Palm Jebel Ali is emerging as a prime, affordable alternative to Palm Jumeirah, offering larger plots, lower prices, and payment plans. With Dubai’s real estate booming and high global demand, early investors in Palm Jebel Ali are poised for strong returns in this expansive, waterfront development.

Read the full article on Khaleej Times

The Real Estate Report is a reader-supported publication. To receive new posts and support my work, consider becoming a paid subscriber.

The IPS 2025 Conference in Dubai (April 14–16) will gather global real estate leaders to discuss innovation, AI, proptech, market trends, women's leadership, and client engagement. Key topics include predictive analytics, digital transformation, and gender diversity, positioning IPS as a major event for industry insights and networking.

Read the full article on Zawya

Abu Dhabi’s residential market is growing, with 38,700 new units expected by 2028. Sales hit AED26 billion in 2024, led by strong demand, rising prices, and government incentives. Ready properties dominated, while off-plan sales dipped. Mortgages surged 34%, and nearly 40 new projects were launched, boosting future inventory.

Read the full article on Zawya

Kleindienst Group is set to add a second Nice-inspired property to its Côte d’Azur-style resorts in Dubai World Islands.

Read the full article on Arabian Business

Morgan Stanley now expects U.S. home prices to dip below 0%, marking a shift from supply-driven optimism to demand concerns—without addressing overvaluation. In Dubai, despite bullish talk, falling off-plan and land prices signal excess supply. As incentives fail and rents drop, a market correction appears inevitable, echoing past cycles.

Read the full article on Gulf News

Burtville Developments launched Bab Al Qasr Resort Residence 18 & 19, a 483-unit luxury hotel-branded project in Masdar City—Masdar’s first of its kind. Spanning 915,000+ sq.ft., it offers upscale, fully furnished units, extensive amenities, and eco-friendly design. Completion is expected by Q3 2028, marking Burtville’s fifth Abu Dhabi project.

Read the full article on Zawya

The UAE’s non-oil economy is expected to grow 5.2% in 2025, led by tourism, real estate, finance, and trade, according to S&P. Real estate remains a key driver, especially in Dubai. Oil sector growth is also forecasted due to rising OPEC+ output, supporting overall GDP alongside digital innovation and reforms.

Read the full article on Khaleej Times

Ajman’s rental market saw strong growth in 2024, with lease contracts reaching AED4.93 billion—a 50% rise from 2022. Residential leases totaled AED2.65 billion, commercial AED2.15 billion, and investment AED266 million. Driven by strategic location, modern amenities, and investor-friendly policies, Ajman continues to attract residents and boost development.

