The real estate transactions in Dubai for February 2024 showcased a robust activity, with a total of AED48,990,674,494 in value down 16% from January. Despite the lower transaction value, the market is still going strong with both off-plan and ready properties each contributing significantly to the overall market dynamics.

Off-Plan Properties

Off-plan properties represented a total value of AED13,848,569,249, indicating a strong investor confidence in future real estate developments. This category was dominated by flats, contributing AED11,679,991,192, which is approximately 84.35% of the off-plan total. Villas followed with a contribution of AED1,856,201,813 (about 13.41%), showcasing a healthy interest in residential living spaces. Hotel apartments and rooms, along with shops and offices, added AED163,914,770 and AED142,689,162, respectively, to the mix, highlighting the diverse investment opportunities within the off-plan sector.

Ready Properties

The ready properties sector posted a total value of AED11,760,103,278, underscoring the ongoing demand for immediate occupancy options. Flats took the lead with AED8,071,248,919, making up roughly 68.63% of the ready property investments. Villas accounted for AED2,155,853,864 (about 18.33%), reflecting the desire for established family homes. The market for hotel apartments and rooms, buildings, and shops and offices was also active, contributing AED599,071,075, AED230,400,000, and AED703,529,421 respectively.

Top Areas by Transactions and Value

Off-Plan

Dubai Maritime City led in both the number of transactions (1102) and value (AED2,052,057,438.25), demonstrating its popularity among investors.

Jumeirah Village Circle and Business Bay also showed strong performance, indicating diverse investor interest across residential and commercial sectors.

Ready

Business Bay and Jumeirah Village Circle were prominent in the number of transactions, while Burj Khalifa and Business Bay led in value, highlighting the premium attached to iconic and strategically located properties.

Top Projects by Value

Off-Plan

DAMAC Casa and Central Park Plaza were among the top, with values of AED667,106,090.00 and AED520,158,729.00 respectively, pointing to high-value, premium projects driving off-plan investments.

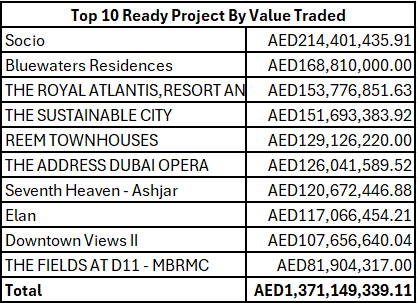

Ready

Projects like Socio and Bluewaters Residences topped the list in the ready segment, with values of AED214,401,435.91 and AED168,810,000.00, showcasing the demand for luxury and lifestyle-oriented properties.

Conclusion

February 2024's real estate transactions in Dubai highlight a market with strong and diverse investment in both off-plan and ready segments. The data indicates a healthy appetite for residential flats, villas, and commercial spaces, with significant investments in both categories. The top areas and projects by transactions and value traded reflect the strategic preferences of investors, with a mix of luxury, lifestyle, and strategic location driving the market dynamics. This comprehensive analysis provides valuable insights for investors, developers, and policymakers to understand and anticipate future trends in Dubai's real estate sector.

Data Source: Dubai Land Department