, and ongoing property management, positioning it as “livability-first” Dubai living.

Read the full article on Khaleej Times

Palma Development awarded Khansaheb a Dh760m contract to build West Residence, a 46-storey, 411-home tower and Phase 1 of the Dh5bn Serenia District at Jumeirah Islands. The project features six lifestyle zones and continues the long-term Palma–Khansaheb partnership, following Serenia projects on Palm Jumeirah.

Read the full article on Gulf News

7th Key Development launched a VARA-approved crypto payment system enabling instant, compliant on-chain property payments in Dubai using stablecoins (USDT/USDC). The gateway promises borderless settlement, strong AML/KYC controls, institutional custody, and clear audit trails, aimed at reducing friction for overseas and institutional buyers and speeding up closings.

Read the full article on Khaleej Times

Experts say redeveloping the DXB airport site is a once-in-a-generation chance to build a sustainable, inclusive, people-first district, not just another high-rise, profit-led enclave. They urge data-led planning, walkable shaded streets, green corridors, transit access, mixed-income housing, and heritage preservation as Dubai shifts airport growth southward.

Read the full article on Construction Week Online

Dubai developers are building “water cities” (inland lagoons, marina-style districts, floating homes) as natural coastline supply tightens and demand for wellness-led waterfront living stays strong. Proponents say improved lagoon tech and alignment with Dubai 2040 make the trend durable; differentiation will hinge on execution, connectivity, and long-term maintenance, not visuals.

Read the full article on Khaleej Times

Dubai Real Estate Transactions as Reported on the 25th of December 2025

On the 25-Dec-2025, the total transacted value reached AED 2,072,138,933. Off-plan dominated with AED 1,642,773,139 (79.3%), while Ready accounted for AED 429,365,794 (20.7%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

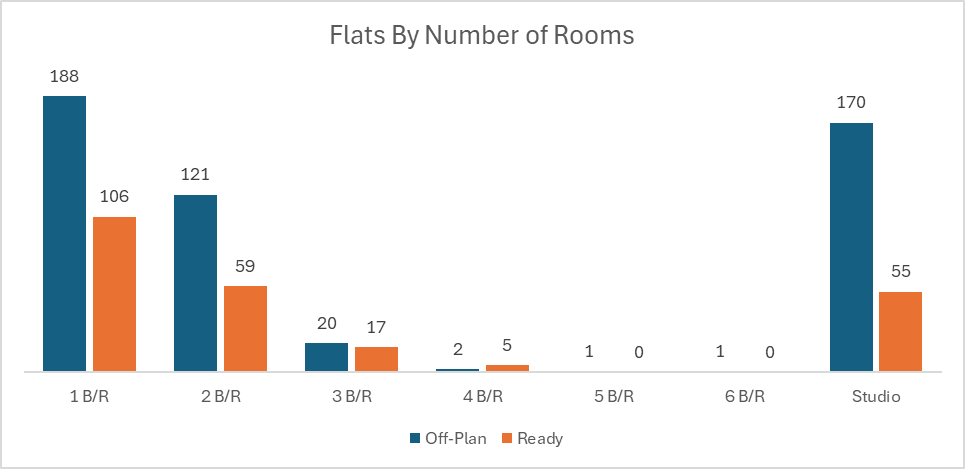

Flats | 1,032.5 | 329.3 |

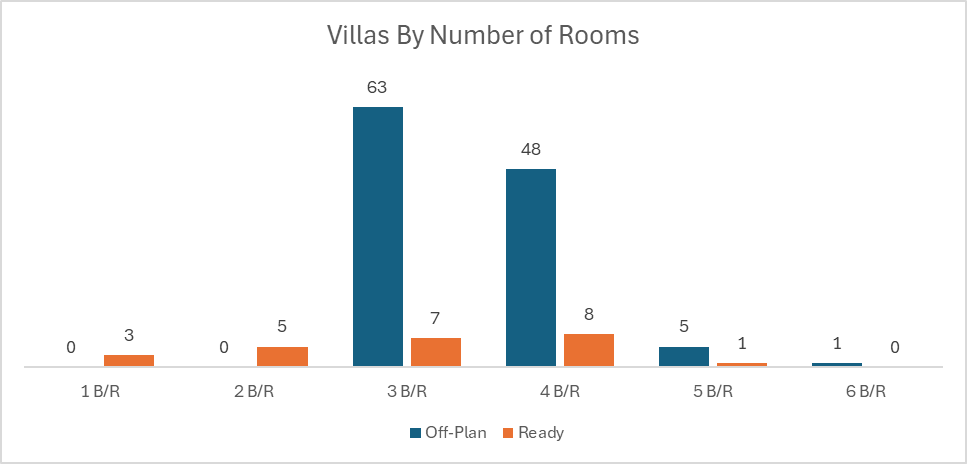

Villas | 516.2 | 63.1 |

Hotel Apt. & Rooms | 2.2 | 9.1 |

Commercial | 91.9 | 27.9 |

Total | 1,642.8 | 429.4 |

Off-Plan Market Performance

Total Value: AED 1,642,773,139

Flats: AED 1,032,450,011 (62.8%)

Villas: AED 516,186,485 (31.4%)

Hotel Apts & Rooms: AED 2,208,000 (0.1%)

Commercial: AED 91,928,643 (5.6%)

Off-plan activity was overwhelmingly driven by flats, with villas providing a strong secondary contribution.

Ready Market Performance

Total Value: AED 429,365,794

Flats: AED 329,252,198 (76.7%)

Villas: AED 63,095,135 (14.7%)

Hotel Apts & Rooms: AED 9,105,000 (2.1%)

Commercial: AED 27,913,462 (6.5%)

Ready transactions were led by flats, while commercial held a meaningful slice relative to other non-residential segments.

On The Micro Level

Market Insights & Outlook

The day’s value was firmly off-plan-led, reflecting continued strength in new supply absorption, particularly in the apartment market. The ready segment was smaller but still active, with end-user and investor demand concentrated in flats, while commercial’s share suggests steady appetite for income-linked assets alongside residential transactions.

Data Source: Dubai Land Department