Get Your Free ChatGPT Productivity Bundle

Mindstream brings you 5 essential resources to master ChatGPT at work. This free bundle includes decision flowcharts, prompt templates, and our 2025 guide to AI productivity.

Our team of AI experts has packaged the most actionable ChatGPT hacks that are actually working for top marketers and founders. Save hours each week with these proven workflows.

It's completely free when you subscribe to our daily AI newsletter.

Dubai was the world’s busiest market for $10 million+ homes in 2024, posting 435 sales, almost matching London and New York combined, and 111 more in Q1 2025. A record 170,000 residential transactions worth $100 billion closed in 2024, with momentum into 2025. HNWIs favor Dubai Marina, Hills Estate and Emirates Hills.

Read the full article on China.org.cn

Gen Z’s entry into Dubai’s property market is reshaping developer offerings: digital-first experiences (VR tours, smart homes), sustainability (eco-friendly materials, green spaces), and affordable financing (low deposits, fractional ownership). These trends are driving high-quality, future-proof communities that align with younger buyers’ values.

Read the full article on Entrepreneur.com

Get Dubai Marina Special Report

Click on the link below to get your free copy of Dubai Marina Special Report

Mag Group and Citic ink an initial agreement for a $6 billion, 18.47 million sq ft luxury mixed-use development in Dubai’s Al Rowaiyah, with phased completion from late 2025 to 2027. The deal comes amid a booming high-end market, driven by surging HNWI demand and constrained luxury housing supply.

Read the full article on The National

Dubai Residential Reit, the GCC’s first pure-play residential leasing REIT managing 35,700 units, debuted on the DFM at Dh1.10 per share, closing up 13.64%. Its IPO raised Dh2.145 billion, valuing the REIT at Dh14.3 billion with a 7.7% yield and 26× oversubscription.

Read the full article on Khaleej Times

Binghatti Holding has acquired an 8 million sq ft freehold plot in Nad Al Sheba to develop its first large-scale master-planned residential community, valued at over Dhs 25 billion ($6.8 billion). This marks a shift from branded high-rises to mixed-use communities, leveraging its Dhs 50 billion portfolio and self-funded model.

Read the full article on Gulf Business

Proptech’s rapid adoption in Dubai, driven by IoT-enabled smart buildings, VR/digital twins, blockchain tokenization and AI analytics, is reshaping the real estate sector. Backed by government strategies and strong investor demand, these technologies boost sustainability, efficiency, transparency and global market accessibility.

Read the full article on Construction Business News

Ajman’s Q1 2025 rental contracts hit AED 1.355 billion, a 41% rise over the three-year period, across 39,009 deals (28,520 residential, 10,422 commercial, 67 investment), driven by Vision 2030 reforms and digital transaction streamlining.

Read the full article on Zawya

When Spain and Greece limit Airbnb, investors flock to Dubai’s short-stay market, drawn by strong yields and clear regulations. With 30,000 – 40,000 listings and strict oversight, Dubai continues growth even as some landlords pivot to annual leases amid rising renewal rates.

Read the full article on MSN

BT Properties launched its first UAE project, WAADA, a master-planned community in Dubai South near Al Maktoum Airport and the Expo 2020 Legacy. Spanning mansions to apartments, it emphasizes sustainability, integrated living, and aligns with Dubai’s 2040 Urban Master Plan.

Read the full article on Zawya

Oia Properties highlights four prime ready-to-move investments on Yas Island, Mayan, Ansam, Water’s Edge and Yas Golf Collection, offering premium amenities, strong rental ROI and proximity to Disneyland Abu Dhabi, Ferrari World and Yas Marina, appealing to both investors and residents.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 28th of May 2025

On 28 May 2025, Dubai’s total real estate transactions reached AED 2.55 billion, with off-plan properties accounting for 70.6% (AED 1.80 billion) and ready properties 29.4% (AED 749.7 million) of the market.

