|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai’s real estate market in June 2025 recorded a total transaction value of AED 64.68 billion across all asset classes. This represents a 19.9% decrease month-over-month from May 2025’s AED 80.72 billion but a 13.5% year-on-year increase versus June 2024’s AED 57.0 billion. The number of transactions stood at 20,524, down 12.2% from May’s 23,383 deals, reflecting a seasonal softening in volume.

Market Breakdown

Category | Tr. Value (AED billions) | % of Total Market |

|---|---|---|

Off-Plan | 21.2 | 32.8% |

Ready | 14,8 | 22.8% |

Land | 28.7 | 44.4% |

Total | 64.7 | 100.0% |

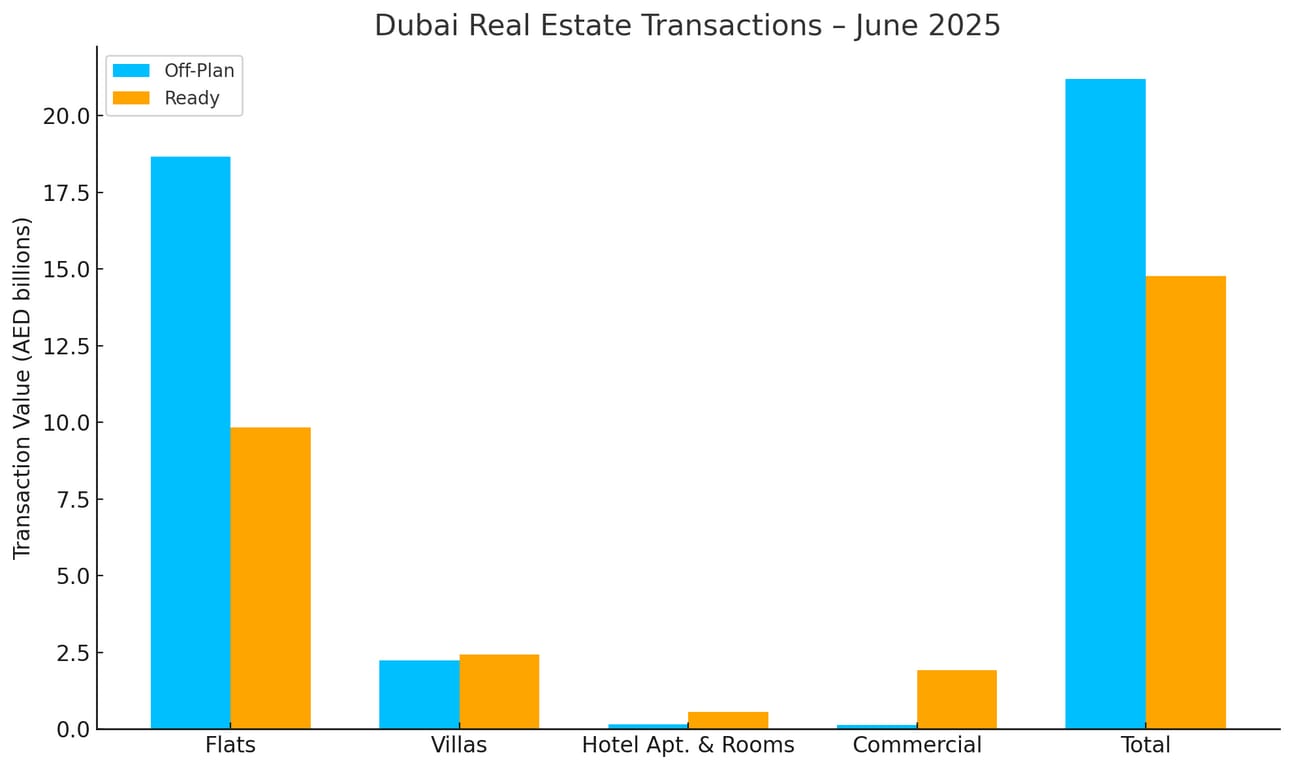

Market Performance by Property Type

