Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Mashriq Elite broke ground on Floarea Oasis in Dubailand, a 257-unit “affordable luxury” project targeting 8–10% rental yields, with handover in Q1 2028. Studios start at AED 630K. The developer plans 1,200+ more units across Dubai as demand for off-plan homes surges.

Read the full article on Khaleej Times

Dubai’s Q3 2025 market is stabilising: price growth slowed as new supply comes, but demand stayed broad. Nearly 59,000 deals worth AED169bn closed, led by off-plan. Affordable areas offered top yields, rents for budget flats fell, and luxury/ villa rents moved unevenly across communities.

Read the full article on Economy Middle East

Samana Developers launched Samana Hills South 3 in Dubai South: a 147-unit, resort-style residential project with 30+ amenities. Prices start at AED 639K, targeting international investors. Handover is October 2028. The project aims to capture rental demand near Al Maktoum International Airport and Dubai South’s growth hub.

Read the full article on Zawya

UAE’s property market in Q3 2025 is booming, led by off-plan sales (75% of deals, AED 96bn). Ready villas are scarce and pricier in areas like Palm Jumeirah and Arabian Ranches 3. Rents are still rising. New luxury launches in Palm Jebel Ali, Emaar Hills and Saadiyat keep demand strong.

Read the full article on Gulf Business

Get home insurance that protects what you need

Standard home insurance doesn’t cover everything—floods, earthquakes, or coverage for valuable items like jewelry and art often require separate policies or endorsements. Switching over to a more customizable policy ensures you’re paying for what you really need. Use Money’s home insurance tool to find the right coverage for you.

PRYPCO launched PRYPCO One, a super app for UAE real estate agents with verified listings, live data, instant mortgage pre-qualification, personal mini-sites, and extra commission. With 9,000+ agents onboard and gamified rewards like iPhones and property allocations, it aims to speed deals and boost agent earnings and loyalty.

Read the full article on Zawya

Abu Dhabi-based developer Aldar has announced plans to launch a series of develop-to-hold projects across the emirate, with a combined gross development value of AED3.8 billion.

Read the full article on Arabian Business

Idealist Real Estate and Citi Developers partnered with Xerime DMCC to enable regulated crypto payments for Dubai real estate, starting with the Amra project. Using Xerime’s proprietary capital model and VARA’s framework, the deal targets institutional investors and positions Dubai as a global leader in tokenised property.

Read the full article on Zawya

Dubai’s AED175bn transport investment has cut 9.5m tonnes of CO₂, saved AED319bn in time and fuel, added AED158bn to property values, and drawn AED32bn+ FDI. RTA plans the 30km Blue Line, plus autonomous and aerial taxis, targeting 25% autonomous mobility by 2030.

Read the full article on Khaleej Times

Riva Residence in Dubai Maritime City won the 2025 ENR Global Merit Award for Residential, recognising its design, sustainability, and engineering. Developed by Vakson, the project focuses on practical luxury, energy efficiency, and long-term value, reinforcing Dubai’s status as a global leader in high-end, future-ready waterfront living.

Read the full article on Construction Week Online

Infracorp signed a deal with Abr Al Mutawassit Contracting to build Phase III of California Village in Dubai: 370 new luxury homes under “California Residences.” The $350m community spans 112,000+ sqm near IMG Worlds and Global Village, aiming to deliver sustainable, family-focused living after successful completion of Phases I and II.

