Damac plans to issue USD benchmark senior unsecured notes (3.5-year fixed rate) to broaden its global investor base and strengthen liquidity. The notes will list on Euronext Dublin, target professional investors outside the US, and be led by J.P. Morgan with regional banks supporting stabilization.

Read the full article on Realty Plus

The Dubai resale market for ultra-luxury villas is being driven overwhelmingly by cash buyers seeking completed homes and minimal risk, according to new research from fäm Luxe, the luxury division of fäm Properties.

Read the full article on Arabian Business

Middle East real estate is expanding on diversification and mega-projects. Dubai leads, driven by strong demand, investor-friendly taxes, ownership rules, and Golden Visa incentives. Buyer preferences are shifting to lifestyle communities. Saudi Arabia, Qatar and Kuwait are rising too, though oil and geopolitics remain risks.

Read the full article on Business News This Week

Saudi proptech platform Ghanem has launched fractional real estate ownership inside REGA’s regulatory sandbox, letting eligible investors buy digitally issued, registry-recorded shares in income-generating properties. The phased rollout tests whether fractional investing can scale while preserving legal clarity, transparency, and market confidence under regulator oversight.

Read the full article on Dubai Week

Dubai South added 653 companies in 2025, taking operational firms to 4,200+ with 90% retention and a 65% rise in new licenses. It delivered 800 homes at The Pulse Beachfront, launched sell-out communities, announced South Bay Mall, expanded logistics and e-commerce facilities, and signed major aerospace deals while unveiling new aviation infrastructure for 2026.

Read the full article on Zawya

Deniz and Seeniun Properties launched 09Life Residences (Infiniti Life Series) on Jan 27 at DIFC’s Ritz-Carlton, partnering with architect Mimar. Located in Dubai Land Residence Complex near Dubai Silicon Oasis, it targets mid-entry investors and end users. The event drew 800+ agencies, signaling strong market confidence.

Read the full article on Gulf News

Blockchain-based fractional ownership is lowering entry barriers, enabling secondary trading and widening Dubai’s investor base, according to industry experts

Read the full article on Zawya

Dubai Municipality has launched a global challenge to construct the world’s first residential villa built entirely using robotic construction systems, marking a significant step in the emirate’s push to transform the construction sector through advanced technologies.

Read the full article on Arabian Business

The UAE property market stayed strong through 2025, driven by population growth, non-oil expansion and rising end-user demand. Dubai surpassed 200,000 residential transactions and 530,000 leases, with rents rising steadily. Abu Dhabi saw its best price gains in over a decade. Luxury demand remains global (e.g., Richmind’s Oystra), while 2026 starts upbeat with Reportage’s Dh110m ACRES sales.

Read the full article on Khaleej Times

UAE real estate is moving from intuition-led decisions to data- and AI-driven “decision engines.” Platforms can unify transaction, pricing and behavior data to improve price discovery, predictive insights and user experience. Tools like automated valuations and gamified broker-quality rankings aim to increase transparency, trust and market efficiency while keeping brokers central to decision-making.

Read the full article on Fast Company

Al Zorah Real Estate (Ajman government–Solidere JV) signed a land deal with Samana to build a AED2.7bn mixed-use waterfront community in Al Zorah Marina 1. It will deliver 2,000+ homes plus 65,000 sq ft retail across 1.43m sq ft saleable area, next to mangroves, golf and yacht club.

Read the full article on Zawya

Sobha Realty set aside Dh260m in FY2025 bonuses for employees outside existing incentive plans, paid in December 2025. The move follows a strong year: Dh30bn in sales (+30% YoY) and heavily oversubscribed sukuk deals, including a debut issuance (~300%) and a green sukuk (~280%), touted as the largest green sukuk by a real estate developer globally.

Read the full article on Khaleej Times

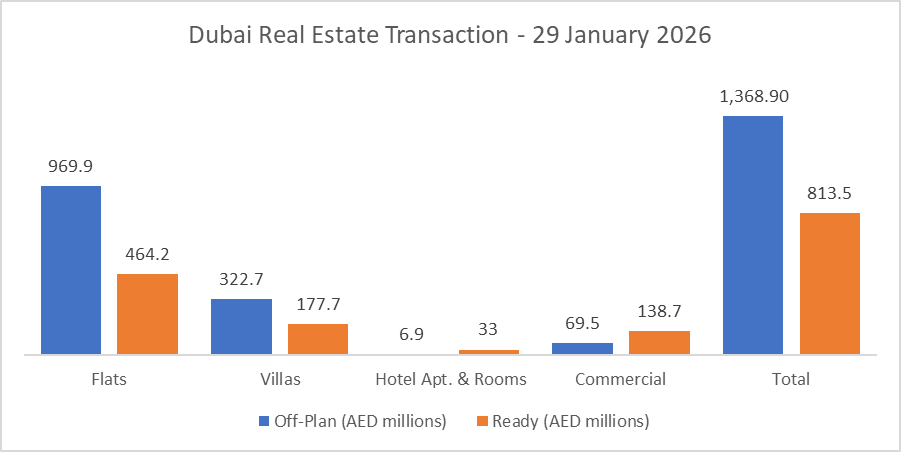

Dubai Real Estate Transactions as Reported on the 29th of January 2026

On the 29-Jan-2026, the total transacted value reached AED 2.18B. Off-plan dominated with AED 1.37B (62.7%), while Ready accounted for AED 0.81B (37.3%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 969.9 | 464.2 |