Category | Off-Plan (AED Millions) | Ready (AED Millions) |

|---|---|---|

Total Value | 21,204.2 | 14,761.2 |

Flat | 18,660.8 | 9,844.1 |

Villa | 2,243.6 | 2,429.2 |

Hotel Apt. & Rooms | 157.7 | 560.8 |

Commercial | 142.1 | 1,927.1 |

Off-Plan Market Performance

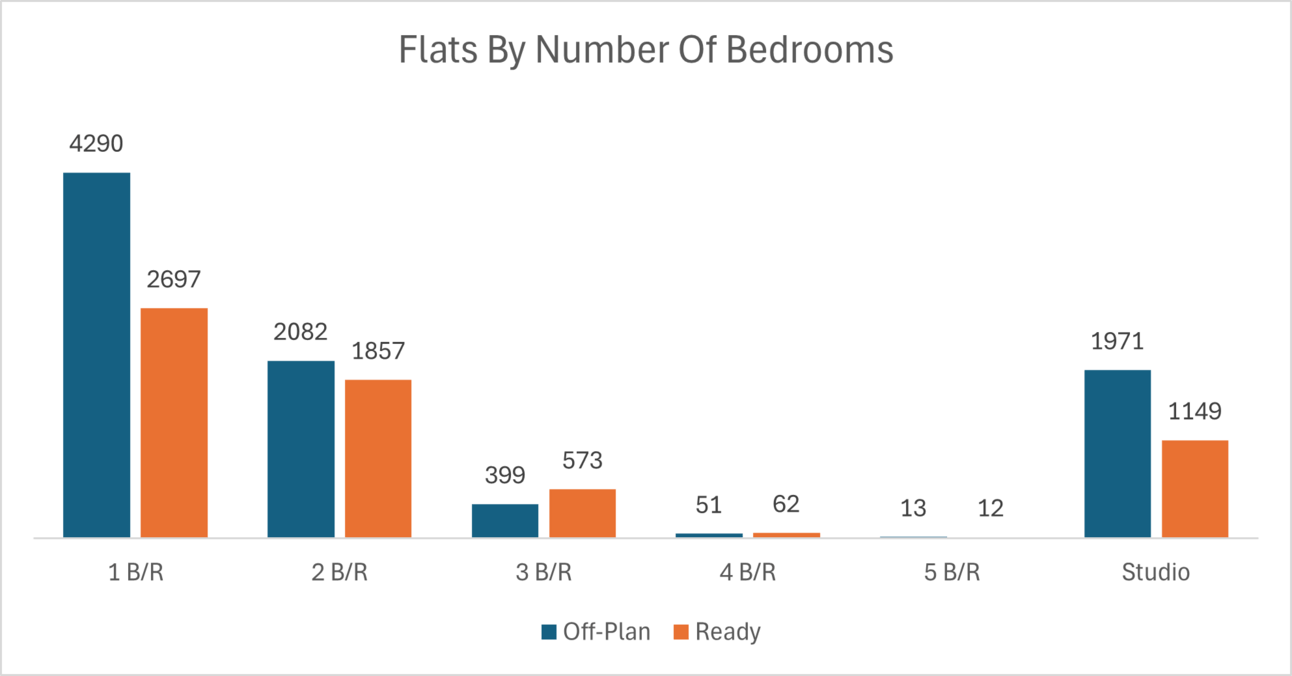

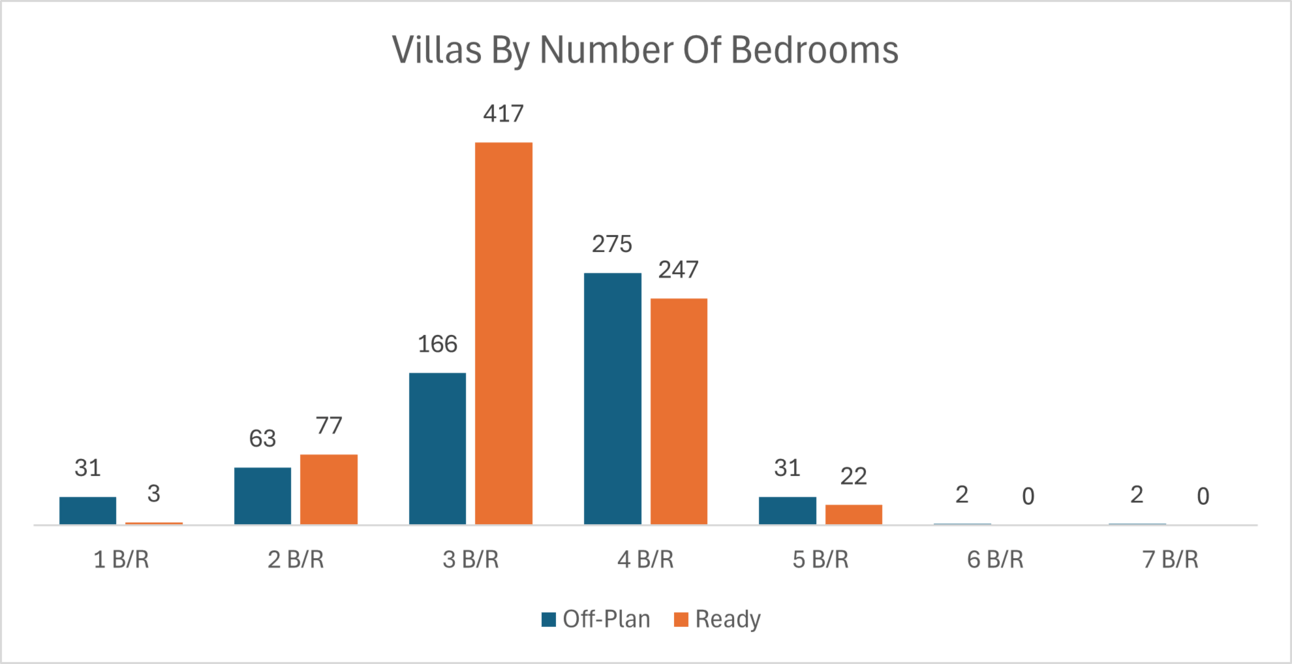

Off-plan transactions amounted to AED 21.20 billion, accounting for 32.8% of the total market. This segment continues to attract buyers seeking long-term gains and pre-delivery payment plans:

Flats: AED 18,660,776,941 (88.0% of off-plan)

Villas: AED 2,243,616,463 (10.6%)

Hotel Apartments & Rooms: AED 157,709,863 (0.7%)

Commercial: AED 142,143,330 (0.7%)

