Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Dubai rents are finally easing in some mid-market apartment areas: Bur Dubai, Arjan, and Dubai Silicon Oasis fell up to 5% in Q3 2025 as new supply hits. Villas remain pricey, especially in Arabian Ranches 3. Affordable areas like DAMAC Hills 2 still offer value and strong yields.

Read the full article on Gulf News

Dubai commercial real estate surged in Q3 2025. Dh30.38bn in sales (+31% y/y), driven by Grade A offices (Dh3.1bn, +93% y/y) amid record-low vacancies. Off-plan commercial hit Dh2.4bn, retail hit Dh1.15bn (+95% q/q). Corporate relocations and limited premium supply keep pushing prices up into 2026.

Read the full article on Khaleej Times

Bayut’s TruBroker programme, launched in late 2024 to promote trust and verified listings, now has 5,700+ accredited agents in the UAE (up 398% year-on-year). The badge is seen as a mark of credibility, helps agents win better leads and income, and is reinforced by AI tools, rankings, and public recognition.

Read the full article on Gulf News

Dubai’s Jumeirah Lakes Towers development is undergoing another transformation, with one of its artificial lakes being drained to make way for new retail and commercial space.

Read the full article on Arabian Gulf Business Insight

Damac is recruiting an “Ultimate Damac Islander”, a full-time, salaried brand ambassador who will live across eight tropical destinations like Mauritius and Barbados, with all travel and housing paid. Global applicants will submit creative entries via damacislander.com to represent the Damac Islands luxury lifestyle.

Read the full article on Zawya

Get home insurance that protects what you need

Standard home insurance doesn’t cover everything—floods, earthquakes, or coverage for valuable items like jewelry and art often require separate policies or endorsements. Switching over to a more customizable policy ensures you’re paying for what you really need. Use Money’s home insurance tool to find the right coverage for you.

Dubai Hills Estate, Emaar’s “Green Heart of Dubai,” is a 40,600+ home master community with parks, golf course, mall, schools, hospital and an upcoming metro. It focuses on sustainability, enjoys high end-user demand, delivers strong capital growth, and appeals to families and investors.

Read the full article on Arabian Business

Vision Developments sold out its new Dubai Sports City project, VERDE By Vision (253 units, AED 300m+), in 10 hours. The developer has delivered 600 units so far and is launching VISTA By Vision in Dubai Production City. Its flexible 20/80 payment plan targets end-users and investors with strong ROI potential.

Read the full article on Zawya

Abu Dhabi’s Etihad Credit Bureau and the Abu Dhabi Real Estate Centre (ADREC) have signed a strategic Memorandum of Understanding to strengthen transparency and data-driven decision-making across the emirate’s real estate sector.

Read the full article on Arabian Business

S&P says Dubai’s economy is resilient, with ~2.9% annual GDP growth expected 2025–2028, driven by diversified non-oil sectors, strong tourism, population growth, FDI and tight Grade-A office demand. Inflation is contained, risks are manageable, and real estate is still supported, though residential price growth may slow as new supply arrives.

Read the full article on Khaleej Times

Amirah Developments says ~80% of Bonds Avenue Residences on Dubai Islands has sold within five months. The waterfront project targets “affordable luxury” with 1–4BR units and penthouses, marketed on ROI and access to key Dubai hubs. The developer plans a second launch in another high-growth Dubai location.

Read the full article on MENA FN

Ras Al Khaimah’s Property Market Booms as Branded Residences and Luxury Projects Drive Record Growth

Ras Al Khaimah real estate is booming: transactions up 250% in 2025, prices up 10–20%, and off-plan now makes up 95% of deals. Demand is driven by Al Marjan Island, Mina, Al Hamra, and RAK Central, plus branded luxury projects and incoming global investors.

