Dubai's real estate market recorded a total transaction value of AED 76.6 billion, marking a substantial 25% increase compared to March 2025 (AED 61 billion) and an even more dramatic 89% rise year-on-year from April 2024 (AED 40.4 billion). This growth reinforces Dubai’s position as one of the world’s most dynamic property markets.

In addition to the value surge, transaction volume climbed to 22,139 in March, up from 18,200 in February, a +21.6% month-on-month increase, indicating strong end-user and investor demand across sectors.

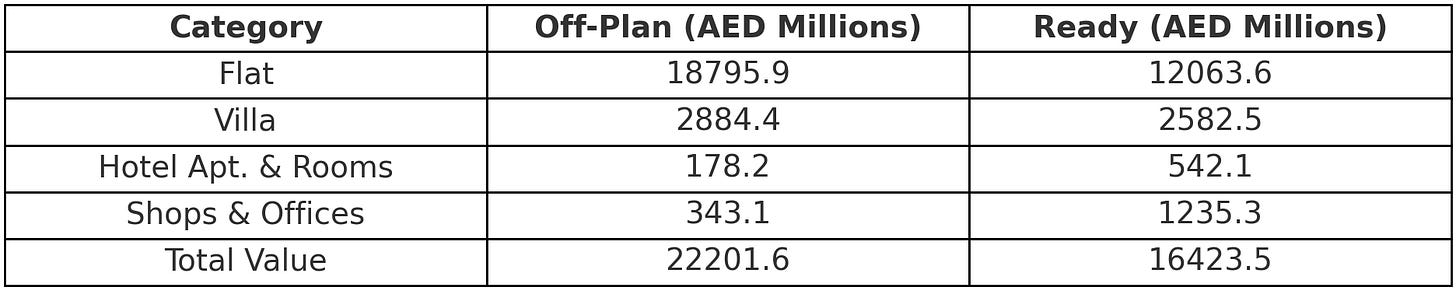

Segment Breakdown

Off-Plan Market: AED 22.2 billion

Ready Market: AED 16.4 billion

Land Transactions: AED 38 billion

The largest contributor to the total transaction volume was land sales, accounting for nearly 50% of the total market activity.

