Top investors are buying this “unlisted” stock

When the team that co-founded Zillow and grew it into a $16B real estate leader starts a new company, investors notice. That’s why top firms like SoftBank invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties – revamping a $1.3T market.

By handing keys to 2,000+ happy homeowners, Pacaso has already made $110m+ in gross profits.

Now, after 41% gross profit growth last year, they recently reserved the Nasdaq ticker PCSO. But the real opportunity is now, at the unlisted stage.

Until May 29, you can join Pacaso as an investor for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Fitch forecasts up to a 15% drop in Dubai residential prices in late 2025 and 2026 as deliveries double to 210,000 units, reversing a 60% post-pandemic surge. Banks and developers can absorb the decline, while prime locations and project delays may soften the impact.

Read the full article on Reuters

Dubai Land Department launched the world’s first Property Token Ownership Certificate via Prypco Mint, selling its inaugural tokenized project to 224 investors in one day. Backed by VARA and the UAE Central Bank, the initiative aims to democratize real estate investment, boost transparency and support Strategy 2033 and D33.

Read the full article on Emirates 24/7

Get Dubai Marina Special Report

Click on the link below to get your free copy of Dubai Marina Special Report

Proximity to a park could boost real estate value by up to 8 per cent Dubai real estate developers told.

Read the full article on Arabian Business

Dubai’s first tokenised property on Prypco Mint was fully funded in one day by 224 investors from over 40 nationalities, with an average stake of AED 10,714. Fractional ownership starts at AED 2,000, and tokenised assets could comprise up to 7% of Dubai’s market by 2033.

Read the full article on Khaleej Times

Despite the tariffs targeting imports into the American market, construction material costs in Dubai remain unaffected as the UAE faces no reciprocal duties on its own imports.

Read the full article on Arabian Business

After record AED 62.1 billion April sales, a Property Finder roundtable saw Dubai real estate leaders cautiously optimistic for 2025, citing strong international demand, lucrative off-plan commissions, and surging luxury resale momentum.

Read the full article on Zawya

Dubai’s real estate market is being reshaped by those who work in technology, design, media, and the arts according to Haider.

Read the full article on Construction Week Online

Akala Hotel & Residences, will house 534 branded residences located between Dubai International Financial Centre (DIFC) and Downtown Dubai.

Read the full article on Arabian Business

Meraas awarded an AED 300 million+ contract to Al Sahel for Elara Phase 7 of Madinat Jumeirah Living. Due Q4 2026, it features three towers with 234 units—from one- to four-bedroom residences and penthouses—set amid lush promenades, near Souk Madinat Jumeirah and Jumeirah Beach with stunning sea views.

