Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Developer Binghatti Holding said revenue more than doubled in the first nine months of 2025, supported by rising property sales and strong market fundamentals.

Read the full article on Arabian Gulf Business Insight

AppCorp Holding, parent of Apparel Group, is entering Dubai real estate by launching KORA Properties, a premium developer. KORA’s first project launches 12 November in Dubai Maritime City. The move diversifies AppCorp beyond retail into housing, commercial, hospitality and healthcare projects under chairman Nilesh Ved.

Read the full article on Khaleej Times

Optiva Capital Partners is expanding into Dubai real estate to offer African investors safe, asset-backed opportunities with rental income and capital growth. The firm targets mid-luxury, off-plan projects in prime areas and links property investment to residency, positioning itself as a global wealth and mobility platform for African families.

Read the full article on Punch

Emaar founder Mohamed Alabbar says he’s interested in entering China’s property market but will wait for its recovery. For now, Emaar is prioritising expansion in India, Eastern Europe, and the Middle East, which he says are performing strongly. Emaar previously planned an $11bn project near Beijing’s Daxing Airport.

Read the full article on Zawya

Nakheel has launched Palm Central Private Residences on Palm Jebel Ali, a 212 one- to five-bedroom apartments and penthouses with private pools across three mid-rise buildings. The project focuses on resort-style, community living with wellness areas, courtyards, retail and amenities, expanding Palm Jebel Ali beyond villas into a walkable, family-oriented neighbourhood.

Read the full article on Trade Arabia

Get home insurance that protects what you need

Standard home insurance doesn’t cover everything—floods, earthquakes, or coverage for valuable items like jewelry and art often require separate policies or endorsements. Switching over to a more customizable policy ensures you’re paying for what you really need. Use Money’s home insurance tool to find the right coverage for you.

Majid Al Futtaim launched Maravelle at Ghaf Woods, a 96-home ultra-premium “wellness-first” residential enclave in Dubai’s first forest community. Homes prioritise privacy, air quality, natural materials, circadian lighting and access to nature. Residents get an exclusive forest wellness club. Ghaf Woods will total 5,000+ homes and 35,000 trees by 2032.

Read the full article on Khaleej Times

Dubai’s property market remains strong, led by off-plan sales (+39% YoY) and population growth. Prices are stabilising in mid-market apartments but remain tight in villas and luxury. Supply is rising through 2027, which may slow price gains but not cause a major correction, especially in top-end and family segments.

Read the full article on Economy Middle East

Miami-based Main Realty has broken ground on Flow Residences by Main in Dubai Islands: a 50-unit ultra-boutique, Miami-inspired waterfront project starting at AED 2.2m, completing Q4 2027. The cruise-ship-shaped building offers 1-3BR apartments and townhouses with private pools and resort-style amenities, targeting lifestyle-led, high-end buyers.

Read the full article on Zawya

Business Bay, with 328 office transactions, and Jumeirah Lakes Towers (JLT), with 277 deals, were the top two key districts in Dubai, as the commercial property sector continued its strong momentum in the third quarter of 2025.

Read the full article on Arabian Business

S&P says Dubai’s major developers should stay highly profitable through 2025 thanks to strong prices and demand. It expects sales and price growth to slow over the next 12–24 months as the market balances. Key risks are new supply, geopolitics, and global slowdown. Dubai Holding–Nakheel–Meydan now controls major land.

Read the full article on Zawya

Aldar, the Abu Dhabi-based developer, is setting its sights on the emirate’s rental market, committing around half a billion dollars to the sector.

Read the full article on Arabian Gulf Business Insight

Dubai Real Estate Transactions as Reported on the 29th of October 2025

On 29-Oct-2025, the total transacted value reached AED 2,016,821,265. Off-plan dominated with AED 1,399,265,474 (69.4%), while Ready accounted for AED 617,555,790 (30.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,093.1 | 399.7 |

Villas | 291.7 | 139.3 |

Hotel Apt. & Rooms | 2.1 | 12.0 |

Commercial | 12.4 | 66.5 |

Total | 1,399.3 | 617.6 |

Off-Plan Market Performance

Total Value: AED 1,399,265,474

Flats: AED 1,093,093,478 (78.1%)

Villas: AED 291,737,033 (20.8%)

Hotel Apts & Rooms: AED 2,073,300 (0.1%)

Commercial: AED 12,361,663 (0.9%)

Off-plan activity was led by flats, which accounted for more than three quarters of off-plan value. Villas provided meaningful depth, while hospitality and commercial were marginal.

Ready Market Performance

Total Value: AED 617,555,790

Flats: AED 399,707,368 (64.7%)

Villas: AED 139,333,719 (22.6%)

Hotel Apts & Rooms: AED 11,989,525 (1.9%)

Commercial: AED 66,525,178 (10.8%)

In the ready market, end-user and investor demand stayed concentrated in completed flats, with villas as a strong second pillar. Ready commercial assets were relatively more active than in off-plan.

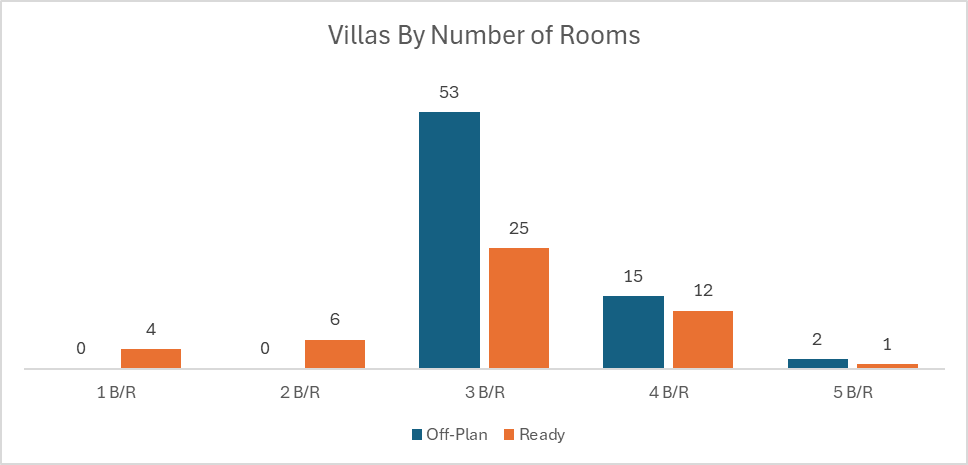

On The Micro Level

Market Insights & Outlook

Nearly 70% of value came from off-plan, signalling ongoing confidence in future delivery and flexible payment plans. Ready stock still cleared over AED 600 million, driven by immediate-occupancy apartments and income-producing assets. The mix suggests investors are still leaning into growth, not retreating to defensiveness.

Data Source: Dubai Land Department