Read the full article on Zawya

Photo by Kate Trysh

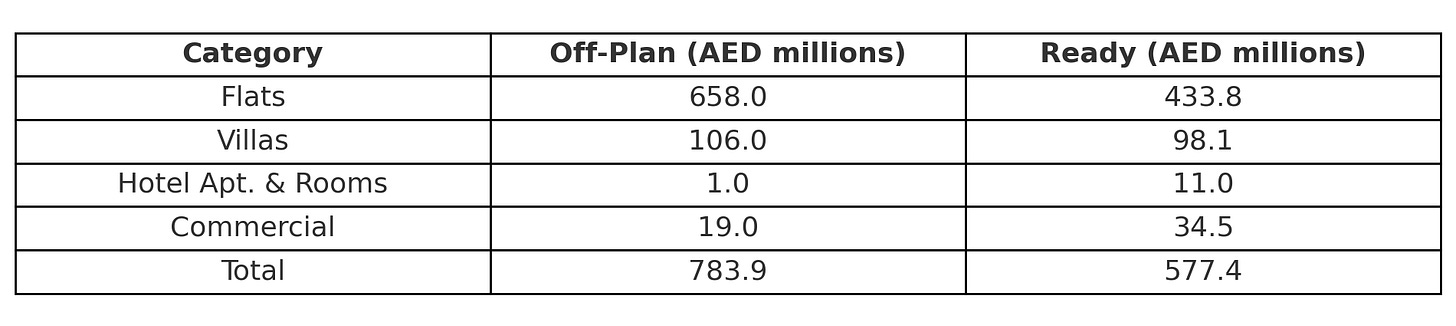

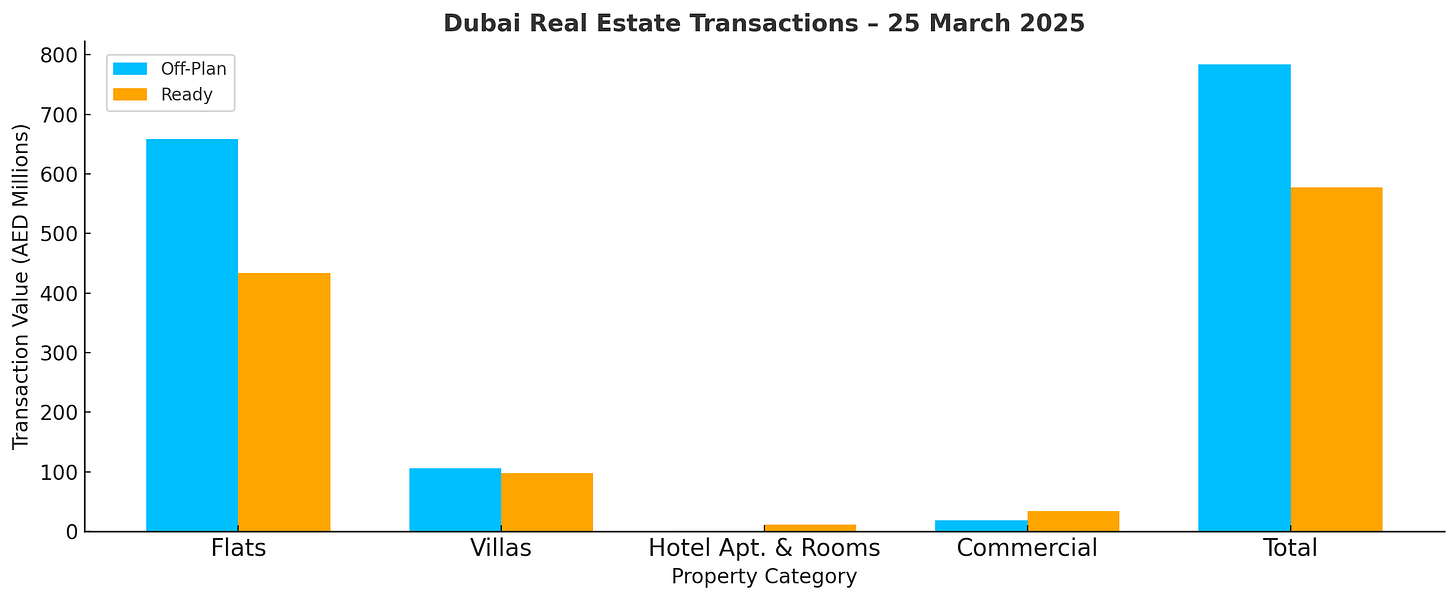

Dubai Real Estate Transactions as Reported on the 25th of March 2025

Dubai’s real estate market continued to demonstrate robust momentum on 25 March 2025, recording a total transaction value of AED1.36 billion across both off-plan and ready properties. The day’s data highlights strong investor appetite, particularly in the off-plan segment, which continues to drive the bulk of market activity.

Off-Plan Segment Leads Market Activity

The off-plan sector accounted for the majority of the total value, contributing 57.6% of the day's transactions at AED783.9 million.

Breakdown by Property Type – Off-Plan:

Flats led the off-plan segment, making up a commanding 83.9% of off-plan sales at AED657.98 million.

Villas followed with AED105.96 million, contributing 13.5% to the off-plan total.

Commercial properties recorded AED18.99 million, accounting for 2.4%.

Hotel Apartments & Rooms came in at AED978,000, representing a marginal 0.1% share.

Ready Properties Maintain Steady Demand

The ready property segment comprised 42.4% of total daily transactions, recording a value of AED577.37 million.

Breakdown by Property Type – Ready:

Flats remained the dominant category, contributing 75.1% to the ready property total at AED433.82 million.

Villas followed at AED98.05 million, capturing 17% of the segment.

Commercial properties reached AED34.49 million, representing 6%.

Hotel Apartments & Rooms saw AED11.01 million in transactions, contributing 1.9%.

Key Takeaways

Off-plan flats continue to be the primary driver of market activity, both in volume and value.

Ready properties show consistent performance, especially in the flats and villa categories.

The combined value of commercial transactions across both segments stood at AED53.48 million, underlining ongoing interest in business-related real estate.

The hotel apartment segment, while smaller, still reflects interest in hospitality-linked assets, particularly in the ready market.

Conclusion

Dubai’s property market remains vibrant with strong daily performance, underpinned by sustained investor confidence in off-plan developments and ongoing demand for ready properties. With nearly AED1.4 billion in transactions in a single day, the real estate sector continues to be a key pillar of the Emirate’s economic landscape.

Data Source: Dubai Land Department