Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Union Properties’ H1 2025 gross profit soared 44% to AED75.6 m, but net profit slipped to AED14.5 m after heavy early-stage development spending. It repaid AED20 m of a planned AED150 m debt, with the balance due Q3, and agreed a AED700 m Motor City asset sale for Q4.

Read the full article on Gulf News

Dubai’s off-plan property market is luring global investors with below-market prices, flexible payment plans, strong capital growth and rental yields, full foreign ownership, tax-free returns and Golden Visas. Added appeal comes from mega sustainable developments, robust regulation, digital purchasing ease and Dubai’s strategic hub status.

Read the full article on Gulf Today

Designed as an exclusive, gated beachfront community, the project will include ultra-luxury villas, beach mansions, suites, and penthouses

Read the full article on Arabian Business

Jumeirah Village Circle draws singles, families and creatives with abundant parks, full amenities and comparatively affordable rents (studios around Dh48k, 1-beds Dh65k-110k). Residents praise walkability and access to major roads. Dust and traffic remain issues, but new RTA interchanges should cut internal travel times by 70%.

Read the full article on Gulf News

Pantheon Development launches VOXA in Jumeirah Village Triangle, offering rare freehold commercial offices (723–1,290 sq ft) within a mixed-use tower. Situated on Al Khail Road, the project provides high connectivity and 24+ lifestyle amenities, blending flexible, design-led workspaces with community and productivity.

Read the full article on Middle East Construction News

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

Abu Dhabi office market: Tight supply, rising demand push occupancy rates to record highs in Q2 2025

Grade-A office demand in Abu Dhabi surged in Q2 2025: CBD rents leapt 42% YoY, ADGM offices fetch AED 2,800-3,500 / sq m, and occupancies sit near full. Supply stays tight, only 100,000 sq m due in 2025 and another 100,000 sq m by 2027, so further rent gains are likely. H1 real-estate transactions rose 39% to AED 51.7 bn.

Read the full article on Economy Middle East

Sharjah’s Central and Eastern Regions logged AED 1.6 bn in real-estate transactions during H1 2025, a 143 % YoY jump across 12,346 deals spanning 22 m sq ft. Central Region led with AED 1.1 bn; mortgages hit AED 178 m and initial sales contracts AED 732 m region-wide.

Read the full article on Zawya

Dubai Land Department and Second Century Ventures launch Reach Middle East proptech accelerator, offering up to $250k funding to 10 startups (seed-Series A) using AI/IoT/blockchain in real estate, construction or sustainability. The 8-month program provides pilots with developers, mentorship, a 330-company alumni network, backing Dubai Real Estate Strategy 2033.

Read the full article on Gulf News

Evergrande faces Hong Kong delisting after liquidation order and failed $23 bn debt revamp, underscoring China’s deep property slump. With >70 % of sector’s offshore bonds in default and home prices still falling, peers like Country Garden struggle to secure creditor approval amid scarce funding and looming restructurings.