Villas | 322.7 | 177.7 |

Hotel Apt. & Rooms | 6.9 | 33.0 |

Commercial | 69.5 | 138.7 |

Total | 1,368.9 | 813.5 |

Off-Plan Market Performance

Total Value: AED 1.37B

Flats: AED 969.9M (70.9%)

Villas: AED 322.7M (23.6%)

Hotel Apts & Rooms: AED 6.9M (0.5%)

Commercial: AED 69.5M (5.1%)

Off-plan was overwhelmingly apartment-led, with villas providing a solid secondary pillar.

Ready Market Performance

Total Value: AED 0.81B

Flats: AED 464.2M (57.1%)

Villas: AED 177.7M (21.8%)

Hotel Apts & Rooms: AED 33.0M (4.1%)

Commercial: AED 138.7M (17.0%)

Ready activity was more diversified, with a notably higher commercial share than off-plan.

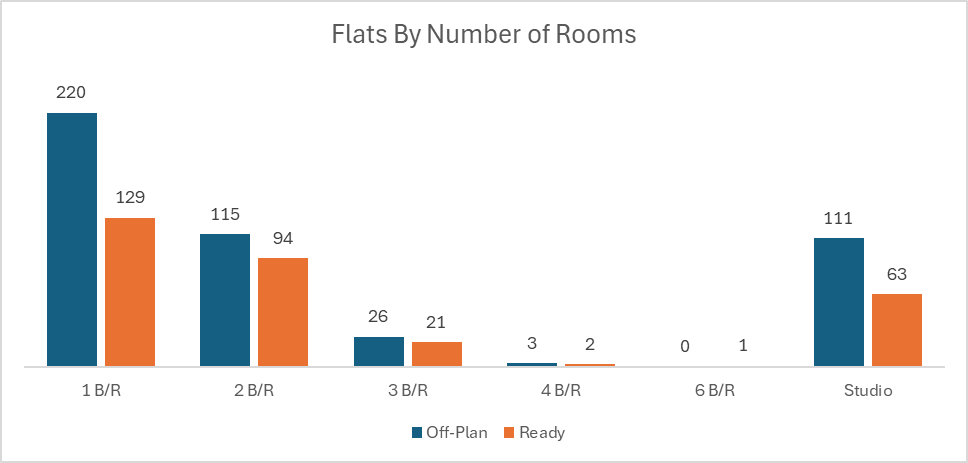

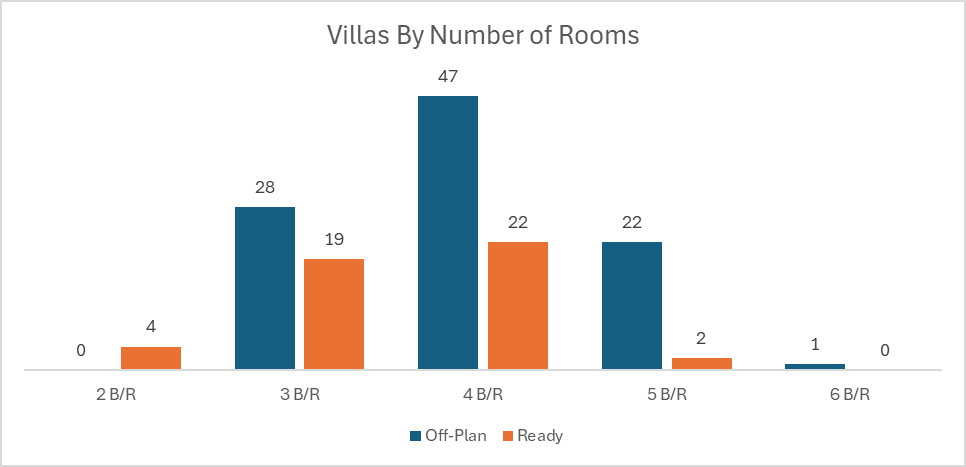

On The Micro Level

Market Insights & Outlook

Today’s tape reflects a classic Dubai split: off-plan momentum driven by apartment absorption, while the ready market shows broader participation, especially in commercial, which captured a meaningful 17% of ready value. If this mix persists, expect continued strength in end-user-friendly apartments alongside selective demand for income-oriented, immediately tradable ready assets.

Data Source: Dubai Land Department