Get Dubai Marina Special Report

Click on the link below to get your free copy of Dubai Marina Special Report

Dubai’s AA Tower is now freehold, with one-bed flats at Dh 3.4–4.5 m, following a decree converting 457 plots on Sheikh Zayed Road and Al Jaddaf. This 60-storey, 369-unit tower, and launches like Burj Azizi and Trump Tower, signal a freehold market boom.

Read the full article on Gulf News

Omoria Private Residences debuts on Dubai Islands as the world’s first ultra-luxury boutique residential hospitality brand, offering fully furnished waterfront homes with wellness concierge, beach access, and holistic amenities. Q1 2025 ultra-luxury transactions hit AED 114.08 billion (+29 %), while properties above AED 15 million surged 688 % since 2015.

Read the full article on Zawya

DLD and Prypco launched Prypco Mint, the Middle East’s first government-backed real estate tokenization platform on the XRP Ledger, enabling UAE ID holders to buy fractional property stakes from AED 2,000. Oversight by UAE regulators; expansion to international investors is planned.

Read the full article on Coincodex

UAE ID holders will be able to invest from Dh 2,000 ($540) to buy blockchain tokens representing thousands of property shares. Investors receive proportional rent and capital gains. Regulated by DLD, CBUAE, VARA; tokenized assets forecast to reach 7 % of the market (Dh 60 billion / $16 billion) by 2033.

Read the full article on Gulf News

AYS Developers hosts a free, record-breaking real estate training on May 31, 2025, at Grand Hyatt Dubai with Dr. Nour El-Serougy and Spencer Lodge. Backed by Al Safi Bank and partners, the Guinness-attempt session and expert panel will equip professionals and highlight Dubai Islands’ innovation.

Read the full article on Zawya

Dubai’s March 19 pilot lets investors buy fractional property tokens, potentially from Dh 100, boosting affordability. MAG inked a $3 billion tokenization deal for Ritz-Carlton and Keturah projects. Expert Imran Khan predicts scaled tokenization will accelerate sales amid global uncertainty, drawing UAE and overseas buyers.

Read the full article on Khaleej Times

Amirah Developments launched Bonds Avenue on Dubai Islands: 810–4,416 sq ft one-to-three-bedroom apartments, four-bedroom penthouses, and triplexes from Dh 1.63 million–Dh 9.95 million. Waterfront views, eco-design, 60/40 payment plan, completion January 2027. Dubai’s real estate asset value tops Dh 2.5 trillion; off-plan sales rose 41 % in H1 2024.

Read the full article on Zawya

DMCC and Ellington Properties have broken ground on Mercer House, a two-tower (34 & 41 storeys) mixed-use development in Uptown Dubai featuring studios to penthouses, Dubai’s first natural-sand urban beach club, plus retail, dining, and wellness amenities, an award-winning project exemplifying integrated city living.

Read the full article on Construction Business News

In 2025, Dubai enables legal crypto purchases of residential and commercial real estate using BTC, ETH, and stablecoins. Supported by VARA and DLD, blockchain transactions offer fast, transparent, borderless investment and diversification—but entail price volatility, regulatory complexity, fraud risks, and limited crypto‐eligible inventory.

Read the full article on Zawya

The Dubai real estate sector recorded AED17.4bn ($4.7bn) of transactions last week, according to data from the Land Department.

