Turn AI Into Your Income Stream

The AI economy is booming, and smart entrepreneurs are already profiting. Subscribe to Mindstream and get instant access to 200+ proven strategies to monetize AI tools like ChatGPT, Midjourney, and more. From content creation to automation services, discover actionable ways to build your AI-powered income. No coding required, just practical strategies that work.

Dubai closed October 2025 with AED 73.20 billion in property transactions across 22,618 deals. This represents an 11.3% increase month-over-month versus September 2025’s AED 65.76 billion, and a 0.8% decrease year-on-year versus October 2024’s AED 73.77 billion. Transaction count rose 3.8% from 21,781 in September to 22,618 in October.

Metric | October 2025 | September 2025 | MoM Δ | October 2024 | YoY Δ |

|---|---|---|---|---|---|

Total value | AED 73.20 bn | AED 65.76 bn | ▲ 11.3 % | AED 73.77 bn | ▼ 0.8 % |

Transactions | 22,618 | 21,781 | ▲ 3.8 % | — | — |

Market Composition

Segment | Value (AED bn) | Share of Total | Key Drivers |

|---|---|---|---|

Land | 27.85 | 38.1% | Large-plot activity and strategic site acquisitions; steady developer land banking. |

Off-Plan | 28.38 | 38.8% | Launch-led demand; apartments in mid-market hubs carried volumes. |

Ready | 16.97 | 23.2% | Broad secondary sales with apartments ~two-thirds of ready value. |

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

Off-Plan Market Performance

Sub-category | Value (AED bn) | % of Off-Plan |

|---|---|---|

Flats | 23.655 | 83.3% |

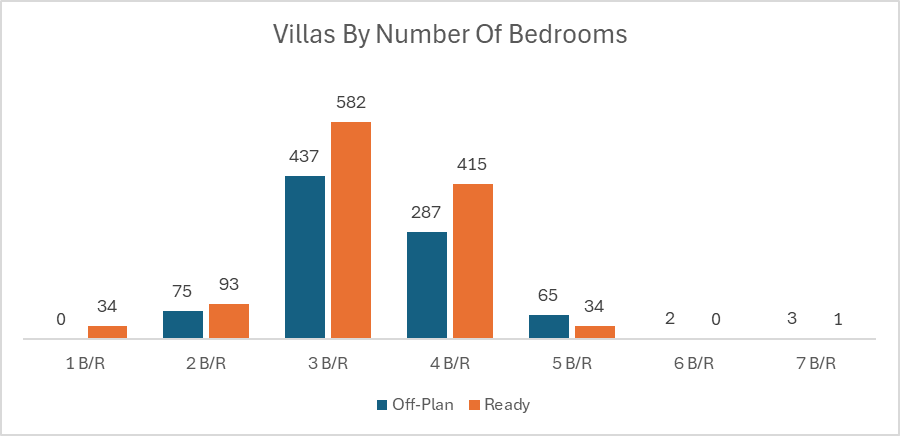

Villas | 3.744 | 13.2% |

Hotel Apt. & Rooms | 0.100 | 0.4% |

Commercial | 0.884 | 3.1% |

New-build apartments overwhelmingly carried off-plan spend.

Top Performing Areas

Area | Value (AED bn) | % Of Off-Plan |

|---|---|---|

Business Bay | 1.864 | 6.6% |

Palm Deira | 1.502 | 5.3% |

JVC | 1.349 | 4.8% |

Trade Center Second | 1.259 | 4.4% |

DIP Second | 1.093 | 3.9% |

Business Bay dominated the off-plan market capturing more than 6.6% of the off-plan traded value, Palm Diera came second with 5.5% of the raded value. JVC stayed on top of the transactions chart.

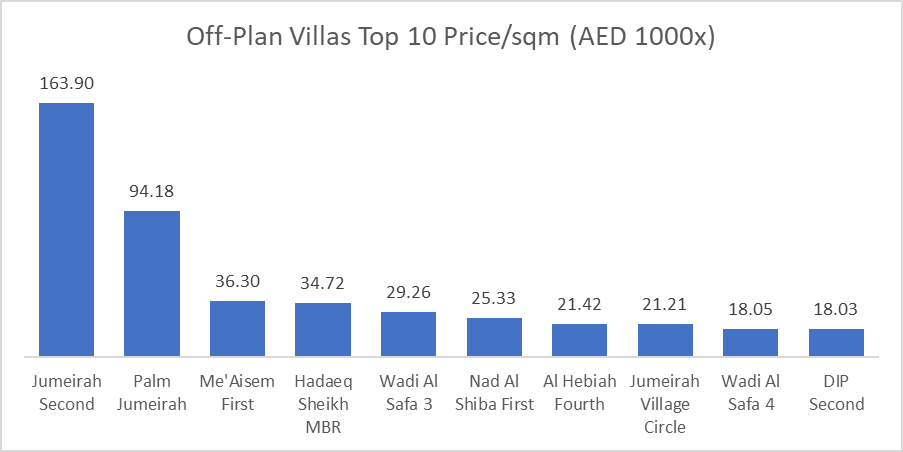

The average price per square meter for off-plan flats stood at AED 23,766 almost unchanged from last month, while off-plan villas averaged AED 20,235 less than 1% increase from last month.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Ready Market Performance

Sub-category | Value (AED bn) | % of Ready |

|---|---|---|

Flats | 11.097 | 65.4% |

Villas | 3.567 | 21.0% |

Hotel Apt. & Rooms | 0.769 | 4.5% |

Commercial | 1.533 | 9.0% |

Secondary sales stayed apartment-heavy, with villas just over one-fifth of ready spend.

