Former Zillow exec targets $1.3T

The top companies target big markets. Like Nvidia growing ~200% in 2024 on AI’s $214B tailwind. That’s why the same VCs behind Uber and Venmo also backed Pacaso. Created by a former Zillow exec, Pacaso’s co-ownership tech transforms a $1.3 trillion market. With $110M+ in gross profit to date, Pacaso just reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Dubai ranked among the top three global prime residential markets in H1 2025, with prices up 5%. Driven by immigration, investor confidence and tight luxury supply, transactions rose 26% to 125,538 (Dh431bn). Savills expects a further 4–5.9% rise in H2, trailing Tokyo and Berlin.

Read the full article on The National

A total of AED1.48bn ($403m) in real estate valuation transactions were carried out in Ajman during July 2025, according to the Department of Land and Real Estate Regulation.

Read the full article on Arabian Business

Dubai-based COLABB launches as an integrated commercial real estate and creative development firm, uniting investment, interior design and digital strategy. Founded by Olga Sukhanova (>$300m past deals), it offers end-to-end acquisition-to-marketing services focused on culturally resonant, design-led asset repositioning.

Read the full article on Gulf Business

Built for Managers, Not Engineers

AI isn’t just for developers. The AI Report gives business leaders daily, practical insights you can apply to ops, sales, marketing, and strategy.

No tech jargon. No wasted time. Just actionable tools to help you lead smarter.

Start where it counts.

Dubai has once again emerged as one of the world’s strongest performing prime residential markets, according to Savills’ latest World Cities Prime Residential Index H1 2025.

Read the full article on Arabian Business

Wealthy Russians are increasingly “packing” assets into Dubai private funds and luxury real estate since 2022 sanctions, drawn by simple setup, neutrality, residency via property, cash deals, easy gold purchases, and low taxes. A 2025 Russia-UAE tax treaty and favorable corporate/VAT rules further boost Dubai’s appeal.

Read the full article on Eurasian Business News

Dubai Islands is emerging as a lower-cost luxury hub, drawing investors from saturated prime areas. Amirah Developments’ Bonds Avenue offers apartments, penthouses and townhouses (Dh1.63m–9.95m) with a 60/40 plan; PSF below Palm Jumeirah, 5% yields expected to rise, and strong capital appreciation (claimed 69%) enhance appeal.

Read the full article on Khaleej Times

Dubai Municipality warns firms over inflated villa designs, enforcing Building Code to cut costs and ensure safe, sustainable construction.

Read the full article on Arabian Business

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

QUBE Development and The Lux Collective broke ground on ELIRE, a LUX-managed branded residences project in Business Bay,100 luxury units with hotel-style services; phase 1 offers furnished 3–4BR duplexes. Handover 2028, marking LUX’s Middle East residences debut and targeting demand for integrated, sustainable, high-end living.

Read the full article on Construction Business News

IKR Development broke ground on Provenza Residences in JVC, a 17-storey, 186-unit tower of studios and 1–2BRs with French-inspired design, smart homes, and 14+ amenities. Select units have private plunge pools (a JVC first). 60/40 payment options; strong connectivity; handover Q3 2027.

Read the full article on Khaleej Times

Oman launches a Golden Visa on Aug 31, 2025, offering 5- or 10-year residency for investors and families. Thresholds: OMR500k (10-year) or OMR250k (5-year); retirement option requires OMR4,000 monthly income. Fees OMR551/326. Apply via Invest Oman. Part of Vision 2040 and broader digital reforms.