Market Performance by Property Type

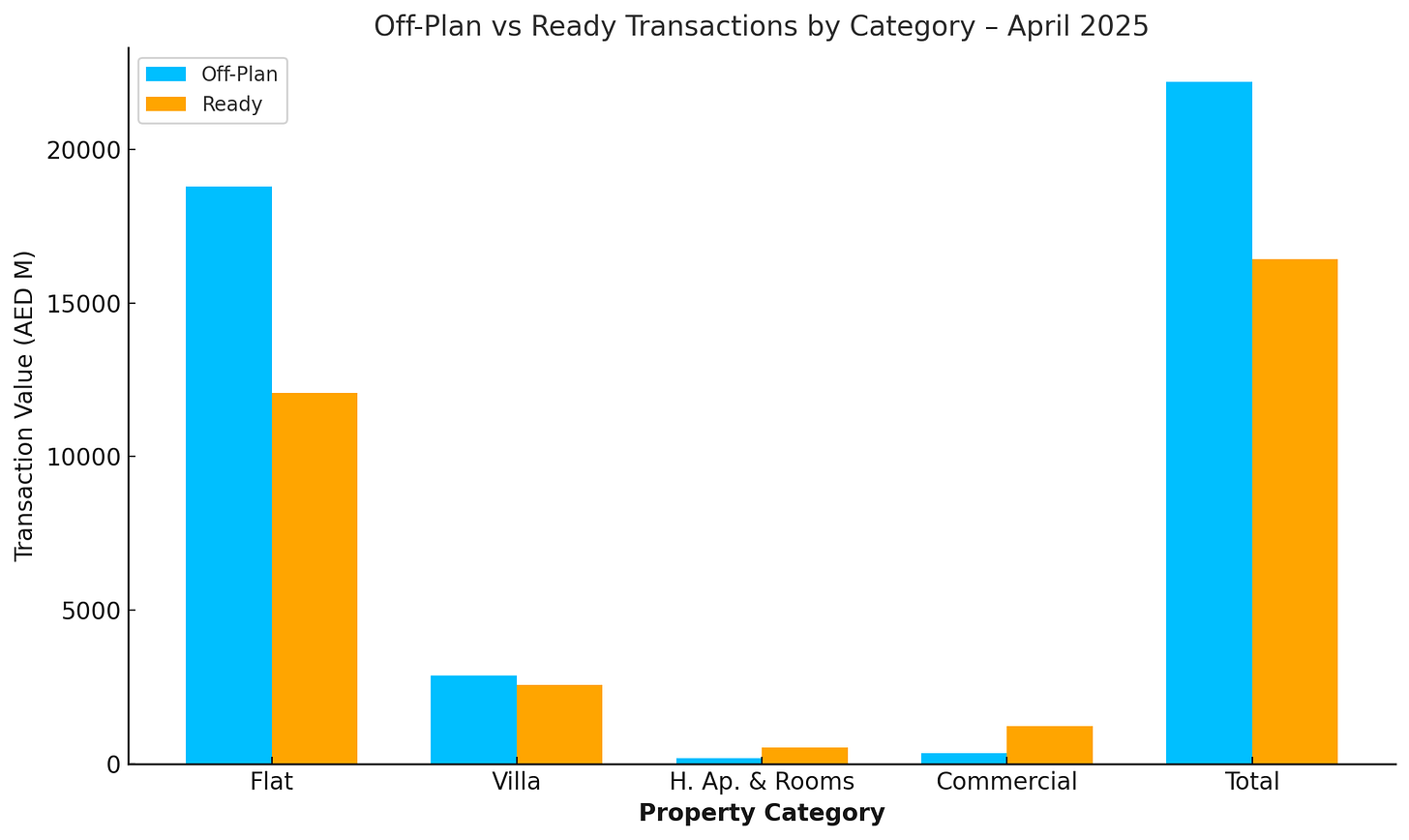

1. Off-Plan Transactions

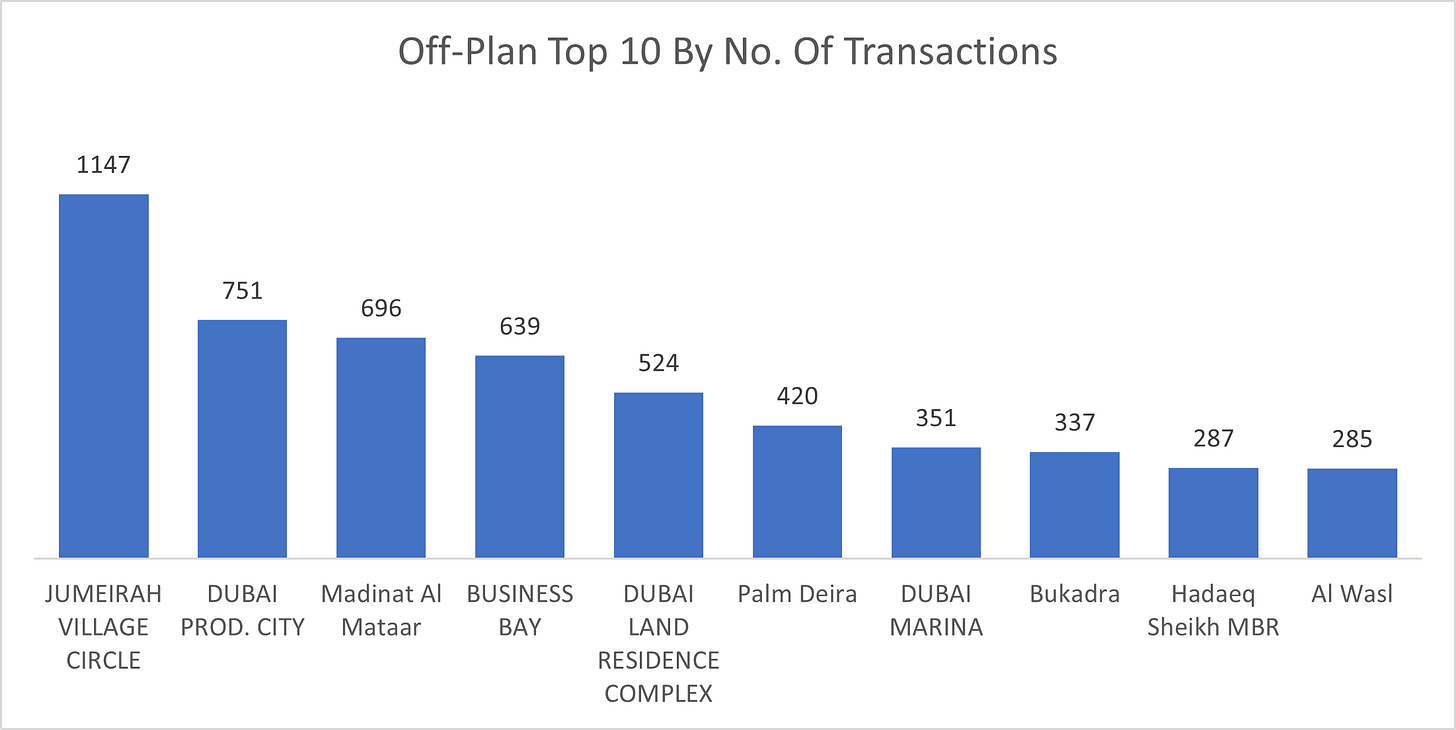

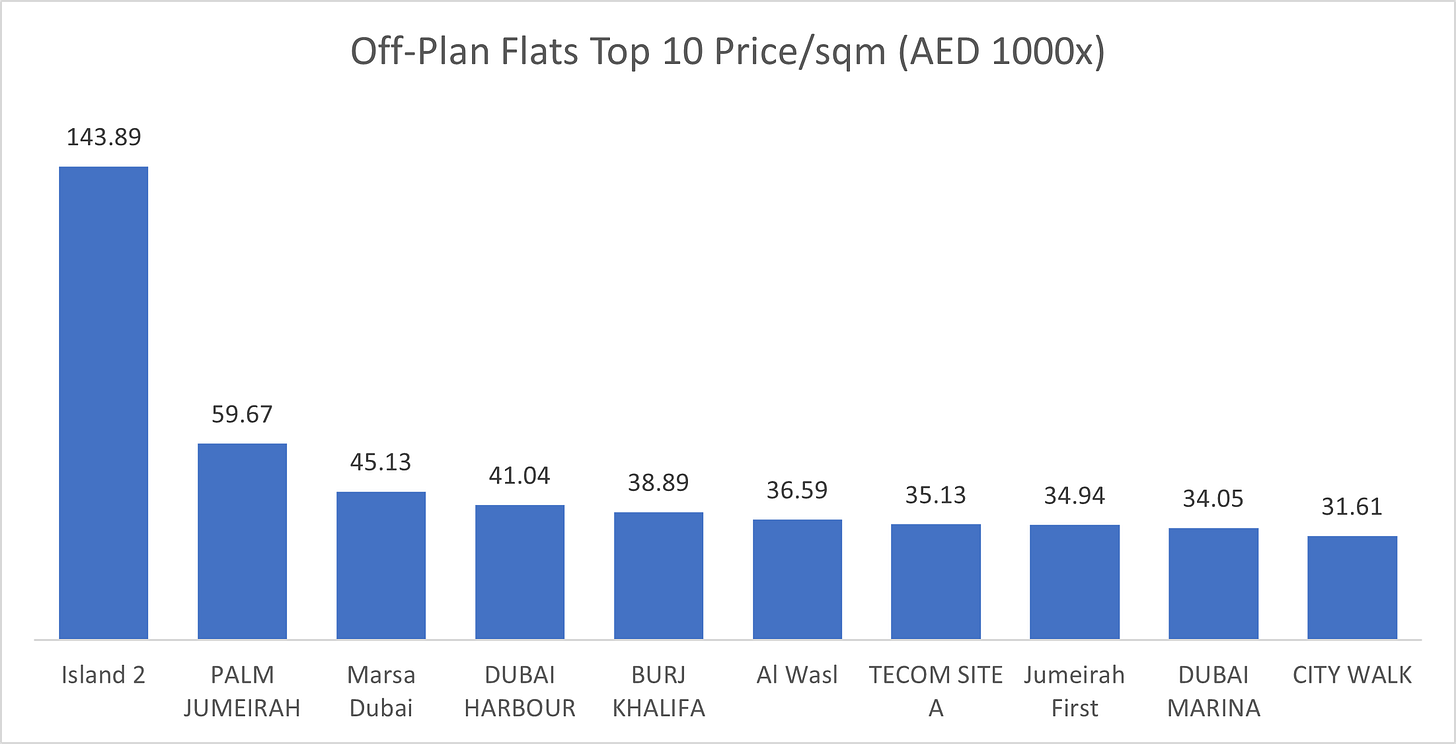

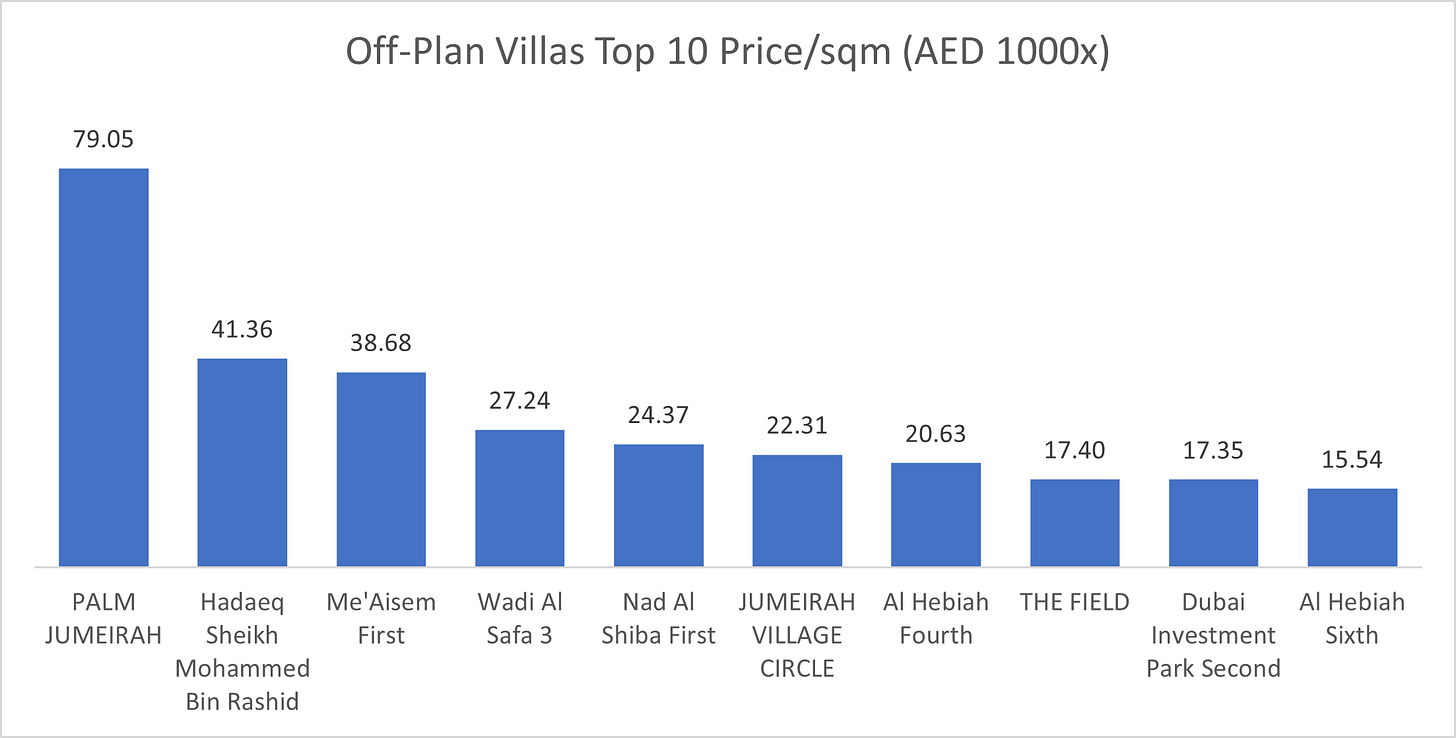

Off-Plan continues to attract both end-users and speculative investors. Flats made up the bulk of activity at AED 18.8B, reflecting strong demand for new apartments in mid- to high-density developments. Villas accounted for AED 2.88B, pointing to growing interest in master-planned suburban communities. New project launches in areas like Business Bay, Madinat Al Mataar, and JVC helped push the category forward. Commercial and hospitality assets also saw movement, with AED 343 million in shop and office sales, and AED 178 million in hotel apartments and rooms.

Top Performing Areas by Transaction Value

Business Bay: AED 1.68 billion

Madinat Al Mataar: AED 1.5 billion

Al Wasl: AED 1.39 billion

JVC: AED 1.28 billion

Marsa Dubai: AED 1.24 billion

The average price per square meter for off-plan flats stood at AED 23,802, while off-plan villas averaged AED 17,580.

While JVC led in transaction count, Business Bay dominated in value, indicating higher ticket sizes and premium launches. Al Wasl and Burj Khalifa areas also featured prominently by value, underlining sustained luxury demand.

