Dubai logged 123,000+ home sales YTD; Q3 nears AED 91bn after a record AED 184.3bn in Q2 (+49% YoY). Developers are shifting to design-led, lifestyle projects. QUBE (AED 4.4bn) launches ELIRE Managed by LUX in Business Bay with concierge-style services and turnkey “away” maintenance.

Read the full article on CBNME

Dubai faces rising housing costs amid surging property prices, but remains relatively affordable versus NYC, London and Singapore. The Dubai Land Department launched a Smart Rental Index to curb gaps and will expand it to commercial. Transactions and investors rose ~24% YTD; prices up 6% H2’24; employers lifting housing allowances.

Read the full article on Khaleej Times

Dubai is eclipsing Silicon Valley as a global hub, attracting UHNWIs and founders with sovereign wealth backing, fast regulation, Golden Visas, tokenized real estate, branded residences, robust legal frameworks, and privacy-friendly wealth infrastructure. With rising millionaire migration and on-chain property innovation, the emirate offers speed, certainty, and lifestyle advantage.

Read the full article on Gulf News

UAE real estate is projected at $693.5bn in 2025, driven by foreign capital, off-plan sales and strong pipelines. Dubai Q2 sales hit AED 153.7bn (+44.5% YoY); Abu Dhabi prices +12.1%. Leasing and offices are rising. Market may reach $759bn by 2029; risk: supply-driven 15% softening.

Read the full article on Khaleej Times

Indian buyers dominate UAE property, drawn by tax-free appeal and Golden Visas. Rising scrutiny means stricter compliance: UAE banks can’t finance fees; buyers need 20–30% down plus 6–7% costs. Under FEMA, avoid credit cards; use LRS (US$250k/year) bank transfers to developer escrow with proper documentation.

Read the full article on Gulf News

Deyaar launched Park Five’s final phase, Ivy and Alder in Dubai Production City, adding 277 units, including the area’s first townhouse-style duplexes. Mix: studios to 3BR. Amenity-rich, sustainability-led and aligned with Dubai Urban Plan 2040. Completion targeted for December 2027, enhancing diverse, family-friendly living.

Read the full article on Zawya

ADREC’s inaugural report shows Abu Dhabi’s strongest H1: demand (+6%) outpacing supply (+2.6%) across ~400k units; apartment/villa prices +14%/+11% YoY. H1 transactions hit AED 54bn (+42%), 81% cash. Premium master-planned projects dominate; rents rising; 45–55k new homes by 2028; AI-powered analytics boost transparency.

Read the full article on Zawya

Saudi Arabia froze annual rent increases in Riyadh for five years from Sept 25, 2025. Leases must be registered on Ejar, renew automatically unless notified, and violations face fines up to 12 months’ rent. Oversight by the Real Estate Authority; rules may extend to other cities to stabilize markets.

Read the full article on Gulf News

MAAIA broke ground on La Clé in Al Furjan: 56 premium 1–3BR apartments, including select private-pool units, completing Q1 2027. Built with Ashiyana Group and Emsquare, the boutique project emphasizes nature-integrated design, community, wellness, and long-term value.