Read the full article on Economy Middle East

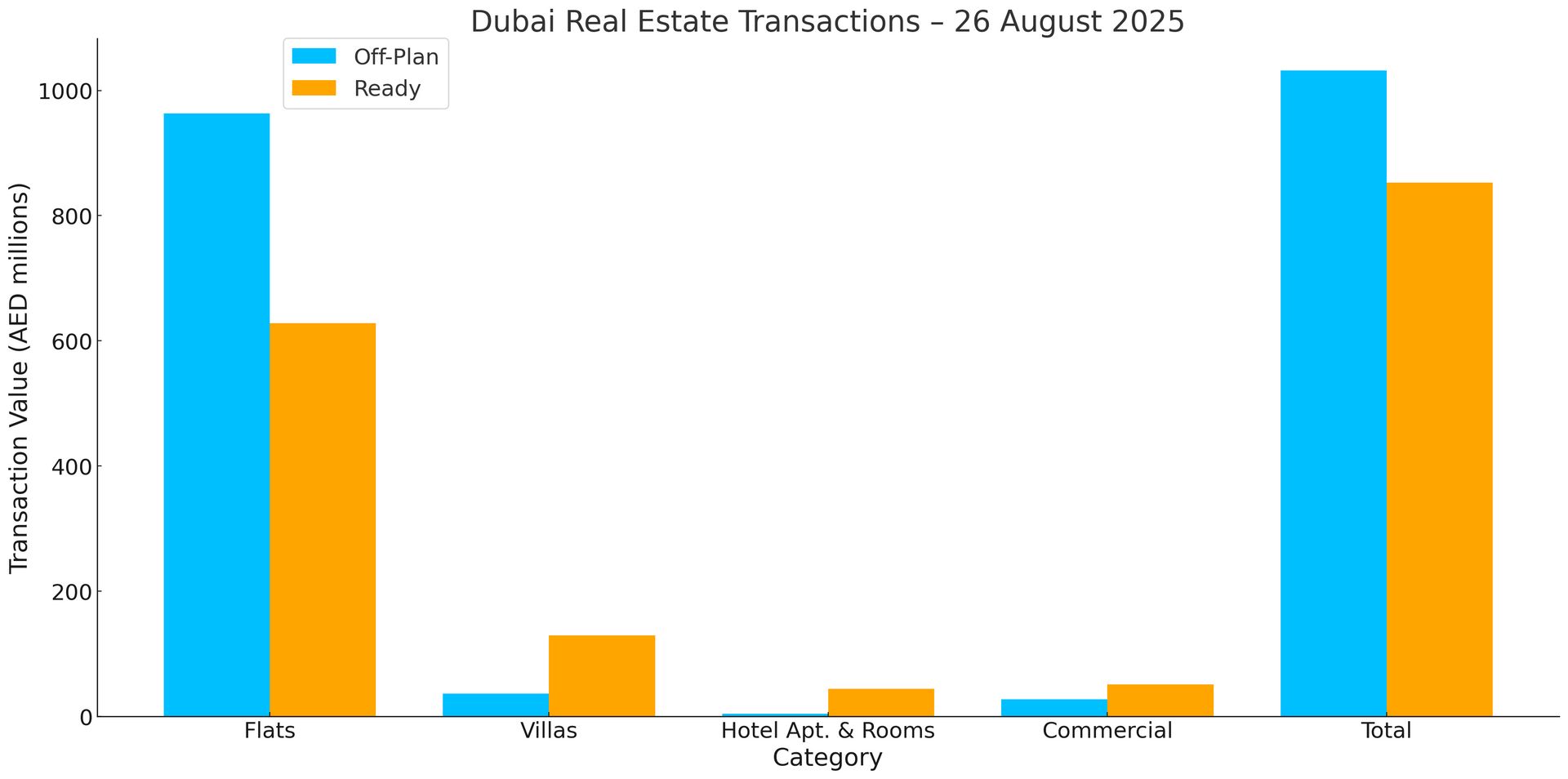

Dubai Real Estate Transactions as Reported on the 26th of August 2025

Dubai recorded AED 1.88bn in transactions. Off-plan led with AED 1.03bn (54.7%), while Ready logged AED 0.85bn (45.3%)—a balanced day with a slight off-plan edge.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 963.3 | 628.3 |

Villas | 36.8 | 129.7 |

Hotel Apt. & Rooms | 4.3 | 43.9 |

Commercial | 27.2 | 50.9 |

Total | 1,031.6 | 852.7 |

Off-Plan Market Performance

Total Value: AED 1,031.6m (54.7% of day)

Flats: AED 963.3m (93.4% of off-plan)

Villas: AED 36.8m (3.6%)

Hotel Apt. & Rooms: AED 4.3m (0.4%)

Commercial: AED 27.2m (2.6%)

Off-plan activity was overwhelmingly apartment-driven, with villas and commercial contributing modestly.

Ready Market Performance

Total Value: AED 852.7m (45.3% of day)

Flats: AED 628.3m (73.7% of ready)

Villas: AED 129.7m (15.2%)

Hotel Apt. & Rooms: AED 43.9m (5.1%)

Commercial: AED 50.9m (6.0%)

Ready sales were also led by flats, with villas providing a meaningful secondary share.