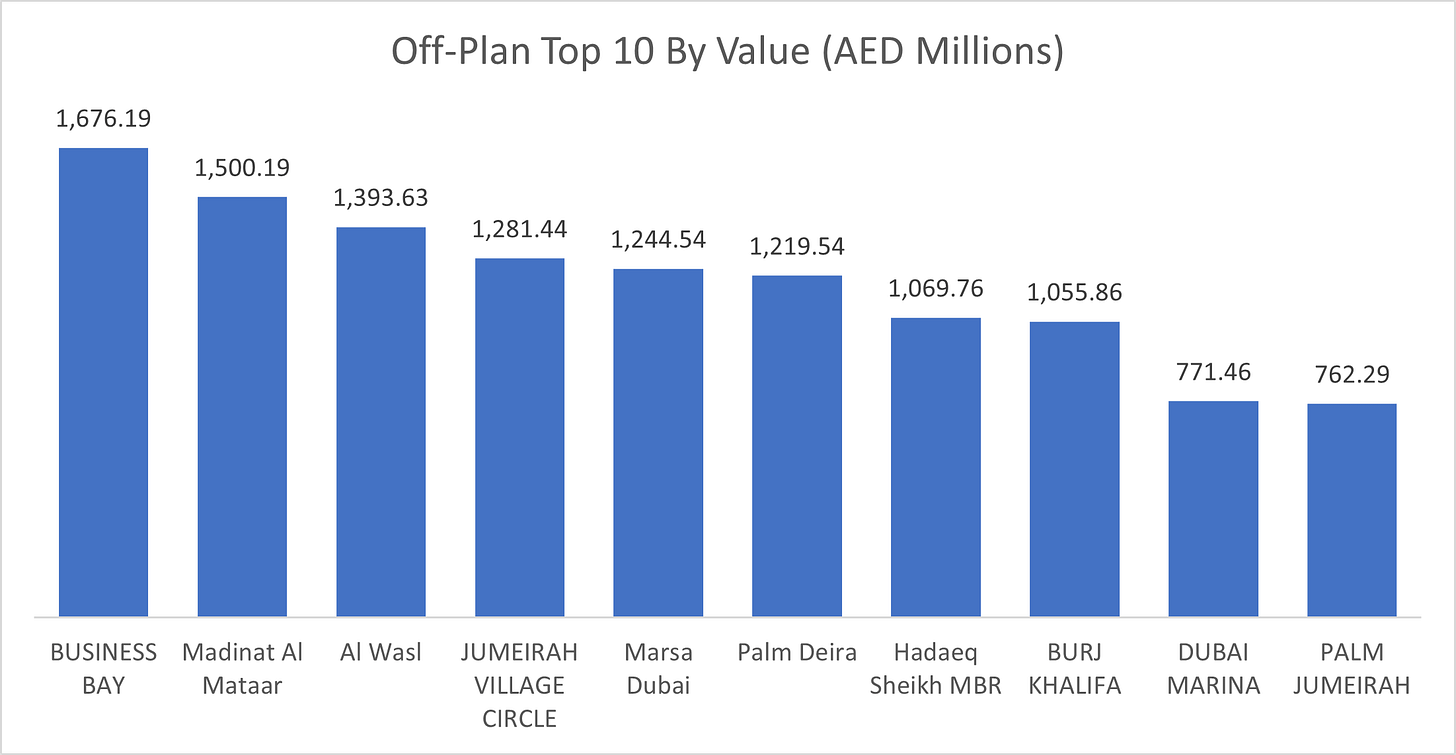

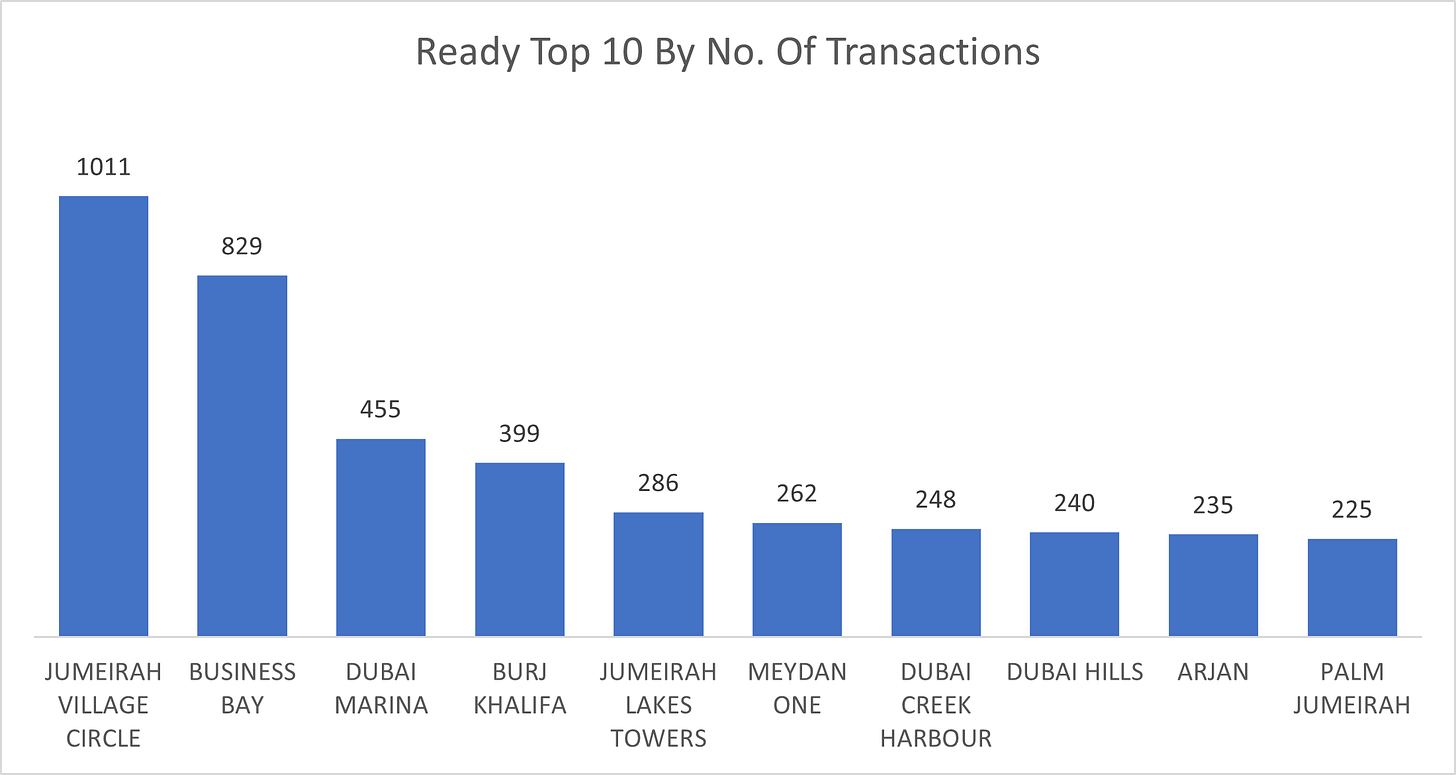

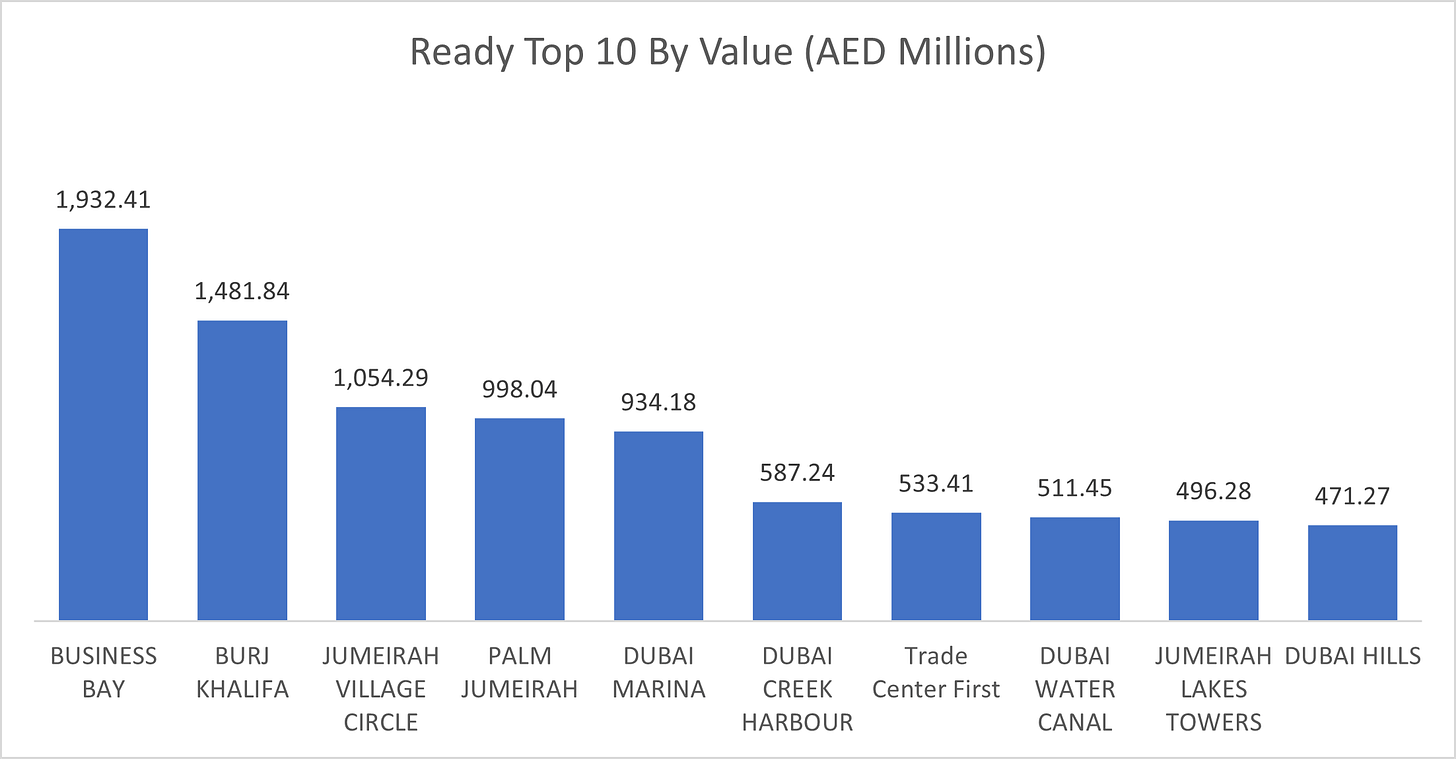

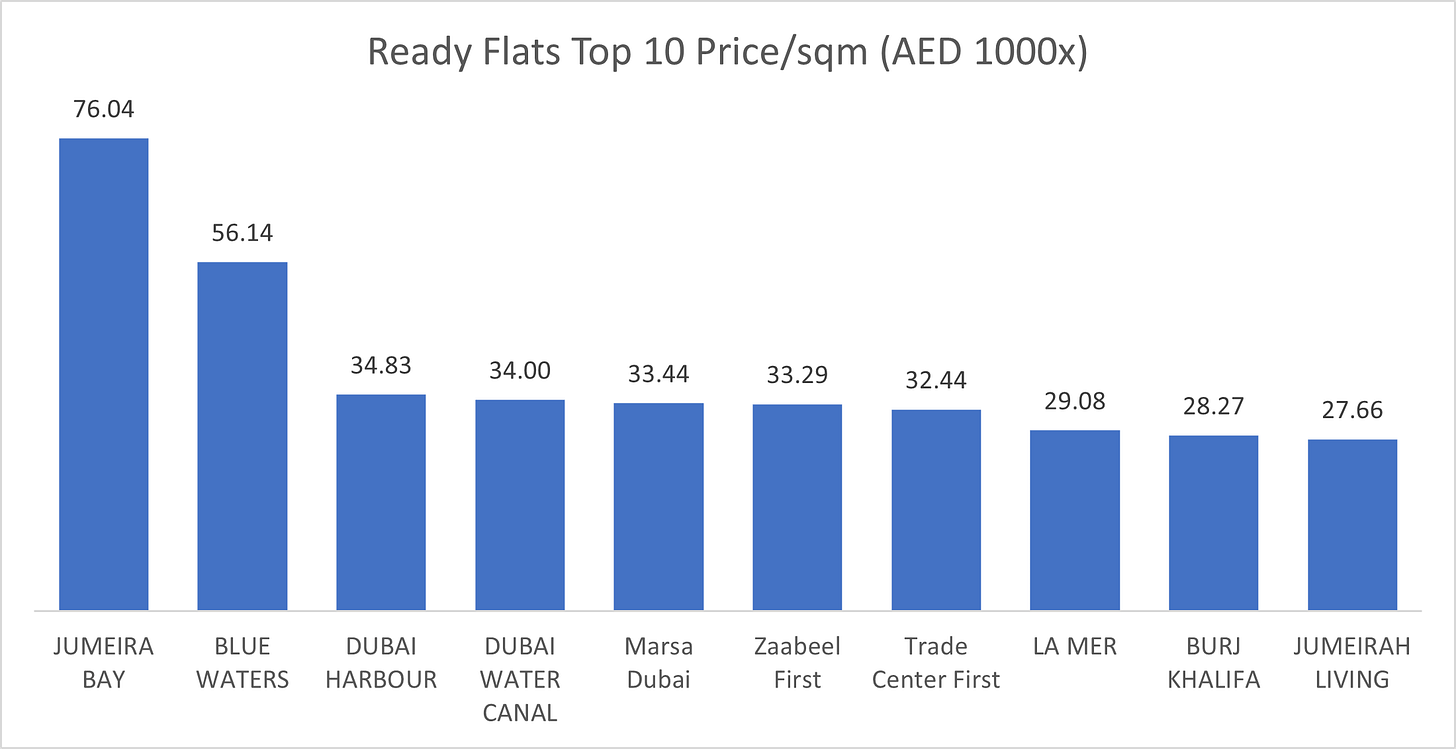

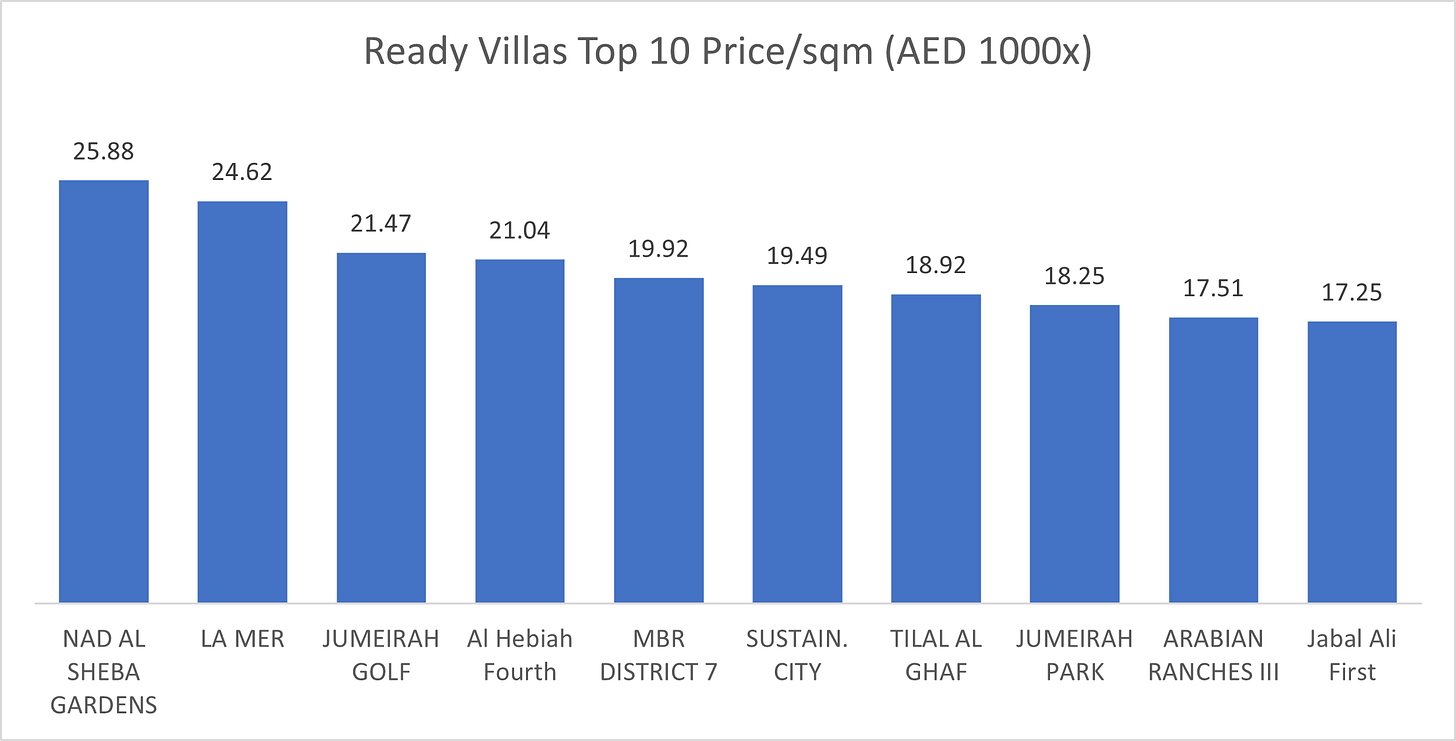

2. Ready Transactions

Completed property sales also saw increasing activity, with flats contributing AED 12.1B and villas AED 2.58B. This signals increasing buyer preference for move-in-ready options amid rising rental yields and occupancy rates. Notably, activity in prime areas like Burj Khalifa, Palm Jumeirah, and Dubai Marina drove much of the high-value transactions. Demand remains consistent among both residents and international investors. Hospitality assets such as hotel apartments and rooms accounted for AED 542 million, while shops and offices generated AED 1.3 billion.