Sub-Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,697.2 | 502.6 |

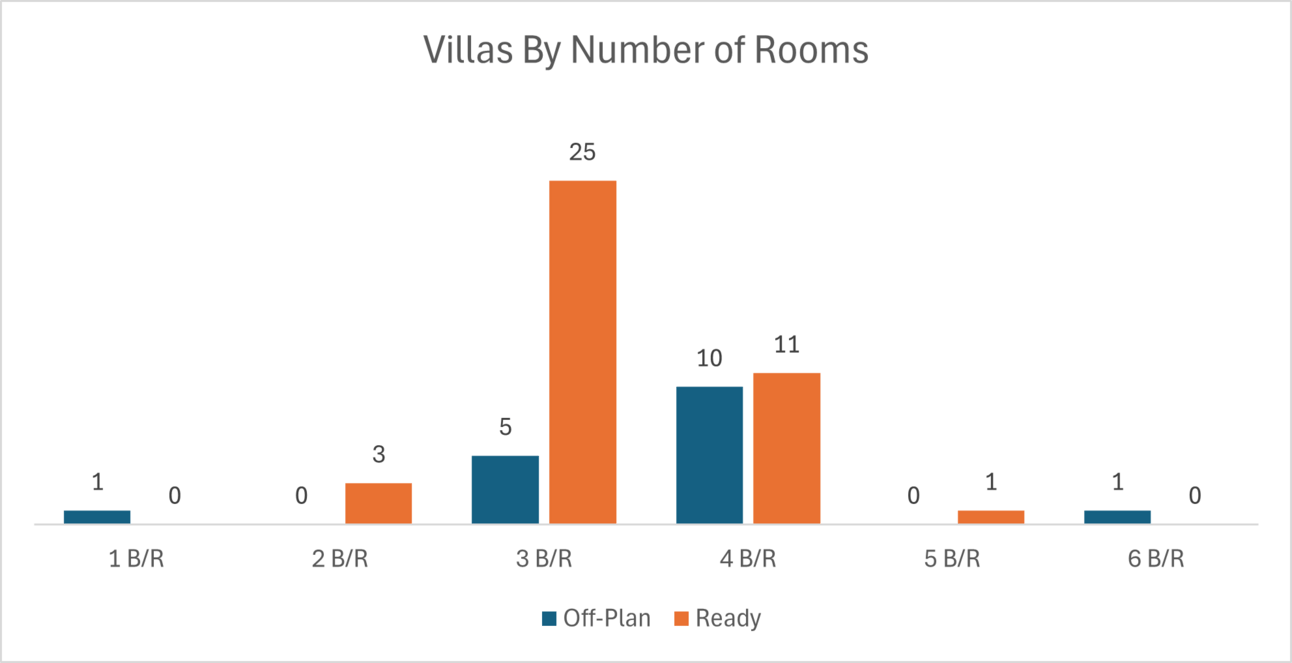

Villas | 96.5 | 147.1 |

Hotel Apt. & Rooms | 5.6 | 23.4 |

Commercial | 1.8 | 76.6 |

Total | 1,801.1 | 749.7 |

Off-Plan Market Performance

The off-plan segment reached AED 1.801 billion, driven overwhelmingly by flats:

Flats: AED 1.697 billion (94.2% of off-plan)

Villas: AED 96.5 million (5.4%)

Hotel Apartments & Rooms: AED 5.64 million (0.3%)

Commercial: AED 1.76 million (0.1%)

Investor appetite remains squarely focused on purpose-built residential flats, with villas and niche asset classes playing only a peripheral role.

Ready Market Performance

The ready segment totalled AED 749.7 million, with a more diversified breakdown:

Flats: AED 502.6 million (67.1% of ready)

Villas: AED 147.1 million (19.6%)

Hotel Apartments & Rooms: AED 23.4 million (3.1%)

Commercial: AED 76.6 million (10.2%)

While flats dominate, villas and commercial assets together account for nearly 30% of ready deals, underscoring steady end-user and corporate demand.

On The Micro Level

Market Insights & Outlook

Flat-Centric Growth: The dominance of off-plan flats highlights persistent investor confidence in new-build high-density housing.

Villa & Niche Segments: Limited share in off-plan (5.4% for villas) suggests boutique projects remain specialized plays.

Ready-Market Diversity: A 30% combined share for villas and commercial ready assets points to balanced demand from residents and businesses.

Supply & Pricing: As the off-plan pipeline expands, developers may need to fine-tune product mix to avoid oversupply of flats. Meanwhile, ready commercial offerings could benefit from rising corporate leasing needs.

Looking Ahead: Seasonal cooling after the summer peak may ease transaction volumes, but robust demand fundamentals and a healthy project pipeline should sustain Dubai’s market momentum into H2 2025.

Data Source: Dubai Land Department