Top investors are buying this “unlisted” stock

When the team that co-founded Zillow and grew it into a $16B real estate leader starts a new company, investors notice. That’s why top firms like SoftBank invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties – revamping a $1.3T market.

By handing keys to 2,000+ happy homeowners, Pacaso has already made $110m+ in gross profits.

Now, after 41% gross profit growth last year, they recently reserved the Nasdaq ticker PCSO. But the real opportunity is now, at the unlisted stage.

Until May 29, you can join Pacaso as an investor for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

The agreement will enable homeowners to secure financing once construction reaches 35 per cent completion across Binghatti’s development projects.

Read the full article on Arabian Business

Chinese and Hong Kong investors are flocking to Dubai’s property market, buyer inquiries rose 28% in Q1 2025, driving multi-billion-dollar transactions and premium luxury purchases. Backed by investor-friendly policies and economic diversification, major deals and strategic initiatives underpin sustained growth despite looming supply increases.

Read the full article on Khaleej Times

eXp Realty Dubai has launched its ICON Program to honor top agents who exceed performance standards and embody the company’s core values. ICONs earn up to AED 100,000 in stock awards, exclusive brand-kit access, and company-wide recognition, with additional rewards for mentoring and community contributions.

Read the full article on Wood TV

Get Dubai Marina Special Report

Click on the link below to get your free copy of Dubai Marina Special Report

Dubai developers are increasingly targeting end-users, with 70% of buyers in Symbolic Developments’ latest Dh210 million Zen Residences being owner-occupiers. The fully furnished, Vaastu-compliant homes near Al Furjan Metro cater to first-time buyers, while Speedex Group’s vertical-farming and hardware roots fuel its expansion amid sustained market growth.

Read the full article on Khaleej Times

Turner & Townsend’s 2025 report finds Middle East office fit-out costs average $3,864/m² in Riyadh versus $3,499/m² in Dubai/Abu Dhabi. Giga-programmes, talent influx and labour shortages are driving costs up as companies opt for tech-integrated, sustainability-led and flexible hybrid workspaces.

Read the full article on Zawya

Bahria Town Properties has launched “Waada,” its first master-planned community in Dubai South near Expo City and Al Maktoum Airport. Aligned with Dubai’s Vision 2040, the development offers schools, hospitals, parks, lakes, retail, and entertainment, reflecting the company’s commitment to trust, quality, sustainability, and “Limitless Living.”

Read the full article on The News

Skyloov has launched Silvia, an AI-driven voice search assistant in its app, enabling users to find properties via natural language. Using NLP and real-time filters, Silvia offers hands-free, personalized searches tailored to local context, marking a first in the UAE proptech scene and enhancing mobile-first property discovery.

Read the full article on Zawya

ALTA’s new brand, KORO Development, has launched KORO One in Jumeirah Garden City. This 144-unit, next-gen residence, featuring flexible layouts, coworking spaces, rooftop gardens, and wellness amenities, completes in early 2026 and is already attracting young professionals and investors.

Read the full article on Zawya

Founded in 2023, Dubai’s Prospect boasts a Dh2 billion+ portfolio of location-led, design-driven projects—Maya V in JVT, Dh400 million Arthouse Residences in RAK, and Dh350 million The LX in Arjan—and is set to launch more high-yield, future-ready developments across the UAE in 2025.

Read the full article on Gulf News

Symbolic Developments has unveiled AED 210 million Zen Residences in Al Furjan: 82 fully furnished, Vaastu-compliant 2.5- and 3.5-bed homes featuring 12-ft ceilings, Zen-themed wellness amenities (pools, yoga deck, sauna), EV charging, smart energy solutions, and convenient transit access after prior projects’ quick sell-outs.