Read the full article on Zawya

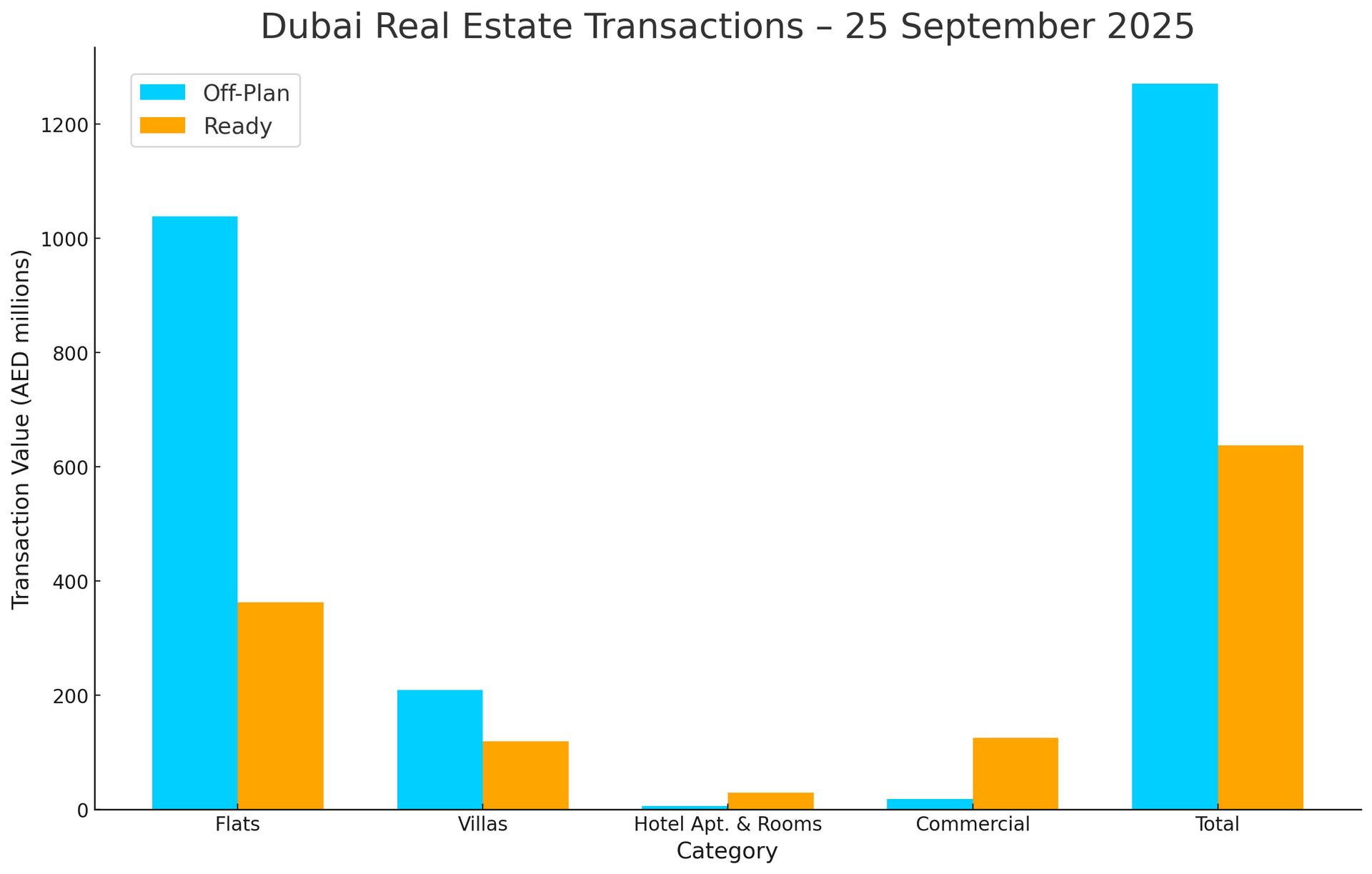

Dubai Real Estate Transactions as Reported on the 25th of September 2025

On 25-Sep-2025, the total transacted value reached AED 1,908,431,176. Off-plan dominated with AED 1,271,092,560 (66.6%), while Ready accounted for AED 637,338,615 (33.4%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,038.1 | 363.1 |

Villas | 209.0 | 119.5 |

Hotel Apts & Rooms | 5.9 | 29.2 |

Commercial | 18.0 | 125.6 |

Total | 1,271.1 | 637.3 |

Off-Plan Market Performance

Total Value: AED 1,271,092,560

Flats: AED 1,038,131,928 (81.7%)

Villas: AED 209,044,824 (16.4%)

Hotel Apts & Rooms: AED 5,892,626 (0.5%)

Commercial: AED 18,023,182 (1.4%)

Off-plan activity was overwhelmingly flat-led, with villas a meaningful secondary contributor.

Ready Market Performance

Total Value: AED 637,338,615

Flats: AED 363,091,532 (57.0%)

Villas: AED 119,454,677 (18.7%)

Hotel Apts & Rooms: AED 29,167,000 (4.6%)

Commercial: AED 125,625,407 (19.7%)

Ready transactions were more diversified; flats led, but commercial assets formed a sizeable share.

On The Micro Level

Market Insights & Outlook

A two-thirds off-plan share indicates persistent demand for new launches, while the strong ready-commercial slice suggests active occupier/investor positioning. If this mix holds, expect developers to prioritize flat-heavy releases, with selective villa supply; watch financing conditions and launch calendars for short-term momentum.

Data Source: Dubai Land Department