Read the full article on Zawya

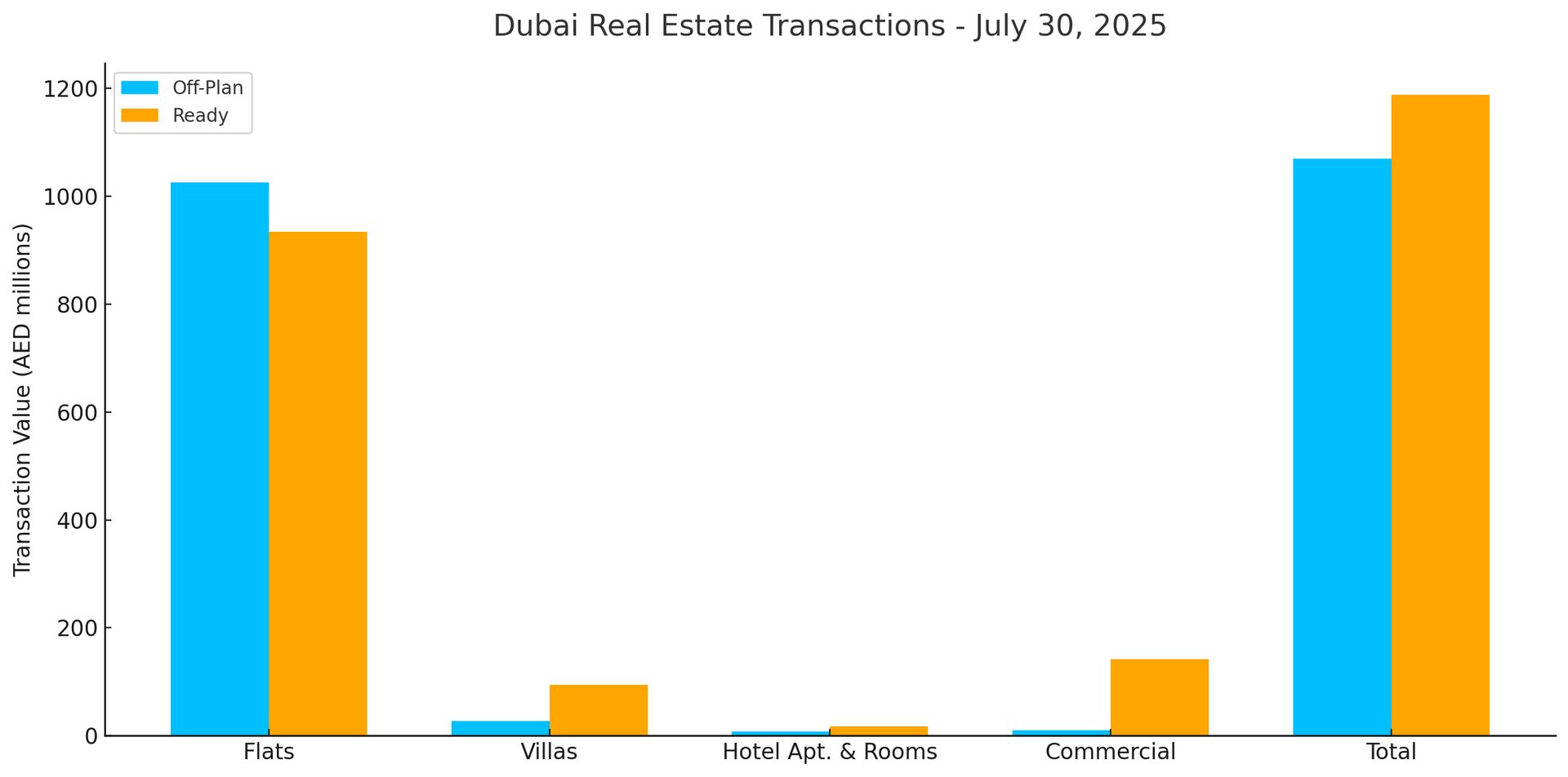

Dubai Real Estate Transactions as Reported on the 30th of July 2025

On 30 July 2025, Dubai’s real estate market recorded total transactions worth AED 2.26 billion. Ready properties edged ahead with 52.6 % of the day’s value (AED 1.19 billion), while off-plan deals contributed 47.4 % (AED 1.07 billion).

Category | Off-Plan (AED mn) | Ready (AED mn) |

|---|---|---|

Flats | 1,025.8 | 934.0 |

Villas | 26.9 | 94.9 |

Hotel Apt. & Rooms | 7.3 | 17.2 |

Commercial | 10.2 | 141.8 |

Total | 1,070.2 | 1,187.9 |

Off-Plan Market Performance

Flats: AED 1.03 billion (95.8 % of off-plan)

Villas: AED 26.9 million (2.5 %)

Hotel Apartments & Rooms: AED 7.3 million (0.7 %)

Commercial: AED 10.2 million (1.0 %)

Apartments overwhelmingly drove off-plan activity, capturing almost the entire segment value.

Ready Market Performance

Flats: AED 934 million (78.6 % of ready)

Villas: AED 94.9 million (8.0 %)

Hotel Apartments & Rooms: AED 17.2 million (1.4 %)

Commercial: AED 141.8 million (11.9 %)

Secondary-market apartments dominated, but commercial units provided a meaningful 12 % contribution.

On The Micro Level

Market Insights

Balanced headline split: Ready transactions narrowly outpaced off-plan, signalling sustained end-user and investor confidence in completed stock while development sales remain robust.

Apartment supremacy: Flats claimed 87 % of total daily value, underscoring persistent demand for smaller, income-generating units in both primary and secondary markets.

Commercial resurgence: The ready commercial sub-segment’s double-digit share hints at growing business activity and owner-occupier interest in income-producing assets.

Data Source: Dubai Land Department