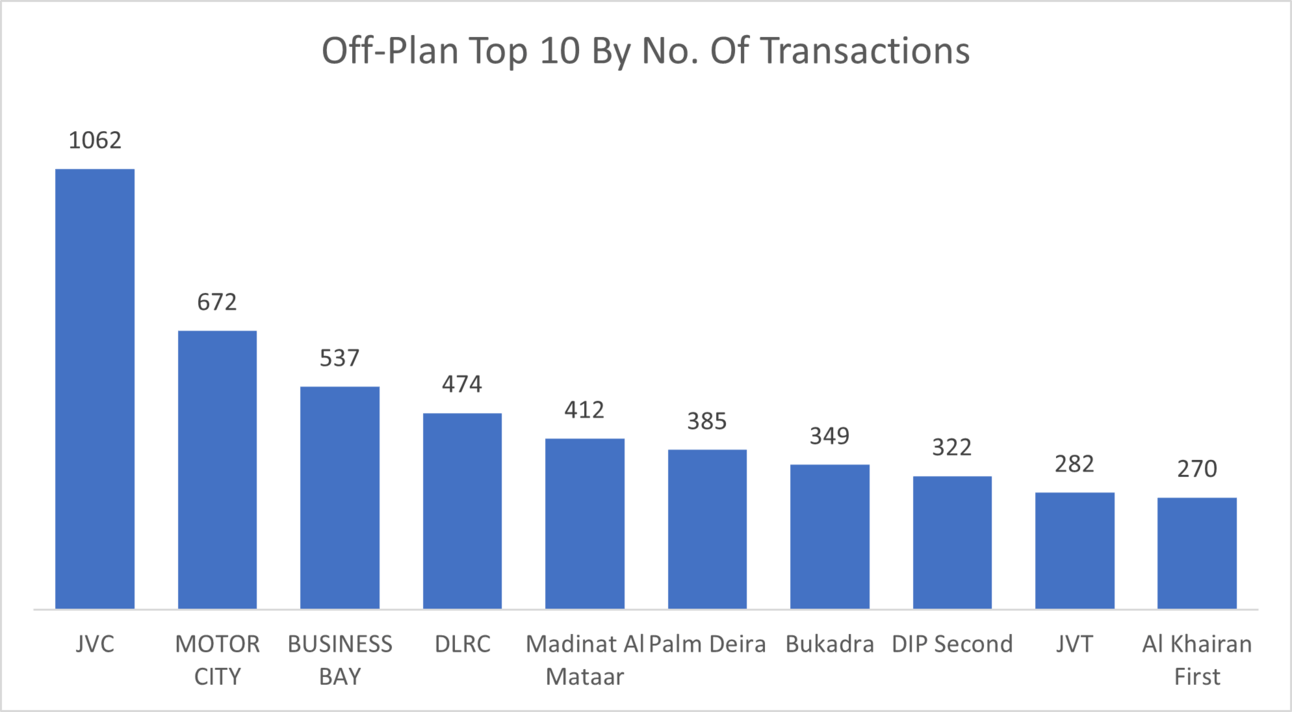

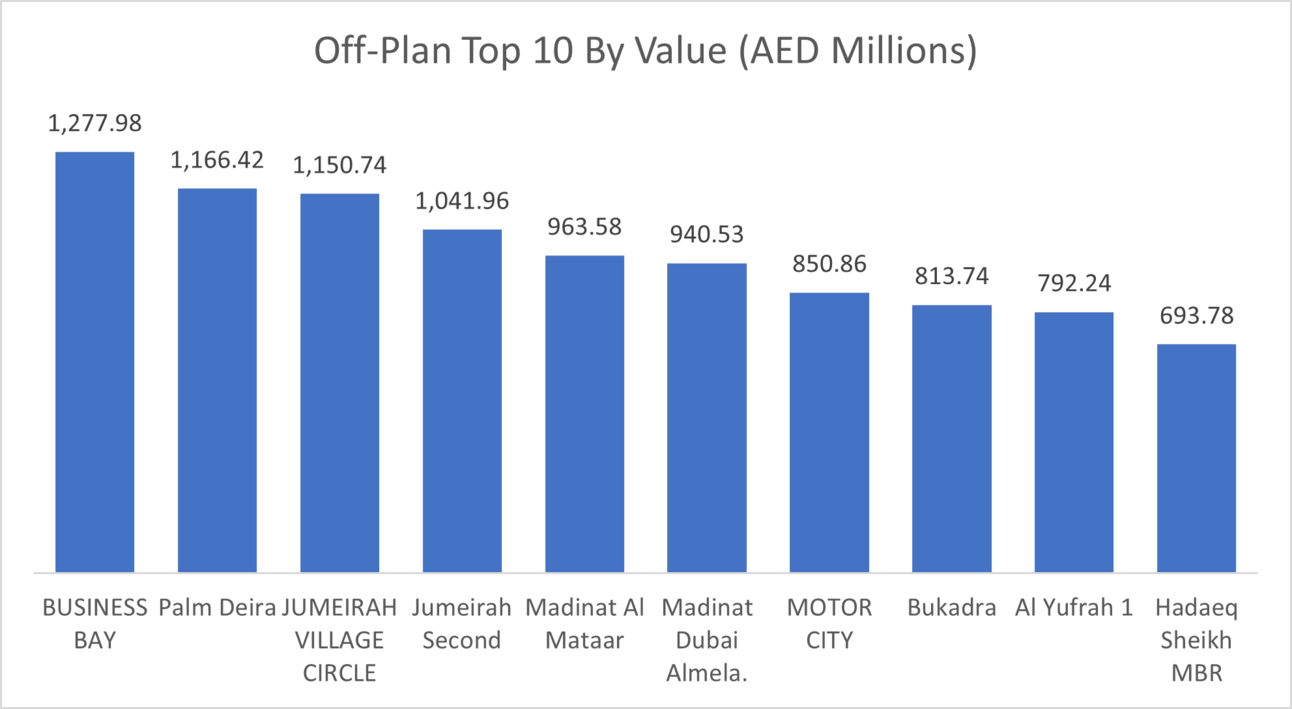

Top Performing Areas by Transaction Value

Business Bay: AED 1.28 billion

Palm Deira: AED 1.17 billion

JVC: AED 1.15 billion

Jumeirah Second: AED 1.04 billion

Madinat Al Mataar: AED 0.96 billion

