Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

Dubai’s Orchid Living launches Orchid Residence 1, a Dh55m low-rise of 44 units in Dubai South, 40% complete with nearly half reserved. Flexible payment plans, strong connectivity and family-focused amenities position the Q2 2026 project as an attractive play for end-users and investors.

Read the full article on Khaleej Times

Dubai record $29.3bn 2026 budget and UAE federal spending surge are accelerating wealth migration as UK tax pressures intensify.

Read the full article on Arabian Business

A 1.015 million sq ft plot on Palm Jumeirah sold for Dh1.86 billion (Dh1,823/sq ft), ranking among Dubai’s biggest land deals this year and underscoring strong global investor demand and the island’s enduring ultra-prime luxury appeal.

Read the full article on Gulf News

190-apartment residential development set in the heart of Meydan, minutes from Sheikh Zayed Road and Al Khail Road.

Read the full article on Arabian Business

Dubai Peninsula is a new ultra-luxury waterfront enclave by Bright Start and H&H on Jumeirah’s coast, uniting Aman and Rosewood hotels and residences, a superyacht marina, beach clubs and parkland into a design-led, culture-rich flagship resort community for Dubai.

Read the full article on Zawya

OMNIYAT’s Marasi Bay is evolving into an ultra-luxury waterfront district anchored by The Lana, ENARA and VELA Viento, with marina, urban beach club, floating Sunset Park and design-led residences. Soaring prices and LEED Platinum offices position the canal-front hub as a flagship address for UHNW residents and global businesses.

Read the full article on Economy Middle East

AMIS Development’s The Tides on Dubai Islands is a fully furnished, sea-facing residential project with 1–3 bed apartments and 4-bed townhouses from AED 2.1m, rich rooftop and wellness amenities, smart-home finishes and a 50/50 plan (5% on booking), completing April 2028.

Read the full article on Trade Arabia

Abu Dhabi and Dubai are gearing up to release a significant pipeline of industrial space as both emirates move to cool a supply crunch that has pushed rents sharply higher.

Read the full article on Arabian Gulf Business Insight

Abu Dhabi plans about 55,000 new homes by 2028, but handovers may lag to avoid oversupply. Q3 saw over 6,400 mainly off-plan sales worth Dhs20.5bn, with apartment and villa prices up ~15% and 12% and rents rising, led by Yas, Reem and Saadiyat Islands.

Read the full article on Gulf Business

‘Longevity’ residences are emerging in the UAE as a new property niche, embedding biohacking and preventive-health tech, cryotherapy, hyperbaric chambers, red-light therapy, into homes. Projects like Émerge, Vincitore Wellness Estate and SHA Residences target wealthy, health-focused buyers, but long-term success hinges on scientific rigor, licensed operations and high-quality maintenance.

Read the full article on Khaleej Times

UAE developer Source of Fate’s Miraggio on Al Marjan Island is attracting 80% overseas buyers, led by UK investors, drawn to sea-view waterfront homes, flexible post-handover payment plans and Ras Al Khaimah’s tourism and entertainment growth, positioning the project as a long-term value play in UAE luxury real estate.

Read the full article on Zawya

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Ras Al Khaimah is rapidly evolving from quiet weekend escape to a master-planned, nature-led investment hub, with real estate transactions doubling, major global developers and Wynn resort driving tourism, branded waterfront communities, strong infrastructure, family-friendly living and sustainability-focused planning creating early-stage value for long-term investors.

Read the full article on Gulf News

Abu Dhabi rents are surging as expat demand and limited new supply cut vacancies. Apartment rents rose ~14% year-on-year in Q3 2025 and villas 5%, while sales hit Dh20.5bn across 6,400 mostly off-plan deals, with prices and rents expected to keep climbing.

Read the full article on Khaleej Times

Gulf House Real Estate has appointed Ashiyana Contracting as main contractor for Olaia Residences on Palm Jumeirah, a luxury beachfront project of 1–5 bed units with resort-style amenities, smart-home specs and Dec 2027 handover, already 20% sold on launch amid tight prime supply.