Read the full article on Zawya

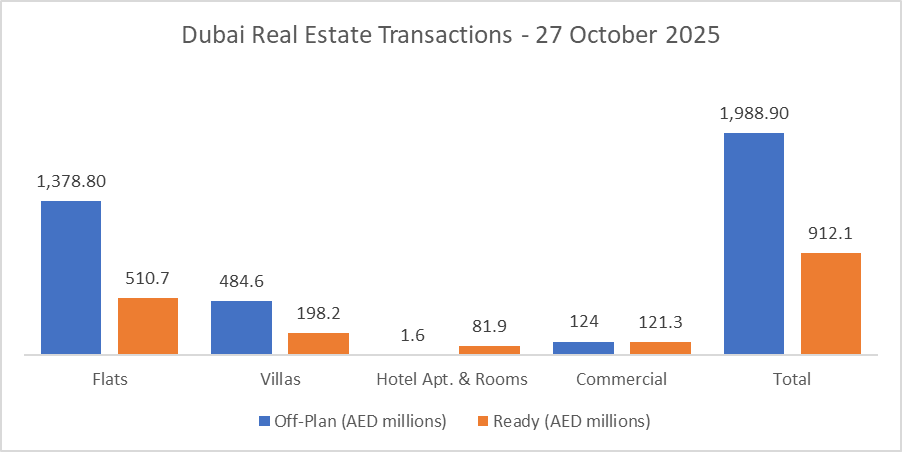

Dubai Real Estate Transactions as Reported on the 27th of October 2025

On 27-Oct-2025, the total transacted value reached AED 2,901,047,946. Off-plan clearly dominated. Off-plan contributed AED 1,988,908,395 (68.6%), while Ready accounted for AED 912,139,551 (31.4%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,378.8 | 510.7 |

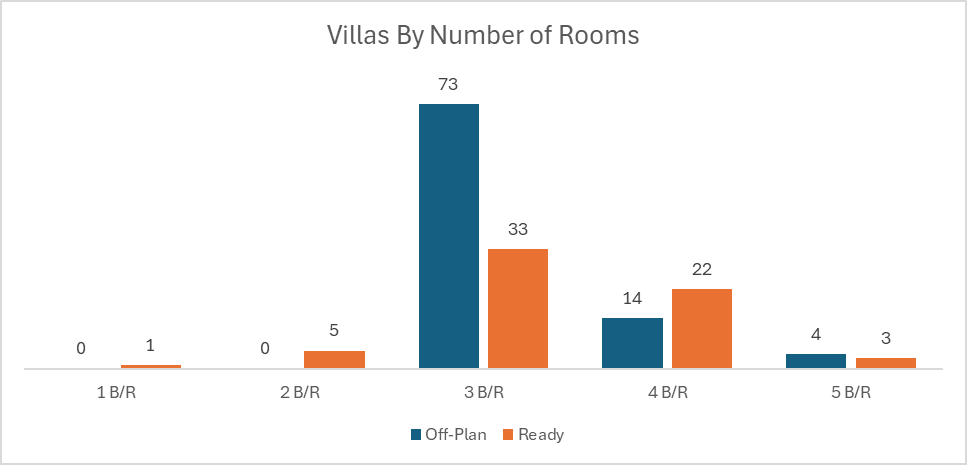

Villas | 484.6 | 198.2 |

Hotel Apt. & Rooms | 1.6 | 81.9 |

Commercial | 124.0 | 121.3 |

Total | 1,988.9 | 912.1 |

Off-Plan Market Performance

Total Value: AED 1,988,908,395

Flats: AED 1,378,750,509 (69.3%)

Villas: AED 484,565,961 (24.4%)

Hotel Apts & Rooms: AED 1,601,650 (0.1%)

Commercial: AED 123,990,275 (6.2%)

Off-plan activity was led by flats, with villas contributing just under a quarter of spend and commercial providing additional depth.

Ready Market Performance

Total Value: AED 912,139,551

Flats: AED 510,696,399 (56.0%)

Villas: AED 198,213,468 (21.7%)

Hotel Apts & Rooms: AED 81,926,100 (9.0%)

Commercial: AED 121,303,584 (13.3%)

Ready transactions were driven by flats, but hotel and commercial assets together made up over 22% of today’s ready spend.

On The Micro Level

Market Insights & Outlook

The market is still developer-led. Nearly 69% of all money spent went into off-plan, reflecting investor appetite for future delivery and flexible payment plans. The ready market remains active in immediately rentable apartments and income-yielding hospitality/commercial stock.

Data Source: Dubai Land Department