Top Performing Areas by Transaction Value

Business Bay: AED 1.93 billion

Burj Khalifa: AED 1.48 billion

JVC: AED 1.05 billion

Palm Jumeirah: AED 998 million

Dubai Marina: AED 934 million

The average price per square meter for ready flats stood at AED 16,911, while ready villas averaged AED 13,268.

JVC continues to shine across both off-plan and ready segments, appealing to both end-users and investors. Business Bay, however, dominates overall value, suggesting consistent interest in central, mixed-use hubs.

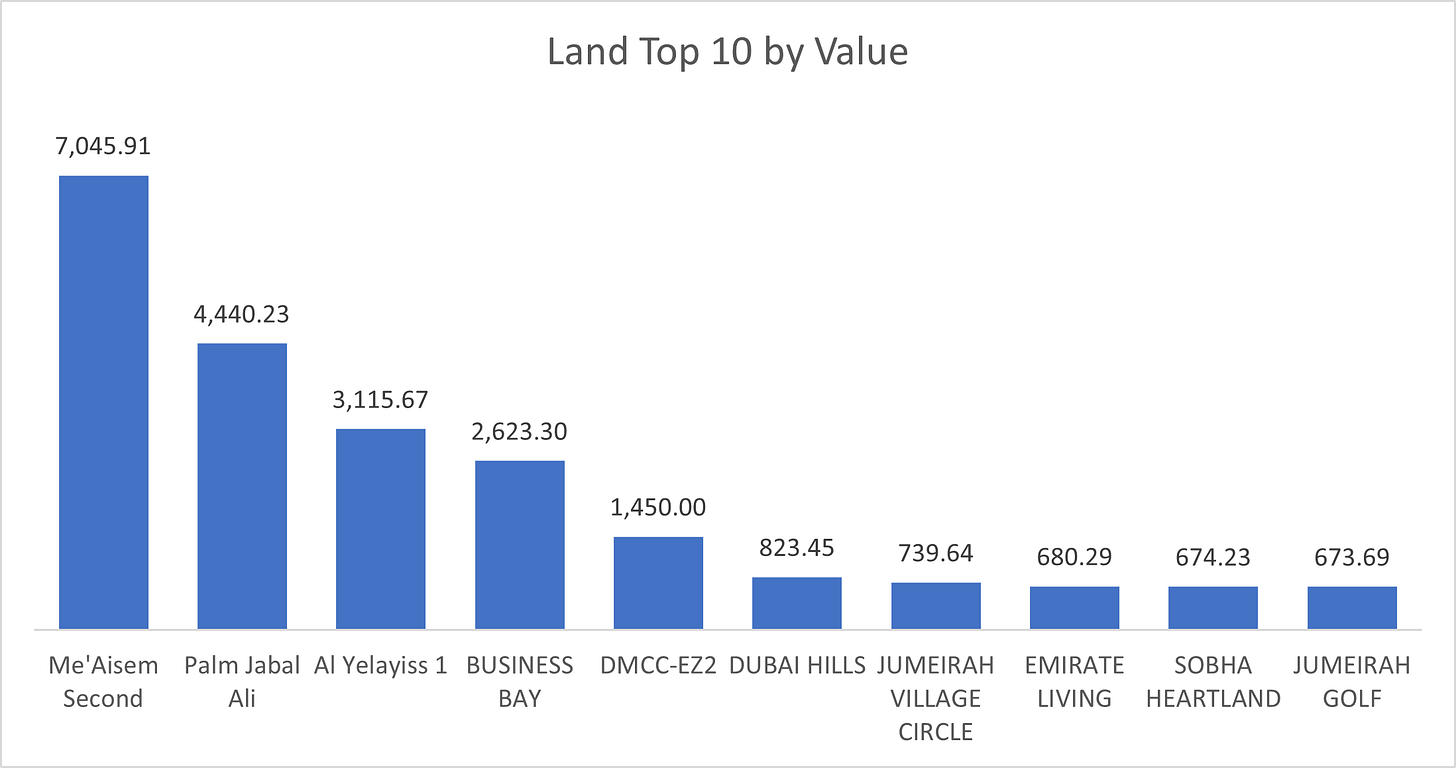

3. Land Transactions

Land continued to dominate the market with a total transaction value of AED 38 billion, a ~ 40% increase over March number, representing a commanding 50% share of the overall market. The most active area for land sales was Me'Aisem Second with more than AED 7 billion and 410 transactions.

Key Market Insights

Business Bay topped both off-plan and ready markets by value, confirming its strength as a high-performing mixed-use hub.

Jumeirah Village Circle led in total transaction volume across both segments, driven by affordability and high investor activity.

Dubai Marina maintained steady demand, ranking in the top 5 for both transaction volume and value in both markets.

Land sales reached AED 38B, making up nearly half of all transactions — signaling strong development and institutional interest.

Madinat Al Mataar and Al Wasl posted strong off-plan numbers, hinting at growing investor focus in emerging and central areas.

Data Source: Dubai Land Department