|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai’s Expo City is emerging as a top real estate investment hotspot, drawing HNWIs from Germany and Switzerland. Backed by visionary government planning, robust infrastructure, and sustainability, it’s seen rapid building and unit sales, strong off-plan demand, above-average yields, and projected 10–15% annual luxury value growth.

Read the full article on Khaleej Times

NBCC India secures RBI approval to invest AED 1 million in its wholly-owned Dubai subsidiary, NBCC Overseas Real Estate LLC, enabling property transactions under ODI norms. Fully owned and regulator-approved, this move diversifies its portfolio amid strong financial growth.

Read the full article on Indian Masterminds

Dubai’s June 2025 real estate report shows apartment prices up 1.1% month-on-month and 19.1% year-on-year (index 174.7), while villa values rose 1.9% monthly and 28.7% annually (index 291.6). Off-plan homes comprise 73.4% of sales despite an 8% monthly dip, and prime luxury deals remain robust.

Read the full article on Khaleej Times

H.H. Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum issued two Executive Council resolutions appointing Majid Saqr Abdullah Al Marri as CEO of the Real Estate Registration Sector and Majida Ali Rashid as CEO of the Real Estate Development Sector at the Dubai Land Department, effective immediately.

Read the full article on Zawya

Dubai’s ultra-luxury real estate surged 63% year-on-year in Q2 2025 to USD 2.6 billion, driven by 143 deals (22 above USD 25 million) and a first-ever lead by apartments (80) over villas (63). Prices rose 18% annually but held steady from Q1, despite regional conflicts.

Read the full article on Asia Business Outlook

|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai’s DIFC Innovation Hub and Dubai Land Department launched the PropTech Hub to unite investors, startups, regulators, and developers, offering incubators and acceleration programmes. By 2030, it aims to support 200+ proptech firms, employ 3,000+, and attract $300 million in investments.

Read the full article on Khaleej Times

Dubai property values remain strong: June saw villas up 1.9% m/m (28.7% y/y) and apartments up 1.1% m/m (19.1% y/y), with off-plan homes dominating 73.4% of sales. Fitch forecasts a modest correction in late 2025, while ultra-prime luxury deals and “accidental millionaires” continue to surge.

Read the full article on The National

DIA Properties officially enters one of the world’s most dynamic real estate markets with the launch of its debut project in Dubai. LuzOra is a premium residential development that redefines waterfront living on the stunning Dubai Islands.

Read the full article on Arabian Business

In H1 2025 Dubai recorded 98,603 sales worth AED 326.7 bn. June’s Price Index reached 220.8 (+1.5% m/m; +23.9% y/y). Villas climbed 1.9% m/m (+28.7% y/y), apartments 1.1% m/m (+19.1% y/y). Off-plan homes dominated 73.4% of sales. JVC and Business Bay topped locations.

Read the full article on Economy Middle East

Bloom Holding’s UAE-wide study of 77 areas finds renting is more cost-effective in 44 regions, especially luxury and emerging suburbs, while buying yields savings in markets like Al Reef, Culture Village and Jumeirah Village Triangle. It recommends short-term rentals, long-term purchases, or mixed strategies to align property decisions with corporate goals.

Read the full article on MSN

AIR is launching an AI-native real estate platform in Dubai, leveraging LLMs for predictive analytics, dynamic pricing, and end-to-end automation. Backed by a USD 20 million investment from Unique Properties, it enhances agent workflows and plans a GCC rollout, with advanced off-plan integration arriving in six months.

Read the full article on Zawya

Huspy raised $59 million in a Series B led by Balderton, bringing total funding to over $100 million. The proptech, active in the UAE and Spain, processes $7 billion in annual transactions and 25 percent of Dubai mortgages. Funds will fuel expansion to 10+ cities, technology upgrades, and hiring.