JVC topped the chart by number of transactions but came third by value traded

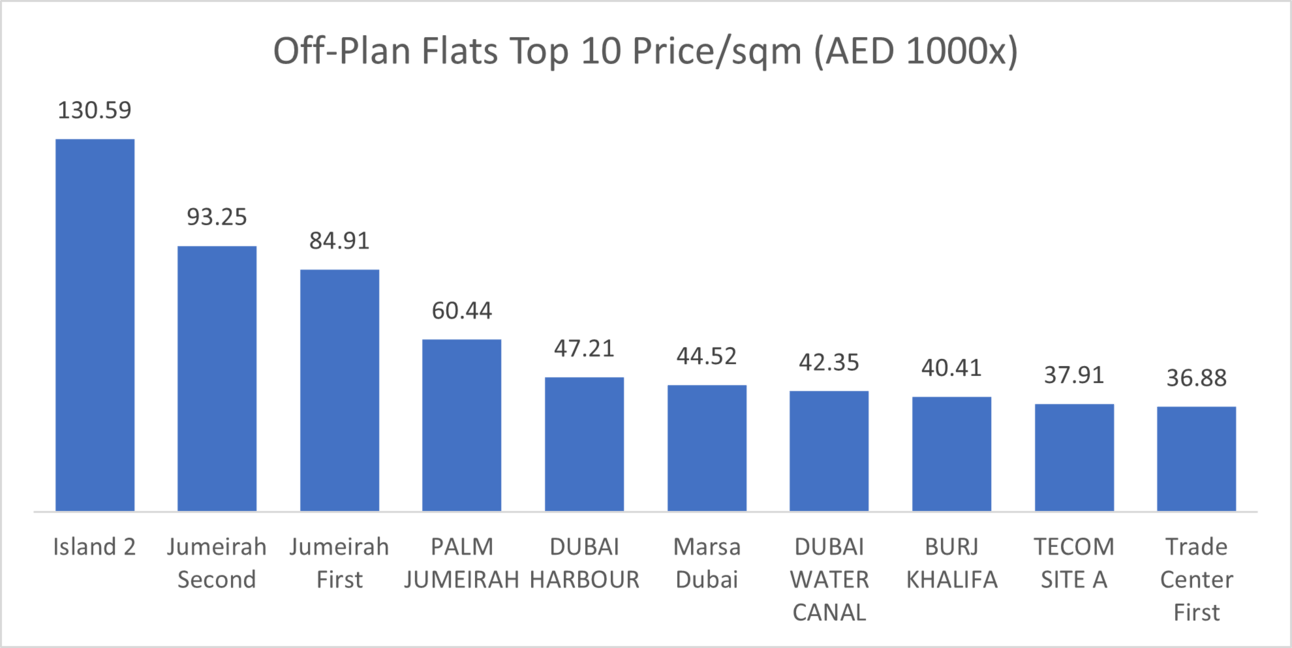

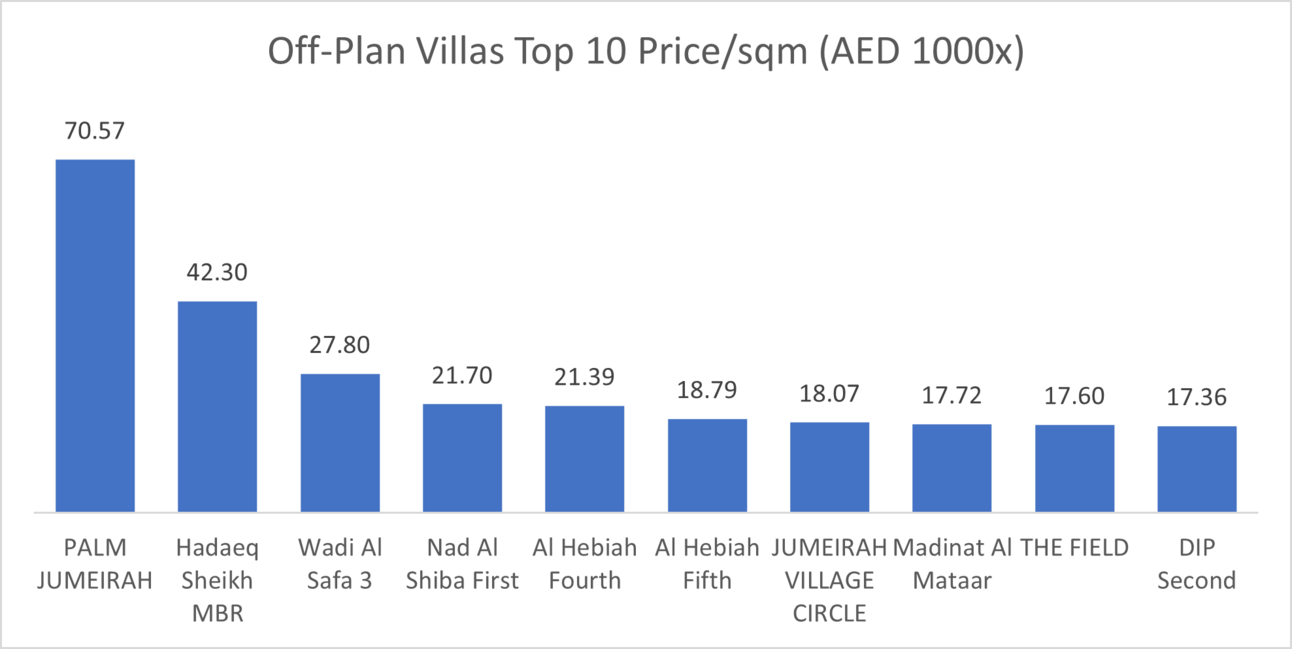

The average price per square meter for off-plan flats stood at AED 24,742, while off-plan villas averaged AED 17,529 both numbers slightly declined from last month.

While JVC led in transaction count, Business Bay led in value, indicating higher ticket sizes and premium launches. Palm Deira and Jumeirah Second areas also featured prominently by value, underlining sustained luxury demand.

