|

The Gulf Business Real Estate Summit in Dubai examined tokenisation, sustainability, and record market activity. Experts debated a potential 2026 correction, noting strong fundamentals but mid-market oversupply risks. They highlighted where value still lies in off-plan projects, concluding the UAE market is maturing, resilient, and increasingly innovation-driven.

Read the full article on Gulf Business

Dubai developers like DAMAC and SOBHA are using Premier League partnerships with Chelsea and Arsenal not just for branding, but to drive global demand for Dubai property, leveraging football’s reach to sell branded residences, lift credibility, and tap HNWI inflows in a fast-growing market.

Read the full article on The Football Week

At its Stake Summit, digital platform Stake launched StakeOne, an app-based, end-to-end service for buying, financing, furnishing, leasing and selling full properties in Dubai, making cross-border ownership easier for global investors through curated units, golden-visa support, real-time portfolio insights and continuous management.

Read the full article on Zawya

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

Rising rents are pushing Dubai tenants toward ownership: 55% now plan to buy within 1–3 years (vs 25% last year), most using mortgages. With higher mortgage activity, stronger secondary and off-plan sales, and longer planned stays, homebuying is becoming a long-term financial strategy, not just shelter.

Read the full article on Khaleej Times

SOL Properties sold a Fairmont Residences Solara Tower triplex sky mansion in Downtown Dubai for AED 174m, one of the area’s highest residential deals. The 245m-high home offers a private elevator, two pools and a rooftop terrace, as SOL grows amid a UAE residential market forecast to expand strongly by 2030.

Read the full article on Zawya

Meraas has launched The Edit at d3, a design-led residential project in Dubai Design District with three waterfront towers and 557 units. Featuring sky gardens, resort-style amenities and direct canal access, it anchors residents in d3’s expanding creative, cultural and lifestyle hub.

Read the full article on Gulf Construction Online

Consider this our entire pitch:

Morning Brew isn’t your typical business newsletter — mostly because we actually want you to enjoy reading it.

Each morning, we break down the biggest stories in business, tech, and finance with wit, clarity, and just enough personality to make you forget you’re reading the news. Plus, our crosswords and quizzes are a dangerously fun bonus — a little brain boost to go with your morning coffee.

Join over 4 million readers who think staying informed doesn’t have to feel like work.

GFH Partners has acquired a majority stake in Devmark, the UAE’s leading development sales and marketing platform. Devmark’s founders remain in charge as the partnership targets GCC expansion, channels institutional capital to developers, and deepens GFH’s exposure to the region’s fast-growing residential market.

Read the full article on Zawya

Reef Luxury Developments has unveiled Reef 996 in Dubai Production City, a luxury studios-and-apartments project with 19 resort-style amenities and patented outdoor-cooled garden lounges and sunken balconies, offering year-round comfort and experiential living ahead of its planned Q3 2028 completion.

Read the full article on Trade Arabia

Holm Developments has launched its brand and first project, Holm One, in Jumeirah Garden City: 218 fully furnished studios and 1-bed apartments with smart-home systems, pool, gym, yoga and co-working spaces, targeting modern urban residents, with handover scheduled for Q1 2028.

Read the full article on Zawya

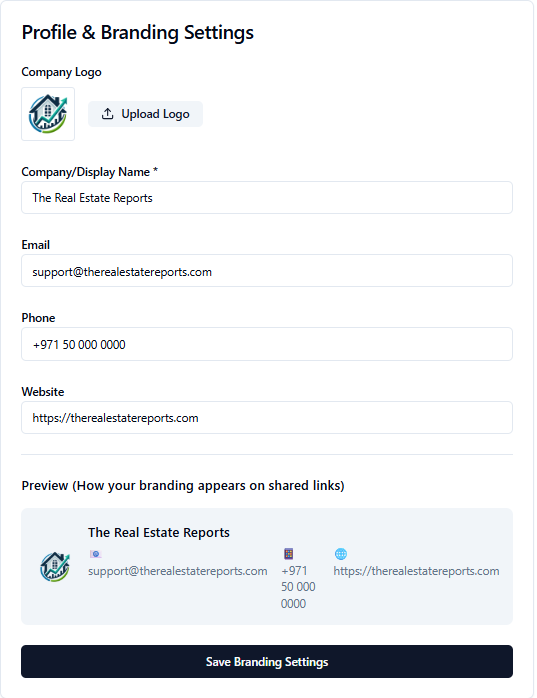

Dubai Real Estate Transactions as Reported on the 25th of November 2025

On the 25 November 2025, the total transacted value reached AED 2,307,665,365. Off-plan dominated with AED 1,679,132,365 (72.8%), while Ready accounted for AED 628,533,000 (27.2%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,436.1 | 386.7 |

Villas | 118.9 | 137.9 |

Hotel Apts & Rooms | 2.4 | 30.7 |

Commercial | 121.7 | 73.1 |

Total | 1,679.1 | 628.5 |

Off-Plan Market Performance

Total Value: AED 1,679,132,365 (72.8% of daily total)

Flats: AED 1,436,147,401 (85.5% of off-plan)

Villas: AED 118,894,480 (7.1% of off-plan)

Hotel Apts & Rooms: AED 2,413,476 (0.1% of off-plan)

Commercial: AED 121,677,007 (7.2% of off-plan)

Off-plan activity was overwhelmingly concentrated in flats, accounting for more than four-fifths of new contract value, while villas and commercial assets provided additional depth and diversification to the off-plan pipeline.

Ready Market Performance

Total Value: AED 628,533,000 (27.2% of daily total)

Flats: AED 386,732,196 (61.5% of ready)

Villas: AED 137,926,030 (21.9% of ready)

Hotel Apts & Rooms: AED 30,749,116 (4.9% of ready)

Commercial: AED 73,125,657 (11.6% of ready)

Within the ready segment, flats remained the core of end-user and landlord demand, while villas captured over one-fifth of traded value, supported by steady interest in established residential communities and income-generating commercial stock.

On The Micro Level

Market Insights & Outlook

The session’s numbers reinforce a structural tilt towards off-plan apartments, as buyers lock in future supply and staged payment plans, while the ready market continues to serve residents and investors seeking immediate occupation or rental income. The balance between a strong off-plan pipeline and healthy ready demand suggests sustained confidence in Dubai’s medium-term growth, with both segments working together to support capital appreciation and yield-driven strategies.

Data Source: Dubai Land Department