Read the full article on Zawya

Major Developments has launched Colibri Views Tower Two in RAK Central after Tower One sold out, underscoring strong investor confidence. Wellness-led and backed by Patrice Evra, the project sits near Wynn Al Marjan and Al Hamra Golf, offering award-winning amenities and a timely entry point into RAK’s next growth phase.

Read the full article on Gulf News

Dubai Real Estate Transactions as Reported on the 27th of November 2025

On 27 November 2025, the total transacted value reached AED 2,517,883,077. Off-plan dominated with AED 1,380,722,987 (54.8%), while Ready accounted for AED 1,137,160,090 (45.2%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,289.7 | 744.0 |

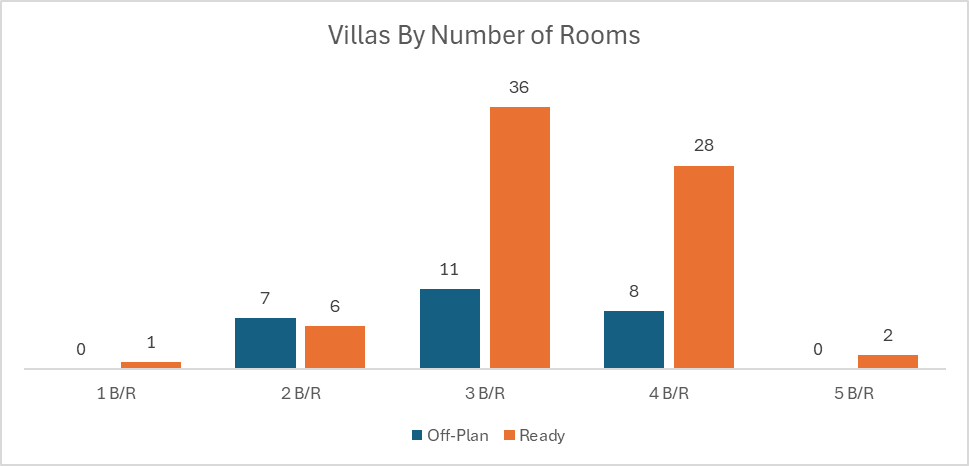

Villas | 66.6 | 214.6 |

Hotel Apts & Rooms | 0.0 | 31.6 |

Commercial | 24.4 | 147.0 |

Total | 1,380.7 | 1,137.2 |

Off-Plan Market Performance

Total Value: AED 1,380,722,987 (54.8% of daily volume)

Flats: AED 1,289,740,010 (93.4% of off-plan)

Villas: AED 66,620,136 (4.8% of off-plan)

Hotel Apts & Rooms: AED 0 (0.0% of off-plan)

Commercial: AED 24,362,841 (1.8% of off-plan)

Off-plan activity was overwhelmingly concentrated in flats, with villas and commercial assets contributing only marginally and no hotel apartment deals recorded. This points to a day dominated by apartment launches and ongoing payment-plan driven demand in the primary market.

Ready Market Performance

Total Value: AED 1,137,160,090 (45.2% of daily volume)

Flats: AED 744,000,929 (65.4% of ready)

Villas: AED 214,576,087 (18.9% of ready)

Hotel Apts & Rooms: AED 31,629,563 (2.8% of ready)

Commercial: AED 146,953,511 (12.9% of ready)

In the ready segment, apartments remained the core of trading, but villas and commercial assets together accounted for nearly one-third of value, signalling healthy interest in established communities and income-generating stock alongside end-user apartment demand.

On The Micro Level

Market Insights & Outlook

The 27 November session reinforces a balanced but growth-oriented market structure: off-plan retains a slight edge in value, reflecting appetite for new product and flexible developer-led payment plans, while the ready market continues to show solid depth in lived-in apartments and villas.

The dominance of flats across both segments highlights Dubai’s ongoing appeal to end-users and investors seeking liquidity, rental yield, and smaller ticket sizes, with villas and commercial assets providing diversification rather than direction. Barring any external shocks, this mix points to continued resilience in daily turnover, with primary and secondary markets moving in tandem rather than competing for capital.

Data Source: Dubai Land Department