Read the full article on Arabian Business

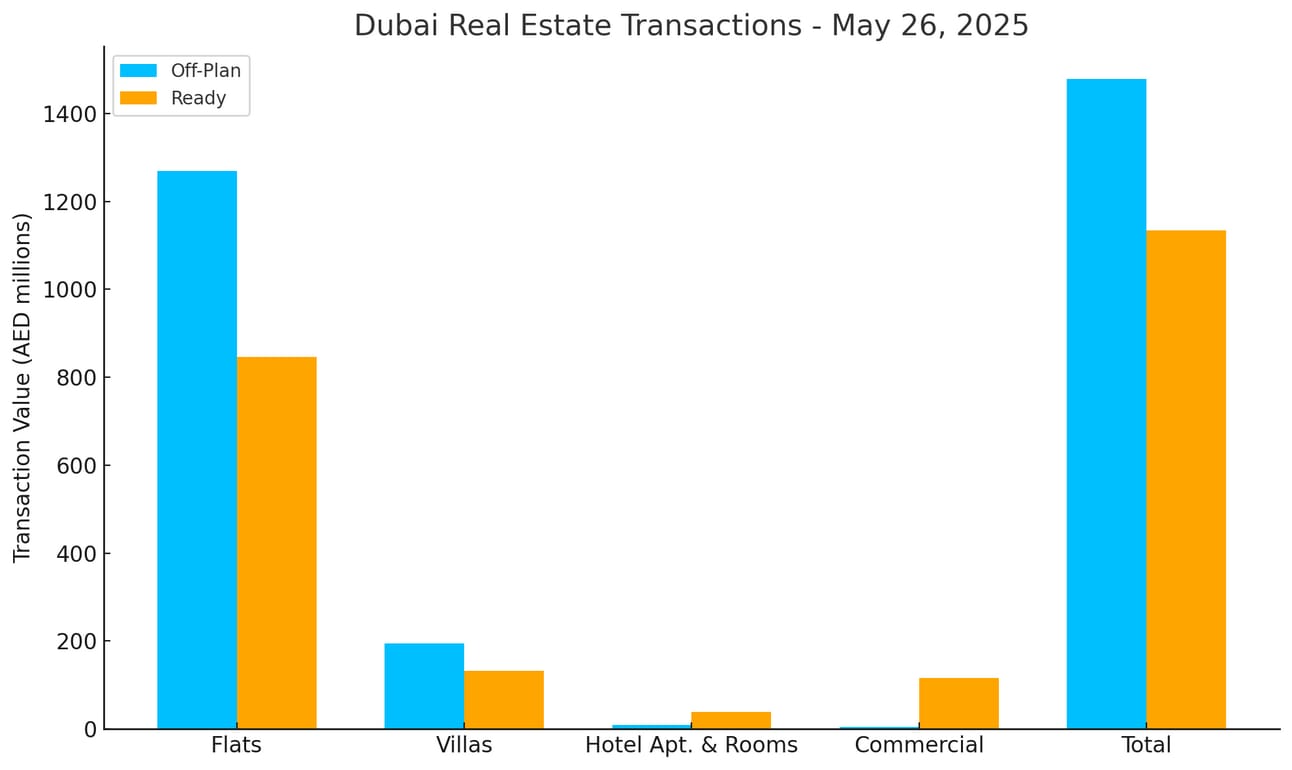

Dubai Real Estate Transactions as Reported on the 26th of May 2025

On 26 May 2025, Dubai’s total real estate transactions reached AED 2.6 billion, with off-plan properties accounting for 56.6% (AED 1.48 billion) and ready properties 43.4% (AED 1.14 billion) of the market.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,269.7 | 846.3 |

Villas | 194.2 | 132.9 |

Hotel Apt. & Rooms | 10.0 | 38.9 |

Commercial | 5.1 | 116.7 |

Total | 1,479.0 | 1,134.8 |

Off-Plan Market Performance

Off-plan activity totalled AED 1.48 billion (56.6% of overall transactions).

Flats: AED 1.270 billion, 85.9 % of off-plan volume

Villas: AED 194.2 million, 13.1 %

Hotel Apartments & Rooms: AED 10.0 million, 0.7 %

Commercial: AED 5.1 million, 0.3 %

Flats overwhelmingly dominated the off-plan segment, reflecting strong investor appetite for new residential launches. Villas held a modest share, while hotel and commercial token sales remained minimal.

Ready Market Performance

Flats: AED 846.3 million, 74.6 % of ready volume

Villas: AED 132.9 million, 11.7 %

Hotel Apartments & Rooms: AED 38.9 million, 3.4 %

Commercial: AED 116.7 million, 10.3 %

Established apartment sales led the ready market, with commercial assets also capturing a double-digit share. Villa transactions were moderate, and hotel-style units made up only a small portion.

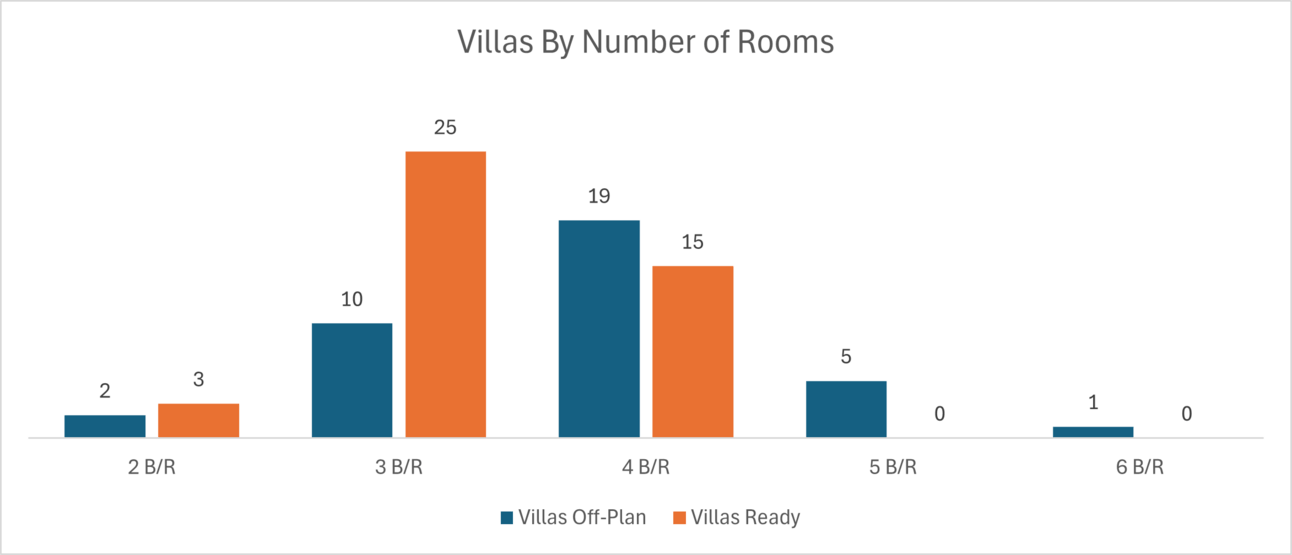

On The Micro Level

Market Insights & Outlook

The 56.6 % off-plan share underlines continued confidence in upcoming projects, driven by competitive pricing and payment plans. Ready-market flats remain the liquidity engine, while commercial ready’s 10.3 % share signals stable corporate demand.

Data Source: Dubai Land Department