Read the full article on Mena Bytes

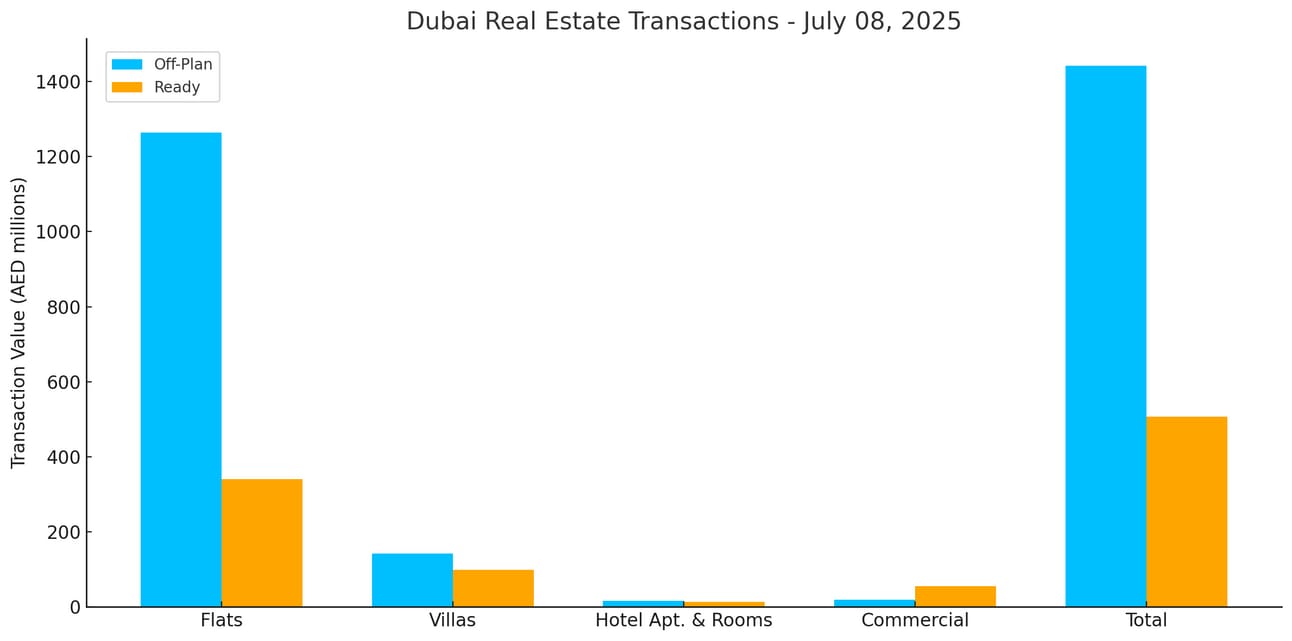

Dubai Real Estate Transactions as Reported on the 8th of July 2025

On the 8th of July, Dubai’s real estate transactions totaled AED 1.95 billion, with Off-Plan assets accounting for 73.9% (AED 1.443 billion) and Ready properties making up 26.1% (AED 507.6 million).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,264.6 | 340.0 |

Villas | 141.6 | 98.7 |

Hotel Apt. & Rooms | 16.7 | 12.9 |

Commercial | 19.9 | 56.0 |

Total | 1,442.8 | 507.6 |

Off-Plan Market Performance

Total Value: AED 1,442,771,585

Share of Total Transactions: 73.9%

Flats: AED 1,264,600,892 (87.7% of Off-Plan)

Villas: AED 141,578,253 (9.8%)

Hotel Apt. & Rooms: AED 16,739,769 (1.2%)

Commercial: AED 19,852,670 (1.4%)

Off-plan is overwhelmingly driven by flats, underscoring strong developer focus on apartment launches.

Ready Market Performance

Total Value: AED 507,577,069

Share of Total Transactions: 26.1%

Flats: AED 339,973,002 (67.0% of Ready)

Villas: AED 98,701,539 (19.5%)

Hotel Apt. & Rooms: AED 12,899,284 (2.5%)

Commercial: AED 56,003,244 (11.0%)

The ready segment shows a more diversified mix, with villas making up almost 20% of the total value, and commercial units making up nearly 11% of activity.

On The Micro Level

Market Insights

Flats overwhelmingly drive both segments, nearly 88% of Off-Plan and two-thirds of Ready sales, underscoring sustained demand for residential apartments. Villas maintain a solid secondary position, especially in the Ready market. Commercial and hospitality assets remain niche, reflecting cautious corporate and investor appetite. The strong Off-Plan bias signals developer confidence and early-buyer interest, while the Ready segment’s healthy villa share hints at growing end-user participation.

Data Source: Dubai Land Department