Ready Market Performance

The ready segment contributed AED 14.76 billion, or 22.8% of the market, driven by end-users and investors seeking immediate handover:

Flats: AED 9,844,085,647 (66.7% of ready)

Villas: AED 2,429,209,712 (16.5%)

Hotel Apartments & Rooms: AED 560,801,125 (3.8%)

Commercial: AED 1,927,125,499 (13.1%)

Top Performing Areas by Transaction Value

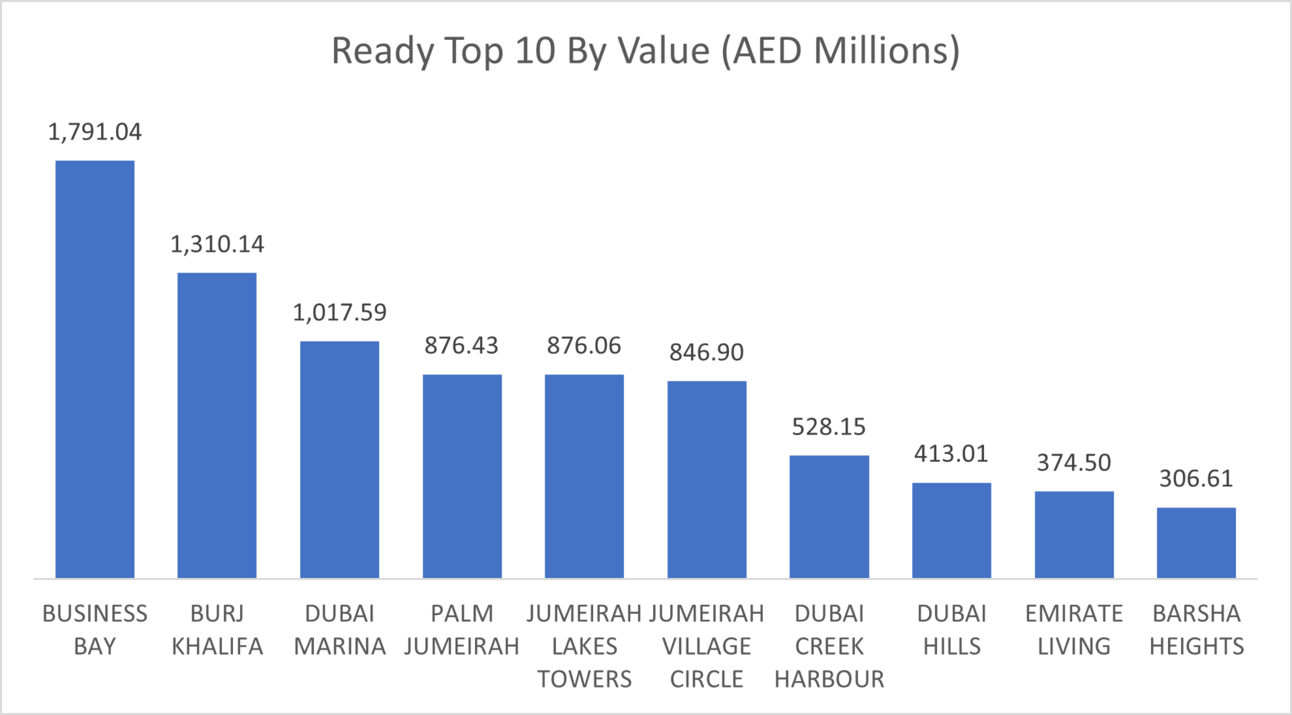

Business Bay: AED 1.79 billion