Read the full article on Zawya

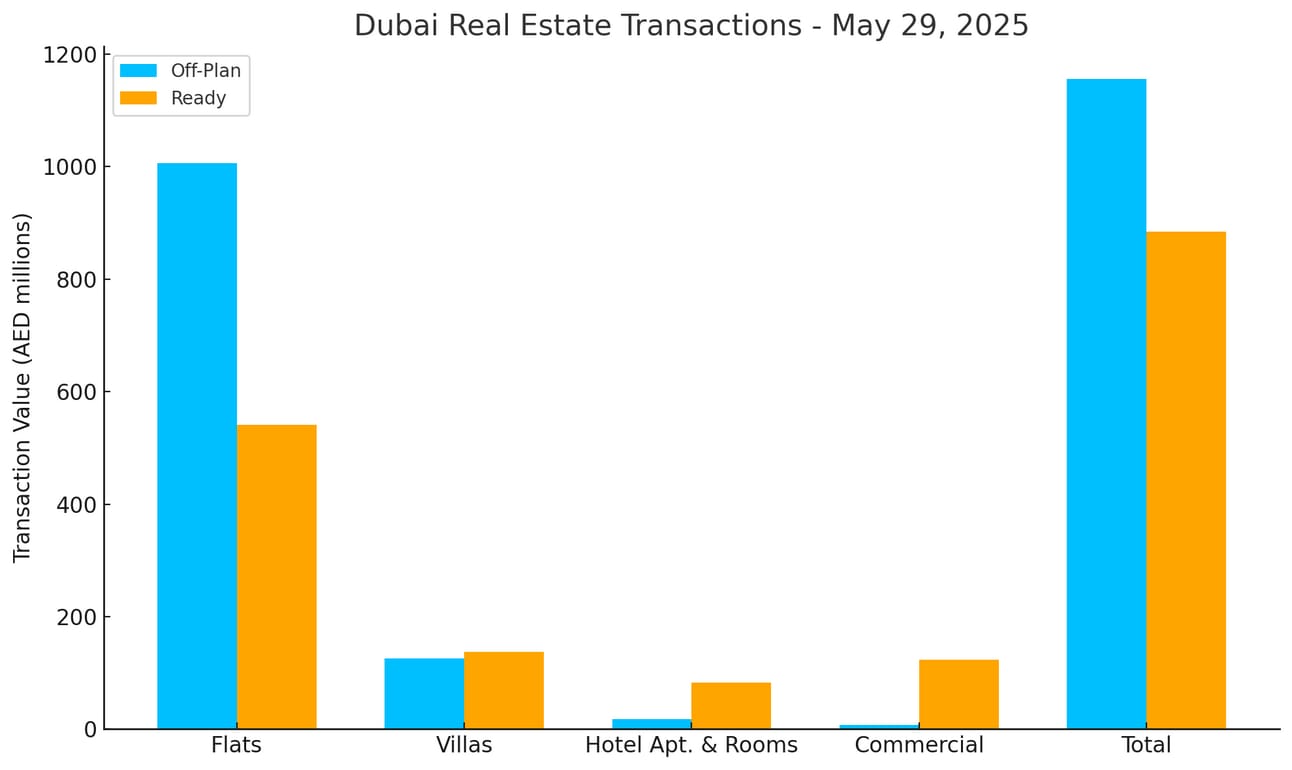

Dubai Real Estate Transactions as Reported on the 29th of May 2025

On 29 May 2025, Dubai’s property market recorded AED 2.041 billion in transactions. Off-plan sales led with AED 1.157 billion (56.7% of total), while ready properties contributed AED 884 million (43.3%).

Sub-Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,005.9 | 541.5 |

Villas | 125.6 | 136.8 |

Hotel Apartments & Rooms | 17.7 | 82.6 |

Commercial | 7.4 | 123.4 |

Total | 1,156.5 | 884.3 |

Off-Plan Market Performance

Flats: AED 1.006 billion (87.0% of off-plan)

Villas: AED 126 million (10.9%)

Hotel Apartments & Rooms: AED 17.7 million (1.5%)

Commercial: AED 7.4 million (0.6%)

Flats overwhelmingly drove off-plan activity, reflecting strong investor appetite for new residential launches. Villa transactions remain a meaningful niche, while hotel and commercial offerings are marginal.

Ready Market Performance

Flats: AED 541.5 million (61.3% of ready)

Villas: AED 136.8 million (15.5%)

Hotel Apartments & Rooms: AED 82.6 million (9.3%)

Commercial: AED 123.4 million (14.0%)

Ready flats continue to dominate handover-driven sales, though the commercial segment has gained traction, accounting for 14% of ready volume. Villas and hotel units also contribute notably as buyers seek immediate occupancy.

On The Micro Level

Market Insights & Outlook

Strong flat demand across both segments underscores Dubai’s enduring residential appeal. The robust share of off-plan flats suggests confidence in forthcoming supply, while ready commercial growth points to rising corporate and investor interest. As the market absorbs new launches and handovers, expect continued flat-led momentum alongside measured expansion in villa and commercial sectors.

Data Source: Dubai Land Department