Read the full article on Zawya

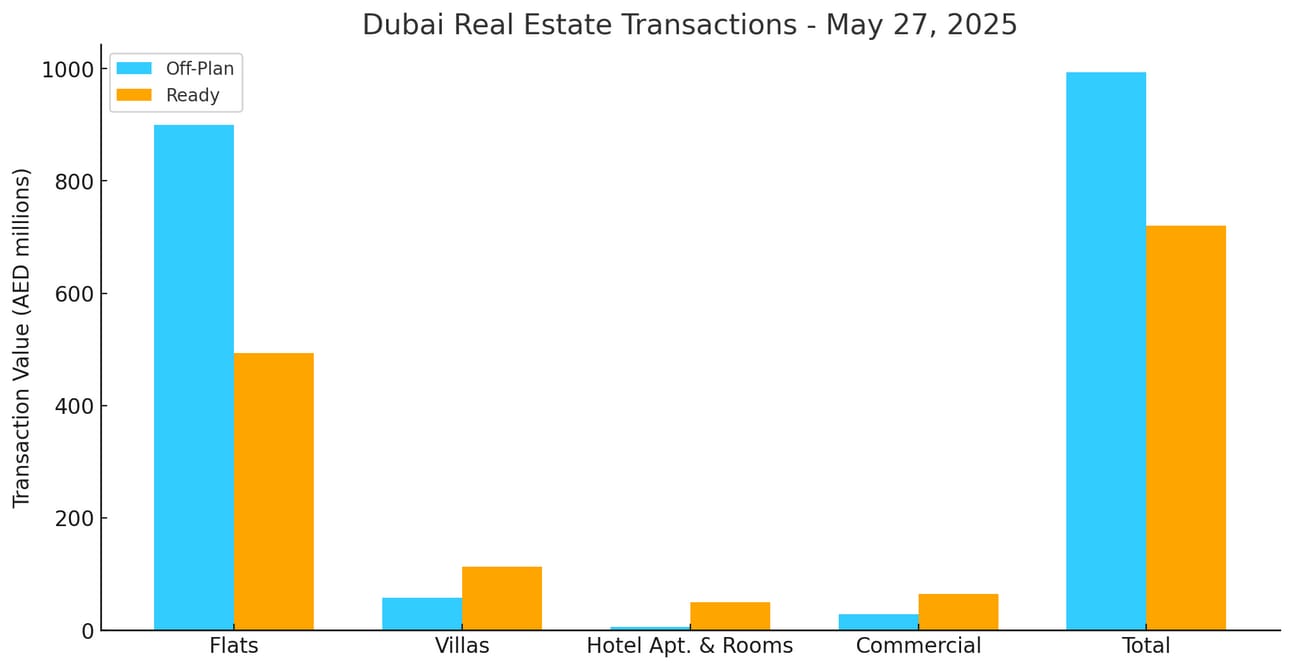

Dubai Real Estate Transactions as Reported on the 27th of May 2025

On 27 May 2025, Dubai’s total real estate transactions reached AED 1.7 billion, with off-plan properties accounting for 57.9% (AED 993.2 million) and ready properties 42.1% (AED 720.9 million) of the market.

Sub-Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 900.4 | 493.3 |

Villas | 57.9 | 112.8 |

Hotel Apt. & Rooms | 5.8 | 49.9 |

Commercial | 29.0 | 64.8 |

Total | 993.2 | 720.9 |

Off-Plan Market Performance

Off-plan deals reached AED 993.2 million, representing 57.9% of the day’s volume. Within this segment:

Flats dominated at AED 900.4 million (90.7% of off-plan).

Villas contributed AED 57.9 million (5.8%).

Commercial units tallied AED 29.0 million (2.9%).

Hotel Apartments & Rooms totaled AED 5.8 million (0.6%).

Flats deals dominating the day with over 90% of the total Off-Plan transactions, dwarfing the rest of the categories that combined, accounted for less than 10%.

Ready Market Performance

Ready assets generated AED 720.9 million, or 42.1% of the day’s activity. Breakdown by asset class:

Flats: AED 493.3 million (68.4% of ready).

Villas: AED 112.8 million (15.7%).

Commercial: AED 64.8 million (9.0%).

Hotel Apartments & Rooms: AED 49.9 million (6.9%).

Ready to move in apartment held the lion’s share of the day’s transactions with 68% of the total. Villas, Commercial Properties, and Hotel Apartments & Rooms all contributed significantly yesterday, making the Ready Properties market more diverse.

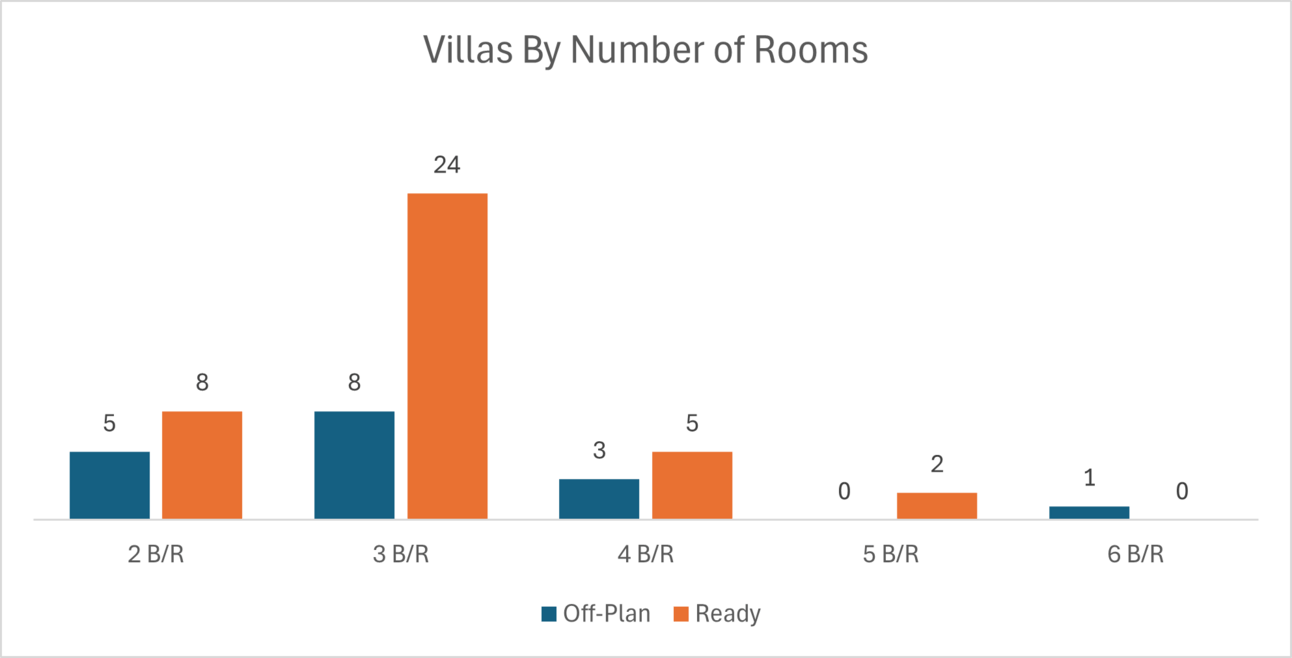

On The Micro Level

Market Insights & Outlook

The overwhelming share of flats—especially off-plan—highlights ongoing demand for entry-level and mid-market residences. Villas and hotel apartments remain niche, while commercial activity is modest. The healthy 42% ready-market share suggests strong appetite for completed assets amid supply constraints.

Data Source: Dubai Land Department