Burj Khalifa: AED 1.31 billion

Dubai Marina: AED 1.02 billion

Palm Jumeirah: AED 0.88 billion

JLT: AED 0.88 billion

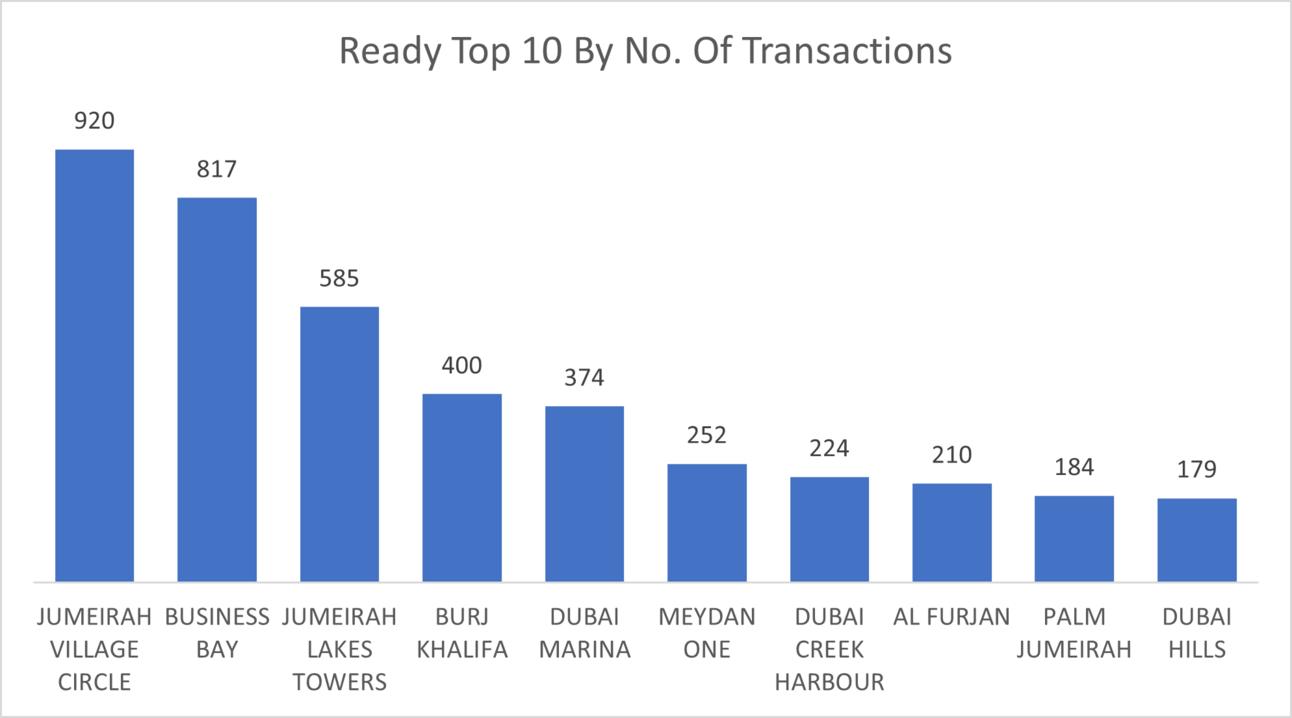

Business Bay came second in number of transactions but topped the chart by value of transactions

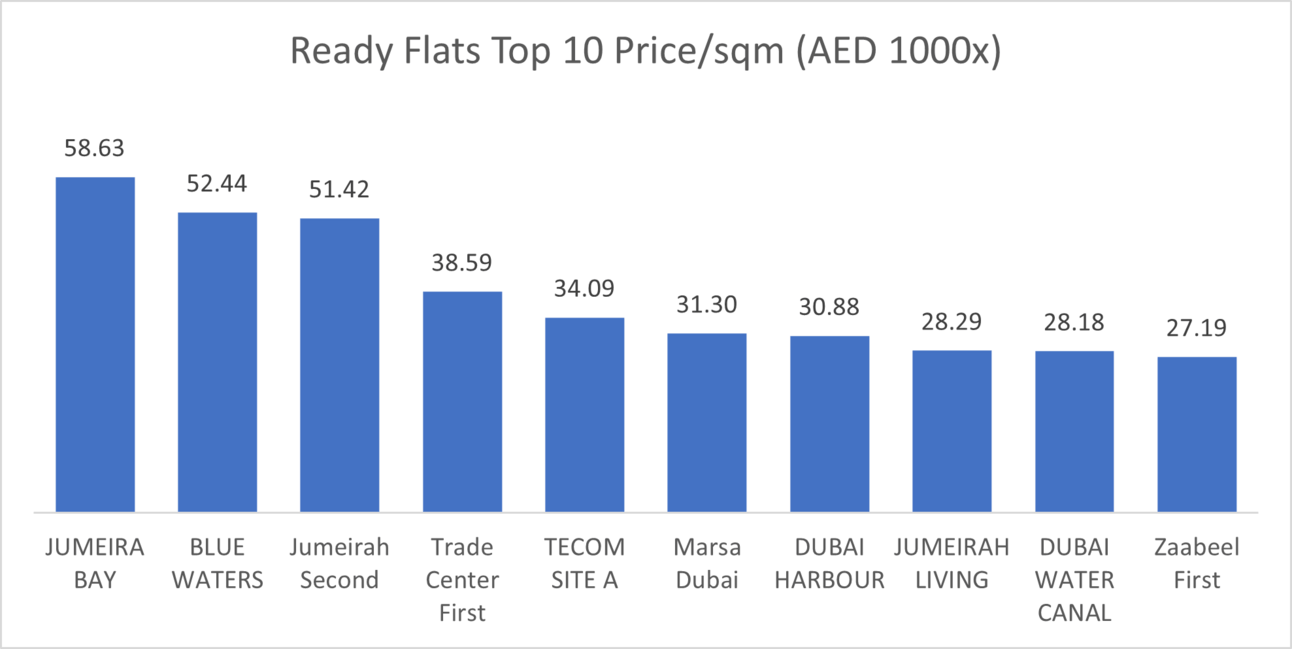

The average price per square meter for Ready Flats stood at AED 15,572, while Ready Villas averaged AED 13,424 almost unchanged from last month.