Top Performing Areas

Area | Value (AED bn) | % Of Ready |

|---|---|---|

Business Bay | 2.228 | 13.1% |

Burj Khalifa (Downtown) | 1.517 | 8.9% |

JVC | 1.041 | 6.1% |

Palm Jumeirah | 0.900 | 5.3% |

Dubai Marina | 0.884 | 5.2% |

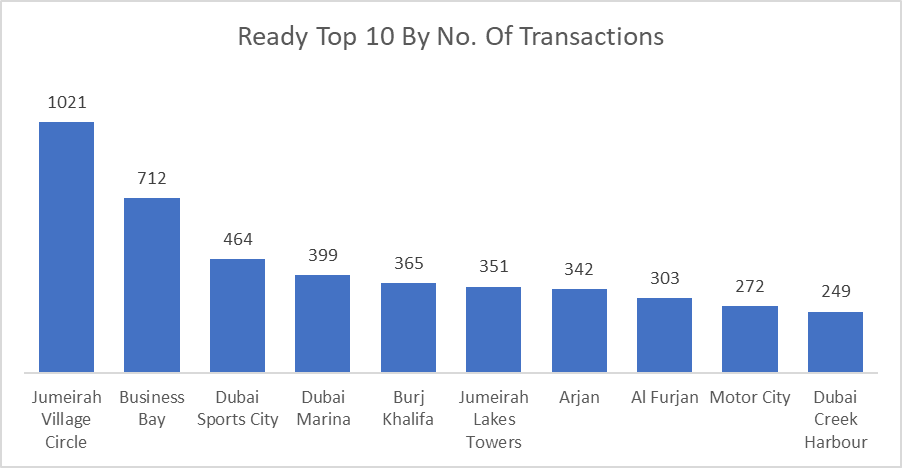

In the ready market, Business Bay topped the chart in the value traded while JVC secured the first place in number of transactions, both areas combined saw more than 19% of the secondary market traded value.

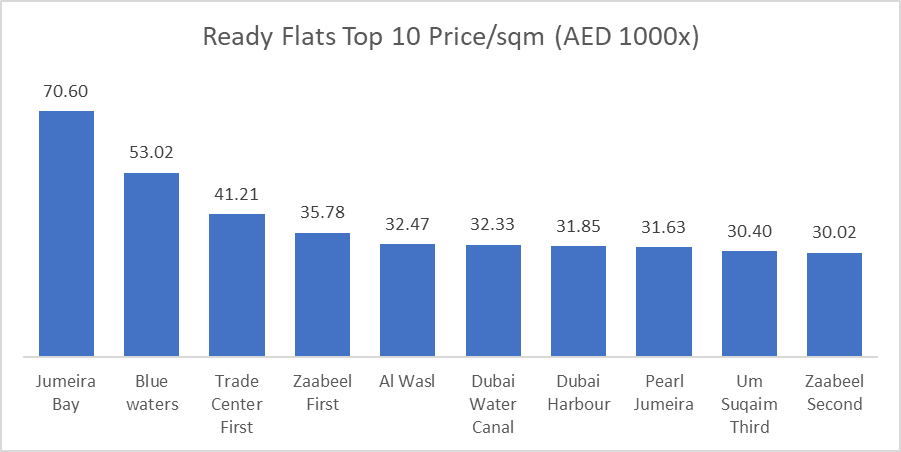

The average price per square meter for Ready Flats stood at AED 16,029 almost unchanged from last month, while Ready Villas averaged AED 13,649, 5% higher than last month average.

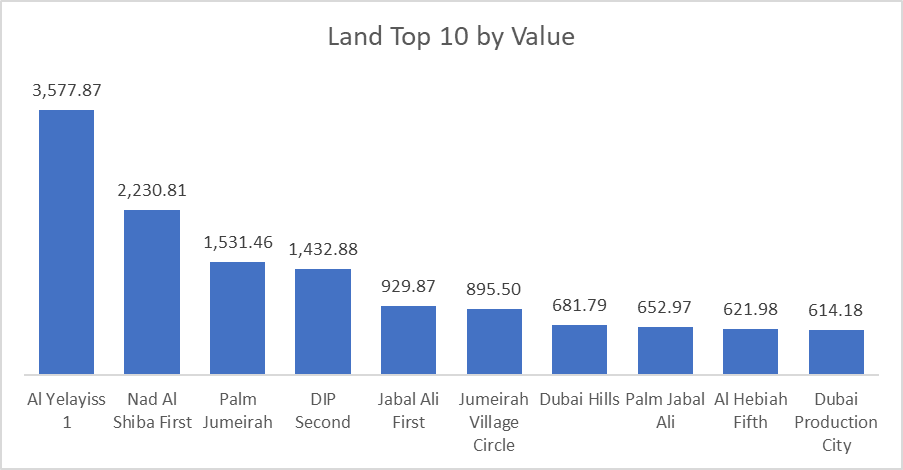

Land Transactions (Value)

Area | Value (AED bn) |

|---|---|

Al Yelayiss 1 | AED3.6 |

Nad Al Shiba First | AED2.2 |

Palm Jumeirah | AED1.5 |

DIP Second | AED1.4 |

Jabal Ali First | AED0.93 |

On the Micro Level

Market Insights & Outlook

Resilient liquidity: Strong MoM rebound in value (+11.3%) and higher deal counts (+3.8%) underscore durable demand into Q4.

Apartment supremacy: Flats dominated spend (off-plan 83.3%, ready 65.4%), aligning with affordability and breadth of product.

Concentrated hotspots: Business Bay and JVC remained bellwethers, leading by either value, volume, or both; moves here often foreshadow wider sentiment.

Outlook: With steady launches and ongoing land acquisitions, momentum should remain firm, though buyers are increasingly selective on payment flexibility, handover timelines, and micro-location fundamentals.

Data Source: Dubai Land Department