Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Dubai’s RTA has invested for 20 years to build a “20-Minute City,” where residents can reach most essentials within 20 minutes. This strategy, led by the Metro, boosted GDP by Dh156bn, saved Dh319bn in time and fuel, raised property values, and made Dubai’s transport faster, cheaper, and more efficient than many global cities.

Read the full article on Gulf News

The Carlyle is launching its first residences outside New York in Dubai’s DIFC. Developed by H&H, the 32-storey tower will feature 40 ultra-luxury apartments and a six-bedroom duplex penthouse with a private wellness floor, pairing The Carlyle’s classic New York heritage with Dubai’s high-end lifestyle.

Read the full article on Zawya

UAE real estate market surges in Q3 as office occupancy hits 94% and $38bn Dubai sales defy slowdown

The UAE real estate market continued its robust growth in the third quarter of 2025, with strong performance across commercial, residential, hospitality, and industrial sectors, according to CBRE Middle East’s UAE Real Estate Market Review.

Read the full article on Arabian Business

Check out the podcast on Gulf News

Union Properties launched “Mirdad,” a AED 2B ($545M) residential project in Motor City: four towers, 1,087 apartments, over 26 lifestyle and wellness amenities, and 50% EV charger coverage. Completion is targeted for Q4 2028. The developer plans to scale its portfolio to AED 6B to meet mid- to high-end housing demand

Read the full article on Zawya

Home insurance costs continue to climb, with premiums rising over 9% this year and more than 60% in the past five years. However, coverage hasn’t kept pace, leaving many homeowners paying significantly more for less protection. With affordability becoming a growing concern, it’s more important than ever to compare options—check out Money’s handy home insurance tool to find the best fit for you.

Dubai’s real estate sector is hiring aggressively, with nearly 40,000 active brokers and 37 new agents daily, but churn is high: average tenure has dropped to under six months. Commissions are strong and top luxury/off-plan agents earn over Dh1m yearly, while most struggle amid intense competition and oversupply of brokers.

Read the full article on The National

Dubai’s off-plan deals contributed 59% in value of real estate sales in the third quarter of 2025, surpassing the historic 50–58% range seen since 2023.

Read the full article on Arabian Business

CBRE says the UAE property market stayed strong in Q3 2025. Dubai offices are 94% occupied with rents up 19%, and residential deals hit AED139.8bn (+16%). Abu Dhabi hit a record 6,610 sales (+79%), with prices/rents up 25%+. Retail, hospitality, and industrial sectors also remain tight and in demand.

Read the full article on Economy Middle East

The Sharjah real estate sector is turning to artificial intelligence (AI) to enhance decision-making for investors, buyers and sellers, while improving data and price transparency across the market, according to industry statements.

Read the full article on Arabian Business

UAE real estate leaders say the market is not a bubble but driven by real demand: fast population growth, strong foreign investment, and government-led infrastructure and tourism projects. Supply is still lagging demand, keeping prices rising. Developers are financially strong, and outlook across all emirates is stable and positive.

Read the full article on Khaleej Times

Emirates Properties Group is pushing into Dubai’s ultra-luxury branded residences with the AED 350M Azha Millennium Residences in JVT, handing over in Q4 2027. The developer sees strong demand, rising land prices, and plans multiple new Dubai/Ajman launches, saying UAE real estate will stay bullish over the next 2–3 years.

Read the full article on Zawya

The Abu Dhabi Real Estate Centre (ADREC) has signed a landmark Memorandum of Understanding (MoU) with five leading technology partners to accelerate blockchain adoption across the emirate’s real estate ecosystem.

Read the full article on Arabian Business

Wasl Group has acquired a prime beachfront plot in Marjan Beach, marking its entry into Ras Al Khaimah. It will develop an ultra-luxury hotel and branded residences, reinforcing RAK’s tourism and investment push under Vision 2030. Construction starts 2026, with phased openings from 2029 in a major new coastal masterplan.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 30th of October 2025

On 30-Oct-2025, the total transacted value reached AED 1,988,088,872. Off-plan dominated with AED 1,096,653,881 (55.2%), while Ready accounted for AED 891,434,990 (44.8%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 915.5 | 631.8 |

Villas | 144.3 | 176.4 |

Hotel Apt. & Rooms | 5.0 | 12.2 |

Commercial | 31.8 | 71.1 |

Total | 1,096.7 | 891.4 |

Off-Plan Market Performance

Total Value: AED 1,096,653,881

Flats: AED 915,545,062 (83.5%)

Villas: AED 144,333,101 (13.2%)

Hotel Apts & Rooms: AED 4,979,912 (0.5%)

Commercial: AED 31,795,807 (2.9%)

Off-plan activity was overwhelmingly driven by flats (more than four-fifths of total off-plan value), with villas providing most of the remaining depth.

Ready Market Performance

Total Value: AED 891,434,990

Flats: AED 631,775,336 (70.9%)

Villas: AED 176,360,280 (19.8%)

Hotel Apts & Rooms: AED 12,154,987 (1.4%)

Commercial: AED 71,144,387 (8.0%)

The ready market was also led by flats, but villas and commercial assets showed meaningful participation, together accounting for nearly 28% of ready value.

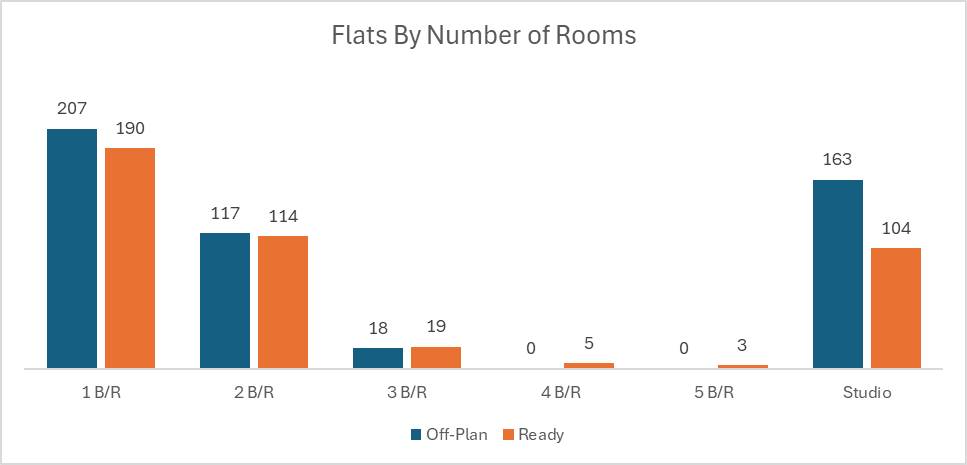

On The Micro Level

Market Insights & Outlook

The split between off-plan (55.2%) and ready (44.8%) shows continued buyer conviction in future supply, but without abandoning completed stock. Flats remain the core of demand in both segments, confirming end-user and investor appetite for apartment-led density rather than standalone villas or pure commercial plays.

Data Source: Dubai Land Department