Read the full article on Dubai Week

Dubai Real Estate Transactions as Reported on the 28th of October 2025

On the 28-Oct-2025, the total transacted value reached AED 2,002,491,287. Off-plan dominated with AED 1,375,155,731 (68.7%), while Ready accounted for AED 627,335,555 (31.3%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,222.0 | 409.4 |

Villas | 103.0 | 135.1 |

Hotel Apt. & Rooms | 6.9 | 58.9 |

Commercial | 43.3 | 23.9 |

Total | 1,375.2 | 627.3 |

Off-Plan Market Performance

Total Value: AED 1,375,155,731

Flats: AED 1,221,955,485 (88.9%)

Villas: AED 103,029,106 (7.5%)

Hotel Apts & Rooms: AED 6,892,800 (0.5%)

Commercial: AED 43,278,340 (3.1%)

Off-plan trading was overwhelmingly led by apartments, with villas adding a smaller but still meaningful share. Hospitality and commercial remained limited.

Ready Market Performance

Total Value: AED 627,335,555

Flats: AED 409,391,424 (65.3%)

Villas: AED 135,132,951 (21.5%)

Hotel Apts & Rooms: AED 58,885,137 (9.4%)

Commercial: AED 23,926,044 (3.8%)

In the ready market, demand focused on lived-in apartments, but ready villas still accounted for over one-fifth of daily value.

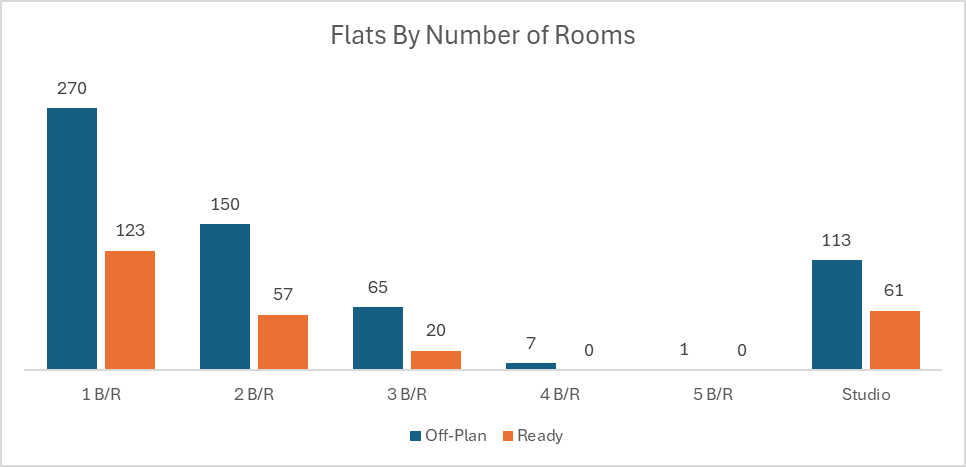

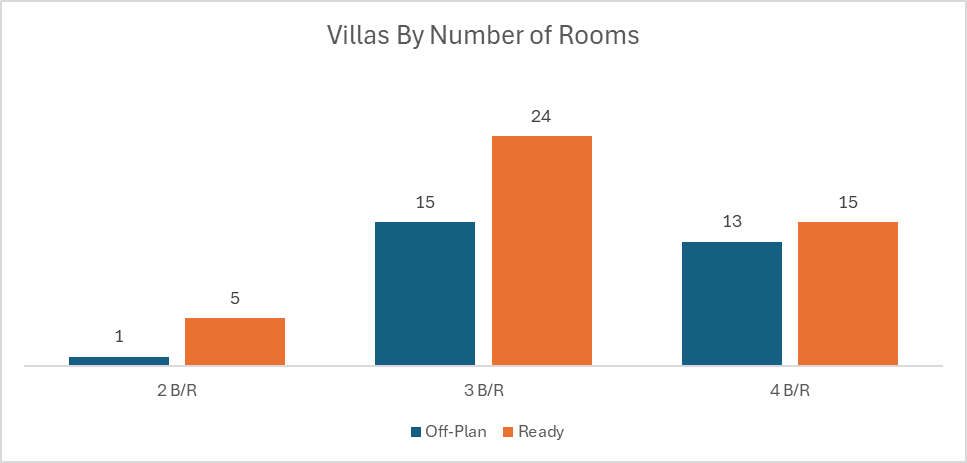

On The Micro Level

Market Insights & Outlook

The market is still being driven by off-plan, which captured almost 69% of all value. That tells you investors are still comfortable with future delivery risk. Ready villas and hotel-style assets remain active, indicating end-user and yield-driven demand alongside speculative off-plan buying.

Data Source: Dubai Land Department