On The Micro Level

Market Insights & Outlook

Apartment dominance: Both segments were led by flats, signaling persistent demand for more liquid, mid-ticket inventory.

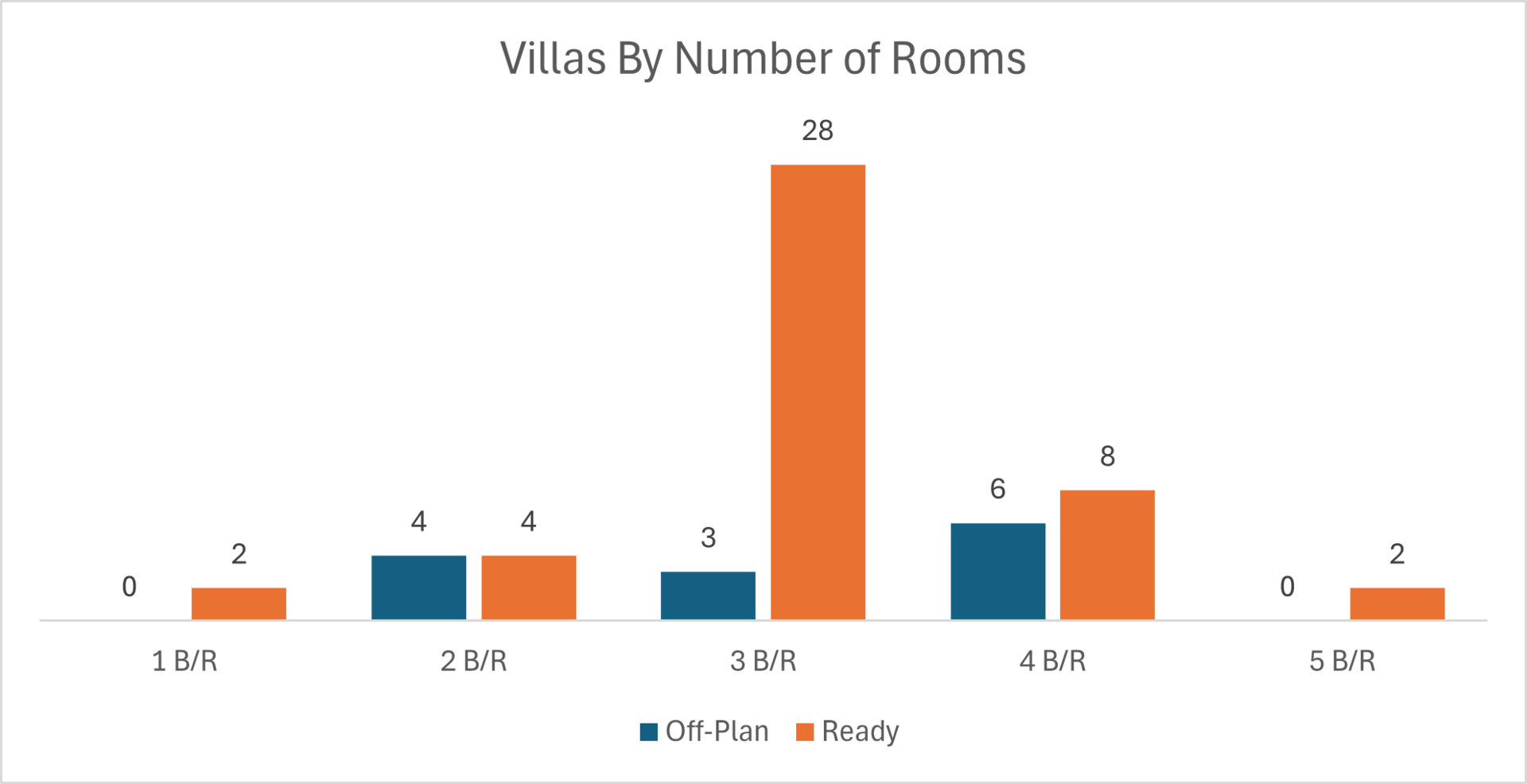

Villas split: Villas were small in off-plan (3.6%) but more visible in ready (15.2%), suggesting end-user and upgrader activity in established communities.

Balanced momentum: With off-plan slightly ahead of ready, sentiment remains constructive across launch and secondary markets. Continued apartment-led launches and selective villa demand should keep values supported near term.

Data Source: Dubai Land Department