Business Bay is the top contributor across both off-plan and ready segments, appealing to both end-users and investors. Burj Khalifa and Dubai Marina continue to attract ultra-premium deals.

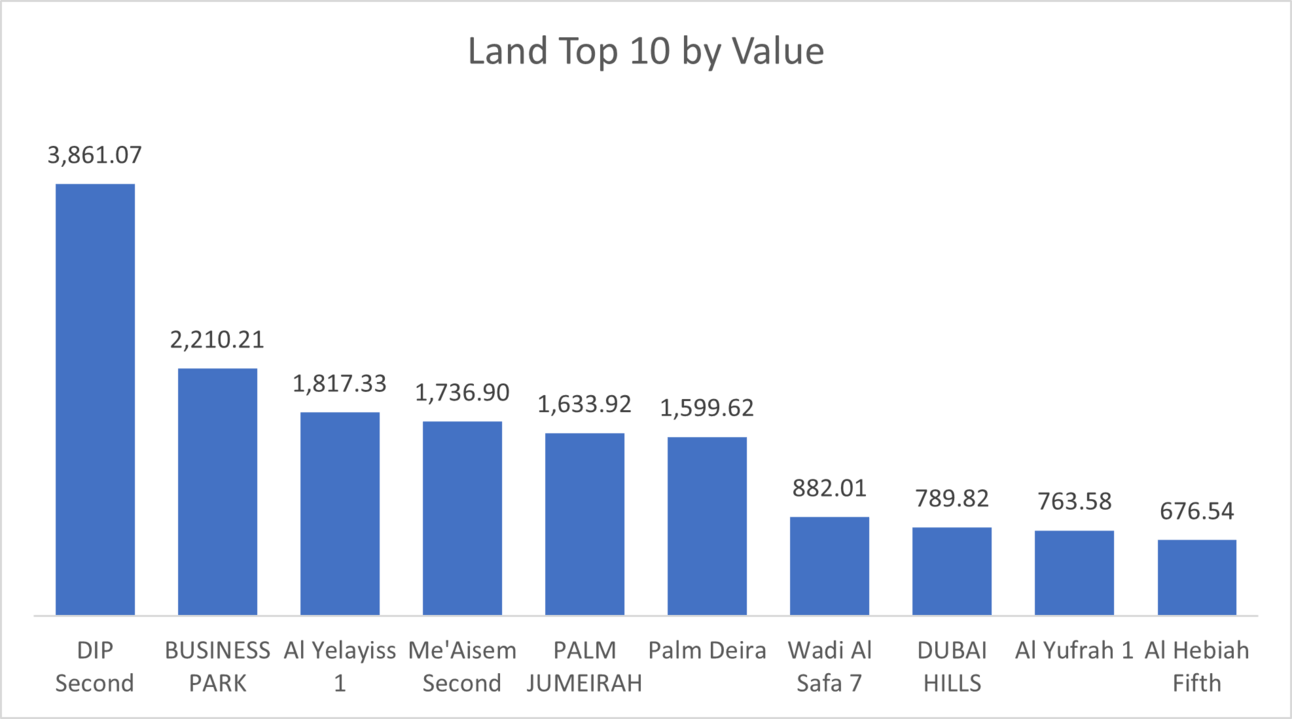

Land Transactions

Land remained the largest category, totaling AED 28.71 billion and comprising 44.4% of the total. This underscores continued appetite for strategic land banking and large-scale development ahead of key infrastructure rollouts.

On the Micro Level

Key Market Insights

June 2025 saw a pullback in both value (–19.9% MoM) and volume (–12.2% MoM), yet the market remains 13.5% ahead of last year, driven by robust land transactions and selective off-plan projects. Off-plan flats continue to dominate new launches, while ready luxury communities like Business Bay, Burj Khalifa and Dubai Marina maintain strong capital turnover. The outsized 44.4% share of land deals highlights ongoing strategic land banking. Looking forward, while short-term seasonal dips are typical, Dubai’s real estate fundamentals, diverse asset choice, regulatory support, and global capital flows, should sustain momentum into H2 2025.

Data Source: Dubai Land Department